Bioplastics Market Report Scope & Overview:

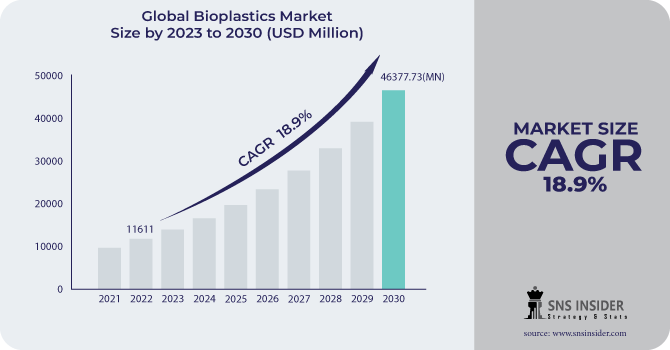

The Bioplastics Market size was valued at USD 11611 million in 2022 and is expected to grow to USD 46377.73 million by 2030 and grow at a CAGR of 18.9% over the forecast period of 2023-2030.

Bioplastics are materials made from renewable resources that can cut down on the amount of plastic trash produced globally. These renewable biomass materials, such as cellulose, plant starch, natural sugars, vegetable fats, and used cooking oils, are widely used to make these bio-based polymers. In addition, fresh sources like seaweeds, insects, and mammals are being studied for their potential. While not all are biodegradable, a significant portion can do so in a very short period of time, making them superior to traditional plastics.

To Get More Information on Bioplastics Market - Request Sample Report

The Corn, wheat, mastic, and sugarcane are some of the common feedstocks used to make bioplastics. Nearly all geographical areas of the world have easy access to these. The worldwide market's fluctuation in crude oil prices has no impact on the development of the bioplastics sector.

MARKET DYNAMICS

KEY DRIVERS:

-

Demand for Biodegradable Plastics to Enhance Soil Quality

-

Rising Packaging Industry Demand for Eco-Friendly Plastics

Numerous industries have used biodegradable plastics, but the packaging business is where they are most frequently used because of their similar characteristics to conventional counterparts. In the coming years, a considerable amount of packing material is anticipated to be utilized due to a growth in e-commerce worldwide. Utilizing bio-based plastics can be a great approach to reduce environmental plastic pollution because they can easily replace conventional plastics.

RESTRAIN:

-

High Cost

OPPORTUNITY:

-

Rising Utilization of Flexible Packaging

-

The government's increased focus on sustainability and supportive green procurement rules

The bio-based polymers have a wide range of applications. The market for bio-based polymers is anticipated to experience tremendous development opportunities in applications for consumer products due to the government's increased focus on sustainability and supportive green procurement rules. It is also anticipated that the packaging application will expand significantly. There are several uses for biodegradable mulch films in the agricultural sector. The use of bio-based polymers in goods like trays, cutlery, and cups for food packaging is crucial and extremely demanding.

CHALLENGES:

-

High demand from the automotive industry

-

Segregation and processing of bioplastic

IMPACT OF RUSSIA-UKRAINE WAR

The continuing conflict between Russia and Ukraine has decreased American exports of plastics to both nations, including resin, plastics machinery, plastics molds, and plastic goods. According to the data in the table below, year-to-date exports as of July were down more than 50 percent from the same time last year. Exports of American plastics to Russia fell by 62.4%, from $101.1 million to $38.0 million, and by 51.4%, from $21.3 million to $10.4 million to Ukraine. So far this year, exports of plastics machinery to the Ukraine and molds for plastics to Russia have ceased. U.S. plastics shipments to Russia increased by 8.1% in 2021. Exports of resin and plastic goods to Russia represented 46.4% and 47.1% of total exports, respectively. Exports of American plastics to Ukraine increased by 39.9%, with resin accounting for 77.2% of all exports in 2021. However, imports of US plastics from Russia fell by 16.8% while those from Ukraine rose by 19.1%.

IMPACT OF ONGOING RECESSION

The plastics production will also increase in 2021. Production decreased 0.6% from September but up 4.0% from October of the previous year. Shipments of plastic and rubber products climbed in September by 6.2% from a year ago and by 0.6% from August. In the last quarter of the year, sales of retail trade and food services, which use plastics products and packaging, got off to a good start. It grew 16.3% from October of last year and 1.7% from September. Expect a rise in sales as the busiest shopping period of the year approaches. In comparison to last year, PLASTICS predicts a 12.3% growth in retail sales (excluding food services).

KEY MARKET SEGMENTATION

By Product

-

-

Biodegradable

-

Starch Blends

-

Polybutylene Succinate (PBS)

-

Others

-

-

-

Non-biodegradable

-

Polyethylene

-

Polyamide

-

Polytrimethylene Terephthalate

-

Others

-

-

By Application

-

-

Packaging

-

Agriculture

-

Consumer goods

-

Textile

-

Automotive & Transportation

-

Building & Construction

-

Others

-

.png)

Do You Need any Customization Research on Bioplastics Market - Enquire Now

REGIONAL ANALYSIS

Europe dominated the global bioplastics market, with Germany, France, Italy, and the United Kingdom accounting for the majority of demand British Empire.

Germany's food and beverage business is distinguished by its approximately 6,000 small and medium-sized enterprise sector. In 2021, it was predicted that the food and beverage market would generate US$3,222 million in revenue. During the anticipated period, the market is anticipated to increase by 6.83% annually, propelling the nation's flexible and rigid packaging sector and the use of bioplastic. Another industry vertical that will drive the market is consumer goods due to the high living levels of the population, they favor higher-quality goods over lower-quality ones.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENTS

-

In July 2021, Solvay purchased the global coatings division of Bayer, which included facilities in Mereville, France, as well as tolling operations in Brazil and the United States. The company's selection of environmentally friendly and biodegradable products for farmers will expand as a result of this acquisition. All product lines, worldwide tolling operations, and R&D initiatives from the Mereville site have now been transferred entirely to Solvay.

-

Novamont and Iren inked a three-year collaboration agreement in the field of integrated waste collecting systems in March 2021. The agreement intends to implement the goals of a circular bio-economy and eliminate non-recyclable waste at source. Both businesses are dedicated to the creation of specialized projects to better the management of compostable goods and packaging, as well as their improvement and recovery, in addition to the organic in the Iren treatment plants, c of the solid waste is processed.

-

In January 2021, Novamont purchased the BioBag Group, a Norwegian business that created low-impact packaging solutions. With this acquisition, Novamont will be able to diversify its distribution network and reach new markets. Additionally, the two businesses have strengthened their connections with the key players, from big retailers to local communities, enabling them to provide the market with a more suitable and comprehensive choice of options.

KEY PLAYERS

The Major Players are TEVJIN LIMITED, TORAY INDUSTRIES, INC., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, BASF SE, Futerro, Trinseo S.A., Braskem, Total Corbion PLAIR and other players are listed in a final report.

Toyota Tsusho Corporation-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2022 | US$ 11611 Mn |

| Market Size by 2030 | US$ 46377.73 Mn |

| CAGR | CAGR of 18.9 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Biodegradable, Non-biodegradable) • By Application (Packaging, Agriculture, Consumer goods, Textile, Automotive & Transportation, Building & Construction, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | TEVJIN LIMITED, TORAY INDUSTRIES, INC., Toyota Tsusho Corporation, Avantium, PTT MCC Biochem Co., Ltd., An Phat Holdings, NatureWorks LLC, SABIC, BASF SE, Futerro, Trinseo S.A., Braskem, Total Corbion PLAIR |

| Key Drivers | • Demand for Biodegradable Plastics to Enhance Soil Quality • Rising Packaging Industry Demand for Eco-Friendly Plastics |

| Market Restraints | • High Cost |