Polylactic Acid (PLA) Market Size Analysis:

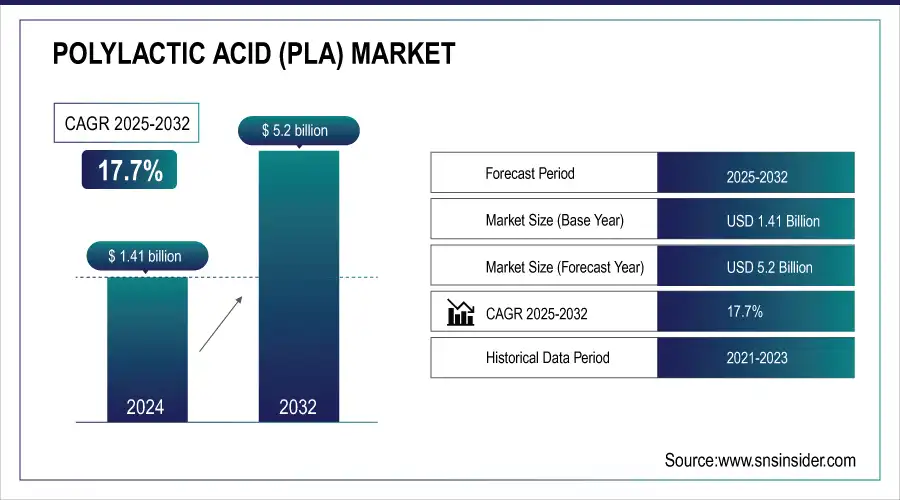

The Polylactic Acid Market Size was valued at USD 1.41 Billion in 2025E and is expected to reach USD 5.20 Billion by 2033, growing at a CAGR of 17.7% over the forecast period 2026-2033.

Polylactic Acid (PLA) is one of the most widely used biodegradable plastics in the world, and its market has grown rapidly due to the increasing demand for sustainable and environmentally-friendly materials. The increasing urge for eco-friendly options to minimize the contribution of petroleum-based plastics to environmental degradation has fueled the demand for PLA, supported by favourable governmental support across the globe. PLA, made from renewable resources such as corn starch, is biodegradable and compostable, aligning with sustainability goals. Support through regulations promoting the use of biodegradable polymers, particularly in packaging, helped strengthen the PLA market in 2023, specifically in the government sector.

Polylactic Acid (PLA) Market Size and Forecast:

-

Market Size in 2025E: USD 1.41 Billion

-

Market Size by 2033: USD 5.20 Billion

-

CAGR: 17.7% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get More Information on Polylactic Acid (PLA) Market - Request Sample Report

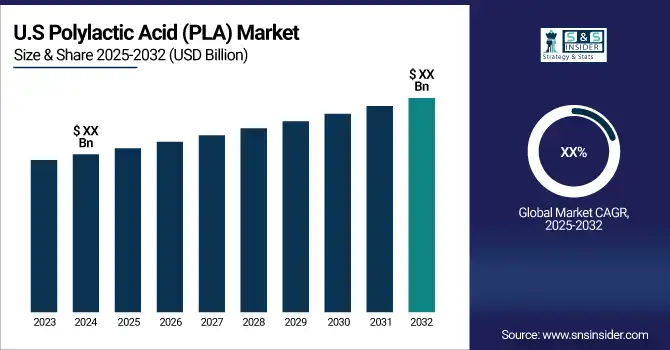

The U.S. Polylactic Acid (PLA) market size was valued at an estimated USD 0.55 billion in 2025 and is projected to reach USD 2.05 billion by 2033, growing at a CAGR of 16.8% over the forecast period 2026–2033. Market growth is driven by increasing demand for biodegradable and bio-based plastics across packaging, textiles, agriculture, and consumer goods industries. Rising environmental concerns, stringent regulations on single-use plastics, and growing adoption of sustainable packaging solutions are accelerating market expansion. Additionally, advancements in PLA production technologies, expanding applications in 3D printing and medical devices, and strong investments in circular economy initiatives further strengthen the robust growth outlook of the U.S. polylactic acid market during the forecast period.

Key Polylactic Acid (PLA) Market Trends:

-

Rising adoption of biodegradable plastics in packaging reduces environmental pollution, driving demand for sustainable alternatives like PLA.

-

Increasing use of PLA in 3D printing supports lightweight, durable, and customizable product manufacturing across industries.

-

Growth in medical applications, including implants and drug delivery systems, leverages PLA’s biocompatibility and biodegradability.

-

Advancements in polymer blending and compounding enhance PLA’s thermal stability, mechanical strength, and processability for diverse applications.

-

Government regulations and bans on single-use plastics accelerate PLA adoption in consumer and industrial packaging.

-

Expansion in the food and beverage sector promotes PLA-based containers, films, and cutlery due to compostability and safety compliance.

-

Investment in large-scale PLA production facilities reduces costs, enabling wider industrial adoption and competitive pricing.

Driven by increased legislative activity, such as the Circular Economy Action Plan from the European Union, the PLA market, for example, had a positive benefit from the potential increase in recycling and utilization of bio-based materials in 2023. Meanwhile, bioplastics such as PLA have also been reported to contribute to lowering reliance on fossil resources, according to the U.S. Environmental Protection Agency (EPA). Governments further provided financial support to firms creating PLA-based applications and PLA manufacturing infrastructure. Consequently, production capacity and adoption across sectors such as packaging, automotive, and textiles have increased for PLA.

Polylactic Acid (PLA) Market Drivers:

-

Increased environmental awareness and the shift towards eco-friendly alternatives are driving demand for PLA, especially in sectors like packaging and textiles.

-

Governments worldwide are introducing regulations to reduce plastic waste, which promotes the adoption of biodegradable materials like PLA in industries such as packaging and agriculture.

-

Continuous R&D in PLA manufacturing techniques is improving the material’s properties, expanding its applications, particularly in automotive and electronics.

The growth of the Polylactic Acid (PLA) market is driven by the demand for sustainable & bio-degradable materials resulting from growing environmental concerns and a global shift toward reducing plastic waste. As a renewable and biodegradable alternative to conventional plastics, PLA is widely used in packaging, textiles, and agriculture. The packaging industry, being one of the largest consumers of PLA, has witnessed an eco-friendly transformation as many brands and companies are opting for biodegradable solutions in response to the consumer demand for greener alternatives. Take Coca-Cola for example, which aims high on its path to sustainability and is determined to manufacture sustainable packaging including PLA- bottled beverages to achieve its environmental objectives.

Moreover, stricter regulations against plastic waste introduced by several governments around the world over the past few years have spurred the demand for PLA. To illustrate, the Single-Use Plastics Directive from the European Union, which limits specific plastic products, has forced sectors to use biodegradable substitutes, such as PLA. Moreover, the improved heat resistance and flexible properties of PLA, owing to technological advancements in its production, are pushing its utilization in many sectors, thereby proving suitable for high-demand automotive and electronics sectors. In the textile industry, PLA fibers have been included in eco-friendly clothing lines by brands such as Patagonia. Combined with innovative developments in the PLA process, this will keep the material relevant in the fight against the growing worldwide plastic pollution.

Polylactic Acid (PLA) Market Restraints:

-

PLA remains more expensive than traditional plastics due to its complex production process, limiting its widespread adoption, especially in price-sensitive markets.

-

PLA has lower heat resistance compared to conventional plastics, restricting its use in high-temperature applications, particularly in electronics and automotive sectors

One significant restraint in the Polylactic Acid (PLA) market is its limited heat resistance. PLA has a reputation for being less heat-resistant than ordinary petroleum-based plastics. This restriction hinders its application in areas of high temperature such as automotive components, electronics, and some food packaging. As an example, PLA softens even at low temperatures (approx 60°C), which means items that are exposed to significant heat (or sun) will be unsuitable for the product (source). Continued attention has gone into this area which focuses on increasing PLA heat tolerable thresholds via novel additives and modifications to PLA itself. Nonetheless, these advances still have not paved the way out of the heat resistance conundrum for PLA yet, making it difficult to use PLA in applications requiring high long-term durability and heat-stability material properties . Although PLA has sustainability advantages, this issue continues to be a major barrier to the widespread implementation of PLA.

Polylactic Acid (PLA) Market Segmentation Analysis:

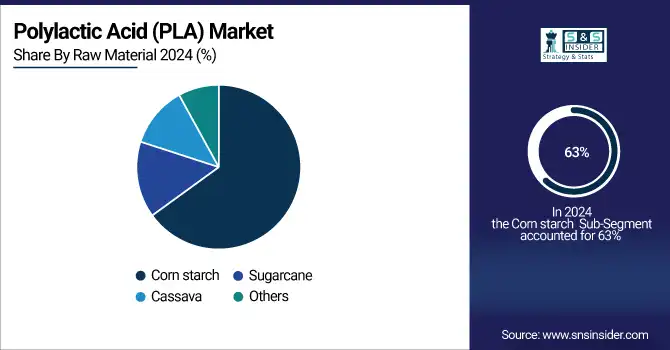

By Raw Material, Corn Starch Dominates the PLA Market Due to High Yield and Government Support

The corn starch accounted for the largest revenue share of the PLA market with 63% revenue share in 2025. This dominance is largely attributed to the availability of corn as an extensive renewable resource along with low-cost feedstock of corn for PLA production. PLA has flourished in the U.S. and Brazil, among the largest corn producers in the world, through the support of agriculture subsidies and government plans to promote bio-based materials. U.S. production of corn starch reached well above 400 million bushels in 2023, per estimates from the U.S. Department of Agriculture (USDA), thanks in large part to growing needs for PLA and associated biodegradable packing materials.

Corn starch also has some advantages over sugarcane, tapioca, or other raw materials. It has a high yield on lactic acid, which then can be transformed into PLA, and therefore, high-scale deployment potential. Corn starch is a key input in PLA production and government support for corn-based products through Farm Bill policies such as bonus points for environmentally beneficial farming practices fortify its use in PLA production. In addition, the U.S. Environmental Protection Agency (EPA) has classified PLA as a key polymer for plastic waste reduction and carbon emissions reduction, placing corn starch-derived PLA as the preferred bio-based alternative for eco-conscious industries.

By Application, Rigid Thermoform Packaging Leads PLA Demand Driven by Biodegradability and Food Industry Adoption

The rigid thermoform application segment of the PLA market accounted for the largest revenue share about 43% in 2025. Demand for biodegradable and compostable rigid thermoform packaging is increasing owing to its utilization in food packaging applications. Motivated by increasing awareness of environmental issues and the introduction of several government initiatives prompting stakeholders to adopt practices that eliminate the amount of waste generated and use bioplastics extensively across assorted channels, the global food industry is likely to witness a shift towards sustainable packaging shortly. The rising use of eco-friendly packaging as a result of government policies such as the European Union's Packaging and Packaging Waste Directive is driving the demand for PLA in this segment.

Thus rigid thermoform packaging is ideal for fresh food and beverages which means that PLA is the best alternative to traditional plastic materials. In addition, with many governments around the world now prohibiting single-use plastics in many applications, particularly within the food industry PLA is appealing since it is biodegradable and will degrade in compost conditions. PLA is just one of the biodegradable packaging solutions that can reduce the amount of plastic waste in landfills and address the problems of waste management according to the U.S. Environmental Protection Agency (EPA). In line with the push toward sustainability, sectors such as food, beverage, and consumer goods are now adopting rigid thermoform packaging that utilizes PLA. An increase in demand is also supported by government regulations; for example, the U.S. Food and Drug Administration has approved the use of PLA for food contact.

By End-use, the Packaging Segment Drives PLA Market Growth Through Sustainability and Regulatory Compliance

The packaging segment dominated the end-use segment of the PLA market in 2025, with more than 36% of the market revenue share. The packaging industry’s dominance in PLA consumption is attributed to the global push for sustainable packaging solutions. Amid rising worries about plastic at the inner and outer layer of the environment and sustainability for future generations of life, various governments are routinely stimulating plants to use less plastic, thus producing a lot of things made of a biodegradable material, PLA. The U.S. Environmental Protection Agency (EPA) includes the packaging industry as one of the major sources of plastic waste and indicates that merely switching to biodegradable counterparts like PLA would be a great solution to minimizing damage from plastic waste.

Policies, including the Plastics Strategy of the European Union, have been established by governments to reduce plastic packaging waste and to promote compostable packaging materials. Additionally, in the United States, the Sustainable Packaging Coalition has been launching efforts to develop PLA as a real alternative to conventional plastics. The result has been the emergence of PLA as the go-to material in high-performance, sustainability-sensitive applications, such as food packaging, beverage containers, and consumer goods. Moreover, the compostable and biodegradable properties of PLA have further proven to be useful in the packaging industries by minimizing landfill space and a smaller ecological footprint. As consumers and regulators continue to seek sustainable packaging solutions, demand is likely to remain robust.

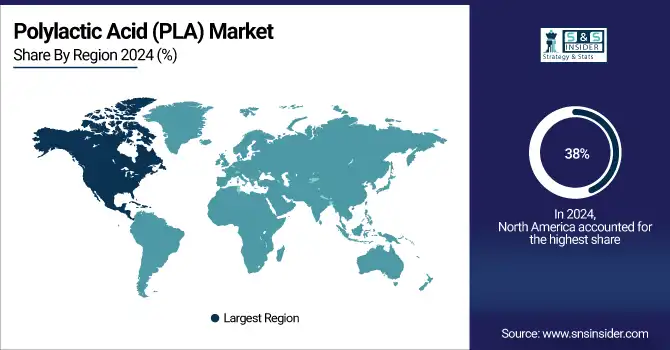

Polylactic Acid Market Regional Overview:

North America Dominates Polylactic Acid Market in 2025

North America holds an estimated 38% market share in 2025, driven by government incentives for biodegradable plastics, high corn production, and growing packaging industry demand. This causes manufacturers to invest in PLA production and adopt sustainable packaging solutions across industries.

Get Customized Report as per Your Business Requirement - Request For Customized Report

-

United States Leads North America’s PLA Market

The U.S. dominates due to large-scale corn production, advanced bioplastics manufacturing infrastructure, and supportive government policies such as the Farm Bill and EPA initiatives promoting PLA adoption. Investments by packaging and food companies to switch from conventional plastics to biodegradable alternatives further reinforce market leadership. Additionally, growing consumer awareness about environmental sustainability encourages PLA usage across food, beverage, and consumer goods industries. The combination of raw material availability, technological capability, and regulatory support positions the U.S. as the largest contributor to North America’s PLA market.

Asia Pacific is the Fastest-Growing Region in Polylactic Acid Market in 2025

The region is expected to grow at a CAGR of 21.5% from 2026–2033, driven by rising demand for sustainable packaging, rapid industrialization, and government-backed green initiatives. This causes businesses to adopt PLA for food packaging, consumer goods, and industrial applications.

-

China Leads Asia Pacific’s PLA Market

China dominates due to its robust manufacturing base, increasing investments in bioplastics, and government initiatives supporting sustainable packaging and environmental protection. The country is the largest consumer of packaging materials globally, and rising concerns about plastic pollution have accelerated PLA adoption in food, beverage, and e-commerce industries. Combined with abundant corn and starch feedstock availability, PLA production is scaling rapidly. International collaborations and technological advancements in PLA polymerization further reinforce China’s leadership in Asia Pacific, making it the fastest-growing PLA market in the region.

Europe Polylactic Acid Market Insights, 2025

Europe is witnessing strong PLA market growth, driven by strict regulations on single-use plastics, government sustainability programs, and rising consumer preference for eco-friendly packaging. Germany’s policies promoting biodegradable plastics and sustainable packaging adoption encourage manufacturers to shift from conventional plastics, boosting PLA demand.

-

Germany Leads Europe’s PLA Market

Germany dominates due to progressive environmental policies, high consumer awareness of sustainability, and strong presence of packaging and bioplastics companies. Initiatives such as the European Union’s Plastics Strategy and Packaging Waste Directive further reinforce PLA adoption in food and consumer goods sectors. Germany’s commitment to circular economy practices and investment in biopolymer R&D ensure continuous growth, making it the leading European contributor to the PLA market.

Middle East & Africa and Latin America Polylactic Acid Market Insights, 2025

PLA adoption in these regions is steadily increasing, supported by rising environmental awareness, government sustainability mandates, and the expansion of food and beverage industries. Countries such as Brazil, Mexico, UAE, and South Africa are investing in biodegradable packaging infrastructure, promoting PLA usage. International collaborations and technology transfers are accelerating production and application of PLA in packaging, consumer goods, and industrial segments. Growing interest in reducing plastic waste and aligning with global sustainability targets is driving steady PLA market expansion across both regions.

Competitive Landscape for Polylactic Acid (PLA) Market:

NatureWorks

NatureWorks is a U.S.-based global leader in polylactic acid (PLA) production, specializing in bio-based polymers for packaging, fibers, and industrial applications. The company produces Ingeo™ PLA resins, offering sustainable alternatives to conventional plastics with biodegradable and compostable properties. NatureWorks operates vertically integrated production, managing raw material sourcing, polymerization, and product delivery. Its role in the PLA market is vital, as it provides high-performance, eco-friendly solutions that reduce carbon footprint and plastic waste across multiple industries. NatureWorks supports brands and manufacturers in transitioning to sustainable packaging and bioplastics while maintaining product quality and functionality.

-

In 2024, NatureWorks expanded its Ingeo™ PLA portfolio, introducing higher-melt and faster-composting variants for rigid packaging, thermoformed containers, and 3D printing applications.

Total Corbion PLA

Total Corbion PLA is a joint venture between TotalEnergies and Corbion, headquartered in the Netherlands, producing bio-based polylactic acid for packaging, food service, and disposable products. The company focuses on high-quality PLA resins with excellent thermal stability, mechanical performance, and compostability. Its role in the PLA market is significant, offering scalable, sustainable polymer solutions to meet global demand for environmentally friendly packaging. Total Corbion PLA enables industries to reduce reliance on petroleum-based plastics and comply with increasing regulatory requirements on single-use plastics and waste reduction.

-

In 2024, Total Corbion PLA launched advanced PLA grades suitable for high-performance thermoforming and extrusion applications, targeting food packaging and industrial solutions.

BASF

BASF, headquartered in Germany, is a leading chemical company producing polylactic acid solutions under its eco-friendly product portfolio for packaging, consumer goods, and industrial applications. The company integrates R&D, polymer technology, and sustainability practices to provide biodegradable and compostable PLA resins. BASF’s role in the PLA market is central, as it enables manufacturers to meet stringent environmental regulations while maintaining product performance. By supplying high-quality biopolymers and collaborating with global brands, BASF drives the adoption of sustainable materials in multiple sectors.

-

In 2024, BASF expanded its PLA solutions with new grades optimized for rigid packaging, consumer products, and injection molding applications, improving thermal and mechanical performance.

Galactic

Galactic is a Belgium-based leader in lactic acid and polylactic acid solutions, offering biopolymers for packaging, food additives, and industrial applications. The company specializes in high-purity lactic acid and PLA derivatives, supporting sustainable material innovation for biodegradable and compostable solutions. Galactic plays a key role in the PLA market by providing eco-conscious alternatives to traditional plastics, enabling companies to reduce environmental impact and enhance circular economy initiatives. Its expertise in lactic acid chemistry ensures high-quality polymers with scalable production capabilities for global applications.

-

In 2024, Galactic introduced new PLA formulations for flexible films, biodegradable coatings, and food-contact applications, expanding its sustainable product portfolio across multiple industries.

Polylactic Acid (PLA) Market Key Players:

-

Total Corbion PLA

-

Galactic

-

Futerro

-

Synbra Technology

-

Zhejiang Hisun Biomaterials Co., Ltd.

-

Shimadzu Corporation

-

Evonik Industries AG

-

Shenzhen Esun Industrial Co., Ltd.

-

Corbion N.V.

-

Danimer Scientific

-

Biome Bioplastics

-

Meredian Holdings Group

-

Shenzhen Polymtek Biomaterials Co., Ltd.

-

Guangdong Green Innovation Materials Co., Ltd.

-

Suzhou Huaan Biotechnology Co., Ltd.

-

Foresight Group

-

Toray Industries, Inc.

-

Henan Jindan Lactic Acid Technology Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.41 Billion |

| Market Size by 2033 | USD 5.20 Billion |

| CAGR | CAGR of 17.7% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Raw Material (Corn starch, Sugarcane, Cassava, Others) • By Grade (Thermoforming, Injection Molding, Extrusion, Blow Molding, Others) • By Application (Rigid thermoform, Film & sheets, Bottles, Others) • By End-use (Packaging, Agriculture, Automotive & Transportation, Electronics, Textile, Consumer goods, Bio-medical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

NatureWorks, Total Corbion PLA, BASF, Galactic, Futerro, Synbra Technology, Zhejiang Hisun Biomaterials, Shimadzu Corporation, Evonik Industries, Shenzhen Esun Industrial, Corbion N.V., Danimer Scientific, Biome Bioplastics, Meredian Holdings Group, Shenzhen Polymtek Biomaterials, Guangdong Green Innovation Materials, Suzhou Huaan Biotechnology, Foresight Group, Toray Industries, Henan Jindan Lactic Acid Technology. |