Bare Metal Cloud Market Report Scope & Overview:

Get more information on Bare Metal Cloud Market - Request Sample Report

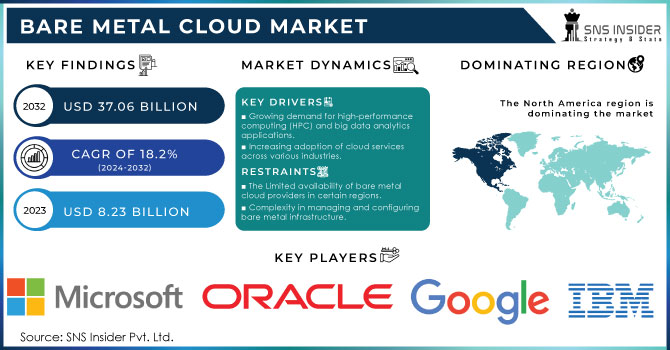

The Bare Metal Cloud Market was valued at USD 8.47 billion in 2023 and is expected to reach USD 46.14 billion by 2032, growing at a CAGR of 20.77% over the forecast period 2024-2032.

The bare metal cloud Market is large and growing, driven by demand for high-performance Computing (HPC) and lastency-sensitive applications by industries such as enterprise, BFSI, healthcare, and others. Instead, bare metal cloud services offer dedicated physical servers free of virtualization, delivering better performance, reliability, and higher control than traditional cloud solutions. This architecture is especially good for data-intensive workloads like artificial intelligence (AI), machine learning (ML), big data analytics predictive analysis, and real-time applications in BFSI, IT & ITeS, and telecommunication verticals. Furthermore, the growth of edge computing and 5G has created a demand for low-latency infrastructure, boosting the uptake of bare metal cloud. In 2024, bare metal cloud services are serving high throughput data streams up to 100 TB for genomic data, 1,000 teraflops of processing required for AI model training. They reduce latency by 15%-30% over virtualized environments, allowing real-time applications to achieve a 1 millisecond latency reduction, and improving trading by 5% as designed.

The other major growth factor is an increased emphasis on data security and compliance. As compliance standards grow increasingly rigorous across various industries, organizations in sectors like healthcare, BFSI, and government are embracing bare metal cloud as it allows them to control their infrastructure while staying within strict regulatory guidelines directly. Growing hybrid cloud strategies are also driving the market as companies use bare metal cloud environments with traditional and virtualized clouds to gain the best balance of cost and performance. All these trends coupled with the automation and orchestration tools are expected to drive the market's growth in the next few years. In 2024, 94% of enterprises with over 1000+ employees are using cloud services and 35 million people's data has been breached. Hybrid cloud strategies are employed by 73% of enterprises, down from 84% in 2021. With data generation predicted to hit 180 zettabytes by 2025, organizations are looking for more automation and orchestration tools for better data security as well as complying with stringent compliance requirements in sectors such as healthcare, BFSI as well as government.

MARKET DYNAMICS

KEY DRIVERS:

-

Microservices and Kubernetes Drive Bare Metal Cloud Growth for High Performance and Real-Time Data Processing

With businesses moving towards microservices-based architectures, the need for high-performance infrastructure for containerized workloads is growing exponentially. The raw nature of the resources in bare metal cloud environments makes it the perfect base upon which to build container orchestration platforms such as Kubernetes, as it allows for unobstructed scaleup and superior performance. It takes away the familiar "noisy neighbor" problem of virtualized environments as it offers predictable resource allocation & latency, which are important when it comes to modern DevOps workflows and CI/CD pipelines. This ability to process streams of data is especially being adopted by industries including media and entertainment, e-commerce, and online gaming for real-time processing and reduce latencies in user experiences. 96% of enterprises use Kubernetes and 85% of enterprises have businesses running on Kubernetes in production workloads, as of 2024. With the move to microservices for better scaling and flexibility, containerized workloads today are growing at a compound annual growth of 20% Cloud gaming platforms, mostly in media and entertainment, support more than 1.5 million simultaneous users per platform instance, lowering latency and improving the overall experience.

-

AI and ML Revolution Driving Bare Metal Cloud Adoption with High-Performance GPU Accelerated Infrastructure

The growth of artificial intelligence (AI) and machine learning (ML) applications in diverse industries is another crucial driver for this market. AI and ML workloads involve a lot of computation, we need plenty of computing, fast storage, and bandwidth to train AI and ML models! Bare metal cloud solutions fulfill these demands by providing custom configurations and GPU-accelerated servers for the most demanding tasks. From predictive analytics in healthcare to personalized services in retail and automation of tasks in the manufacturing sector, industries are using AI-fueled insights to thrive. The growing proficiency of AI-driven applications that include self-driving cars, natural language processing, and recommendation systems have also increased the need for stable, dedicated infrastructure that bare metal clouds offer. The on-demand scalability of bare metal cloud services, combined with their cost efficiency, makes them ideal for AI/ML-based innovation, further boosting this trend. 85% of AI and ML workloads demand GPU-accelerated servers, with 40% of these workloads utilizing bare metal cloud environments. Even GPT-4 requires 10-50x higher bandwidth than traditional workloads, processing as much as 10TB of data per day by AI models. 50% of bare metal cloud deployments use NVIDIA A100 or V100 GPUs.

RESTRAIN:

-

Challenges of Bare Metal Cloud Adoption: Complexity Scalability and Integration Issues for Dynamic Workloads

One of the major hindrances of the Bare Metal Cloud Market is, that deployments and management of Bare Metal Cloud solutions are more complex as compared to virtualized environments. Because there are fewer abstraction layers without virtualization, bare metal cloud solutions have deeper config, optimization, and maintenance requirements. The same reason adds complexity in deployment times and reliance on professionals that may not be available in your region. Another important restriction is restricted scalability and flexibility for some use cases. Bare metal clouds, on the other hand, might provide more raw performance but are not as flexible with variable workloads and support for multi-tenant installed prisms. In particular, the dramatic real-time scaling up and down of resources needed by industries with dynamic workload requirements, and on-demand supply from retail and media can present an issue. For instance, integrating with current hybrid or multi-cloud strategies may be difficult, especially for enterprises with a mix of infrastructures or legacy systems.

SEGMENTS ANALYSIS

BY SERVICE TYPE

Computer Services represented the largest portion of the market share in 2023, at 32.7%. Bare Metal Cloud is also becoming the new norm for compute-intensive applications, such as big data analytics, AI, ML, and real-time processing, among other use cases, which is also propelling demand for such solutions. Build with metal under the hood Bare metal compute services deliver the best performance by offering dedicated hardware that removes performance bottlenecks commonly found in shared virtualized environments. The adoption of compute services has been heavily driven by the BFSI, IT & ITeS, and telecommunications sectors that require high processing power for calculation-intensive simulations, transaction processing, and data-crunching capabilities.

Networking Services is set to grow at the highest CAGR between 2024 and 2032, propelled by the increasing deployment of 5G networks and edge computing. More than ever, businesses are focusing on low-latency, high-bandwidth networking solutions for real-time applications including IoT, autonomous vehicles, and online gaming. Bare Metal Cloud Networking Services offer low-level access to the network configuration, which enables users to design the ideal configuration for low-latency workloads. Finally, when companies move towards a hybrid and multi-cloud strategy, strong networking services become essential to easily integrate data and migrate workloads seamlessly between on-premises and cloud locations. Such increasing requirement for more flexible and high-performing networking capabilities is one of the important factors driving its rapid growth trajectory.

BY ENTERPRISE SIZE

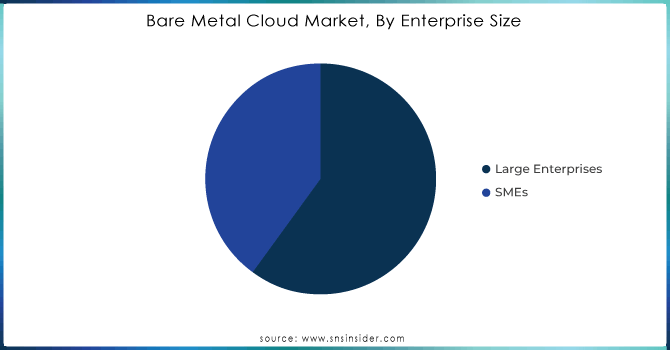

Large enterprises account for the largest market share with a 59.6% share of the market in 2023, as they continue to invest in high-performance, high-scalable, and secure infrastructure capable of handling complex workloads. Most enterprises in sectors including BFSI, healthcare, and telecommunications depend on bare metal cloud solutions to perform data-heavy operations such as big data analytics, AI/ML model training, and hosting mission-critical applications. Because they boast not only the capital but the technical prowess required to implement (and maintain) bare metal cloud environments, these enterprises are the top customers of these solutions. In addition, large enterprises prefer stringent adherence to data security laws and want absolute control over their infrastructure, something bare metal solutions align well with.

SMEs are expected to register the highest CAGR during the period from 2024 to 2032, owing to the growing accessibility and affordability of such bare metal cloud services. Flexible pay-as-you-go pricing models and managed services have brought this capability to many SMEs, allowing them to utilize enterprise-grade infrastructure without major upfront investments required. Bare Metal (BM) Cloud is being more widely adopted by SMEs to boost performance for specific applications (e.g., e-commerce, CRM, and lightweight analytics). In addition, the rising trend of digital transformation among SMEs and the necessity to be competitive in a high-speed market is fueling the need to use Cloud Infrastructure. Coupled with this, the availability of regional service providers specifically targeting small and medium-sized businesses is also expanding.

BY INDUSTRY VERTICAL

The BFSI segment held the largest market share of 22.7% in 2023 owing to the higher dependence of this industry on secure and high-performance computing infrastructure. Large volumes of sensitive data of customers are handled by the BFSI sector with real-time transaction processing, fraud detection, and risk analysis of the tasks being performed. Bare metal Cloud solutions can help BFSI organizations meet the compliance-specific need for high processing power, very low latency, and close-to-bare-metal level security features to comply with extremely stringent regulatory requirements, such as GDPR and PCI DSS. Furthermore, the increasing use of AI and machine learning in BFSI to personalize banking, predictive analytics, and algorithmic trading has also driven the growth of the bare metal cloud market.

The manufacturing sector is projected to register the highest CAGR from 2024 to 2032 due to the rapid adoption of Industry 4.0 and smart manufacturing. The sector-wise implementation of IoT use cases is gaining traction now, for instance, IoT-enabled predictive maintenance, real-time supply chain monitoring, and digital twin simulations, all of which are being enabled by bare metal cloud infrastructure. Bare metal solutions can provide the required high computation accuracy and low latency needed by manufacturing processes. In addition, robotics, automation, and the adoption of AI-driven analytics in production workflows are increasing the demand for large-scale, high-performance computing solutions. With the shift to digital and modernization in operations being part of the journey for many manufacturers, gaining access to the requisite technology without compromising on performance is going to be an important aspect and manufacturing will be at the forefront of the bare metal cloud growth story in the years to come.

REGIONAL ANALYSIS

In 2023, North America led the market with a 39.1% share, thanks to the strong presence of leading technology companies, as well as advanced infrastructure and early cloud solution adoption. The region has numerous global market leaders in BFSI, IT, healthcare & telecommunications that heavily depend on bare metal cloud services for high-performance computing, data security, and scalability. Take, for example, Amazon Web Services (AWS) and Microsoft Azure both offer bare metal cloud services for North American enterprises, including financial institutions like Goldman Sachs, as well as healthcare organizations such as Mayo Clinic that need the highest-security, high-performance infrastructure for data-centric applications. Further, the surging trend of utilizing AI, machine learning & IoT which need dedicated hardware along with the growing usage of cloud computing in various verticals across the region are contributing significantly towards the market growth making the North American region dominate the market.

Asia Pacific is anticipated to register the highest CAGR over the forecast timeframe, owing to the presence of rapid digital transformation in various important countries such as China, India, Japan, and Southeast Asia. With industries like manufacturing, healthcare, and retail turning towards bare metal cloud services for use cases in high-performance computing and real-time data processing, the migration of cloud technologies across the region is accelerating. Alibaba Cloud, the largest cloud provider in Asia, has bare metal cloud solutions that enable enterprises across China to support high-performance workloads. Similarly, India's reliance industries are also adopting modern-day technologies like AI and IoT in their manufacturing and retail process, which leads to the demand for low latency, scalable infrastructure. With continued investment in digitalization and technological innovation, especially in emerging markets, the demand for bare metal cloud will likely grow quickly and Asia Pacific is expected to be one of the high-growth engines.

Need any customization research on Bare Metal Cloud Market - Enquiry Now

Key players

Some of the major players in the Bare Metal Cloud Market are:

-

IBM Cloud (Bare Metal Servers, Virtual Servers)

-

Oracle Cloud (Bare Metal Instances, Block Volumes)

-

Rackspace Technology (Managed Bare Metal Hosting, Data Freedom)

-

Liquid Web (Dedicated Servers, Cloud VPS)

-

INAP (Bare Metal Servers, Cloud Backup)

-

RedSwitches (Bare Metal Servers, Server Management)

-

OpenMetal (Custom Bare Metal Servers, Cluster System Support)

-

Vultr (Bare Metal Servers, Cloud Compute)

-

OVHcloud (Bare Metal Servers, Public Cloud)

-

PhoenixNAP (Bare Metal Servers, Cloud Storage)

-

HostHatch (Bare Metal Servers, VPS Hosting)

-

Scaleway (Bare Metal Cloud, Object Storage)

-

Packet (Bare Metal Servers, Edge Compute)

-

Leaseweb (Bare Metal Servers, Cloud Hosting)

-

Interoute (Bare Metal Servers, Virtual Data Center)

-

SoftLayer (Bare Metal Servers, Cloud Storage)

-

Datapipe (Bare Metal Servers, Managed Hosting)

-

SingleHop (Bare Metal Servers, Cloud Hosting)

-

ServerMania (Bare Metal Servers, Cloud Hosting)

-

Hostwinds (Bare Metal Servers, VPS Hosting)

Some of the Raw Material Suppliers for companies:

-

Intel Corporation

-

AMD (Advanced Micro Devices)

-

NVIDIA

-

Seagate Technology

-

Western Digital

-

Micron Technology

-

Samsung Electronics

-

Broadcom

-

Arista Networks

-

Cisco Systems

RECENT TRENDS

-

In February 2024, IBM Cloud Bare Metal Servers now feature 4th Gen Intel Xeon processors, offering enhanced core density, faster memory speeds, and improved data access for high-performance computing needs.

-

In September 2024, Oracle Cloud Infrastructure (OCI) launched the general availability of its Compute instances powered by AMD Instinct MI300X GPUs, designed to accelerate AI workloads.

-

In October 2024, Liquid Web launched a high-performance GPU hosting solution using NVIDIA GPUs, designed for AI, machine learning, and rendering applications. The service offers flexible, on-demand bare-metal servers with improved GPU performance at competitive pricing.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 8.47 Billion |

|

Market Size by 2032 |

USD 46.14 Billion |

|

CAGR |

CAGR of 20.77% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Service Type (Compute Services, Networking Services, Storage Services, Database Services, Security Services, Managed Services, Others) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

IBM Cloud, Oracle Cloud, Rackspace Technology, Liquid Web, INAP, RedSwitches, OpenMetal, Vultr, OVHcloud, PhoenixNAP, HostHatch, Scaleway, Packet, Leaseweb, Interoute, SoftLayer, Datapipe, SingleHop, ServerMania, Hostwinds |

|

Key Drivers |

• Microservices and Kubernetes Drive Bare Metal Cloud Growth for High Performance and Real-Time Data Processing |

|

RESTRAINTS |

• Challenges of Bare Metal Cloud Adoption: Complexity Scalability and Integration Issues for Dynamic Workloads |