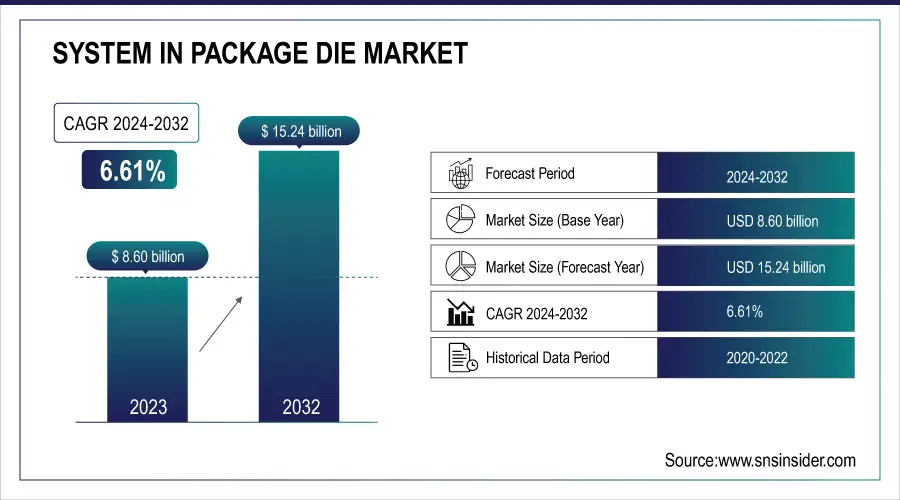

System in Package Die Market Size & Growth:

The System in Package Die Market was valued at USD 8.60 billion in 2023 and is expected to reach USD 15.24 billion by 2032, growing at a CAGR of 6.61% over the forecast period 2024-2032. Rising diced wafer fab capacity utilization caused by demand for miniature and high-efficiency solutions (known as System in Package (SiP) Die) is fueling significant business momentum. With the rapid growth of IoT and growing adoption of wearable devices, SiP that offers space and power efficiency would continue to aid the adoption of this technology. The integration of SiP in new technologies such as AI, 5G, and edge computing can improve performance and scalability. SiP solutions are also gaining traction in automotive and industrial applications for advanced driver-assistance systems (ADAS), connectivity, and automation. U.S. SiP die market demand soared in 2024 as a result of 5G, AI and IoT innovation. Top-tier semiconductor companies increased R&D on the integration of heterogeneous dies. It was used for a wide range of applications, such as smartphones, data centers, automotive electronics, and high-performance computing systems.

To Get more information on System in Package Die Market - Request Free Sample Report

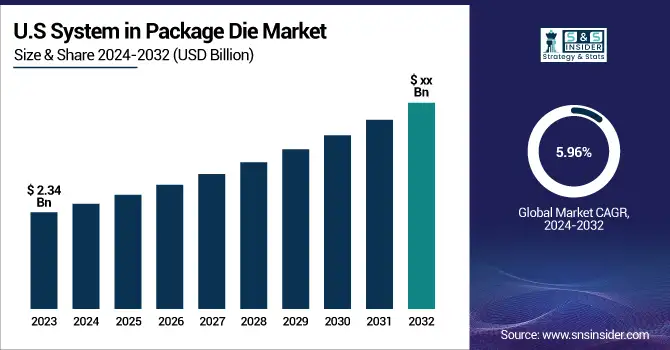

The U.S. System in Package Die Market is estimated to be USD 2.34 billion in 2023 and is projected to grow at a CAGR of 5.96%. Enhancements in the U.S. System in Package Die industry package are increasingly used in aerospace, medical devices, and defense, which require low, stress-resistant analog circuit integration technology, fostering system-on-chip (SoC) and system-on-package (SoP)-based applications. The demand is also driven by the move towards edge computing and wearable technology.

System in Package (SiP) Die Market Dynamics

Key Drivers:

-

Rising Demand for Miniature High Performance Devices Driving System in Package Die Market Growth

An increase in the demand for miniature, high performance consumer electronic devices mainly across consumer electronics, particularly smartphones, consumer electronics, and wearables will amplify the growth of the overall System in Package (SiP) Die market. SiP technology is essential for modern mobile and IoT devices that require miniaturization, complexity, and much better thermal performance in a small footprint, as is the case today Key factors supporting the adoption of SiP integration such as the proliferation of 5G networks and advances in semiconductor packaging are also supporting SiP integration, with devices requiring fast, low-latency communications. Moreover, growth in demand for energy-efficient electronic devices combined with the need for fast data processing capabilities can drive the manufacturers to incorporate these solutions and provide advanced capabilities to electronic systems while maintaining compactness and low power consumption.

Restrain:

-

High Manufacturing Costs and Complexity Limit System in Package Die Adoption Across Price Sensitive Markets

The high manufacturing and development cost turns out to be one of the prominent restraint in the System in Package (SiP) Die market. Although SiP does provide several benefits, but having complex packaging and assembly processes, mostly needing expensive equipment and material are the fundamental confounding aspects raising the production cost. While this is great for the economic growth of larger enterprises, it could become an obstacle for smaller to medium-sized companies to leverage the advantages of SiP solutions thus restricting their adoption particularly in price-sensitive geographical markets. This results in an increased risk of defects and reliability issues as well as product performance and longevity due to the inherent complexity of designing and integrating many components into one package. As stringent quality control and higher testing costs are required, it also increases the cost on the product level.

Opportunity:

-

IoT and Wearable Technology Expansion Creating Lucrative Opportunities for System in Package Die Market Growth

Expanding Internet of Things (IoT) and wearable technology segments provide market growth opportunities. As smart homes are expanding, industrial IoT applications spreading, and health-monitoring wearables rising, the demand for multifunctioning chips that are expected to have integrated RF circuits on a single space-saving chip doing multiple complex tasks seamlessly will only increase. The aforementioned advantages of System-in-Package (SiP) technology allow integrating various functions such as; sensor, processors, and connectivity modules/hardware into a monolithic package making SiP ideal solution for next-gen applications. Besides, the scope of growth in the next years will broaden due to growing investment in AI-driven consumer electronics and emerging markets in Asia-Pacific.

Challenges:

-

Technological Complexity and Skilled Labor Shortage Challenge Growth of System in Package Die Market

As demand for more powerful and efficient SiP solutions grows, the pace of technological innovation in semiconductor manufacturing technology continues to present challenges. SiPs are progressing, with an increasing demand for smaller form-factors, improved performance and power efficiency, requiring companies to invest continuously in R&D and innovation over time as consumer electronics progress. The second one is the high demand of skilled people who are available and the technical expert in advanced packaging skills. Moreover, delays in securing essential materials and components can extend production timelines and lead to increased expenses, thus aggravating supply chain disruptions. Bottom line: this leads to uncertainty in the SiP market that can affect how quickly manufacturers can ramp production to meet demand.

System in Package Die Market Segmentation Overview

By Application

The Consumer Electronics sector held the largest market share at 36.2% in 2023 for the System in Package (SiP) Die market. This is primarily being driven by the need for high-performance, small-size devices such as smart-phones, wearables and tablets which drives the need for SiP technology to give miniaturization with improved performance. Growth will continue, driven by consumer gadgets that require smaller, more versatile, and energy-efficient chips.

From 2024 to 2032, Automotive is projected to be the fastest-growing vertical in terms of CAGR. Quality Insight The increasing penetration of advanced driver-assistance systems (ADAS), electric vehicles (EVs) and connected car technologies have made interesting and significant opportunities for SiP. Automotive use case needs highly robust, high-performance chips that are designed to feature in automotive industry-specific hardcore environments, along with features such as sensors, engine internal real-time data processing, and communication modules stitching all that together.

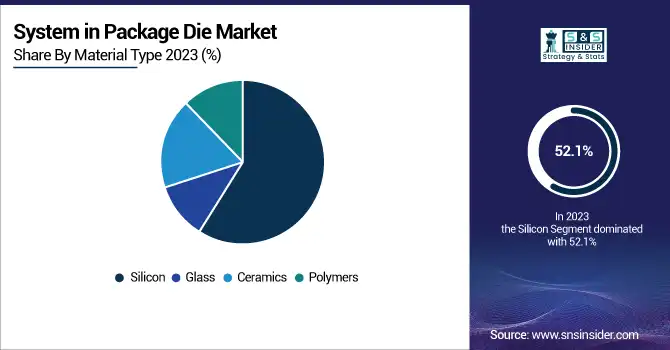

By Material Type

Silicon captured 52.1% of the System in Package (SiP) Die market in 2023, the highest share. Silicon-based semiconductors remain the material of choice for semiconductor innovation because their manufacturing ecosystems are mature and cost-efficient, and they are able to perform a wide variety of electronic functions. This is primarily due to its capability to combine a range of components like sensors, processors, and memory within a smaller form factor that is desirable for consumer electronics and IoT which allows silicon to continue to reign supreme in the SiP segment.

From 2024 to 2032, the glass sector is anticipated to be the fastest-growing segment. Glass is also a favorable substrate material for SiP applications because of its good thermal and mechanical performance for high performance miniaturized devices. Glass as a substrate offers improved signal integrity and mechanical strength, which are important for next generation wearable and automotive electronics and other advanced communication systems. With the growth of those industries, demand for glass-based SiP solutions will continue to increase.

By End-Use

Smartphones held the largest share in the System in Package (SiP) Die market, accounting for 46.3% in 2023. Such domination is propelled by persistent demands for smaller but speedy, high-power devices in the smartphone market. This is intimately related to the SoC design where the critical components like processors, sensors, memory are integrated into a compact, efficient package – an advancement that can hardly be overlooked by the modern smartphone demanding advanced features in a sleek packaging style. The demand for such SiP solutions in this sector is also robust, particularly from smartphone brands that are equipped with 5G and AI features.

The fastest CAGR during the forecast period of 2024 to 2032 is anticipated to be connected to wearables. This growth is driven by increasing adoption of smartwatches, fitness trackers and health-monitoring device across world. Wearable devices need low-power, compact, multi-functional chips, which makes SiP technology a suitable candidate to integrate them. Wearables Segment w/Precise Technology – As consumers take note of their well-being, the over use of wearable tech will bring a considerable market for the SiP solutions to wearables demand which is estimated to grow even much larger than other segments.

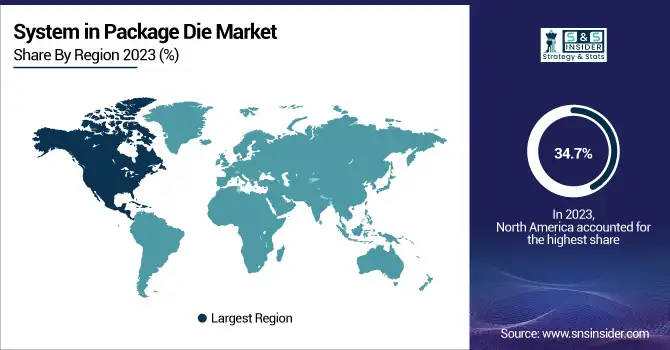

System in Package (SiP) Die Market Regional Outlook

The system in package (SiP) Die market in North America held the largest share, accounting for 34.7% of total market revenue in 2023 Particularly the consumer electronics, automotive, and IoT sectors with the significant presence of large technology firms have contributed to establishing regional leadership. Furthermore, because some of the largest semiconductor companies like Intel and Qualcomm are in the United States, their influence effectively sways SiP adoption across multiple sectors within the country. Apple is a prime North American example of dominant SiP integration, exploiting sophisticated SiP designs to improved performance with vastly better capabilities in very small form factors in devices like the iPhone and Apple Watch.

From 2024 to 2032, the highest CAGR is anticipated to occur in the Asia-Pacific area. The booming growth is popularly reflected across industries, including consumer electronics, automotive industry, and, rising application of IoT within China, Japan, and South Korea. Leading SiP firms include one of South Korea's tech giants, Samsung, and major Chinese communications firm, Huawei, both of whom are actively integrating SiPs into their smartphones and wearables. Moreover, the growth of the automotive market in the area, especially electric vehicles and autonomous driving technologies, is a major driver for SiP developments.

Get Customized Report as per Your Business Requirement - Enquiry Now

Major Players in the System in Package Die Market are:

-

ASE Group (ASE SiP)

-

Amkor Technology (Amkor SiP)

-

Intel Corporation (Intel SiP Technology)

-

Qualcomm Technologies (Qualcomm SiP Solution)

-

TSMC (TSMC SiP)

-

Broadcom Inc. (Broadcom SiP Packaging)

-

STMicroelectronics (ST SiP Technology)

-

Samsung Electronics (Samsung SiP)

-

NXP Semiconductors (NXP SiP Module)

-

Texas Instruments (TI SiP)

-

Microchip Technology (Microchip SiP Package)

-

Infineon Technologies (Infineon SiP)

-

ON Semiconductor (ON Semiconductor SiP)

-

Kyocera Corporation (Kyocera SiP)

-

Zyxel Communications (Zyxel SiP Module)

System in Package Die Market Recent Trends

-

In March 2025, Ainos and ASE partnered to integrate AI-powered scent digitization in semiconductor manufacturing, using AI Nose technology for real-time air quality monitoring and process optimization.

-

In December 2024, Broadcom launched the industry's first 3.5D Face-to-Face (F2F) technology for AI XPUs, offering a breakthrough in performance, power efficiency, and reduced latency. The new platform integrates over 6000 mm² of silicon and 12 HBM modules, targeting advanced AI workloads.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.60 Billion |

| Market Size by 2032 | USD 15.24 Billion |

| CAGR | CAGR of 6.61% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Consumer Electronics, Telecommunications, Automotive, Industrials, Medical) • By Material Type (Silicon, Glass, Ceramics, Polymers) • By End-Use (Smartphones, Tablets, Wearables, IoT Devices) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ASE Group, Amkor Technology, Intel Corporation, Qualcomm Technologies, TSMC, Broadcom Inc., STMicroelectronics, Samsung Electronics, NXP Semiconductors, Texas Instruments, Microchip Technology, Infineon Technologies, ON Semiconductor, Kyocera Corporation, Zyxel Communications |