Biopolymers Market Report Scope & Overview:

The Biopolymers Market Size was valued at USD 17.5 billion in 2023 and is expected to reach USD 47.4 billion by 2032 and grow at a CAGR of 11.7% over the forecast period 2024-2032.

Get More Information on Biopolymers Market - Request Sample Report

The market for biopolymers is gaining pace with growing demand from industries and consumers in terms of sustainability and eco-friendly products. Industry players are now investing further in the development and production of this biopolymer, sourced from renewable resources, due to increased awareness of the strong influence that traditional plastics exert on the environment. Such substitutes for conventional plastics may extend into packaging, agriculture, textiles, and automotive fields. The dynamic factors include regulatory pressures, consumer demand for sustainable products, and advancements in technology to enable efficient production with the functionality of biopolymers.

Recent trends show the pace in the biopolymers market. For example, European Bioplastics urged increased action to ensure acceleration in the growth of biopolymers in Europe at the end of January 2024. The industry leaders asked for the policymakers to collaborate, and further innovation that would support investment in bioplastics-that is, an initiative that would reflect a concerted effort towards the establishment of a viable biopolymers industry to stand up against increasing demands for environmentally friendly materials. Such moves are considered steps to overcome the shortcomings of ordinary plastics while supporting circular economies through the reduction of waste generation and enhanced recycling activities.

Another crucial development, released in September 2024, focuses on collaborative research, which presents a combination of ocean-based biopolymers with synthetic materials. This approach may help enhance the properties of biopolymer materials while maintaining sustainability. Ocean-based sources of biopolymers can add diversity to raw materials and will be supportive of maintaining the sustainability of ocean ecosystems. Examples of research in alternative sources of biopolymers reflect continued investigation toward fulfilling a broader range of applications and high-performance biodegradable materials.

Investment in bioplastics is upward as proven by Braskem, for example. This company announced the opening of a representative office in Tokyo as of October 2023, to reinforce its position in Asia. This strategic step is proof of investment in the development and adoption of biopolymers in the region. The Asian market is rapidly gaining interest in the search for sustainable packaging solutions as it becomes increasingly environmentally conscious, and Braskem will take hold of this trend. The company will then be positioned to effectively engage local businesses with such an investment, hence helping introduce new innovative biopolymer products in different sectors more rapidly. It will be technological advancements that play the key role in what the future of biopolymers will look like. Recent research scientists at the beginning of September 2023 detected a new class of biopolymers with emerging technology like atom transfer radical polymerization, or ATRP. The developments mean biopolymers can be designed and tailored for given applications for better performance and increased utilization. Such innovations are crucial in beating the existing limitations of biopolymer materials and resulting in better functional and versatile alternatives. The fact that biopolymer technology is not static presents the market with prospects for strong growth, with industries working toward higher performance and sustainability alternatives.

The dynamic characteristic of the biopolymers market is continuously emerging. The market is supposed to depend on various factors, such as sustainability trends, regulatory frameworks, and others that help grow further. Ongoing investments and innovative developments are contributing to the sector's substantial growth as it addresses all environmental challenges and the ever-changing needs of consumers and industries.

Biopolymers Market Dynamics:

Drivers:

-

Rising awareness of environmental issues is boosting demand for sustainable products, such as biopolymers, which serve as eco-friendly alternatives to traditional plastics.

The growing consciousness of consumers about the environment is increasingly demanding sustainable products, thereby emphasizing the desire for biopolymers derived from renewable resources. Biodegradable and extremely eco-friendly since they offer an alternative for traditional plastics to conscious consumers and businesses, these polymer substrates open up new possibilities in the quest for business-to-consumer sustainability in industries that seek alternatives to conventional plastics, which are considered the hardest pollutants of our environment. More forward-thinking practices by companies are under pressure due to global awareness of climate change and waste management. The increase in demand for biodegradable and compostable materials in packaging, textiles, and automobile applications is often interpreted as a change in consumer preference. Biopolymers, produced from natural sources such as corn, sugarcane, and other forms of biomass, are emerging as a preferable option for business houses looking to comply with regulations and cater to consumer expectations. There are also policies by governments and organizations on the use of biodegradable materials, hence there is a good environment for biopolymers. For instance, plastic bags and incentives for sustainable practices encourage the manufacture of biopolymers. As supply from consumer demand and support at the regulatory level tends to drive the need for innovation and further improvements in biopolymer technologies and applications, the biopolymers market is set to grow rapidly as a direct consequence.

-

Innovative production technologies like fermentation and enzymatic processes are enhancing the efficiency and quality of biopolymers, making them more competitive with traditional plastics.

The continued improvement in production technology has made biopolymers efficient and applicable. Due to fermentation and enzymatic treatment, methods have led to commercial-scale production of good-quality biopolymers. Therefore, biopolymers have a competitive opportunity with traditional plastics. Technologically, the latest extraction techniques, the latest fermentation techniques, and the latest polymerization processes may have improved and increased the manufacturing and production processes of biopolymers. Advanced fermentation and many other techniques are used to take agricultural feedstocks and change them into high-performance biopolymers with increased yield and minimal waste in the actual production process. Additionally, developments in enzymatic processing improve the control over the properties of biopolymers, thus having various materials customized to specific applications. A level of advancement is crucial in improving the performance characteristics including strength, durability, and biodegradability of biopolymers. As the production processes are being refined, biopolymers can increasingly match or even surpass the properties of conventional plastics. Hence, biopolymers are viable alternatives for a wide array of industries. Investments in research and development also create opportunities for collaborating research between academia and industry to provide real breakthroughs that could facilitate bringing down the costs of production and thus the scope of application of biopolymers. This sets the biopolymers market up for long-term growth counterbalancing between environmental and performance needs helps sustain it.

Restraint:

-

Biopolymers production relies on the availability and cost of chitin from crustacean shells, which can limit market growth.

Biopolymers are more expensive to make than their traditional oil-based alternatives. Costs also can be accounted for by the source of raw material, sophisticated processes involved in making these products, and also because production is relatively on a smaller scale. All these make costs remain high enough to limit penetration in the market. High costs of production of biopolymers remain the biggest challenge for the market. This will limit further uptake and drive competitiveness against traditional plastics. The extraction of raw materials, mainly agricultural feedstocks, poses many problems of price volatility and supply. Bioplastics also lack established supply chains or scale economies because bioplastics are made from crops that are prone to many factors of agricultural risks, such as changes in climate, pest outbreaks, and land use change. Furthermore, the biopolymer production process may be complicated and energy-intensive. In which improvements in technology are found to increase efficiency, the initial capital investment related to production facilities of biopolymer is huge. This may discourage new-market entrants and restrict the growth of existing producers. Thus, it creates high costs on biopolymer production to translate into higher prices for final consumers at the product end, making biopolymers compete unfavorably with traditional, cheaper plastics. Hence, it should be a challenge for continuous research into cost-cutting measures which might include the optimization of supply chains, improvement of production technologies, and finding alternative feedstocks to improve the overall economic feasibility of biopolymers.

Opportunity:

-

Emerging markets provide strong opportunities for biopolymer adoption, driven by rising consumer demand for sustainability and supportive government policies.

Emerging markets can further propel the adoption of biopolymers, with increased consumer demand for sustainable products and the government's continuing support of policies that bring these opportunities to the forefront. Growth in this field may further aid the biopolymer industry. Biopolymer manufacturers are finding emerging markets ever more attractive since increased levels of consumer awareness over environmental issues work to increase demand for environmentally sustainable products. Increasing population size and higher incomes in such markets cause a shift toward more eco-friendly alternatives in packaging, consumer goods, and agriculture, among other sectors. Many emerging market governments are now beginning to implement policies promoting the use of biodegradable products. Tax breaks, subsidies, and regulatory frameworks that decrease plastic waste are among the incentives encouraging the take-up of biopolymer adoption. The combination of regulatory support coupled with a growing consumer base is creating fertile ground for market expansion. Emerging economies also provide abundant agriculture resources not yet tapped, where the raw material for biopolymer production could be harvested. The opportunity to break into this market can then be provided to local producers. Companies can create sustainable supply chains from which both the economy and the environment would benefit by investing in such a production facility and forming partnerships with agricultural stakeholders. Indeed, as the awareness and demand for biopolymers increase in these regions, probably the innovation and development of new products may find a lead in the biopolymers market to be a key area of growth in the future.

Challenge:

-

The biopolymers market faces strong competition from cheaper, more accessible petroleum-based plastics, hindering its growth.

High competition comes from traditional, established petroleum-based plastics, which are in the main relatively cheaper, more readily available, and have well-established supply chains. This is a challenge to the growth of this market. The challenge facing biopolymers is the unchallenged dominance of conventional plastics in the market. Since traditional plastics have extremely large infrastructural investments, consolidated supply chains, and low cost of production, these conventional plastics have proved to be very competitively advantageous for many manufacturers as well as consumers. This well-established presence offers a major obstacle for companies engaged in the manufacture of biopolymers seeking to penetrate other industries. These prevalent attributes of traditional plastics, such as strength, flexibility, and low cost, make the landscape of competition even more complex. Many companies still shy away from switching to biopolymers on account of performance, availability, and price-related apprehensions in applications where specific physical properties are critical. Innovation and improvement in the properties of products remain a challenge to manufacturing the new biopolymer. They need to show that, theoretically, biopolymers can be equivalent in performance to traditional plastics. They, therefore, need to invest in further research and development to improve not only production efficiency but also cost reduction along with wider application areas for biopolymers. Building awareness of the environmental benefits of biopolymers and fostering industry-to-industry collaborations toward better solutions will also shift consumer and business preferences toward more sustainable alternatives.

Biopolymers Market Segmentation Overview

By Source

In 2023, the plant-based segment dominated the biopolymers market, accounting for an estimated market share of 65%. This significant share is largely due to the widespread availability and abundance of plant materials, such as corn, sugarcane, and potato starch, which serve as sustainable feedstocks for biopolymer production. Plant-based biopolymers are increasingly favored for their biodegradability and eco-friendliness, making them suitable for various applications, including packaging, textiles, and automotive components. For instance, companies like NatureWorks LLC have leveraged plant-based feedstocks to produce Ingeo, a widely used polylactic acid (PLA) biopolymer derived from corn. Additionally, Novamont S.p.A. has developed Mater-Bi, a family of biodegradable plastics made from renewable resources, further showcasing the versatility and growing demand for plant-based biopolymers across multiple industries. As consumers and manufacturers alike prioritize sustainability, the plant-based segment is expected to maintain its leading position in the biopolymers market.

By Type

In 2023, the biodegradable polymers segment dominated the biopolymers market, holding an estimated market share of 70%, with polylactic acid (PLA) being the leading sub-segment, accounting for approximately 40% of this segment. The growing emphasis on environmental sustainability and the increasing regulatory pressure to reduce plastic waste has significantly contributed to the popularity of biodegradable polymers. PLA, produced from renewable resources like corn starch, is widely used in packaging, disposable cutlery, and agricultural films due to its biodegradability and versatility. For example, NatureWorks LLC's Ingeo PLA is a prominent product that has gained traction in various industries as a sustainable alternative to conventional plastics. Additionally, the increasing availability of PLA production facilities and advancements in production technologies are expected to further enhance its market presence. As awareness of environmental issues continues to grow, the biodegradable polymers segment, particularly PLA, is well-positioned for sustained growth in the biopolymers market.

By Application

In 2023, the films segment dominated the biopolymers market, capturing an estimated market share of 40%. This dominance can be attributed to the growing demand for sustainable packaging solutions across various industries, particularly in food packaging, where biopolymer films offer an eco-friendly alternative to conventional plastics. These films are highly favored for their biodegradability, flexibility, and barrier properties. For instance, companies like Novamont S.p.A. produce biodegradable films using Mater-Bi, which are increasingly used in packaging fresh produce and other perishable goods. Additionally, the rise in e-commerce and online food delivery services has further boosted the demand for biopolymer films as businesses seek to reduce their environmental footprint. The ability of these films to break down naturally after disposal aligns with global sustainability goals, making them a preferred choice among manufacturers and consumers alike. As a result, the film segment is expected to continue leading the biopolymers market, driven by ongoing innovations and regulatory support for sustainable packaging solutions.

By End-Use Industry

In 2023, the packaging segment dominated the biopolymers market, holding an estimated market share of 50%. This significant share is primarily driven by the increasing consumer demand for sustainable and eco-friendly packaging solutions. The rise in environmental awareness and regulatory pressures to reduce plastic waste has prompted manufacturers to seek biodegradable alternatives for packaging materials. Biopolymers, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are increasingly utilized in various packaging applications due to their biodegradability and performance characteristics. For example, companies like Braskem are advancing their biopolymer solutions for flexible and rigid packaging, while NatureWorks LLC's Ingeo PLA is widely adopted in food packaging due to its excellent barrier properties and compostability. Moreover, the convenience of using biopolymers in single-use items, such as bags and containers, aligns with the global shift toward sustainable practices in the packaging industry. As brands strive to enhance their sustainability profiles, the packaging segment is expected to maintain its leadership in the biopolymers market, supported by continuous innovation and consumer preferences for greener options.

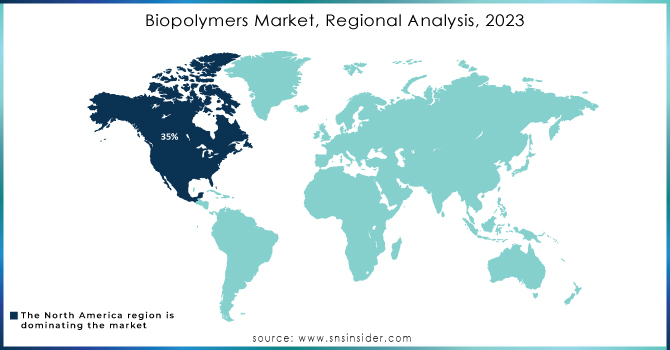

Biopolymers Market Regional Analysis

In 2023, North America dominated the biopolymers market, accounting for an estimated market share of 35%. This leadership can be attributed to the strong presence of key players, substantial investments in research and development, and increasing consumer demand for sustainable products. Companies such as NatureWorks LLC and BASF SE are headquartered in this region, driving innovation and expanding the availability of biopolymer products. Furthermore, the rising regulatory pressures to reduce plastic waste and promote environmentally friendly materials have led to increased adoption of biopolymers in various applications, particularly in packaging and consumer goods. The region's focus on sustainability initiatives and green technology has also bolstered the growth of the biopolymers market, positioning North America as a significant player in the global landscape.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the biopolymers market, with an estimated CAGR of 12%. The rapid growth in this region is primarily driven by the increasing demand for biodegradable materials, particularly in packaging and agricultural applications, as countries like China and India focus on sustainability to combat pollution and waste. Moreover, initiatives to promote the use of renewable resources and investments in biopolymer manufacturing capabilities have further accelerated market growth. For example, companies like Braskem are expanding their biopolymer production in Asia-Pacific to meet the rising demand. Additionally, government policies aimed at reducing plastic usage and promoting eco-friendly alternatives are fostering an environment conducive to the growth of the biopolymers market in this region. As consumer awareness regarding sustainability continues to rise, Asia-Pacific is expected to maintain its rapid growth trajectory in the biopolymers sector.

Need Any Customization Research On Biopolymers Market - Inquiry Now

Recent Developments

June 2024: BASF expanded its Ecoflex biodegradable polymer line to boost sustainable packaging production.

May 2024: HTL Biotechnology acquired the Modern Meadows collagen platform to enhance its biopolymers for beauty and biomedical uses.

July 2023: Braskem increased biopolymer production by 30% with an investment of USD 87 million to support renewable material availability.

Key Players

-

BASF SE (Ecoflex, Ecovio)

-

Bio-on S.p.A. (Minerv PHAs, Bioplastic Granules)

-

Cardia Bioplastics (Cardia Compostable Resins, Cardia Biohybrid Resins)

-

DuPont de Nemours, Inc. (Sorona, Biomax)

-

Futerro (Futerro PLA, Futerro PHA)

-

Green Dot Bioplastics (Mater-Bi, EcoSphere)

-

Mitsubishi Chemical Corporation (BioPBS, BioPolymer)

-

NatureWorks LLC (Ingeo, Ingeo biopolymer)

-

Novamont S.p.A. (Mater-Bi, Novamont Bioplastics)

-

Total Corbion PLA (Luminy PLA, Luminy PHA)

-

AkzoNobel N.V. (Aerosol Propellants, Biobased Resins)

-

Braskem S.A. (I’m Green Polyethylene, Green Plastic)

-

Cargill, Inc. (NatureWorks PLA, Cargill Bioplastics)

-

Danimer Scientific, Inc. (Nodax PHA, PHA Resins)

-

Galactic S.A. (Lactide, Galabio)

-

Lenzing AG (TENCEL, Lenzing Lyocell)

-

Phaerista (PHA-based Biopolymers, PHA Compounds)

-

Solvay S.A. (Amodel, Radel)

-

Synlogic, Inc. (Biopolymer Solutions, Synthetic Biology Products)

-

Toray Industries, Inc. (Torayca, Toray Biomaterials)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 17.5 Billion |

| Market Size by 2032 | US$ 47.4 Billion |

| CAGR | CAGR of 11.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Plant-based, Microbial, Animal-based) •By Type (Biodegradable Polymers {Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Starch Blends, Cellulose-based Polymers}, Non-biodegradable Polymers {Bio-based Polyethylene (Bio-PE), Bio-based Polypropylene (Bio-PP), Bio-based Polyethylene Terephthalate (Bio-PET)}) •By Application (Films, Bottle, Fibers, Seed Coating, Vehicle Components, Medical Implants, Others) •By End-Use Industry (Packaging, Textile, Automobile & Transport, Electronics & Electricals, Coatings & Adhesives, Agriculture & Horticulture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, DuPont de Nemours, Inc., NatureWorks LLC, Novamont S.p.A., Mitsubishi Chemical Corporation, Cardia Bioplastics, Total Corbion PLA, Futerro, Bio-on S.p.A., Green Dot Bioplasticsand other key players |

| Key Drivers | •Rising awareness of environmental issues is boosting demand for sustainable products, such as biopolymers, which serve as eco-friendly alternatives to traditional plastics •Innovative production technologies like fermentation and enzymatic processes are enhancing the efficiency and quality of biopolymers, making them more competitive with traditional plastics |

| Restraints | • Biopolymers production relies on the availability and cost of chitin from crustacean shells, which can limit market growth |