Cell Therapy Market Report Scope & Overview:

Get More Information on Cell Therapy Market- Request Sample Report

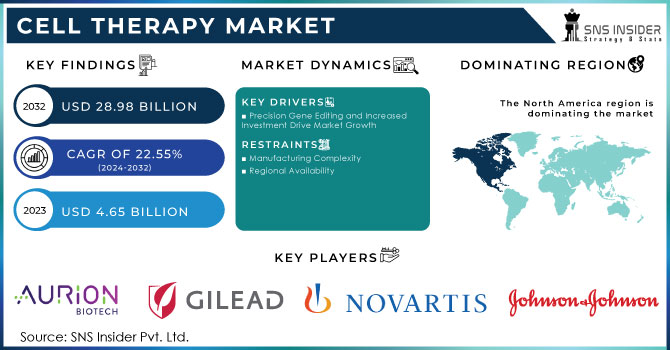

The Cell Therapy Market was valued at USD 4.65 Billion in 2023 and is expected to reach USD 28.98 billion by 2032 and grow at a CAGR of 22.55% over the forecast period 2024-2032.

Expanding Understanding of Cell-Based Treatments Drives Innovation

The cell therapy market is witnessing exponential growth, driven by cutting-edge technological advancements, robust funding, and a deeper understanding of the therapeutic potential of cell-based treatments. Companies are heavily investing in research and development to innovate and bring forward novel cell therapies targeting a diverse range of diseases.

Technological Advancements and Funding Propel the Cell Therapy Market

Technological advancements, particularly the development of CRISPR-Cas9 gene editing tools, are enabling the creation of more precise and effective cell therapies. This technology, combined with increased funding from government grants, venture capital investments, and strategic partnerships, is accelerating research, development, and clinical trials. Moreover, the growing prevalence of chronic diseases and the limitations of traditional treatments are increasing the demand for cell-based therapies. For instance, Achilles Therapeutics secured a USD 4.2 million grant from Horizon Europe, the EU's leading funding program for research and innovation, in July 2022, to advance personalized therapies.

Challenges in the Cell Therapy Market

Despite rapid growth, the cell therapy market faces significant challenges that could impact its trajectory. Complex and specialized manufacturing processes are required for cell therapies, making production costly and challenging. Additionally, navigating the regulatory landscape is often time-consuming and expensive, as companies must adhere to stringent safety and efficacy regulations. Securing reimbursement from healthcare payers for these therapies, particularly for high-cost treatments, remains a hurdle. These challenges may pose obstacles to the widespread adoption and commercialization of cell therapies.

Key Trends Shaping the Cell Therapy Market

The future of the cell therapy market is being shaped by several key trends. Personalized medicine is gaining traction as cell therapies offer the potential for highly tailored treatments based on individual genetic profiles, leading to improved outcomes and reduced side effects. Stem cell therapy is also gaining momentum for its potential to treat a broad spectrum of diseases, including autoimmune and metabolic disorders. Gene editing technologies like CRISPR-Cas9 are driving the development of more precise and effective cell therapies. Additionally, industry consolidation through mergers and acquisitions is becoming more common as companies aim to expand their product pipelines, geographic reach, and manufacturing capabilities. For example, in May 2022, Sernova and Evotec collaborated on the development of iPSC-based cell therapies for patients with insulin-dependent diabetes.

Growth Outlook for the Cell Therapy Market

The cell therapy market is expected to continue its upward growth trajectory, fueled by technological advancements, increased funding, and rising demand. As more cell therapy products receive regulatory approvals and become available to patients, the market is poised to make a significant impact on healthcare. However, overcoming challenges related to manufacturing, regulation, and reimbursement will be essential for sustained growth.

Market Dynamics

Drivers

-

Precision Gene Editing and Increased Investment Drive Market Growth

Precision gene editing technologies, such as CRISPR-Cas9, are enabling scientists to make precise modifications to genes, leading to the creation of more effective and personalized cell therapies. This has spurred increased interest and investment in the field, with companies and research institutions focusing on developing innovative treatments for a wide range of diseases. The combination of precision gene editing and increased investment is expected to drive significant growth in the cell therapy market in the coming years.

Restraints

-

Manufacturing Complexity

The production of cell therapies often involves complex and specialized manufacturing processes, which can be challenging and costly.

Cell therapies can be expensive, limiting their accessibility to patients.

-

Regional Availability

Cell therapies may not be available in all regions or healthcare settings.

-

Limited Clinical Data

-

Uncertainty Regarding Long-Term Outcomes

-

High Costs

Key Segmentation

By Type

-

Autologous Therapy Segment

Dominating the market with a 91.2% share in 2023, this segment's growth is driven by the widespread adoption of CAR-T therapies, which have shown promising results in treating various cancers and genetic disorders. FDA approvals are rapidly expanding their adoption. For example, in February 2022, the FDA approved ciltacabtagene autoleucel (Carvykti) for adult patients with multiple myeloma who have relapsed or are refractory to other treatments.

-

Allogeneic Cell Therapy Segment

Expected to experience significant growth from 2024 to 2032, this segment is gaining traction due to its increasing adoption in developing innovative therapeutic regimens. Currently, there are 542 active allogeneic CAR-T agents in the global pipeline, many showing promising outcomes. For instance, Adaptimmune Ltd. is collaborating with Genentech to explore iPSC-derived allogeneic therapies for creating T-cells with enhanced proliferation capabilities compared to mature T-cells.

By Therapeutic Area

-

Oncology Segment

The oncology segment led the market with the largest revenue 29.8% share in 2023. CAR T-cells targeting CD19 have demonstrated high rates of complete and long-lasting remissions in patients with acute lymphocytic leukemia (ALL). The increasing FDA approval of novel therapies is expected to create growth opportunities. For instance, in October 2021, the FDA approved brexucabtagene autoleucel (Tecartus), a CAR T therapy for adults with B-cell precursor ALL who have relapsed or are refractory to prior treatment. This approval marked brexucabtagene as the first CAR T treatment for adults with ALL.

-

Musculoskeletal Disorders Segment

Anticipated to see significant market expansion, ongoing research is focused on developing technologies to regenerate or repair damaged musculoskeletal tissues. Researchers are studying clinically applicable cell types for musculoskeletal tissue regeneration therapies, as well as exploring the direct application of engineered or native skeletal progenitor cells to stimulate tissue repair and revitalize musculoskeletal tissues. These factors are expected to drive the growth of this segment.

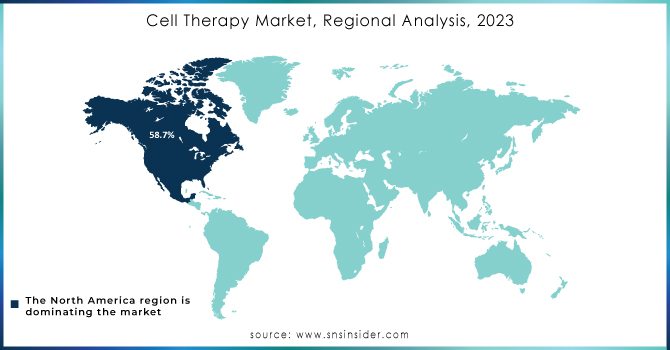

Regional Analysis

North America

The North American market dominated the cell therapy industry with a revenue share of 58.7% in 2023, attributed to collaborative research efforts between research institutes and pharmaceutical giants in the region. Numerous collaborations have led to significant advancements in cell therapy. For example, in June 2022, Immatics partnered with Bristol Myers Squibb to develop Gamma Delta Allogeneic Cell Therapy Programs. Government funding has also been a crucial driver of market growth in the U.S. In January 2022, Cellino Biotech raised USD 80 million in a Series A funding round to expand access to stem cell-derived therapies and develop the first independent human cell foundry by 2025.

Asia-Pacific

The Asia-Pacific region is projected to experience substantial growth in the cell therapy market during the forecast period. Increased awareness of novel therapies, growing investments, and favorable government policies are key factors expected to accelerate market expansion. For instance, in June 2022, Tessa Therapeutics Ltd. raised USD 126 million to fund the development of next-generation cancer therapies. The South Korean market is also anticipated to exhibit strong growth due to strategic initiatives by local and international companies. In August 2022, Panacea Biotech announced plans to use Natural Killer (NK) cells, brown Adipose-Derived Stem Cells (ADSC), and exosomes for treating COVID-19 infection.

Need any customization research on Cell Therapy Market - Enquiry Now

Key Players

-

JCR Pharmaceuticals Co., Ltd.

-

Novartis AG

-

Nkarta, Inc.

-

Bristol-Myers Squibb Company

-

JW Therapeutics

-

S. BIOMEDICS

-

Atara Biotherapeutics

-

Holostem Terapie Avanzate S.r.l

-

Anterogen Co., Ltd., and others

Recent Developments

-

Novartis: In January 2024, Novartis announced positive results from a Phase III clinical trial of Kymriah (tisagenlecleucel) for the treatment of relapsed/refractory diffuse large B-cell lymphoma.

-

Gilead Sciences: In February 2024, Gilead Sciences initiated a Phase III clinical trial for its CAR T cell therapy, Yescarta, to treat patients with relapsed/refractory follicular lymphoma.

-

Bluebird Bio: In March 2024, Bluebird Bio announced positive results from a Phase III clinical trial of its gene therapy, LentiGlobin, for the treatment of sickle cell disease.

-

CRISPR Therapeutics: In April 2024, CRISPR Therapeutics and Vertex Pharmaceuticals initiated a Phase III clinical trial for their CRISPR-based gene therapy, CTX001, to treat sickle cell disease and beta-thalassemia.

-

Celgene: In May 2024, Celgene, a Bristol Myers Squibb company, initiated a Phase III clinical trial for its CAR T cell therapy, JCAR015, to treat patients with relapsed/refractory multiple myeloma.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 4.65 Billion |

| Market Size by 2032 | US$ 28.98 billion |

| CAGR | CAGR of 22.55% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type [Allogeneic Therapies (Stem Cell Therapies, Non-Stem Cell Therapies), Autologous Therapies (Stem Cell Therapies, Non-Stem Cell Therapies)] •By Therapeutic Area [Oncology, Cardiovascular Disease (CVD), Musculoskeletal Disorders, Dermatology, Others] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Aurion Biotech, Gilead Sciences, Inc., JCR Pharmaceuticals Co., Ltd., Novartis AG, Johnson & Johnson Services, Inc, Nkarta, Inc., Bristol-Myers Squibb Company, MEDIPOST, JW Therapeutics, S. BIOMEDICS, Atara Biotherapeutics, Holostem Terapie Avanzate S.r.l, Anterogen Co., Ltd., and others. |

| Key Drivers | • Precision Gene Editing and Increased Investment Drive Market Growth |

| Restraints | •Manufacturing Complexity • Regional Availability • Limited Clinical Data • Uncertainty Regarding Long-Term Outcomes • High Costs |