LTE AND 5G BROADCAST MARKET REPORT SCOPE & OVERVIEW:

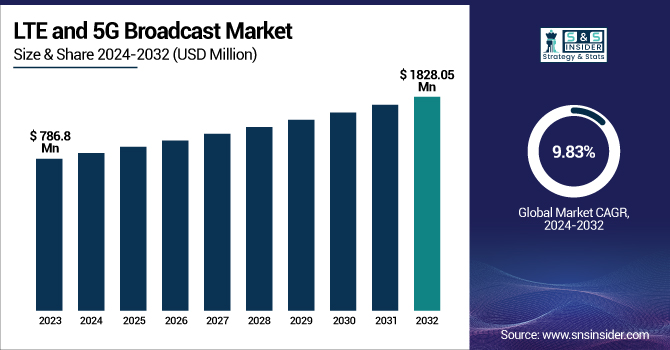

The LTE and 5G Broadcast Market was valued at USD 786.8 Million in 2023 and is expected to reach USD 1828.05 Million by 2032, growing at a CAGR of 9.83% over the forecast period 2024-2032.

To Get more information on LTE and 5G Broadcast Market - Request Free Sample Report

The LTE and 5G Broadcast Market is boosting extensively as there is a huge demand for higher quality, seamless communication, and entertainment experiences. Increased use of media-rich content (Video Demand, Mobile TV, and data-heavy applications) has been accelerated by the growth of mobile devices (particularly mobile phones and tablet computers). 5G will provide ultra-high data speeds, ultra-low latency, and greater network efficiency to deliver superior broadcast quality, thus transforming services such as live streaming, videoconferencing, and immersive technologies like augmented/virtual reality. Moreover, 5G has an improved capacity to handle network congestion that can deliver content, no matter how full the stadium is. India tentatively had 180 million 5G users in 2024 with 108 million on Reliance Jio and 72 million on Airtel. According to the report, 5G data consumption in India jumped to 6,239 petabytes, up 12.6%. During 2023, Telefónica achieved 5G coverage in 90% of Spain, in 5,100 municipalities, including 1,500 with 3.5 GHz service. For instance, in Spain, it helped break the 100-petabyte threshold of data traffic during the Euro Cup 2024 in 5G traffic, coming primarily from viewing mobile video.

The increasing penetration of smart technologies, especially in terms of connected cars and stadiums, is another major growth-propelling factor for the market. 5G and LTE have established themselves as natural platforms for processing real-time data feeds; powerful navigation solutions; and entertainment systems, as vehicles become more increasingly integrated with connectivity solutions. In addition, these technologies are being adopted in stadiums and other public venues to improve audience engagement with a variety of services, including live sports streaming, interactive content, and emergency alerts. The increasing number of IoT devices and the requirements for high-speed, high-reliability communication networks fuel the continued deployment of LTE and 5G broadcast technology in different industries, which brings opportunities to innovate and grow the market ecosystem. By 2028, over 180 million connected car drivers in the U.S. will represent 70.9% of all licensed drivers. During the 2022 World Cup, 5G reduced video streaming start times from 2.3 seconds on 4G to 1.7 seconds. By 2030, nearly 90% of connected cars sold are expected to feature embedded 5G capabilities.

MARKET DYNAMICS

KEY DRIVERS:

-

Global Expansion of 5G Infrastructure Driving Market Growth in Broadcast Services Video Streaming and Gaming

The expansion of 5G infrastructure is among the major factors driving the growth of the LTE & 5G broadcast market. 5G networks today boost more investments from telecommunication companies and service providers leading to better coverage, capacity, and speed. Enhanced 5G base station deployments and LTE Network Enhancement for greater broadcast capabilities supporting rapid content delivery, higher download speeds, and more resilient connections. The expansion of this infrastructure serves as a backbone for the growing consumption of services like video streaming, mobile gaming, and remote work applications all of which require a high-speed data transfer rate. With the introduction of 5G networks in the recent past, the demand for broadcast solutions will expand, in turn, driving market growth. China has rolled out more than 2.5 million 5G base stations by 2024, and the U.S. is projected to surpass 200 million 5G connections. 5G coverage in South Korea will exceed 97% of the population, while investment globally in 5G infrastructure is estimated to go beyond USD 100 billion.

-

The Rising Demand for Low Latency Applications Driving 5G Networks in Autonomous Vehicles Telemedicine and Industry

Another important driver is the increasing demand for applications that require low latency. The increasing demand for industries requiring real-time communication, like autonomous vehicles, telemedicine, and remote industrial operations, makes latency minimization integral. With its ultra-low latency (sub-1ms), 5G networks support new use cases that could not be satisfied by LTE networks. Autonomous cars, for instance, need to communicate with the network immediately to prevent crashes, and telemedicine relies on low latency for live consultations. To this end, LTE and 5G broadcast technologies will be pushed even further along as these low-latency applications require broadcast solutions that meet the draconian needs of efficient and responsive use cases. The increasing number of applications will continue to propel development and encourage investments needed to provide strong and reliable broadcast services in the market. 5G networks is set for ultra-low latency of 1 millisecond by 2024, down from 200 milliseconds for 4G. The research cites that more than 60% of autonomous vehicle prototypes will toss on 5G for communication in real-time. 5G enables real-time, low-latency video calls for telemedicine consultations, which are expected to surpass the considerably one billion range. Further, 5G will also be widely implemented for remote monitoring and control in 25% of industrial operations, with nearly zero latency in activities.

RESTRAIN:

-

Challenges in LTE and 5G Broadcast Market: Spectrum Shortages Complex Integration and Interoperability Issues

The limited spectrum availability is one of the main restrictions to the LTE and 5G Broadcast Market. With the increasing need for faster, more reliable networks we see radio frequency spectrum allocation becoming one of the most important considerations. Too many countries are struggling with spectrum resource allocation and management to satisfy the needs of 5G and LTE businesses. The shortage of spectrum will lead to network congestion, limiting the capacity of high-quality broadcast services, and affecting the efficiency of LTE and 5G networks. The second challenge is that network integration is complex. This necessary infrastructure deployment and integration process of 5G with existing LTE will need a lot of engineering skill, planning, and seamless coordination of many stakeholders. Such complexity could slow the adoption of 5G broadcast services, particularly in markets with low-quality network infrastructures. In addition, one of the main hurdles for service providers is ensuring seamless interoperability between the frontiers of multiple network generations and technologies.

KEY MARKET SEGMENTS

By Technology

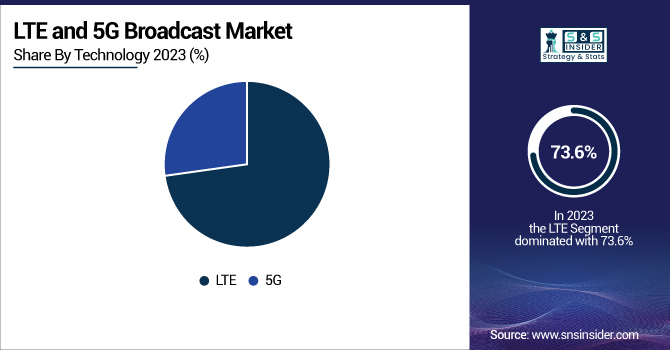

In 2023, LTE accounted for a 73.6% share of the market thanks to vast infrastructure and market acceptance. Since launching over a decade ago, LTE networks have reached large scale in both developed and developing markets, achieving a certain level of maturity. These offer mobile and quite reliable connectivity with high upfront speed, in video streaming, mobile applications & data-heavy services. As 5G starts to get commercially deployed worldwide, LTE continues to serve many users in many regions and remains the leading technology in the majority of instances in terms of the number of sites with coverage, because the investment in infrastructure to cover these users is very large, and LTE is a very low-cost solution compared to deploying a 5G network.

5G is likely to hold the highest growth in terms of CAGR from 2023 to 2032. Features like super-fast data speeds, low latency, and increased network capacity of 5G will be a boon for emerging techs like autonomous vehicles, industrial automation, IoT, Augmented Reality, and Virtual Reality. These features provide new use cases that LTE cannot completely fulfill. The growing availability of global 5G infrastructure and the investment by service providers to increase the capability of their networks will increase the adoption of 5G causing it to pace LTE more quickly than before. The market for 5G technologies will continue to dominate as it rapidly develops and the demand for next-generation communication and broadcast services will continue driving the market in the years ahead.

By End-Use

The Video on Demand (VoD) held the largest market share with a 34.8% share size in 2023 driven predominantly due to its penetration into different sectors of the industry and the growing consumer demand for tailored, quality entertainment experiences. VoD or Video on Demand services have become a go-to choice for entertainment across the world due to the increasing penetration of smart devices, cheap data, and popular streaming platform providers like Netflix, Amazon Prime, and Disney+. Also, VoD helps reach the consumer that is modern which means, can enjoy the flexibility and work anytime anywhere. Its supremacy has been propelled by the global embrace of digitalization also, and advancements in 4K and HDR streaming technologies. Indeed, VoD still accounts for a large share of all traffic on LTE and, more so, 5G networks, continuing to be the top market pull for broadcast technology investments.

Connected cars are expected to grow at the highest CAGR in the segment from 2024 to 2032. Connected Car business models build upon reliability and low latency communication networks which are the pillars of LTE and 5G networks respectively to provide real-time data, navigation, and entertainment services. With the growth of the electric vehicle (EV) market as well as the existing trends in advanced driver-assistance systems (ADAS), demand for connected car technologies has further been accelerated. Smart city projects and vehicle-to-everything (V2X) communication, dictate that governments and automotive manufacturers must combine their investments in these areas but fully rely on reliable network connectivity. The continued deployment of 5G networks around the world will create a new avenue for the increasing functionality of connected cars, including features such as real-time diagnostics and over-the-air updates, and improved safety technology, all of which will unprecedentedly boost the market as forecast period, according to the report.

REGIONAL ANALYSIS

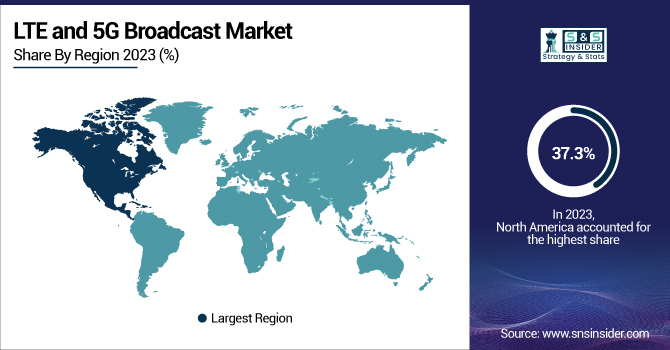

North America was the largest contributor to the LTE and 5G Broadcast Market with 37.3% of the market share in the year 2023, resulting from its advanced and convenient telecommunication infrastructures with high consumer demand for digital services. The region hosts top firms such as Qualcomm, and Verizon, and AT&T which lead the world in deploying LTE and 5G. With major streaming platforms like Netflix, Hulu, and Disney+, the demand for broadcast services is even more trending. Moreover, the USA is one of the leaders in the implementation of 5G, as it has already invested heavily in the nation's infrastructure, and industries such as entertainment technology, healthcare technology, and autonomous vehicles are already starting to embrace it. Verizon, for example, has started to offer 5G Ultra-Wideband service in several cities, and T-Mobile is expanding mid-band 5G network coverage.

The Asia Pacific is anticipated to hold the fastest compound annual growth rate between the timeline of 2024 and 2032, due to the quick urbanization phenomenon, increasing smartphone users, and large-scale government projects to signify 5G networks in the region. China, Japan, South Korea, and India are heavily investing in 5G infrastructure to benefit smart city projects, IoT, and advanced industrial applications. As an example, China Mobile together with Huawei has leveraged to accelerate the 5G coverage launch, while the 5G services are being provided mostly in South Korea by companies like SK Telecom and KT Corporation, with services like real-time broadcasting as well as gaming. Meanwhile, India´s Reliance Jio and Bharti Airtel are extending their 5G networks to keep up with the burgeoning digital economy. The Asia Pacific region is well-poised to lead the charge in future market growth, with the aforementioned advancements further bolstered by the region’s large and tech-savvy population of consumers.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players

Some of the major players in the LTE and 5G Broadcast Market are:

-

Qualcomm (Snapdragon X65 5G Modem-RF System, Snapdragon 8 Gen 1 Mobile Platform)

-

Verizon (5G Home Internet, 5G Ultra-Wideband Network)

-

KT Corporation (5G Standalone Network, GiGA Live VR Service)

-

MediaTek (Dimensity 9000 5G Chipset, Helio M70 5G Modem)

-

Telstra (5G Network Rollout, Telstra TV)

-

Sequans Communications (Monarch 2 LTE-M/NB-IoT Platform, Calliope 2 Cat 1bis Platform)

-

Ericsson (Radio System Hardware, Cloud Core Network Solutions)

-

Mavenir (Open RAN Solutions, Cloud-Native IMS)

-

Telit Cinterion (ME910G1-W1 Module, OneEdge IoT Platform)

-

Tejas Networks (GPON Equipment, Optical Transmission Network Solutions)

-

Nokia (AirScale Radio Access, 5G Cloud Core)

-

Huawei (5G CPE Pro Router, 5G Core Network Solutions)

-

Samsung Electronics (Exynos Modem 5123, 5G New Radio Solutions)

-

ZTE Corporation (5G Base Stations, 5G Core Network Products)

-

Cisco Systems (Ultra Services Platform, 5G xHaul Transport Solutions)

-

NEC Corporation (Open RAN Radio Units, 5G Core Network Solutions)

-

Intel Corporation (Atom P5900 Processor, 5G Network Acceleration Solutions)

-

Fujitsu Limited (5G Radio Access Units, 5G Core Network Products)

-

AT&T (5G+ Network, 5G Mobile Hotspots)

-

T-Mobile (5G Home Internet Plans, 5G Standalone Network)

Some of the Raw Material Suppliers for LTE and 5G Broadcast companies:

-

Soitec

-

Covestro

-

Amphenol Corporation

-

TE Connectivity

-

Quarktwin Electronic

-

Samtec

-

Syensqo

-

Rogers Corporation

-

DuPont

-

Murata Manufacturing Co., Ltd.

RECENT TRENDS

-

In November 2024, Astrum Mobile and Qualcomm successfully trialed 5G Broadcast services on a GEO satellite, delivering signals directly to standard smartphones, marking a major milestone in satellite-based mobile communications.

-

In April 2024, Verizon Business, AWS, and the NHL showcased 5G-enabled cloud broadcasting at the 2024 NAB Show, highlighting live-to-air production capabilities for high-quality, low-latency sports content delivery.

-

In October 2024, Samsung and KT have been selected to build a private 5G network for the Republic of Korea Navy, enhancing naval operations with a "Smart Naval Port" project, set for completion by December 2025.

| Report Attributes | Details |

| Market Size in 2023 | USD 786.8 Million |

| Market Size by 2032 | USD 1828.08 Million |

| CAGR | CAGR of 9.83% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (LTE, 5G) • By End Use (Video on Demand, Fixed LTE Quadruple Play, e-newspapers and e-magazines, Last Mile CDN, Emergency Alerts, Radio, Mobile TV, Connected Cars, Stadiums, Data Feeds & Notifications, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, Verizon, KT Corporation, MediaTek, Telstra, Sequans Communications, Ericsson, Mavenir, Telit Cinterion, Tejas Networks, Nokia, Huawei, Samsung Electronics, ZTE Corporation, Cisco Systems, NEC Corporation, Intel Corporation, Fujitsu Limited, AT&T, T-Mobile. |