Battle Royale Games Market Report Scope & Overview:

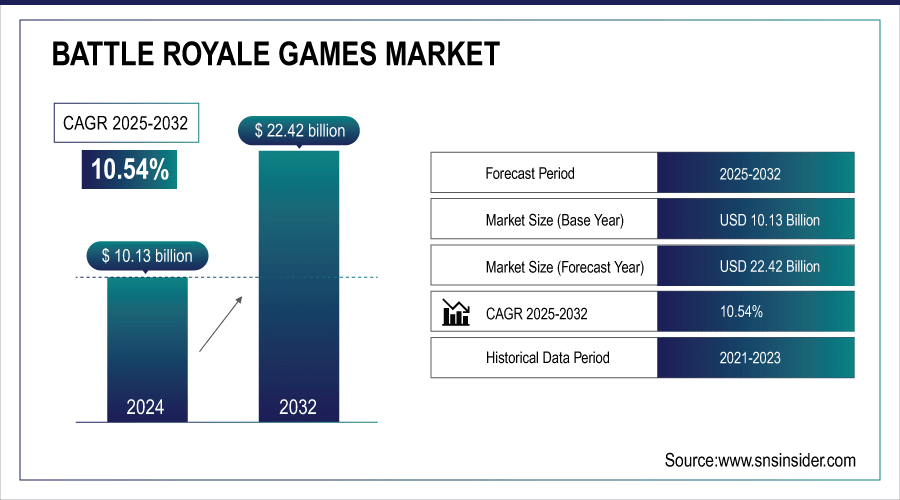

Battle Royale Games Market was valued at USD 10.13 billion in 2024 and is expected to reach USD 22.42 billion by 2032, growing at a CAGR of 10.54% from 2025-2032.

The growth of the Battle Royale Games Market is driven by increasing popularity of immersive multiplayer experiences, rising smartphone penetration, and expanding internet connectivity. Integration of advanced graphics, cross-platform play, and frequent in-game updates enhance player engagement. Additionally, monetization through in-game purchases, esports expansion, and social gaming trends significantly contribute to sustained market expansion.

A clear example of this momentum is Garena Free Fire, which is available in more than 130 countries and recorded over 100 million daily active users as of early 2024. Its global reach was further underscored during the Free Fire World Series 2021 in Singapore, which drew a peak of 5.4 million concurrent esports viewers marking the highest viewership ever for an esports event outside Chinese platforms.

To Get More Information On Battle Royale Games Market - Request Free Sample Report

Battle Royale Games Market Trends

-

Rising popularity of free-to-play models with in-game purchases is fueling market growth.

-

Cross-platform compatibility is enhancing player engagement and expanding user bases.

-

Integration of AR/VR and immersive graphics is improving gameplay experiences.

-

Esports tournaments and live streaming platforms are boosting global visibility and monetization.

-

Frequent content updates, new maps, and seasonal events are driving player retention.

-

Mobile gaming adoption is expanding accessibility and revenue opportunities.

-

Collaborations with brands and entertainment franchises are creating new monetization streams and wider audience reach.

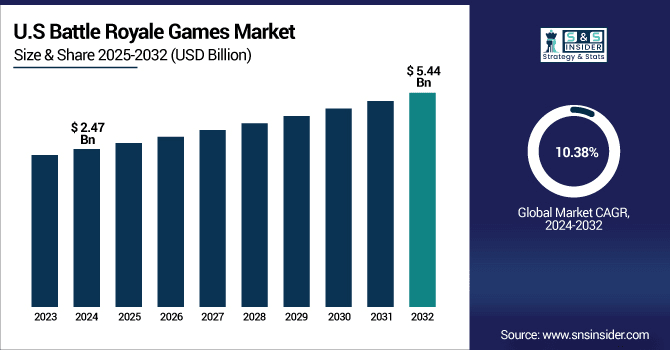

U.S. Battle Royale Games Market was valued at USD 2.47 billion in 2024 and is expected to reach USD 5.44 billion by 2032, growing at a CAGR of 10.38% from 2025-2032.

The U.S. Battle Royale Games Market is growing due to high adoption of advanced gaming consoles, strong esports culture, and rising demand for competitive online experiences. Widespread smartphone usage, seamless cross-platform gaming, and innovative monetization through in-game purchases further drive market expansion, supported by strong developer investments and frequent content updates.

Battle Royale Games Market Growth Drivers:

-

Rising popularity of immersive multiplayer gaming experiences driving strong engagement and revenue growth in the battle royale games market globally

Growing interest in immersive multiplayer formats is fueling the adoption of battle royale games worldwide. The real-time competition, large player pools, and dynamic environments attract a wide demographic, enhancing engagement across casual and professional gamers. Streaming platforms and esports have amplified popularity, generating revenue through advertising, sponsorships, and tournaments. The free-to-play model with in-game purchases encourages accessibility, supporting rapid market expansion. Mobile penetration has further widened the audience base, particularly in Asia-Pacific. This combination of inclusivity, entertainment value, and social interactivity positions battle royale games as a dominant force in the interactive entertainment industry.

-

Epic Games Store reported USD 1.09 billion in player spending in 2024, a 15% increase from the previous year. Fortnite itself continues to dominate with approximately 650 million registered players as of 2025, supported by over 60 million daily active users and 110 million monthly active users, underscoring the scale and sustained engagement of immersive multiplayer gaming.

Battle Royale Games Market Restraints:

-

Intense competition and market saturation creating challenges for new entrants in the global battle royale gaming industry landscape

The battle royale market is heavily saturated, with dominant titles like Fortnite, PUBG, and Free Fire capturing the largest shares. Continuous innovation and updates are required to retain player interest, creating high costs for developers. Smaller studios face entry barriers due to limited resources, difficulty competing with established franchises, and aggressive marketing by global leaders. Market saturation also leads to reduced differentiation among games, making it harder for new entrants to gain traction. Over time, repetitive gameplay experiences risk player fatigue, further intensifying the competitive environment. These dynamics restrict growth opportunities for emerging participants in this crowded gaming sector.

Battle Royale Games Market Opportunities:

-

Integration of advanced technologies like AR, VR, and AI creating immersive opportunities for innovation in battle royale gaming experiences

The adoption of advanced technologies such as augmented reality, virtual reality, and artificial intelligence offers transformative opportunities for battle royale games. AR and VR enable deeper immersion, creating life-like experiences that enhance player engagement and retention. AI-driven personalization tailors gaming environments to individual preferences, improving satisfaction. These innovations also support advanced in-game analytics, dynamic storytelling, and adaptive difficulty levels, making gameplay more interactive. Furthermore, integration with wearable devices and cloud gaming services expands accessibility. With technological advancements, developers can differentiate their products, attract broader audiences, and sustain competitive advantage in the evolving global battle royale games market.

-

At State of Unreal 2025, Epic Games unveiled the Persona Device, a groundbreaking AI tool within Unreal Editor for Fortnite (UEFN). It enables creators to design their own AI-powered NPCs controllable characters with custom voices, behaviors, and personalities. This follows the debut of the AI-powered Darth Vader in the game.

Battle Royale Games Market Segment Highlights

-

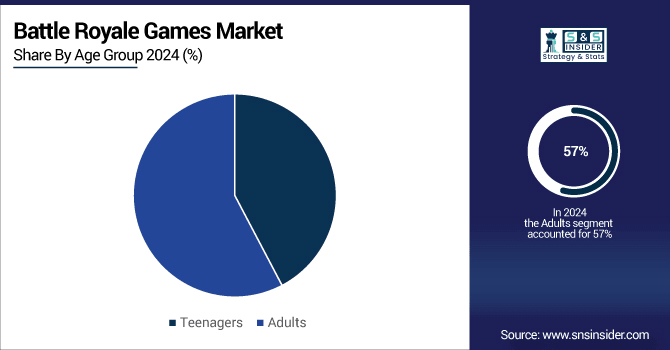

By Age Group, Adults dominated with ~57% share in 2024; Teenagers fastest growing (CAGR 11.88%).

-

By Game Type, Free-to-Play dominated with ~78% share in 2024; Pay-to-Play fastest growing (CAGR 12.52%).

-

By Platform, Mobile dominated with ~43% share in 2024; PC fastest growing (CAGR 12.12%).

-

By Revenue Model, In-Game Purchases dominated with ~64% share in 2024; Advertising fastest growing (CAGR 12.90%).

Battle Royale Games Market Segment Analysis

-

By Age Group

Adults segment dominated the Battle Royale Games Market in 2024 due to higher disposable income, strong interest in competitive online gaming, and active participation in esports and streaming. Their willingness to spend on premium skins, passes, and upgrades ensured higher revenue generation, solidifying this group as the most profitable demographic.

Teenagers segment is expected to grow at the fastest CAGR from 2025-2032, supported by increasing smartphone usage, free-to-play accessibility, and rising influence of social gaming culture. Growing participation in esports, strong adoption of online multiplayer formats, and engagement through streaming platforms are fueling expansion, making teenagers the fastest-emerging audience base.

-

By Game Type

Free-to-Play segment dominated the Battle Royale Games Market in 2024 as it removed entry barriers, attracting mass audiences across diverse demographics. Accessibility on mobile and PC, supported by in-game monetization models like skins and battle passes, encouraged player retention and spending, making it the most preferred format globally among casual and competitive gamers.

Pay-to-Play segment is expected to grow at the fastest CAGR from 2025-2032, driven by rising demand for premium, ad-free experiences and exclusive in-game content. Growing willingness of serious gamers to invest in high-quality, secure platforms with fewer distractions enhances its appeal, positioning this model for significant future expansion in the market.

-

By Platform

Mobile segment dominated the Battle Royale Games Market in 2024 owing to widespread smartphone penetration, affordable internet data, and the popularity of accessible free-to-play formats. Cross-platform integration, continuous updates, and localized content further strengthened engagement, making mobile the leading platform for both casual and competitive gamers across emerging and developed economies.

PC segment is expected to grow at the fastest CAGR from 2025-2032 as demand for high-quality graphics, immersive gameplay, and professional esports experiences increases. Rising investments in advanced hardware, streaming setups, and PC-based tournaments are driving growth, making it the preferred choice for serious and competitive players worldwide.

-

By Revenue Model

In-Game Purchases segment dominated the Battle Royale Games Market in 2024 due to the popularity of skins, battle passes, and personalization features. Continuous updates, seasonal content, and exclusive items encouraged recurring spending, creating a sustainable revenue stream for developers while providing players with engaging, customizable, and socially appealing gaming experiences.

Advertising segment is expected to grow at the fastest CAGR from 2025-2032, supported by integration of non-intrusive ad formats, brand collaborations, and event-based promotions. Growing esports audiences and streaming platforms create attractive opportunities for advertisers, allowing developers to expand revenue sources while enhancing player engagement through sponsored content and partnerships.

Battle Royale Games Market Regional Highlights

-

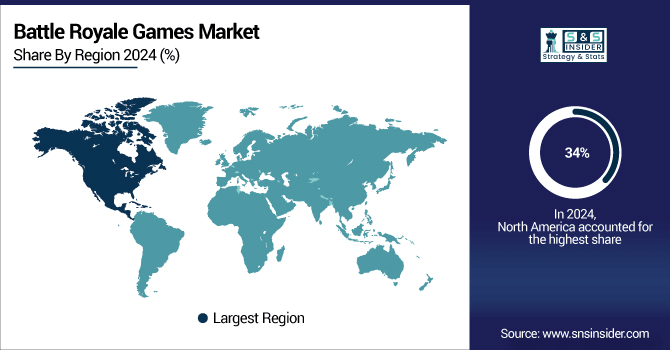

By Region, North America dominated with ~34% share in 2024; Asia Pacific fastest growing (CAGR 12.20%).

Battle Royale Games Market Regional Analysis

North America Battle Royale Games Market Insights

North America dominated the Battle Royale Games Market in 2024 due to its advanced gaming infrastructure, widespread adoption of high-end consoles and PCs, and strong esports ecosystem. The region benefits from high disposable incomes, a mature player base, and significant spending on in-game purchases. Strong presence of global developers, continuous technological innovation, and extensive streaming platforms further solidify North America’s leadership, making it the largest revenue-generating region in the battle royale gaming industry.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Asia Pacific Battle Royale Games Market Insights

Asia Pacific is expected to grow at the fastest CAGR from 2025-2032, driven by rapid smartphone penetration, affordable internet access, and rising popularity of free-to-play models. The growing youth population, expansion of esports tournaments, and strong community-based gaming culture enhance engagement. Localized content, increasing 5G adoption, and investments from global publishers further accelerate regional growth, positioning Asia Pacific as the fastest-emerging hub for battle royale gaming expansion worldwide.

Europe Battle Royale Games Market Insights

Europe in the Battle Royale Games Market is experiencing steady growth, supported by strong console and PC adoption, widespread broadband access, and rising esports popularity. Increasing demand for immersive multiplayer experiences, coupled with high consumer spending on in-game purchases, drives market expansion. Regulatory oversight and cultural diversity encourage localized content, making Europe a significant contributor to the global battle royale gaming industry.

Middle East & Africa and Latin America Battle Royale Games Market Insights

Middle East & Africa in the Battle Royale Games Market is growing with rising smartphone penetration, affordable data, and increasing youth interest in mobile gaming. Expanding esports events and localized content further fuel adoption.

Latin America shows strong growth driven by a vibrant gaming community, popularity of free-to-play formats, and rising internet access, making it a key emerging region.

Battle Royale Games Market Competitive Landscape:

Epic Games

Epic Games plays a leading role in the Battle Royale Games Market, primarily through its flagship title Fortnite. Known for dynamic gameplay, cross-platform accessibility, and regular content updates, Fortnite has become a cultural phenomenon. Epic’s innovative monetization strategy via in-game purchases and collaborations with global brands boosts revenue and engagement. Its focus on esports, community-driven events, and immersive virtual experiences further strengthens Epic Games’ dominance in the evolving battle royale segment.

-

2025 — Epic Games introduced Blitz Royale, a five-minute, 32-player Battle Royale mode designed for mobile devices with cross-platform support, released globally on June 18, expanding Fortnite’s fast-paced experiences.

-

2025 — Epic Games launched Fortnite Chapter 6 Season 4: Shock ’N Awesome on August 7, featuring Power Rangers and Halo crossover, bug-themed POIs, new weapons, medallions, quests, and Dino Megazord.

-

2024 — Epic Games launched Fortnite Ballistic, a tactical 5v5 FPS mode with round-based, no-respawn combat, marking a significant shift from traditional Battle Royale gameplay and expanding Fortnite’s competitive offerings.

Krafton

Krafton is a key player in the Battle Royale Games Market, best known for PUBG: Battlegrounds and PUBG Mobile. The company revolutionized the genre with realistic graphics, strategic gameplay, and large-scale online battles. PUBG Mobile’s global popularity, especially in emerging markets, drives significant revenue through in-game purchases and events. Krafton’s continuous updates, esports initiatives, and investment in next-generation technologies ensure its strong presence and competitive edge in the battle royale segment.

-

2025 — Krafton released PUBG Update 35.1, introducing unified gameplay across maps, reworked Aim Punch for smoother gunplay, Recall system for downed players, and standardized seasonal mechanics for balanced play.

-

2025 — Krafton launched PUBG Update 35.2, adding destructible terrain to Taego, improved vehicle camouflage, interactive map features like vending machines, and enhanced environmental interactivity, deepening realism and tactical gameplay.

-

2024 — Krafton partnered with K-pop group NewJeans for a PUBG collaboration, featuring themed visuals, care packages, and teaser content dropping in-game on PC (June 12) and consoles (June 20).

Key Players

Some of the Battle Royale Games Market Companies

-

Epic Games

-

Tencent

-

Krafton

-

Activision Blizzard

-

Electronic Arts

-

Respawn Entertainment

-

Mediatonic

-

Daybreak Game Company

-

Rec Room Inc.

-

Techland

-

Ubisoft

-

Bethesda Game Studios

-

Proletariat

-

Automaton

-

DICE (EA)

-

Davevillz

-

Triternion

-

Capermint Technologies

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 10.13 Billion |

| Market Size by 2032 | USD 22.42 Billion |

| CAGR | CAGR of 10.54% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (PC, Console, Mobile) • By Game Type (Free-to-Play, Pay-to-Play) • By Age Group (Teenagers, Adults) • By Revenue Model (In-Game Purchases, Advertising, Game Purchases) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Epic Games, Tencent, Krafton, Activision Blizzard, Electronic Arts, Respawn Entertainment, Mediatonic, Daybreak Game Company, NetEase, Rec Room Inc., Techland, Ubisoft, Bethesda Game Studios, Proletariat, Automaton, Treyarch, DICE (EA), Davevillz, Triternion, Capermint Technologies |