Fruit Fillings Market Report Scope & Overview:

Get More Information on Fruit fillings Market - Request Sample Report

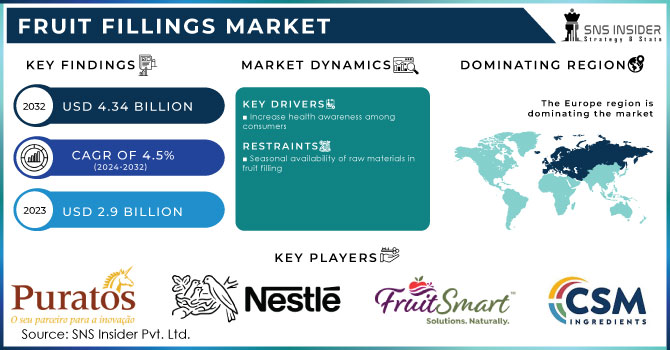

The Fruit Fillings Market size was USD 2.9 billion in 2023 and is expected to Reach USD 4.34 billion by 2032 and grow at a CAGR of 4.5 % over the forecast period of 2024-2032.

The market for fruit fillings has been continuously expanding in recent years as a result of the rising desire for quick-to-prepare and healthy foods. Due to the widespread consumption of baked goods and sweets, fruit fillings are employed in a wide range of culinary products. The preference for clean-label products and healthier choices among customers has raised the demand for fruit fillings free of artificial ingredients. Additionally, the sector has seen advancements in exotic fruit flavors, expanding consumer choices.

Based on applications the fruit fillings are segmented into Diary, Ice Cream, Bakery, Confectionery, and Beverages. Fruit fillings can be used in a variety of dairy products. American customers have recently shown a strong preference for incorporating novel fruits like passionfruit, peach, guava, and other citrus, tropical, and fruit flavors in cultured dairy products.

MARKET DYNAMICS

KEY DRIVERS

-

Increase health awareness among consumers

Customers are looking for healthier options and are becoming more aware of the ingredients they consume. Fruit fillings are a healthy and natural replacement for conventional fillings like sugary syrups or synthetic flavors. Additionally, they are a source of antioxidants, minerals, and vitamins. Food can easily be enhanced in flavor and sweetness using fruit fillings rather than by preparing fresh fruit. Customers who are looking for quick dinner options will find this attractive.

RESTRAIN

-

Seasonal availability of raw materials in fruit filling

Fruit fillings require high-quality fruits that adhere to strict flavor, size, and texture standards. To avoid product rejections, vendors must routinely check that their fruits comply with these specifications. Raw materials of poor quality could increase waste and slow down production. If a company does not have a contract with its suppliers, artificial inflation could become a significant problem. External factors including weather, political turmoil, trade disputes, transportation issues, and natural disasters can have a significant impact on the availability of crucial filler components. The potential for these uncertainties to result in pricing adjustments and supply chain disruptions may have an influence on the production of companies and their financial performance. As a result, the market's expansion is significantly hampered by the change in raw material prices.

OPPORTUNITY

-

Increased demand for convenience food

Health and well-being are prioritized heavily in the food sector, and the market for fruit fillings is no exception. Fruit fillings with less sugar, fat, and calories are being produced by manufacturers in response to consumer demand for healthier options. To meet consumer demand for healthier options, they also include beneficial ingredients like fiber in their products. Fruit fillings are a great way to get the vitamins and fiber you need for optimum health. For instance, fillings made from blueberries and apples have the potential to be good sources of antioxidants and dietary fiber, respectively.

CHALLENGES

-

Fluctuation in prices of materials

Several variables, including weather, crop yields, and demand, can affect the cost of fruits, sugar, and other ingredients used in fruit fillings. Due to this, it may be challenging for manufacturers to keep their product prices stable, which may result in fewer sales.

IMPACT OF RUSSIA UKRAINE WAR

The market for fruit fillings has been significantly impacted by the Russia-Ukraine conflict. Fruits and vegetables, both fresh and processed, are widely imported into Russia. The market in Ukraine is substantially smaller. During the season, Russia received 21% of our exported pears, 6% of our exported apples, and 9% of our exported plums. Exports of fresh produce to these nations are now at risk due to the conflict in Ukraine. Wheat, an essential component of fruit fillings, has seen a substantial spike in price as a result of the war. Due to the increased cost of fruit fillings as a result, consumers' budgets have been strained.

IMPACT OF ONGOING RECESSION

Fresh produce consumption domestically continued to decline in the first quarter of the year 2023, with Italian families purchasing 1.27 million tons, or 8% less than they did during the same period in 2022. All of January, February, and March had low scores. When comparing the average price of fruit and vegetables over three months between 2023 and the first quarter of 2022, the difference rises to +8% in 2023 and +21% over five years. Despite an increase in the average purchase price from €1.90/kg in the first quarter to €1.32 billion, spending on fruit declined by 2%, setting a negative record.

MARKET SEGMENTATION

By Filling Type

-

Fruit Fillings with Pieces

-

Candied or Semi-candied Fruit Fillings

By Fruit Type

-

Citrus Fruits

-

Berries

-

Tropical Fruits

-

other

By Application

-

Diary

-

Ice Cream

-

Bakery

-

Confectionery

-

Beverages

REGIONAL ANALYSIS

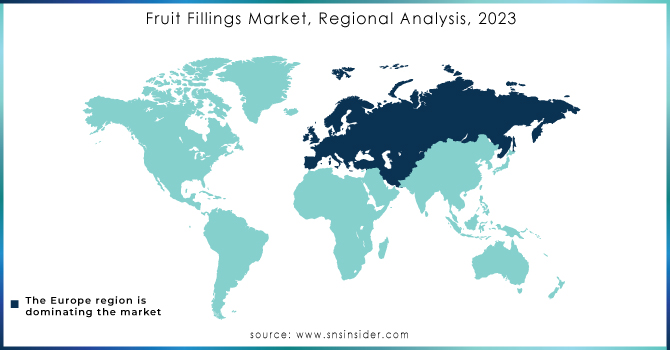

The Europe region led the market in 2022 In terms of revenue share of 30 %. The regional market is expanding as a result of an increase in consumer taste for sweets and baked products such as cakes, pastries, breads, doughnuts, and updated versions of classic treats. Significant efforts by top industry players to establish a competitive edge in the local market for premium confectionery items would also support the market revenue growth.

North America is the largest market for fruit fillings with a market share of 36 % in 2022. This is due to the region's developed food industry and consumer demand for convenient, healthy snacks and demand for vitamin C-based food ingredients. The United States is the largest market for fruit fillings in North America, followed by Canada.

Asia Pacific is the rising growth of the fruit fillings market, with a CAGR growth of 5.6% in the forecasting period. The rising popularity of fruit fillings in developing countries. The region's growing food and beverage industry and the demand for convenience foods are driving the demand for fruit fillings in Asia Pacific. China, India, and Japan are the largest markets for fruit fillings in Asia Pacific.

South America, the Middle East and Africa are smaller markets but still have steady growth due to the increasing demand for processed food, ready-to-eat food, and healthy snacks in this region.

Need any customization research on Fruit Fillings Market - Enquiry Now

REGIONAL COVERAGE

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

Some major key players in the Fruit Fillings Market are Puratos, Nestle, FruitSmart, Dawn Food Products Inc., Agrana Beteiligungs- AG, CSM Ingredients, Bakels Worldwide, Barry Callebaut, Andros Group, Zentis Gmbh & Co. KG, Rice & Company Inc., and other key players.

RECENT DEVELOPMENTS

In 2023, Nestle has announced plans to make a $100 million investment in its fruit fillings division. The company's decision is aimed at increasing the capacity of its fruit fillings and encouraging the development of new and creative products in this category.

In 2023 J&J Snack Foods purchased FruitSmart, a well-known producer specializing in fruit fillings for the pastry sector. With this acquisition, J&J Snack Foods strengthened its position in the constantly increasing fruit fillings sector. J&J Snack Foods hopes to capitalize on the growing demand for fruit-based fillings, which are frequently utilized in pastry products such as pies, pastries, and cakes, with this big step.

In 2023 Puratos announced the acquisition of Give Konfekture in Give and the company behind it, Dainty ApS, a Danish producer of fruit fillings and jams.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.9 Billion |

| Market Size by 2032 | USD 4.34 Billion |

| CAGR | CAGR of 4.5 % From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Filling Type (Fruit Fillings with Pieces, Candied or Semi-candied Fruit Fillings) • By Fruit Type (Citrus Fruits, Berries, Tropical Fruits) • By Application (Diary, Ice Cream, Bakery, Confectionery, Beverages) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Puratos, Nestle, FruitSmart, Dawn Food Products Inc., Agrana Beteiligungs- AG, CSM Ingredients, Bakels Worldwide, Barry Callebaut, Andros Group, Zentis Gmbh & Co. KG, Rice & Company Inc. |

| Key Drivers | • Increase health awareness among consumers |

| Market Challenges | • Fluctuation in prices of materials |