Biobanking Market Report Scope & Overview:

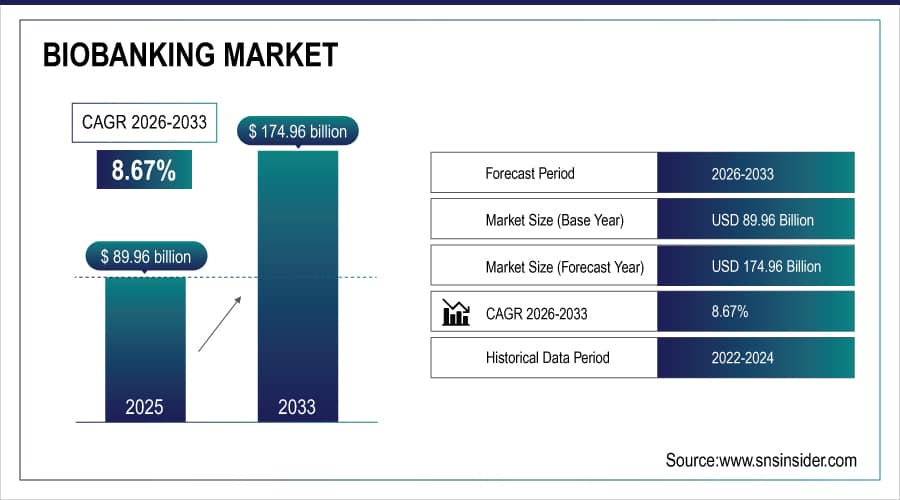

The Biobanking Market size is estimated at USD 89.96 billion in 2025 and is expected to reach USD 174.96 billion by 2033, growing at a CAGR of 8.67% over the forecast period of 2026-2033.

The global biobanking market trend is driven by accelerating precision medicine initiatives, expanding genomic research, and rising demand for high-quality biospecimens in drug discovery. Increasing prevalence of chronic diseases requiring personalized therapeutic approaches, coupled with significant investments in biorepository infrastructure and cold chain logistics, are fundamentally transforming market dynamics. Growing adoption of automated storage systems, sophisticated laboratory information management systems (LIMS), and stringent regulatory frameworks for biospecimen quality are catalyzing market expansion across academic, pharmaceutical, and clinical diagnostics sectors globally.

For instance, in January 2025, the NIH's All of Us Research Program surpassed 750,000 fully enrolled participants, with over 325,000 providing biosamples, dramatically increasing accessible genomic data and fueling demand for advanced biobanking solutions.

Biobanking Market Size and Forecast:

-

Market Size in 2025E: USD 89.96 billion

-

Market Size by 2033: USD 174.96 billion

-

CAGR: 8.67% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get More Information On Biobanking Market - Request Free Sample Report

Biobanking Market Trends:

-

Integration of Artificial Intelligence and machine learning for biospecimen inventory optimization, sample quality prediction, and automated annotation of clinical metadata.

-

Expansion of population-based biobanks and large-scale cohort studies supporting genome-wide association studies (GWAS) and translational research.

-

Growing adoption of cryopreservation techniques for complex biospecimens including organoids, 3D tissues models, and live cell therapies.

-

Increased implementation of blockchain technology for enhancing sample traceability, donor consent management, and ensuring data integrity across the biospecimen lifecycle.

-

Rise of virtual biobanking platforms facilitating decentralized sample discovery, collaborative research networks, and cross-institutional biospecimen sharing.

-

Strategic partnerships between biobanks, pharmaceutical companies, and diagnostic firms to create integrated biorepositories supporting companion diagnostic development.

-

Strengthening of ethical, legal, and social implication (ELSI) frameworks and standardization initiatives by ISO, ISBER, and WHO promoting biospecimen quality and interoperability.

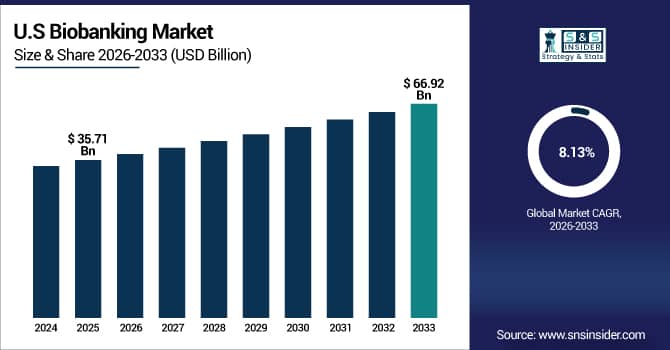

The U.S. Biobanking Market is estimated at USD 35.71 billion in 2025 and is expected to reach USD 66.92 billion by 2033, growing at a CAGR of 8.13% from 2026-2033. Due to its sophisticated healthcare system, wide-ranging genomic research initiatives, and significant funding from both the public and private sectors, the U.S. leads the biobanking industry. Strong regulatory frameworks, well-established research institutes, the broad use of precision medical techniques, and the early incorporation of automation technology all contribute to market leadership. Additionally, the status of the U.S. as the world's largest regional market is reinforced by strategic partnerships between pharmaceutical businesses, biotechnology companies, and academic institutions.

Biobanking Market Growth Drivers:

-

Precision Medicine and Genomic Research Expansion is Driving the Biobanking Market Growth

One of the main factors propelling the rise of the biobanking market share is the expansion of precision medicine initiatives and extensive genomic research. National biobanking initiatives, such as the Million Veteran Program and the UK Biobank, are producing previously unheard-of amounts of phenotyped and genotyped biospecimens, which are crucial for locating treatment targets and biomarkers. This increase expands the global revenue streams for both public and commercial biobanking by generating a persistent need for advanced storage infrastructure, specialized consumables, and informatics solutions that can handle intricate, interconnected datasets.

For instance, in Q3 2024, the UK Biobank released whole-genome sequencing data for its entire 500,000-participant cohort, triggering a 22% increase in global research applications and corresponding demand for ancillary biobanking services and data management tools.

Biobanking Market Restraints:

-

High Operational Costs and Complex Regulatory Compliance are Hampering the Biobanking Market Growth

Substantial capital expenditure for automated storage systems, continuous energy consumption for ultra-low temperature preservation, and escalating costs associated with regulatory compliance significantly restrain biobanking market expansion. Navigating heterogeneous international regulations concerning donor consent, data privacy (GDPR, HIPAA), and biospecimen transfer creates operational complexity and financial burden, particularly for smaller academic and nonprofit repositories, limiting market participation and investment in emerging regions.

Biobanking Market Opportunities:

-

Emerging Economies and Strategic Bio-repository Networks Drive Future Growth Opportunities for the Biobanking Market

The establishment of large-scale, standardized biobanks in the Middle East, Asia-Pacific, and Latin America presents a significant potential to diversify global genetic databases and address disease burdens unique to these regions. Multi-omics research can be accelerated by creating federated, integrated biobanking networks that link disparate repositories using shared data models and access controls. Additionally, using biobanks to generate real-world data for outcomes research and post-market surveillance offers service providers a sizable and expanding financial opportunity.

For instance, in February 2025, the African Centres for Disease Control launched a pan-African biobanking network initiative, aiming to standardize collection across 15 countries to study infectious diseases and cancer, highlighting the strategic expansion into underserved markets.

Biobanking Market Segment Analysis:

-

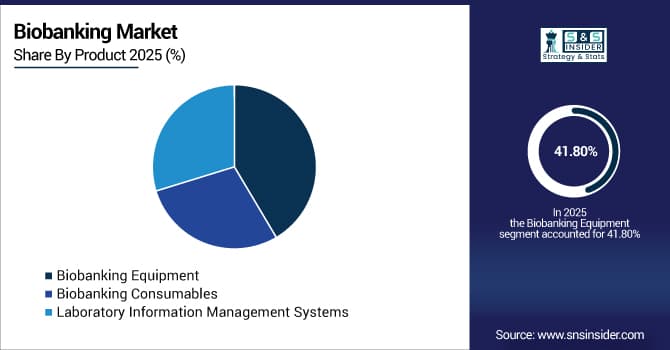

By product, biobanking equipment held the largest share of around 41.8% in 2025E, while laboratory information management systems (LIMS) are expected to register the highest growth with a CAGR of 10.2%.

-

By service, biobanking & repository services dominated the market with approximately 35.4% share in 2025E, while cold chain logistics is expected to register the highest growth with a CAGR of 9.8%.

-

By biospecimen type, human tissues accounted for the leading share of nearly 38.9% in 2025E, while stem cells are expected to register the highest growth with a CAGR of 11.3%.

-

By application, drug discovery & clinical research led the market with about 44.7% share in 2025E, while the therapeutics segment is forecasted to grow the fastest at a CAGR of 10.1%.

By Product, Equipment Leads the Market, While Laboratory Information Management Systems (LIMS) Registers Fastest Growth

The biobanking equipment segment, encompassing automated stores, temperature control systems, and monitoring devices, accounted for the highest revenue share of approximately 41.8% in 2025, driven by continuous capital investment in high-capacity, robotic repositories by large-scale research consortia and pharmaceutical R&D centers.

The laboratory information management systems (LIMS) segment is anticipated to achieve the highest CAGR of nearly 10.2% during the 2026–2033 period, propelled by the critical need for sample traceability, integration with electronic health records, and compliance with FAIR data principles in precision medicine research.

By Service, Biobanking & Repository Dominates, While the Cold Chain Logistics Segment Shows Rapid Growth

The biobanking & repository service segment held the largest revenue share of approximately 35.4% in 2025, owing to the core, recurring nature of sample processing, long-term storage, and associated data management provided by commercial and academic service providers.

The cold chain logistics segment is predicted to grow at the strongest CAGR of approximately 9.8% during 2026–2033, driven by increasing multi-center clinical trials, global biospecimen exchange, and stringent regulatory requirements for maintaining sample integrity during transport, particularly for temperature-sensitive cell therapies and vaccines.

By Biospecimen Type, Human Tissues Lead, and Stem Cells Register Fastest Growth

Human tissues accounted for the largest share of the biobanking market with about 38.9% in 2025, owing to their irreplaceable role in oncology research, biomarker validation, and histopathology.

The stem cells segment is slated to grow at the fastest rate with a CAGR of around 11.3% throughout the forecast period, fueled by accelerating regenerative medicine pipelines, the expansion of induced pluripotent stem cell (iPSC) banks for disease modeling, and growing investment in allogeneic cell therapy development requiring characterized starting materials.

By Application, Drug Discovery & Clinical Research Leads, While the Therapeutics Segment Grows the Fastest

The drug discovery & clinical research application held the largest revenue share of around 44.7% in the biobanking market in 2025, as pharmaceutical companies increasingly rely on well-annotated, high-quality biospecimens for target identification, pharmacogenomics, and patient stratification in clinical trials.

The therapeutics segment, however, is projected to register the highest CAGR of around 10.1% during the forecast period, directly linked to the growth of autologous and allogeneic cell and gene therapies, which require extensive donor screening, cell banking, and rigorous quality control processes integral to biobanking services.

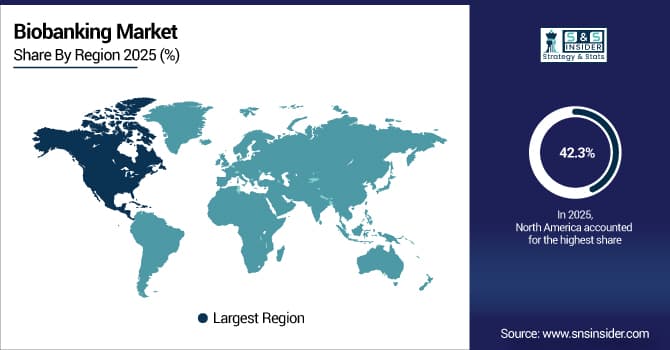

Biobanking Market Regional Highlights:

North America Biobanking Market Insights:

Due to significant federal support from NIH and DoD, a high concentration of pharmaceutical and biotechnology R&D facilities, and sophisticated healthcare infrastructure, North America had the largest revenue share of the biobanking market in 2025, which is roughly 42.3%. Early automation adoption, robust intellectual property frameworks that support biorepository operations, and innovative large-scale population biobanks, such as the All of Us program all contribute to market leadership. The sustained dominance of cutting-edge biobanking technologies and services is guaranteed by high healthcare spending and substantial venture capital investments in precision medicine businesses.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Biobanking Market Insights:

With the help of a strong network of cooperative, publicly sponsored biobanks under BBMRI-ERIC, strict EU legislation encouraging data and sample standardization, and solid academic research traditions, Europe has the second-largest biobanking industry. Pan-European research is being facilitated by the GDPR's harmonization efforts for data protection and the creation of cross-border access protocols, which is increasing demand for integrated LIMS and quality management systems. The market is continuing to rise thanks to national initiatives in the UK, Germany, and Scandinavia that concentrate on cancer and rare illness biobanking.

Asia Pacific Biobanking Market Insights:

With a CAGR of 10.8%, Asia Pacific is the biobanking market's fastest-growing segment. This growth is driven by rapidly advancing biomedical research capabilities, government genomics initiatives (such as China's Precision Medicine Initiative and Japan's BioBank), and an increase in the outsourcing of clinical trial biospecimen management to the region. There is a significant need for biobanking equipment, consumables, and cold chain logistics solutions due to the increasing prevalence of chronic diseases with distinct genetic determinants, growing healthcare investment, and the creation of national biobank networks in South Korea, Singapore, and Australia.

Latin America (LATAM) and Middle East & Africa (MEA) Biobanking Market Insights:

The biobanking industry is changing across Latin America and the Middle East and Africa due to initiatives to investigate disease variations unique to each region, emerging precision medicine initiatives, and rising involvement in international clinical trials. Strategic alliances with North American and European consortia, as well as international assistance for infectious disease biobanking (such as for TB and malaria), are promoting market growth despite ongoing infrastructure and financial obstacles. Brazil, South Africa, and the Gulf Cooperation Council nations are investing more on their national biorepository capacities as a result of growing awareness of the economic benefits of genetic sovereignty.

Biobanking Market Competitive Landscape:

Thermo Fisher Scientific Inc. (est. 2006) is a global leader serving science, with a comprehensive biobanking portfolio spanning ultra-low temperature freezers, automated storage systems, cryogenic consumables, and cloud-based sample management software. Its integrated solutions support the entire biospecimen workflow from collection to analysis.

-

In November 2024, the company launched its next-generation -150°C automated biobank, featuring robotic sample handling and AI-driven inventory management, specifically designed for large-scale population genomics repositories.

BioIVT (formerly BioreclamationIVT) is a leading global provider of biospecimens and related research services, with a focus on clinical samples characterized for disease state, treatment history, and genomic data, serving pharmaceutical and diagnostic development.

-

In March 2025, BioIVT expanded its oncology biorepository with the addition of over 50,000 longitudinal solid tumor samples linked to real-world clinical outcomes data, enhancing its value for biomarker discovery programs.

Merck KGaA (est. 1668), through its MilliporeSigma business, provides a critical range of biopreservation media, cryocontainers, and cell banking services, supporting the growing market for advanced therapy medicinal products (ATMPs) and stem cell research.

-

In January 2025, the company received EU GMP certification for its new dedicated cell and gene therapy biobanking facility in Darmstadt, Germany, strengthening its position in the compliant storage of starting materials and finished therapeutics.

Biobanking Market Key Players:

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

BioIVT

-

Charles River Laboratories International, Inc.

-

Hamilton Company

-

Brooks Life Sciences

-

Precision for Medicine

-

STEMCELL Technologies Inc.

-

Coriell Institute for Medical Research

-

Lonza Group Ltd.

-

Azenta Life Sciences

-

Biolife Solutions, Inc.

-

Labcorp Drug Development

-

Qiagen N.V.

-

PHC Holdings Corporation (PHCbi)

-

Worthington Industries (Taylor Wharton)

-

Cryoport, Inc.

-

So-Low Environmental Equipment Co., Inc.

-

PromoCell GmbH

-

AMSBIO

-

GenVault (acquired by IntegenX)

-

Bay Biosciences LLC

-

CTI Biotech

-

Firalis S.A.

-

BioRep S.p.A.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 89.96 Billion |

| Market Size by 2033 | USD 174.96 Billion |

| CAGR | CAGR of 8.67% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Biobanking Equipment (Temperature Control Systems, Incubators & Centrifuges, Alarms & Monitoring Systems, Accessories & Other Equipment), Biobanking Consumables, Laboratory Information Management Systems] • By Service [Biobanking & Repository, Lab processing, Qualification/ Validation, Cold Chain Logistics, Other Services] • By Biospecimen Type [Human Tissues, Human Organs, Stem Cells (Adult Stem Cells, Embryonic Stem Cells, IPS Cells, Other Stem Cells), Other Biospecimens] • By Biobanks Type [Physical/Real Biobanks (Tissue Biobanks, Population-Based Biobanks, Genetic (DNA/RNA), Disease Based Biobanks), Virtual Biobanks] • By Application [Therapeutics, Drug Discovery & Clinical Research, Clinical Diagnostics, Other Applications] • By Biobanks Ownership [University Owned, National/Regional Agencies Owned, Non-profit Organizations Owned, Private Organization Owned] • By End-use [Pharmaceutical & Biotechnology Companies, CROs & CMOs, Academic & Research Institutes, Hospitals] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Merck KGaA, BioIVT, Charles River Laboratories International, Inc., Hamilton Company, Brooks Life Sciences, Precision for Medicine, STEMCELL Technologies Inc., Coriell Institute for Medical Research, Lonza Group Ltd., Azenta Life Sciences, Biolife Solutions, Inc., Labcorp Drug Development, Qiagen N.V., PHC Holdings Corporation (PHCbi), Worthington Industries (Taylor Wharton), Cryoport, Inc., So-Low Environmental Equipment Co., Inc., PromoCell GmbH, AMSBIO, GenVault (acquired by IntegenX), Bay Biosciences LLC, CTI Biotech, Firalis S.A., BioRep S.p.A. |