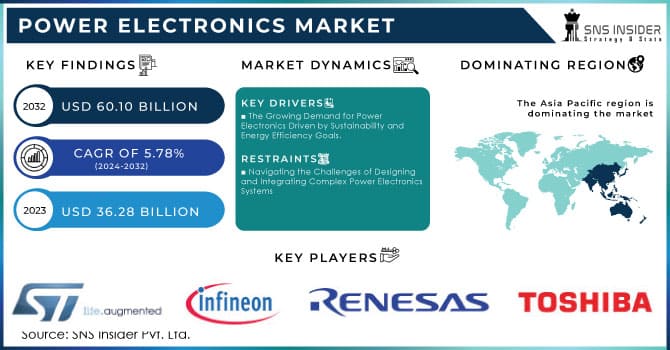

Power Electronics Market Size & Trends:

The Power Electronics Market Size was valued at USD 36.28 Billion in 2023 and is expected to reach USD 60.10 Billion by 2032, growing at a CAGR of 5.78% over the forecast period 2024-2032.

The power electronics market is a vital sector within the broader electronics industry, primarily focused on the conversion, control, and management of electric power. The market has experienced substantial growth due to the increasing demand for energy-efficient devices, rising global energy consumption, and the ongoing transition towards sustainable energy solutions.

To get more information on Power Electronics Market - Request Sample Report

In recent years, the demand for renewable energy solutions, particularly solar power and wind energy, has significantly influenced the power electronics market. Power electronic converters are essential in these systems, enabling the efficient conversion of generated energy into usable electricity. For instance, photovoltaic (PV) inverters are crucial in solar energy systems, allowing the conversion of direct current (DC) produced by solar panels into alternating current (AC) for grid use. Similarly, in wind energy, power converters help in optimizing output and improving the stability of the energy produced.

Electric vehicles (EVs) represent another significant application area for power electronics. In 2022, the global electric vehicle stock soared to approximately 14 million units, reflecting a 60% increase from the previous year. This surge is attributed to government initiatives promoting electric mobility, with global EV sales surpassing 10 million units in the same year. Additionally, the renewable energy sector is witnessing significant advancements, with installed capacity reaching 3,193 gigawatts in 2022. This shift necessitates efficient power management solutions provided by power electronics to optimize energy output. As the automotive industry increasingly shifts towards electrification, the need for efficient power management systems has surged. Power electronics facilitate the conversion and management of energy between the battery, electric motor, and other components in EVs. High-performance power electronic systems not only enhance vehicle efficiency but also improve overall driving range and performance. The proliferation of EV charging infrastructure further underscores the importance of power electronics in supporting sustainable transportation.

Power Electronics Market Dynamics

Drivers

-

The Growing Demand for Power Electronics Driven by Sustainability and Energy Efficiency Goals.

The increased emphasis on sustainability worldwide and decreasing carbon footprints has driven the need for energy-efficient solutions in different industries. Power electronics is essential for improving the effectiveness of electrical systems. As governments and organizations work towards achieving energy conservation goals, the use of power electronics in industrial settings, residential structures, and commercial spaces is increasing. Energy-saving technologies reduce energy usage, leading to decreased utility expenses and easing the strain on the power grid. Power electronic devices can lead to substantial energy savings when incorporated into applications like motor drives, lighting systems, and HVAC systems. An example of this is variable frequency drives (VFDs) that enable motors to run at varying speeds, enhancing efficiency and cutting down on energy wastage. Furthermore, market expansion is driven by regulatory requirements that target the reduction of greenhouse gas emissions and the promotion of energy-efficient technologies. Organizations are motivated to implement power electronics solutions that aid in meeting these regulations. This leads to a strong market for power electronics since industries are driven to develop and adopt energy-saving methods.

-

Surging Demand for Advanced Power Electronics Driven by Growth in Consumer Electronics.

The expansion of consumer electronics like smartphones, laptops, and home appliances plays a major role in the increase of the power electronics market. Efficient power management systems are needed for these devices to guarantee top performance, battery life, and safety. Power electronics play a crucial role in many consumer goods by offering effective power conversion and control. For instance, chargers containing advanced power electronic technologies can provide quicker charging speeds and improved energy efficiency. Manufacturers are focusing on power electronics solutions to improve product performance and user experience as consumer demand grows for energy-efficient and smart devices. The increasing desire for cutting-edge consumer electronics is still fueling the demand for advanced power electronics, opening up new possibilities for companies in the market.

Restraints

-

Navigating the Challenges of Designing and Integrating Complex Power Electronics Systems

Designing and integrating power electronics systems may be complicated and necessitate specialized knowledge and expertise. With the progression of technology, systems are becoming more complex, requiring sophisticated engineering expertise for their creation and application. This intricacy presents obstacles when it comes to being compatible with current systems, especially in sectors with outdated infrastructure. Incorporating fresh power electronic solutions into existing systems may necessitate considerable time and resources, resulting in possible project delays and higher expenses. Additionally, the fast rate of technological progress can result in difficulties in meeting industry requirements and rules, highlighting the importance of companies providing ongoing training and growth opportunities for their engineers. The intricacy of design and integration may serve as a barrier, constraining market expansion and uptake.

Key Segmentation of Power Electronics Market

by Material

Silicon (Si) held a major market share of 89% in 2023 and is the primary material used in its production. Its widespread utilization is credited to its affordability, well-established production techniques, and exceptional electrical characteristics. Silicon is well-suited for many uses, like power supplies, inverters, and motor drives, and is a key material in industries like consumer electronics, automotive, and industrial automation. Infineon's CoolMOS technology boosts power supply performance in data centers, while ON Semiconductor's Si-based power devices are crucial for electric vehicles (EVs), aiding in efficiency enhancements and energy loss reduction.

The sapphire segment is going to be the fastest-growing with a rapid CAGR during 2024-2032, such as its high thermal conductivity, great electrical insulation, and resistance to radiation. The use of sapphire substrates is growing in applications that demand high performance, like LED lighting and high-frequency devices. AIXTRON creates deposition tools to make top-notch sapphire substrates necessary for advanced LED uses.

by Device

ICs segment dominated with a 55% market share in 2023 because of their small size, excellent efficiency, and integration features. Integrated circuits are crucial in a wide range of uses, such as consumer electronics, automotive, industrial automation, and renewable energy systems. For instance, Texas Instruments and Infineon Technologies create power management ICs that enhance energy efficiency in devices such as smartphones and electric vehicles.

Modules are experiencing a rapid growth rate during 2024-2032 in the power electronics market due to the rising need for efficient solutions in sectors such as renewable energy, electric vehicles, and industrial automation. These modules integrate various parts, such as power transistors and passive devices, into one package, enhancing efficiency and decreasing thermal management needs. For example, Mitsubishi Electric and ABB produce power modules for solar inverters and electric vehicle chargers.

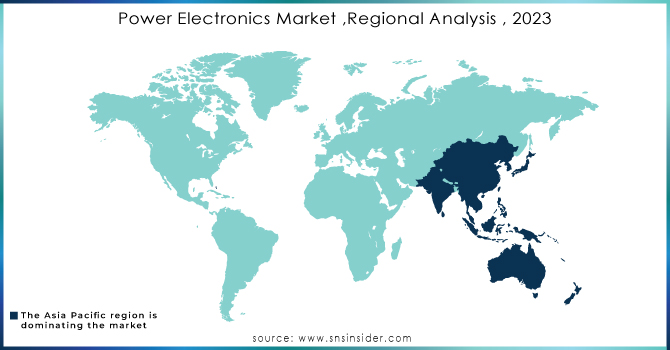

Power Electronics Market Regional Analysis

The Asia-Pacific led the market with a 39% market share in 2023 due to its strong manufacturing capabilities and expanding consumer electronics industry. Nations such as China and India are leading the way in this expansion, fueled by increasing needs for energy-saving gadgets and sustainable energy options. China's focus on electrification and green technologies has resulted in notable progress in power electronics used in different industries like industrial automation, transportation, and renewable energy. by leading in electric vehicle powertrains and energy storage systems, companies like byD and Huawei are important figures in the industry.

North America is accounted to become the fastest-growing region during 2024-2032, fueled by the rising use of renewable energy sources, electric vehicles (EVs), and smart grid technologies. Government efforts and financial support to encourage sustainable energy practices also enhance market expansion. Tesla and General Motors are making major strides in EV technology by incorporating advanced power electronics to improve performance and efficiency. Furthermore, prominent semiconductor producers like Texas Instruments and Infineon Technologies are actively engaged in creating sophisticated power management solutions specifically designed for automotive and industrial uses.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The major key players in the Power Electronics Market are:

-

STMicroelectronics (STPOWER MOSFETs, STM32 Microcontrollers)

-

Infineon Technologies AG (CoolMOS MOSFETs, XMC Microcontrollers)

-

Vishay Intertechnology, Inc. (Power MOSFETs, IGBTs)

-

ON Semiconductor (NCP3065 LED Driver, NCP81074 Gate Driver)

-

Renesas Electronics Corporation (RA Microcontroller Series, ISL8117 DC-DC Regulator)

-

Texas Instruments Incorporated (LM25118 DC-DC Converter, C2000 Microcontrollers)

-

TOSHIBA CORPORATION (Toshiba MOSFETs, Microcontrollers)

-

Mitsubishi Electric Corporation (IGBT Modules, Power Supply Units)

-

Fuji Electric Co., Ltd. (IGBT Power Modules, Power Supply Controllers)

-

NXP Semiconductors (LPC Microcontrollers, Power Management ICs)

-

Broadcom Inc. (AFBR-S50 Optical Sensors, Power Management ICs)

-

Nexperia (Power MOSFETs, Schottky Diodes)

-

Analog Devices, Inc. (Power Amplifiers, Voltage References)

-

Maxim Integrated (MAX14922 Power Management IC, MAX20752 DC-DC Converter)

-

Hitachi, Ltd. (IGBT Modules, Power Amplifiers)

-

Semikron International GmbH (SKiiP Modules, Power Modules)

-

International Rectifier (now part of Infineon) (IRF MOSFETs, Power ICs)

-

Power Integrations (HiperPFS-4 Power Factor Correction IC, LINKSwitch-4 Switcher IC)

-

Schneider Electric (Altivar Drives, Power Distribution Equipment)

-

Eaton Corporation (Powerware UPS Systems, Eaton 9PX UPS)

Recent Development

-

September 2024: Odisha took a significant step towards its goal of becoming a semiconductor hub of the country with the groundbreaking of the first silicon carbide manufacturing facility to be set up by RIR Power Electronics at EMC Park.

-

July 2024: Wide-bandgap (WBG) semiconductors are surging in popularity in power electronics, offering superior performance characteristics compared with traditional silicon-based devices.

-

February 2024: ABB launched a new SiC power module that enhances efficiency and performance in various applications, including electric vehicles and renewable energy systems.

-

January 2024: STMicroelectronics unveiled a new line of power management integrated circuits (PMICs) aimed at enhancing the efficiency of battery-operated devices.

-

November 2023: Infineon Technologies introduced a new series of 1200V SiC MOSFETs designed to optimize efficiency and thermal performance in power conversion applications.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 36.28 Billion |

| Market Size by 2032 | USD 60.10 Billion |

| CAGR | CAGR of 5.78% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Silicon (Si), Sapphire, Silicon Carbide (SiC), Gallium Nitride (GaN), Others) • By Device (Discrete, Module, IC) • By Application (ICT, Consumer Electronics, Power, Industrial, Automotive, Aerospace & Defense, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | STMicroelectronics, Infineon Technologies AG, Vishay Intertechnology, Inc., ON Semiconductor, Renesas Electronics Corporation, Texas Instruments Incorporated, TOSHIBA CORPORATION, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd., NXP Semiconductors, Broadcom Inc., Nexperia, Analog Devices, Inc., Maxim Integrated, Hitachi, Ltd., Semikron International GmbH, International Rectifier, Power Integrations, Schneider Electric, Eaton Corporation |

| Key Drivers | • The Growing Demand for Power Electronics Driven by Sustainability and Energy Efficiency Goals. • Surging Demand for Advanced Power Electronics Driven by Growth in Consumer Electronics. |

| RESTRAINTS | • Navigating the Challenges of Designing and Integrating Complex Power Electronics Systems. |