Bio-Based Propylene Glycol Market Report Scope & Overview:

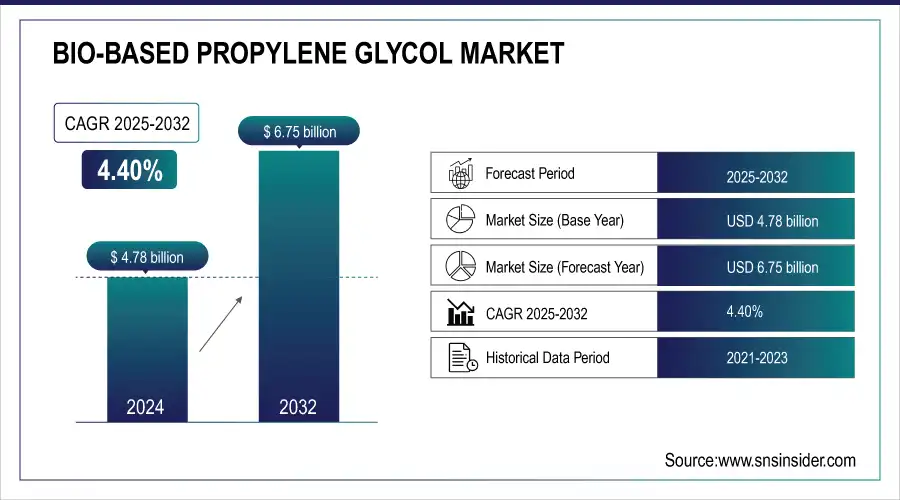

The Bio-Based Propylene Glycol Market was valued at USD 4.78 billion in 2025E and is expected to reach USD 6.75 Billion by 2033, growing at a CAGR of 4.40 % over the forecast period 2026-2033.

Get More Information on Bio-Based Propylene Glycol Market - Request Sample Report

Regulatory backing and subsidies for renewable resources are driving the Bio-Based Propylene Glycol market growth. The rising strictness of environmental standards and the market incentive to adopt a bio-based chemical production technique are pressing governments and regulatory bodies worldwide to promote the usage of bio-based chemicals. Together with the development in biotechnology and much better and advanced production techniques, bio-based propylene glycol is competitive from economic, environmental, and social perspectives. With sustainable development on everyone's mind and the growing need for industries to lower their carbon footprint, the demand for BPG is likely to grow exponentially over the next few years. The U.S. Biorefinery, Renewable Chemical, and Biobased Product Manufacturing Assistance Program made up to USD 250 million in loan guarantees available for the production of renewable chemicals in 2023.

Market Size and Forecast:

-

Bio-Based Propylene Glycol Market Size in 2025: USD 4.78 Billion

-

Bio-Based Propylene Glycol Market Size by 2033: USD 6.75 Billion

-

CAGR: 4.40% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

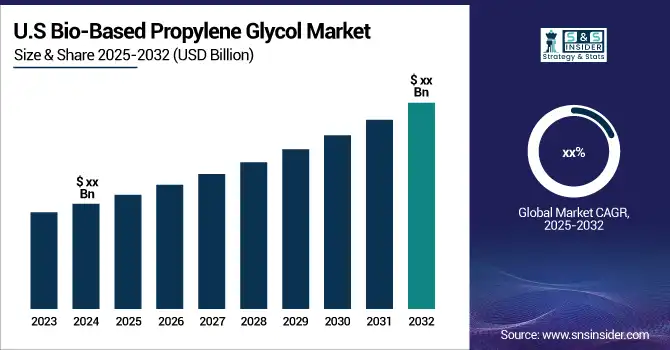

The U.S. Bio-Based Propylene Glycol market size was valued at an estimated USD 1.65 billion in 2025 and is projected to reach USD 2.30 billion by 2033, growing at a CAGR of 4.2% over the forecast period 2026–2033. Market growth is driven by increasing demand for sustainable and environmentally friendly chemicals across industries such as food & beverages, pharmaceuticals, cosmetics, and personal care. Rising regulatory support for bio-based products, growing consumer preference for low-toxicity and renewable ingredients, and expanding applications in antifreeze, de-icing fluids, and industrial formulations are further supporting market expansion. Continuous advancements in bio-refining technologies and strong participation from key U.S. manufacturers are expected to sustain steady market growth during the forecast period.

Key Bio-Based Propylene Glycol Market Trends

-

Rising demand for sustainable and renewable chemicals as substitutes for petroleum-based propylene glycol.

-

Increasing adoption in personal care and cosmetics due to its non-toxic, biodegradable, and skin-friendly properties.

-

Growth in food and beverage applications as a humectant, solvent, and preservative, driven by clean-label trends.

-

Expansion in pharmaceutical and nutraceutical sectors for drug formulations and oral solutions.

-

Rising interest in bio-based antifreeze, de-icing solutions, and industrial applications to reduce carbon footprint.

-

Advancements in fermentation and bio-refinery technologies improving yield, purity, and production scalability.

-

Government incentives and regulatory support for bio-based chemicals promoting market adoption globally.

-

Increasing integration of bio-based propylene glycol in polymers, resins, and green adhesives for sustainable materials.

Bio-Based Propylene Glycol Market Growth Drivers

-

Rising Demand for Bio-Based Propylene Glycol in Automotive Coolants Driven by Environmental Awareness and Consumer Preferences

The primary market driver of the Bio-Based Propylene Glycol (BPG) market is the rise in bio-based chemicals in the automotive sector, which can be used in antifreeze and coolant formulations. With the growing trend of environmental awareness among consumers and manufacturers, the market for automotive fluids that can offer these eco-friendly solutions has expanded rapidly. Most antifreeze and coolant products are derived from petrochemicals, and traditional antifreeze and coolant have environmental safety concerns, thus leading to the introduction of bio-based reality such as BPG. Because BPG is also biodegradable and non-toxic, it is a perfect replacement in automotive applications where environmental safety is a consideration. Therefore, increasing focus on green chemistry and implementation of sustainable technologies in the automotive industry is anticipated to boost the demand for BPG. To ensure sustainable solutions, 20% of new automotive coolants in the U.S. are bio-based such as BPG so far in 2023. Meanwhile, biodegradability and non-toxicity reduces environmental risk for bio-based propylene glycol which is 100% biodegradable, more than 25% of automotive fluid manufacturers serve bio-based ingredient in the EU countries. BPG-based coolants biodegrade in under 10 days compared to months for petroleum-based alternatives. In addition, 40% of North American consumers choose vehicles in line with environmentally responsible fluids, which shows the demand for eco-friendly automotive solutions.

-

Growing Demand for Bio-Based Propylene Glycol in Cosmetics and Pharmaceuticals Driven by Consumer Preferences

The Bio-Based Propylene Glycol market also benefits from its increased use for pharmaceutical and cosmetic applications providing another major key driver for its growth. Due to rising consumer awareness of health and the growing demand for natural, organic products, companies are increasingly using bio-based design ingredients. Also, BPG is considered a non-toxic renewable source product and is increasingly used for the production of pharmaceuticals, skincare, and personal care products. It serves as a solvent, humectant, and emulsifier, which is why it is a common ingredient in formulated creams, lotions, and more products for the home care category. BPG demand is growing due to the rising inclination of clean-label products and the transition towards natural constituents in the beauty and health sectors. Bio-based alternatives such as BPG are well-positioned to capture impending market share as regulatory bodies amplify the pressure for more stringent guidelines on chemical use in these sectors. In 2023, the demand for more natural formulations drove the inclusion of bio-based ingredients such as BPG in 30% of personal care products worldwide. The clean-label consumer preference (which includes 45% of consumers) drives the transition of products to bio-based alternatives. 38% of pharmaceutical manufacturers in the U.S. used more non-toxic ingredients like BPG Sustainability regulations from the European Commission in 2023 saw 50% of EU skincare brands adopting bio-based ingredients. Moreover, in North America, the number of new skincare launches in 2023 with a BPG claim for its safety and sustainability totaled 22%.

Bio-Based Propylene Glycol Market Restraints

-

Challenges in Bio-Based Propylene Glycol Market Include Raw Material Availability Scalability and Production Hurdles

Some of the major issues in the BPG market include the availability and scalability of the raw materials. BPG can be produced from renewable resources, like vegetable oils and corn, but these feedstocks are not consistent and are subject to market fluctuations. This will make it difficult for BPG supply to keep up with growing demand as industries shift towards joinery alternatives. Circumvented likewise, BPG generation requires unique innovation and also facilities, which might not be located in all areas, additionally restricting its large uptake. In traditional industries where propylene glycol production methods have been established using petroleum inputs, progress can be slow as established processes can be resistant to change. Making the switch from fossil fuel to bio-based solutions may entail significant manufacturing changes, such as the purchase of new equipment or product reformulation.

Bio-Based Propylene Glycol Market Segment Analysis

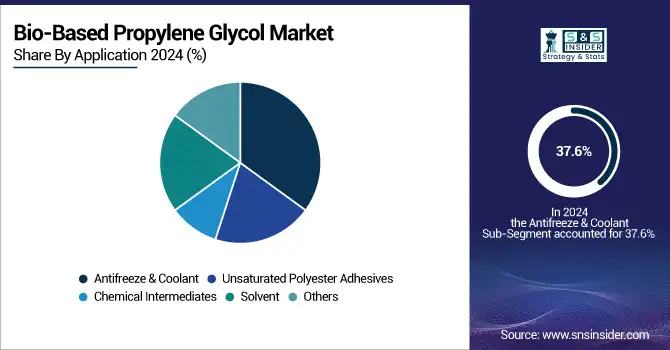

By Application

Antifreeze & Coolant had the highest market share of 37.6% in 2025 and is projected to grow at the fastest CAGR during the forecast period of 2026 to 2033. This dominance can be attributed to the increasing focus on eco-friendly automotive products. Petrochemical-based traditional antifreeze and coolant products are increasingly being replaced by bio-based alternative products, such as BPG that are considered non-toxic, biodegradable, and safe for the environment. With consumers calling for more sustainable automotive fluids and the industry searching for ways to help their customers meet these sustainability objectives, BPG is becoming the preferred copacker for producers of sustainable automotive fluids. Furthermore, with the electric vehicle (EV) market share booming, bio-based antifreeze and coolant solutions will also find greater adoption shortly. With EVs becoming mainstream and the automotive sector turning sustainable, the demand for sustainable fluids like BPG is projected to increase further. Such changes in consumer habits and industrial benchmarks will fuel the growth of the BPG market in the antifreeze and coolant application segment.

By End-Use

Pharmaceuticals accounted for the largest share of the Bio-Based Propylene Glycol (BPG) market, at 29.6% in 2025, and is also anticipated to register the highest CAGR during the forecast period (2026-2033). This growth is attributed to the increasing need for natural and sustainable ingredients in drug formulations. The safety and non-toxic biodegradable properties of BPG make it an attractive solvent, humectant, and emulsifier for pharmaceutical applications. With the focus on cleanliness in consumerism and healthcare providers alike, the use of bio-based components like BPG is gaining traction. In addition, increasing regulations in the pharmaceutical industry on synthetic chemicals and subsequently forcing manufacturers toward bio-based alternatives. Increasing adoption of clean-label products, in addition to the rising consumer shift toward natural formulations, is expected to propel BPG market demand in the pharmaceutical industry. The growing preference for sustainable and bio-based solutions is likely to remain a key factor for the growth of the BPG market in pharmaceuticals over the forecast period.

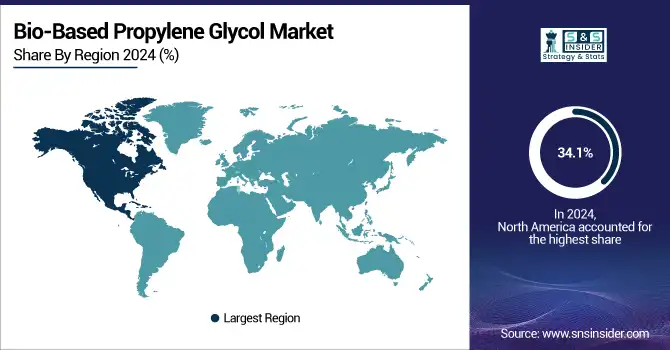

Bio-Based Propylene Glycol Market Regional Analysis

North America Bio-Based Propylene Glycol Market Insights

In 2025, North America in Bio-Based Propylene Glycol (BPG) market held the largest market share of 34.1%, and continues to lead owing to higher demand for sustainable & environment-friendly products across various end-use industries. Across the region, there are organizations such as Dow Chemical and Cargill, that play an important role in BPG, particularly in the development and production of BPG from renewable sources. The demand for bio-based antifreeze and coolants has been largely driven by the U.S. automotive industry, as it concentrates on producing more greener and sustainable vehicles. Moreover, the rising popularity of safer non-toxic products among consumers is expected to bolster demand for bio-based ingredients such as BPG across the pharmaceutical and personal care industries in North America.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific Bio-Based Propylene Glycol Market Insights

Asia Pacific is predicted to grow at a CAGR highest among all regions from 2026 to 2033. This growth is fueled by rapid industrialization combined with the rising need for sustainable solutions. While nations such as China and India are at the forefront in this stage with the corresponding efforts from companies like SABIC and LG Chem in increasing their bio-consumer chemical range. BPG is already benefitting from the near insatiable demand that the Chinese government is creating for greener technologies, green processes, and cleaner production wherein BPG finds applications such as antifreeze, cosmetics, and pharmaceuticals. Likewise, the ascent of the pharmaceutical business in India and the patterns in awareness of sustainable ingredients in cosmetic production are also expected to spur the demand for bio-based propylene glycol in the region.

Europe Bio-Based Propylene Glycol Market Insights

The Europe bio-based propylene glycol market is witnessing steady growth in 2025, driven by increasing demand for sustainable and renewable chemicals in personal care, cosmetics, and food applications. Key markets such as Germany, France, and the U.K. are adopting bio-based solutions to meet stringent environmental regulations and sustainability targets. Rising consumer preference for clean-label and eco-friendly products, along with government incentives for green chemicals, is further propelling market expansion in the region.

Latin America (LATAM) Bio-Based Propylene Glycol Market Insights

The Latin America market is growing steadily due to expanding food, beverage, and personal care industries, particularly in Brazil and Mexico. Manufacturers are increasingly adopting bio-based propylene glycol to replace petroleum-based variants, driven by sustainability initiatives and rising environmental awareness. Growth of local chemical manufacturing and investment in renewable feedstock production are also supporting market expansion in the region.

Middle East & Africa (MEA) Bio-Based Propylene Glycol Market Insights

The MEA market is gaining momentum in 2025, supported by increasing adoption of sustainable chemicals in industrial, pharmaceutical, and personal care applications. Countries such as the UAE, Saudi Arabia, and South Africa are investing in bio-based chemical manufacturing and green technology initiatives to reduce dependency on petroleum-based products. Regulatory emphasis on environmental sustainability and carbon footprint reduction is further driving demand for bio-based propylene glycol solutions.

Bio-Based Propylene Glycol Market Competitive Landscape

Dow

Dow is a global leader in chemical manufacturing, specializing in advanced materials and sustainable solutions.

-

In May 2024, Dow expanded its propylene glycol capacity by 80,000 tons annually at its Thailand facility to meet rising demand in key industries.

-

In September 2023, Dow launched lower carbon, bio-based, and circular propylene glycol solutions in Europe, aiming to meet sustainability demands across industries.

Gevo & LG Chem

Gevo is a renewable chemicals and biofuels company, and LG Chem is a leading global chemical manufacturer.

-

In December 2024, Gevo and LG Chem extended their agreement to commercialize bio-propylene using Gevo's Ethanol-to-Olefins technology. This partnership aims to produce sustainable, carbon-neutral propylene for various industries.

Bio-Based Propylene Glycol Market Key Players

Some of the major players in the Bio-Based Propylene Glycol Market are:

-

Archer Daniels Midland Company (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

BASF SE (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

The Dow Chemical Company (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

DuPont Tate & Lyle Bio Products Company, LLC (BioPure™ Propylene Glycol, BioPure™ Propylene Glycol USP Grade)

-

Huntsman International LLC (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

Cargill (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

Oleon (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

Ashland (Propylene Glycol Industrial Grade, Propylene Glycol USP Grade)

-

SK Chemicals (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

Metafrax (Green Propylene Glycol, Green Propylene Glycol USP Grade)

-

UPM Biochemicals (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

ADM (Plant-Based Propylene Glycol, Plant-Based Propylene Glycol USP Grade)

-

Evolution Renewables (Bio-Based Propylene Glycol, Bio-Based Propylene Glycol USP Grade)

-

Corbion (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

LyondellBasell (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

LG Chem (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

Reliance Industries Limited (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

SABIC (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

ExxonMobil (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

-

Shell Chemicals (Bio-based Propylene Glycol, Bio-based Propylene Glycol USP Grade)

Some of the Raw Material Suppliers:

-

ADM

-

BASF SE

-

The Dow Chemical Company

-

DuPont Tate & Lyle Bio Products Company, LLC

-

Huntsman International LLC

-

Cargill

-

Oleon

-

Ashland

-

SK Chemicals

-

Metafrax

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 4.78 Billion |

| Market Size by 2033 | USD 6.75 Billion |

| CAGR | CAGR of 4.40% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Solvent, Chemical Intermediates, Unsaturated Polyester Adhesives, Antifreeze & Coolant, Others) • By End Use (Food Processing, Building & Construction, Cosmetics, Automotive, Pharmaceuticals, Transportation, Detergent & Household, Marine, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Henkel AG & Co. KGaA, H.B. Fuller Company, Dow Chemical Company, Exxon Mobil Corporation, Arkema Group, Jowat SE, LyondellBasell Industries, 3M Company, Bostik, Beardow Adams, Sika AG, Avery Dennison, Evans Adhesive Corporation, Ashland Global Holdings Inc., Sika AG, Toyobo Co., Ltd., Huntsman Corporation, Eastman Chemical Company, Sinopec Limited, Adtek Malaysia Sdn Bhd |

|

|