Laboratory Information Management System Market Report Scope & Overview:

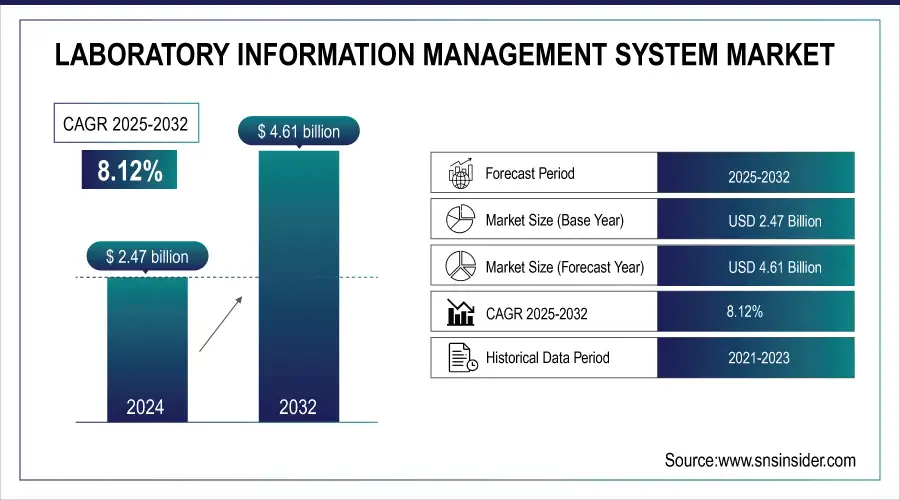

The Laboratory Information Management System Market size was valued at USD 2.47 billion in 2024 and is expected to reach USD 4.61 billion by 2032 with a growing CAGR of 8.12% over the forecast period of 2025-2032.

Get more information on Laboratory Information Management System Market - Request Sample Report

Laboratory Information Management System (LIMS) Market Size and Forecast:

-

Market Size in 2024: USD 2.47 Billion

-

Market Size by 2032: USD 4.61 Billion

-

CAGR: 8.12% from 2025 to 2032

-

Base Year: 2023

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Laboratory Information Management System Market Trends

-

The adoption of cloud-based LIMS platforms is rising as laboratories seek scalability, cost-effectiveness, and remote data access.

-

AI- and ML-powered LIMS solutions are transforming lab operations with predictive analytics and automated decision-making.

-

Growing regulatory compliance requirements such as FDA 21 CFR Part 11 are driving demand for secure and audit-ready LIMS.

-

The pharmaceutical and biotechnology sectors are leading adopters due to strict quality control and documentation needs.

-

Laboratories are increasingly adopting LIMS for automation and data accuracy, reducing manual errors and streamlining workflows.

-

Small and medium-sized laboratories are turning to cloud LIMS, making advanced solutions more affordable and accessible.

The Laboratory Information Management System (LIMS) market has experienced significant growth due to the increasing demand for automation, data accuracy, and regulatory compliance across industries such as healthcare, pharmaceuticals, and environmental testing. LIMS solutions play a vital role in enhancing laboratory efficiency by automating processes like sample tracking, data collection, and reporting. These systems help reduce human error, ensure accurate data management, and improve overall laboratory performance, making them essential tools for labs handling complex datasets.

Moreover, LIMS is evolving with the integration of artificial intelligence (AI) and machine learning (ML), which further enhance laboratory efficiency by automating complex processes and providing real-time insights. For instance, LabWare’s AI-powered LIMS offers predictive analytics and process optimization, helping laboratories make faster and more accurate decisions. This capability is particularly valuable in industries like genomics and personalized medicine, where large volumes of complex data need to be managed and analyzed with precision.

LIMS Market Drivers

-

Increasing Demand for Automation and Efficiency

The need for greater automation in laboratories is one of the primary drivers of the Laboratory Information Management System (LIMS) market. As laboratories handle an increasing volume of data and complex workflows, the demand for solutions that can streamline and automate key processes, such as sample tracking, data collection, and reporting, has grown substantially. LIMS enables laboratories to automate repetitive tasks, reducing the risk of human error while improving the accuracy and efficiency of data management. By automating these processes, LIMS enhances overall laboratory productivity, ensuring faster processing times, improved quality control, and more reliable results. The ability to integrate LIMS with other laboratory instruments and systems further boosts efficiency, as it reduces manual intervention, speeds up workflows, and provides real-time data access. This demand for automation is fueling the adoption of LIMS across various sectors, including healthcare, pharmaceuticals, and environmental testing.

-

Regulatory compliance is a critical driver of LIMS adoption, particularly in industries like pharmaceuticals, biotechnology, and clinical diagnostics.

Laboratories are required to follow stringent guidelines and regulations such as FDA 21 CFR Part 11, which governs the management of electronic records and signatures. LIMS helps laboratories maintain compliance by ensuring data integrity, enabling proper documentation, and providing secure audit trails. The system tracks and records every action performed on samples and data, making it easier for laboratories to demonstrate compliance during inspections. Furthermore, LIMS ensures that data is consistently accurate, protected, and accessible, which is essential in industries where precise results are critical for patient safety, drug development, and environmental testing. With increasing regulatory scrutiny, laboratories are increasingly adopting LIMS to ensure they meet these requirements while optimizing operational efficiency.

-

The shift towards cloud-based Laboratory Information Management Systems (LIMS) is rapidly transforming the market, offering laboratories greater scalability, flexibility, and cost-effectiveness.

Cloud LIMS solutions allow labs of all sizes, including smaller research facilities and clinical labs, to access advanced data management features without the need for costly on-premise infrastructure. These cloud solutions enable remote access to real-time data, making it easier for laboratory personnel to collaborate, monitor workflows, and manage operations from anywhere. Cloud LIMS also supports seamless integration with other enterprise systems, such as Laboratory Execution Systems (LES) and Enterprise Resource Planning (ERP), ensuring smooth data exchange and more streamlined operations. Additionally, cloud platforms reduce the burden of maintenance and updates, allowing laboratories to focus on core activities while benefiting from the latest technological advancements. This flexibility and ease of integration are driving the widespread adoption of cloud-based LIMS solutions.

LIMS Market Restraints

-

High Implementation Costs and Integration Challenges

One of the key restraints in the Laboratory Information Management System (LIMS) market is the high cost of implementation, particularly for small and medium-sized laboratories. While LIMS offers significant long-term benefits, the initial investment required for software, hardware, and training can be a barrier for many labs. Furthermore, integrating LIMS with existing laboratory equipment and enterprise systems such as Laboratory Execution Systems or Enterprise Resource Planning can be complex and time-consuming. Laboratories may face compatibility issues between legacy systems and new LIMS solutions, leading to additional costs and potential disruptions in operations. Additionally, the customization required to tailor LIMS to the specific needs of a laboratory can further drive up costs. These challenges, combined with the need for skilled personnel to operate and maintain the system, often discourage some laboratories from adopting LIMS or lead to delayed implementation.

Laboratory Information Management System Market Segmentation Analysis

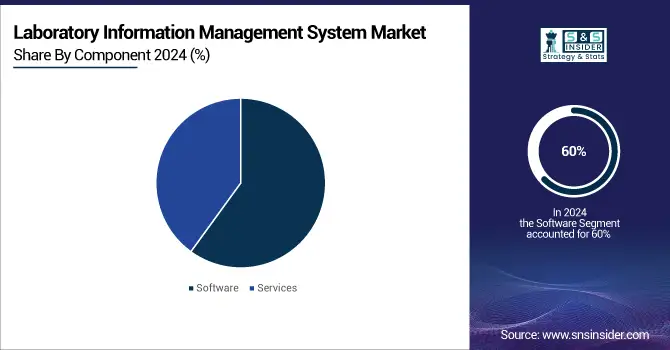

By Component, In 2024, the services component segment dominated the market, accounting for over 60% of the total market share

The segment's prominence stems from the critical role services play in ensuring successful LIMS implementation, integration, and maintenance. Laboratories increasingly rely on professional services for customization, workflow optimization, and system training to meet their unique needs. Additionally, the demand for ongoing technical support, cloud migration, and compliance consulting has cemented the dominance of the services segment in the market.

The software segment is the fastest growing, driven by advancements in technology and the rising need for automation in laboratories. Software forms the backbone of LIMS, enabling seamless sample tracking, data analysis, and reporting. The integration of artificial intelligence and machine learning into LIMS software has further enhanced its efficiency, making it indispensable for modern laboratory management. This rapid evolution and the growing emphasis on digital transformation have propelled the software segment's swift expansion.

By Product, In 2024 the cloud-based LIMS segment dominated the market, accounting for 45% of the total market share

The preference for cloud-based systems is fueled by their scalability, flexibility, and cost-effectiveness. These solutions allow laboratories to access real-time data remotely, eliminating the need for expensive on-premise infrastructure. Cloud-based LIMS also streamline workflows, enhance collaboration, and lower maintenance costs, making them the ideal choice for laboratories of all sizes. This segment's dominance is particularly pronounced in emerging markets, where affordability and ease of implementation are critical. As laboratories increasingly adopt digital transformation strategies, the demand for cloud-based solutions is expected to sustain its lead.

The web-hosted segment is the fastest growing, driven by its ability to offer a middle-ground solution between on-premise and cloud-based systems. Web-hosted LIMS provides laboratories with centralized data management and easy access through web browsers without the need for extensive on-premise installations. Its cost-efficiency and simplified deployment make it a preferred option for labs transitioning from traditional setups. The growing focus on secure and efficient data management has propelled the web-hosted segment's rapid adoption, positioning it as a key growth driver in the market.

Laboratory Information Management System Market Regional Insights

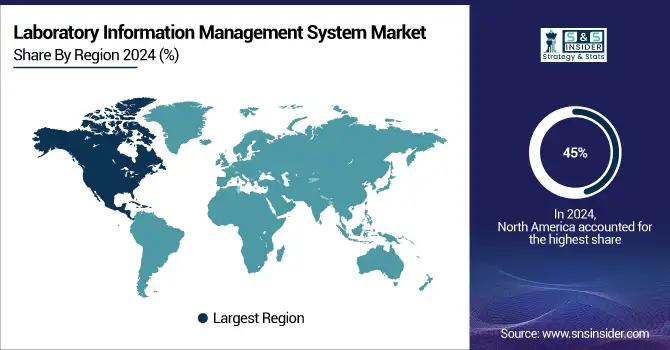

North America Dominates the Laboratory Information Management System (LIMS) Market

North America remained the dominant region, accounting for a 45% share of the market in 2024, with the United States leading the charge. This dominance is attributed to the presence of well-established pharmaceutical, healthcare, and biotechnology industries, which have adopted LIMS to streamline their operations, ensure compliance with stringent regulations, and enhance laboratory efficiency. Furthermore, the rapid adoption of cloud-based LIMS solutions in North America, fueled by high levels of technological adoption and digital transformation, is contributing to the region's continued growth.

Need any customization research on Laboratory Information Management System Market - Enquiry Now

Europe’s LIMS Market Growth Driven by Regulatory Compliance and R&D

Europe followed closely, driven by strong healthcare infrastructure, research activities, and a growing emphasis on regulatory compliance. Countries like Germany, the UK, and France are leading the charge in the adoption of LIMS solutions in laboratories, especially in clinical diagnostics and pharmaceutical industries. The region’s focus on research and development in life sciences is accelerating the adoption of LIMS to manage complex workflows and improve operational efficiency.

Asia Pacific Emerges as the Fastest-Growing LIMS Market

Asia Pacific is the fastest-growing market, with countries like China, India, and Japan seeing significant adoption of LIMS due to rapid industrialization, technological advancements, and expanding healthcare infrastructure. The increasing number of research laboratories, coupled with rising investments in biotechnology and pharmaceuticals, is driving the demand for efficient data management systems.

Laboratory Information Management System Market Key Players

-

Thermo Fisher Scientific Inc. – Thermo Scientific SampleManager LIMS

-

Siemens – Siemens Lab Automation LIMS

-

LabVantage Solutions Inc. – LabVantage LIMS

-

LabWare – LabWare LIMS

-

PerkinElmer Inc. – LABWORKS LIMS

-

Abbott – Abbott Informatics STARLIMS

-

Autoscribe Informatics – Matrix Gemini LIMS

-

Illumina, Inc. – GenoLogics LIMS

-

Labworks – LABWORKS LIMS

-

LabLynx, Inc. – LabLynx LIMS

-

Computing Solutions, Inc. – CSols LIMS

-

CloudLIMS.com (LabSoft LIMS) – CloudLIMS

-

Ovation – Ovation LIMS

-

LABTRACK – LABTRACK LIMS

-

AssayNet Inc. – AssayNet LIMS

-

Agilent Technologies – Agilent SLIMS (Scientific Laboratory Information Management System)

Laboratory Information Management System Market Competitive Landscape:

Sapio Sciences is a leading provider of Laboratory Information Management Systems (LIMS) and Electronic Lab Notebooks (ELN), offering scalable, cloud-based platforms for life sciences, healthcare, and research industries. Its integrated solutions enhance laboratory productivity, ensure regulatory compliance, and support digital transformation, positioning it strongly in the global LIMS market.

- In Nov 2024, Sapio Sciences partnered with Waters Corporation in a co-marketing agreement to improve data integrity, streamline workflows, and boost laboratory productivity through their science-awareTM lab informatics platform.

LabVantage Solutions is a global leader in Laboratory Information Management Systems (LIMS), offering cloud-ready, configurable platforms tailored for industries including pharmaceuticals, biotechnology, healthcare, and food & beverages. Its solutions integrate advanced analytics, automation, and compliance features, enabling laboratories to streamline workflows, enhance data accuracy, and accelerate digital transformation in the LIMS market.

- In Sep 2024, LabVantage Solutions, Inc. partnered with Henkel AG & Co. KGaA to integrate its LabVantage LIMS and SAP Product Lifecycle Management (PLM) solutions into Henkel's R&D 4.0 platform. This collaboration is part of Henkel's strategy to drive innovation, sustainability, and digital transformation across its consumer businesses.

| Report Attributes | Details |

| Market Size in 2024 | USD 2.47 Billion |

| Market Size by 2032 | USD 4.61 Billion |

| CAGR | CAGR of 8.12% From 2025 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [On-premise, Web-hosted, Cloud-based] • By Component [Software, Services] • By End-Use [Life Sciences, CROs, Petrochemical Refineries & Oil and Gas Industry, Chemical Industry, Food and Beverage & Agriculture Industries, Environmental Testing Laboratories, Other Industries (Forensics and Metal & Mining Laboratories)] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Thermo Fisher Scientific Inc., Siemens, LabVantage Solutions Inc., LabWare, PerkinElmer Inc., Abbott, Autoscribe Informatics, Illumina, Inc., Labworks, LabLynx, Inc., Computing Solutions, Inc., CloudLIMS.com (LabSoft LIMS), Ovation, LABTRACK, AssayNet Inc., Agilent Technologies. |