AI Agents Market Report Scope & Overview:

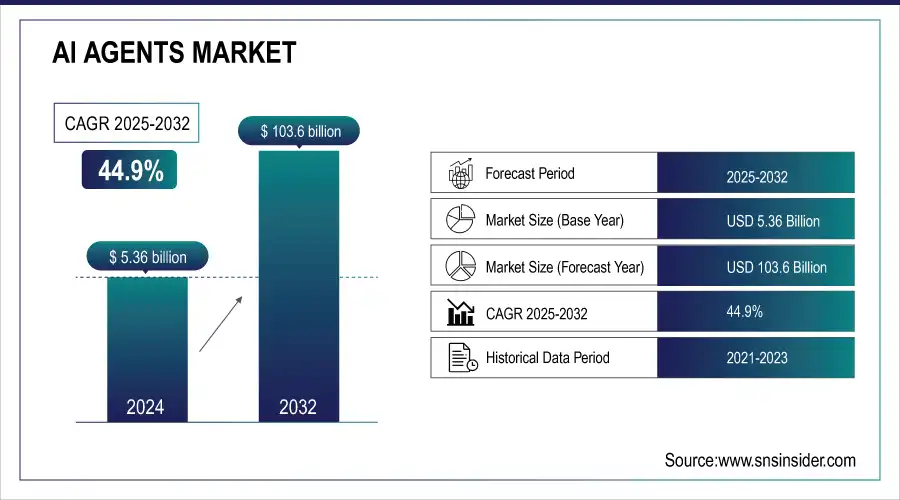

The AI Agents Market Size was valued at USD 5.36 Billion in 2024 and is expected to reach USD 103.6 Billion by 2032, growing at a CAGR of 44.9% over the forecast period 2025-2032.

To Get More Information on AI Agents Market - Request Sample Report

The remarkable growth of the AI agents’ market in 2023 has been fuelled by increasing government investments and the spread of advanced technologies. According to the latest statistics from the U.S. government, its federal AI research and development spending climbed to $1.5 billion in 2023, which is a 20% increase from the previous year. This investment aligns with global trends, as governments worldwide are recognizing AI's potential to improve public services, economic competitiveness, and national security. For example, the European Union has allocated more than €1 billion for AI projects in 2023, focusing on ‘ethical’ AI and data sovereignty. These investments have the goal of increasing the speed of the spread of AI technologies across such sectors as healthcare, education, as well as defense, and transportation. One of the main technologies is machine learning and, more specifically, natural language processing.

AI Agents Market Size and Forecast:

-

Market Size in 2024: USD 5.36 Billion

-

Market Size by 2032: USD 103.6 Billion

-

CAGR: 44.9% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key AI Agents Market Trends:

-

Integration of AI agents with autonomous decision-making enhances process automation, operational efficiency, and real-time task execution across industries.

-

Advancements in natural language processing (NLP) improve human-like communication, enabling intelligent virtual assistants, customer support, and content generation.

-

Expansion of AI agents into consumer applications supports personalized shopping, smart home automation, and interactive user experiences.

-

Cloud-based deployment of AI agents ensures scalability, flexibility, and cost-effective adoption for enterprises of all sizes.

-

Industry-specific AI agents optimize performance in healthcare, finance, retail, and manufacturing, addressing unique operational challenges.

-

Collaborations between AI developers, cloud providers, and enterprises accelerate innovation, integration, and ecosystem development.

-

Regulatory focus on AI ethics, privacy, and security ensures responsible deployment and reduces risks associated with autonomous systems.

-

Rising enterprise adoption of AI agents drives efficiency improvements, predictive analytics, and enhanced decision-making across business functions.

AI agents are being deployed across industries, in various roles from automation to predictive analytics, and assist with decision-making. The market for AI agents involved in problem-solving has experienced rapid growth, with a special emphasis put on sectors like customer service, healthcare, and finance. Governments are not only investing in AI R&D but also implementing AI-driven policies, such as the U.S. National AI Initiative, which aims to ensure AI leadership. These policies contribute to a favorable environment for the growth of AI agents, as public and private entities increasingly rely on these technologies to streamline operations and drive innovation. Customers demand personalized services, which can be effectively provided by AI agents investing their big data processing capabilities and offering adaptive solutions in real-time, as evidenced in the e-commerce sector, as well as targeted support. AI agents supporting the customer service departments are adept at managing inquiries, as well as notifying patients they are looking for. They assist in detecting and responding to threats of security. The advancements in machine learning, deep learning, and natural language processing ensure the improved efficiency of AI agents, subsequently boosting their popularity for use in more difficult tasks in various industries.

AI Agents Market Drivers:

-

Businesses are increasingly implementing AI agents to automate repetitive tasks, enhancing operational efficiency and reducing labor costs.

-

Companies are deploying AI agents, such as chatbots and virtual assistants, to improve customer service and engagement, leading to higher customer satisfaction and loyalty.

One major driver for the AI agents market is the growing adoption of automation. All organizations aim to increase their operational efficiency. Thus, more and more industrial operators and businesses realize the significant benefits of implementing AI agents into their processes. A good example of how companies can adopt such solutions almost 70% of all companies have increased their automation pace since 2024. Therefore, AI-driven solutions have become an integral part of most companies’ operational strategies. In this regard, a prime example that demonstrates the effectiveness of this driver comes from customer service. Here, AI chatbots are increasingly used to interact with clients and manage their low-complexity, repetitive inquiries or calls.

In 2023, the U.S. Department of Veterans Affairs reported that their AI-driven customer support service managed more than 2 million inquiries in a single month of providing customer support, with over 1 million coming from the query-based virtual assistant. As a result, response times decreased manyfold, and live support agents had to deal with more complex inquiries. Also, another domain benefiting from such automation is healthcare and finance. Here, AI agents are used for scheduling, data input, and monitoring compliance. In health care, AI virtual assistants are increasingly used for patient reception and appointment scheduling, thus smoothing the patient’s flow and reducing the administrative burden. Finalizing the analysis, it is clear that extensive interest in automation not only increases the efficiency of its users but also drives change and innovation within these users, presenting AI agents as an integral tool for these companies’ future growth and development.

AI Agents Market Restraints:

-

The increasing scrutiny over data privacy and security regulations poses challenges for AI agents, as businesses must ensure compliance while managing sensitive customer information.

- The initial costs associated with deploying AI agents, including infrastructure, training, and maintenance, can be a significant barrier for small and medium enterprises (SMEs).

A significant restraint in the AI agents market is data privacy concerns. Since AI agents typically deal with customers’ sensitive information, the potential risks of data breaches and their misuse become a major issue for organizations. Consequently, as the incidence of relevant regulations such as the General Data Protection Regulation in Europe and the California Consumer Privacy Act in the U.S. has been on the rise, companies have had to deal with a set of complicated requirements and standards that must be met. As a result, the use of data, and performance are coming under critical scrutiny. Furthermore, the efforts to ensure data security and establish appropriate means of handling sensitive information are often costly.

Moreover, it is important to note the widespread concern that customers often have about how their personal data is processed by AI agents. Ultimately, such concerns of data privacy that companies are ethically, legally, and economically compelled to address serve as a major restraint, their data security measures undermined or being imperfectly sufficient. As a result, the need to invest effort and funds in relevant data protection measures and ensure the necessary transparency slows down the promotion and adoption of AI agents in a wide array of industries.

AI Agents Market Segmentation Analysis:

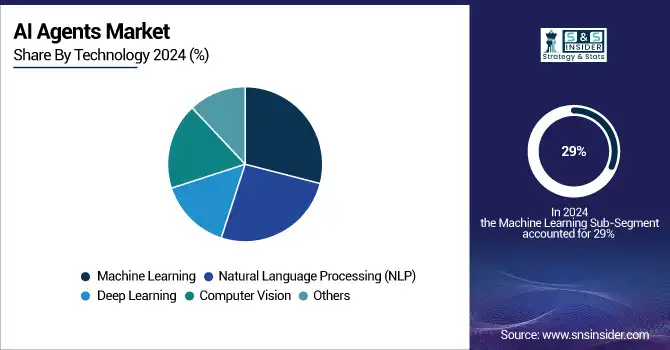

By Technology, Machine Learning Dominates the AI Agents Market with 29% Revenue Share in 2024

Machine learning held the highest market share of 29% of global revenue in the AI agents market in 2024. This is probably associated with ML's extensive use in different AI agent applications, such as natural language processing, computer vision, and predictive analytics. As a result of machine learning models learning from vast datasets, these AI agents have become much more accurate and functional, facilitating much more complex decision-making processes.

Furthermore, machines learned to recognize patterns in these datasets, demonstrating an ability to perform specific tasks and improve over time without human intervention. According to government data, a significant portion of the amount of $1.5 billion provided by the U.S. for AI research in 2024 was spent on the development of machine learning in various fields, such as healthcare diagnostics and autonomous systems. In turn, the Chinese government aims to become the world leader in AI by 2030 and has allocated substantial funds to advance ML nationwide. These examples serve as evidence of machine learning vital role in both the public and private sectors and its critical contribution to the market share. Additionally, due to ML's range of uses and capacity for processing large amounts of data, it serves as a key technology in developing AI agents.

By Application, Customer Service, and Virtual Assistants Lead AI Agents Market Revenue in 2024

In the context of the AI agents market, the customer service and virtual assistants segment generated the highest revenue in 2024. Virtual assistants, such as chatbots and automatic services representatives, have become an integral part of customer interaction platforms whose use significantly decreases responding times, increases user satisfaction, and has an overall positive effect on the operation. According to the data provided by the government, there has been an annual increase of 25% annual growth rate, with public sectors like healthcare and transportation increasingly adopting these technologies to enhance service delivery.

The rise of e-governance and AI-driven public service platforms has further accelerated this trend. In 2024, the U.S. government reported that 45% of customer-related interactions were covered by AI agents. In India and China, the statistic reached 70% and 65%, respectively, with the trend more pronounced in sectors like health and public administration. Thus, the increase in the use of AI agents and virtual assistants in customer service has been extremely swift, creating a demand for new, more advanced, and efficient solutions.

By End-use, the Enterprise Segment Holds the Largest Revenue Share in the AI Agents Market in 2024

The enterprise segment held the largest revenue share in 2024 in the AI agents market highlighting the extensive adoption of AI agents in corporate operations. Enterprises, especially in finance, healthcare, and retail have been adopting AI agents for various applications including customer support, data analysis, and process automation. Based on the government report, the adoption of AI by large enterprises in India grew by 35% in 2024, as businesses use AI agents to enhance efficiency, reduce the cost of operations, and improve decision-making.

Similarly, the government in the U.K. informed in the report that the use of AI agents by large enterprises reached over 70% by the end of 2024. The benefits including cost reduction, accuracy, and scalability of AI agents are contributing to the increasing adoption of AI agents among enterprises. Thus, the largest end-use market for the AI agents industry is the enterprise market.

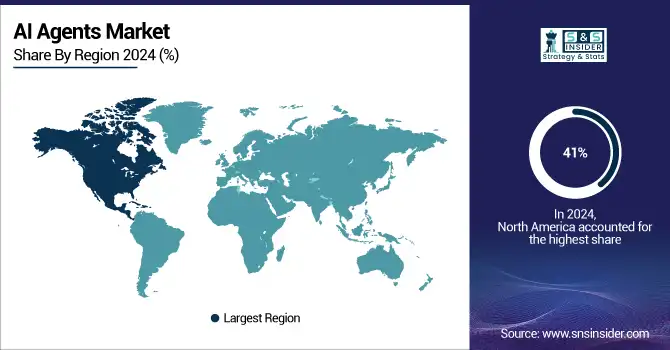

AI Agents Market Regional Analysis:

North America Dominates the AI Agents Market in 2024

North America holds an estimated 41% market share in 2024, driven by widespread AI adoption, advanced IT infrastructure, and government-backed AI initiatives. This causes enterprises to prioritize AI agent deployment for automation, predictive analytics, and customer service enhancements, accelerating operational efficiency across industries.

Do You Need any Customization Research on AI Agents Market - Inquire Now

-

United States Leads North America’s AI Agents Market

The U.S. dominates due to large-scale AI research investments, advanced technology startups, and extensive enterprise adoption in healthcare, finance, and e-commerce. Federal funding and regulatory support accelerate AI agent integration, while companies leverage machine learning and NLP-based solutions to optimize operations and customer engagement. With robust R&D, mature infrastructure, and supportive policies, the U.S. remains the largest contributor to North America’s AI agents market leadership.

Asia Pacific is the Fastest-Growing Region in the AI Agents Market in 2024

The region is expected to grow at a CAGR of 46.2% from 2025–2032, driven by rapid digital transformation, expanding enterprise adoption, and government AI initiatives. This causes businesses to integrate AI agents for virtual assistants, automated customer service, and predictive analytics, boosting market demand.

-

China Leads Asia Pacific’s AI Agents Market

China dominates the Asia Pacific market due to its aggressive national AI strategy, including investments in machine learning, NLP, and robotics. Government initiatives promote research, startup growth, and AI integration across healthcare, finance, and manufacturing. Rising enterprise adoption of virtual assistants and automation tools further accelerates AI agent deployment. Combined, these factors make China the largest and fastest-growing contributor to the region’s AI agents market.

Europe AI Agents Market Insights, 2024

Europe is witnessing steady growth in 2024, fueled by enterprise digitalization, AI research programs, and regulatory frameworks. Germany’s industrial AI adoption and research programs improve efficiency, causing accelerated AI agent deployment across Europe.

-

Germany Leads Europe’s AI Agents Market

Germany dominates Europe due to strong AI research initiatives, industrial digitalization, and early adoption of AI agents in banking, healthcare, and automotive sectors. Public-private partnerships and substantial R&D investments support predictive analytics, process automation, and enhanced operational performance. Germany’s focus on AI innovation and enterprise adoption positions it as the regional leader in the AI agents market.

Middle East & Africa and Latin America AI Agents Market Insights, 2024

The AI agents market in these regions is expanding steadily, driven by growing enterprise digitization, government AI programs, and demand for automated customer service solutions. Countries like the UAE and Saudi Arabia invest in smart city projects and AI-powered public services, while Brazil and Mexico focus on AI adoption in banking, healthcare, and retail. Partnerships with global AI providers accelerate deployment, improve operational efficiency, and broaden market reach across both regions.

Competitive Landscape for the AI Agents Market:

IBM Corporation

IBM Corporation is a U.S.-based global leader in AI and enterprise technology solutions, offering advanced AI agent platforms, automation tools, and analytics services. The company provides end-to-end AI solutions, including machine learning integration, natural language processing, and cognitive computing for enterprises across healthcare, finance, and retail. IBM’s AI agents enhance operational efficiency, automate workflows, and support decision-making, positioning the company as a key player in the AI agents market.

-

In 2025, IBM expanded its AI agent offerings with the launch of Watson AI automation tools, enabling enterprises to deploy intelligent virtual assistants and predictive analytics at scale.

Microsoft Corporation

Microsoft Corporation, headquartered in the U.S., is a leading provider of cloud-based AI agent solutions, including Azure AI services, virtual assistants, and enterprise automation platforms. The company enables organizations to integrate AI agents into customer service, workflow automation, and data analytics applications. Microsoft strengthens the AI agents market by offering scalable, secure, and intelligent solutions that improve operational efficiency and user experience.

-

In 2025, Microsoft introduced new Azure AI agent features, enhancing multi-lingual virtual assistant capabilities and predictive business insights for global enterprises.

Google LLC

Google LLC, a U.S.-based technology giant, develops AI agents for enterprise, consumer, and cloud applications, focusing on machine learning, natural language understanding, and automation. Google’s AI agents support virtual assistants, chatbots, and predictive analytics solutions, enhancing efficiency, engagement, and decision-making. Its role in the AI agents market is pivotal, providing both scalable cloud platforms and AI development tools that accelerate enterprise adoption.

-

In 2025, Google launched new AI agent capabilities in Google Cloud, offering advanced conversational AI and automated data analysis solutions for businesses worldwide.

Amazon Web Services, Inc.

Amazon Web Services (AWS), headquartered in the U.S., is a global leader in cloud-based AI services and AI agent deployment. AWS offers machine learning frameworks, virtual assistant solutions, and intelligent automation tools for enterprises across multiple industries. The company supports scalable AI agent adoption, enabling real-time analytics, predictive modeling, and customer interaction automation. AWS plays a central role in the AI agents market by combining cloud infrastructure with advanced AI capabilities to meet enterprise demands.

-

In 2025, AWS expanded its AI agent services with enhanced Amazon Lex and SageMaker integrations, allowing enterprises to deploy intelligent chatbots and automation solutions efficiently.

AI Agents Market Key Players:

-

IBM Corporation

-

Microsoft Corporation

-

Google LLC

-

Amazon Web Services, Inc.

-

Baidu, Inc.

-

SAP SE

-

Oracle Corporation

-

Salesforce.com, Inc.

-

Nuance Communications, Inc.

-

IPsoft Inc.

-

Kore.ai

-

Artificial Solutions International AB

-

Pypestream Inc.

-

Verint Systems Inc.

-

Boost.ai AS

-

Inbenta Technologies Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 5.36 Bn |

| Market Size by 2032 | US$ 103.6 Bn |

| CAGR | CAGR of 44.9% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Ready-to-Deploy Agents, Build-Your-Own Agents) • By Technology (Machine Learning, Natural Language Processing (NLP), Deep Learning, Computer Vision, Others) • By Agent System (Single Agent Systems, Multi Agent Systems) • By Application (Customer Service and Virtual Assistants, Robotics and Automation, Healthcare, Financial Services, Security and Surveillance, Gaming and Entertainment, Marketing and Sales, Human Resources, Legal and Compliance Others) • By End Use (Consumer, Enterprise, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | IBM Corporation, Microsoft Corporation, Google LLC, Amazon Web Services, Inc., Apple Inc., Baidu, Inc., SAP SE, Oracle Corporation, Hewlett Packard Enterprise (HPE), Salesforce.com, Inc., Nuance Communications, Inc., IPsoft Inc., Avaamo, Inc., SoundHound Inc. |