Bioremediation Market Report Scope & Overview:

Get More Information on Bioremediation Market - Request Sample Report

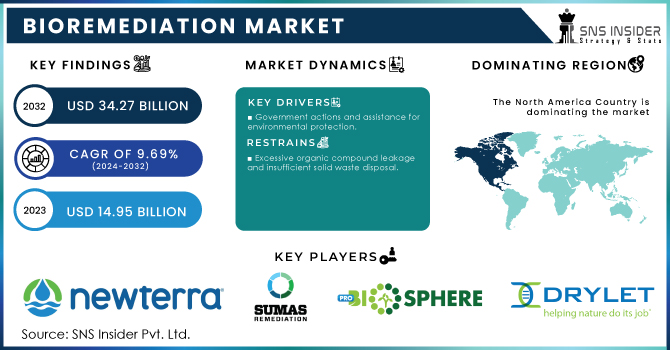

The Bioremediation Market Size was valued at USD 14.86 Billion in 2023 and is expected to reach USD 35.30 Billion by 2032, growing at a CAGR of 10.10% over the forecast period of 2024-2032.

The bioremediation market is evolving rapidly as environmental sustainability gains global urgency. Our report presents a regional capital investment trendline, revealing how funding patterns influence technology adoption. A comprehensive government funding and incentives chart highlights fiscal policies driving market momentum across nations. The impact of regulatory norms timeline outlines how stricter environmental laws have catalyzed bioremediation initiatives over time. To gauge market maturity, consumer awareness and acceptance levels are analyzed, offering insights into growing trust in biological solutions. Post-treatment monitoring techniques trends are also explored, emphasizing the role of innovation in ensuring long-term remediation success. These exclusive insights provide a data-rich narrative of how policy, investment, and technology are converging to shape the future of the bioremediation market.

The US Bioremediation Market Size was valued at USD 254.49 Million in 2023 with a market share of around 60% and growing at a significant CAGR over the forecast period of 2024-2032.

The US bioremediation market is experiencing significant growth, driven by stringent environmental regulations and increasing public awareness of sustainable practices. The U.S. Environmental Protection Agency (EPA) has been instrumental in promoting bioremediation technologies, particularly at Superfund sites, by incorporating them into cleanup strategies due to their cost-effectiveness and environmental benefits. For instance, the EPA has highlighted the use of bioremediation at sites like Onondaga Lake in New York, where natural processes are enhanced to degrade contaminants. Additionally, U.S.-based companies such as EM America are actively involved in providing bioremediation solutions, offering products like EM.1 for waste cleanup and wastewater treatment. These developments underscore the growing adoption and integration of bioremediation technologies across various sectors in the U.S.

Market Dynamics

Drivers

-

Expansion of Brownfield Redevelopment Projects Stimulates Adoption of Site-Specific Bioremediation Solutions

The redevelopment of brownfield sites previously contaminated industrial or commercial lands is becoming a major driver for bioremediation, especially in urban and semi-urban areas. Governments and private developers are investing in these projects to revitalize unused properties, often incentivized by tax credits and regulatory relaxations. Bioremediation, being cost-effective and environmentally friendly, is a preferred method for cleaning these sites. For instance, in the United States, the Environmental Protection Agency's Brownfields Program supports projects that often employ phytoremediation and bioaugmentation techniques to treat petroleum hydrocarbons and heavy metals. These projects not only restore land usability but also promote sustainable urban development. The ability to tailor bioremediation strategies to the unique contaminant profiles of each site adds to its appeal in redevelopment planning. As cities aim for greener, low-impact infrastructure expansion, the demand for such site-specific, minimally disruptive remediation methods is set to rise, providing a steady growth trajectory for the market.

Restraints

-

Inconsistencies in Microbial Efficiency Across Varying Environmental Conditions Limit the Scalability of Bioremediation Technologies Globally

One of the major restraints in the bioremediation market is the variability in microbial performance across different environmental conditions. Microorganisms used in remediation are highly sensitive to changes in temperature, pH, oxygen levels, and contaminant concentration. A bioremediation solution that works effectively in one location may underperform or fail in another due to these factors. For example, cold climates slow down microbial metabolism, delaying treatment results, while arid conditions may limit the moisture essential for microbial survival. Moreover, highly toxic or mixed contaminant sites can suppress microbial activity or require custom consortia, increasing costs and complexity. Such uncertainties make it difficult for industries and municipalities to adopt bioremediation on a large scale without detailed feasibility studies. This unpredictability adds time and cost to projects, especially when immediate cleanup is needed, thereby making chemical or mechanical alternatives more appealing in certain cases, particularly in highly industrialized or time-sensitive remediation scenarios.

Opportunities

-

Collaboration Between Biotech Startups and Agricultural Sectors Opens New Avenues for Remediating Pesticide and Fertilizer Contamination in Farmlands

With rising concerns about soil health and groundwater contamination due to excessive pesticide and fertilizer use, the agricultural sector presents a promising growth opportunity for the bioremediation market. Innovative biotechnology startups are developing microbial solutions that can target specific agrochemical residues, restoring soil fertility and improving crop productivity. These solutions are gaining traction among sustainable farming communities and organic certification bodies. For instance, companies like MicroGen Biotech in the United States are partnering with farm cooperatives to deploy bioaugmentation products that remediate legacy herbicide buildup. Beyond treatment, these biological agents often have plant growth-promoting properties, adding economic value for farmers. As sustainable agriculture policies expand globally and consumer preference shifts toward cleaner food production, such collaborations are expected to scale up. Government grants and regenerative agriculture subsidies can further accelerate adoption, making this intersection between biotech innovation and agri-environmental needs a fertile ground for market development.

Challenge

-

Difficulty in Quantifying Post-Remediation Success Metrics Limits Confidence Among Regulatory Agencies and End Users

A major hurdle in scaling bioremediation adoption is the difficulty in quantifying post-treatment success. Unlike chemical or mechanical methods that offer visible, immediate changes, bioremediation's impact is often subtle, biological, and long-term. Assessing microbial activity, toxin degradation rates, and ecological balance restoration requires advanced and continuous monitoring. Many remediation projects lack the infrastructure or budget to carry out such post-treatment evaluations. Regulatory agencies, especially in regions like North America and Europe, demand empirical evidence of contaminant breakdown, often involving expensive lab analyses or real-time monitoring systems. This data scarcity leads to hesitation among potential clients municipalities, industries, and real estate developers who may opt for more measurable remediation techniques. Moreover, without standardized post-remediation metrics, benchmarking and certification become difficult, affecting credibility. Enhancing monitoring tools and developing universally accepted bioremediation success indicators is necessary to build stakeholder trust and encourage broader market adoption.

Segmental Analysis

By Type

In 2023, the In Situ segment dominated the bioremediation market with a market share of 55.4%. This dominance can be attributed to the fact that In Situ remediation offers numerous advantages, particularly in terms of cost and convenience. By treating contaminants directly at the site without excavation or removal, it reduces labor, equipment, and disposal costs. In situ technologies, including bioaugmentation and biostimulation, are widely used in soil and groundwater decontamination. For example, in the U.S., the Environmental Protection Agency has supported In Situ bioremediation in contaminated sites such as Superfund locations, allowing for the reduction of hazardous substances like petroleum hydrocarbons. The Department of Defense has also recognized in situ techniques as effective for managing contaminated military sites. This method’s ability to be applied across a wide range of sites without disturbing the surrounding environment continues to drive its adoption.

By Technology

The Phytoremediation technology segment dominated the bioremediation market in 2023, with a market share of 32.8%. This approach uses plants to absorb, degrade, or stabilize contaminants in the soil, water, or air, making it an eco-friendly and cost-effective solution. The increasing preference for sustainable and non-invasive treatment methods has fueled the rise of Phytoremediation, especially in the agricultural sector. For instance, the U.S. Department of Agriculture (USDA) has funded projects using Phytoremediation to treat heavy metal contamination in agricultural lands. Additionally, the growing global focus on reducing carbon footprints aligns with the environmental benefits of this technology, boosting its adoption. Phytoremediation is also recognized for its ability to restore soil health and improve biodiversity, making it a preferred choice for land reclamation projects. As such, its effectiveness in tackling a range of pollutants like heavy metals and organic chemicals contributes significantly to its dominance.

By Services

Soil Remediation dominated the bioremediation market in 2023, accounting for a 41.2% market share. The increasing focus on contaminated land management and soil health has significantly contributed to the growth of this service segment. Soil remediation techniques such as bioremediation are essential for restoring lands impacted by industrial waste, agriculture, and urbanization. For example, the U.S. Environmental Protection Agency (EPA) has supported numerous bioremediation projects aimed at remediating contaminated soils across the country, particularly in areas impacted by petroleum spills and hazardous chemicals. The push toward sustainable land use practices, driven by both government regulations and public concern over environmental protection, has further amplified the demand for soil remediation services. Additionally, the rising need for soil revitalization in agricultural regions also contributes to its dominance. Soil remediation not only helps mitigate environmental risks but also enhances land usability, encouraging more industrial and residential developments.

Regional Analysis

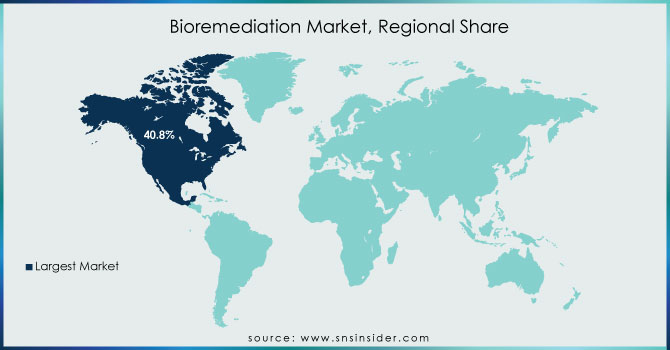

In 2023, North America dominated and held the largest share of the bioremediation market, with a market share of 40.3%. The U.S. leads this market due to stringent environmental regulations and significant investments in sustainable waste management solutions. For instance, the U.S. Environmental Protection Agency (EPA) has heavily funded and promoted bioremediation technologies for environmental cleanup, particularly at Superfund sites. The country’s established infrastructure for bioremediation services, along with advanced research and development in microbial treatments, continues to support this dominance. Furthermore, U.S.-based companies like Regenesis and Biorem Technologies Inc. are pioneers in advancing bioremediation technologies, expanding their market presence globally. Canada, with its emphasis on natural resource conservation and environmental health, also contributes significantly to North America's dominance in the bioremediation sector. In Mexico, the government has increasingly recognized bioremediation as a viable solution for industrial waste cleanup, further expanding the region’s leadership.

On the other hand, Asia Pacific emerged as the fastest-growing region in the bioremediation market, with a significant growth rate during the forecast period in 2024 to 2032. The region's rapid industrialization, coupled with stringent government regulations on environmental pollution, has driven the demand for sustainable remediation solutions. In countries like China and India, bioremediation is gaining traction as an alternative to conventional chemical treatments for industrial waste management. For instance, the Chinese government has been investing in research and development to promote eco-friendly technologies, including bioremediation. Additionally, Southeast Asian nations are increasingly adopting bioremediation solutions for oil spill cleanup, following successful trials in the region. The market's growth is further fueled by the rising awareness of environmental sustainability among consumers and businesses alike. With government initiatives supporting the adoption of cleaner technologies, Asia Pacific is expected to continue expanding its bioremediation market share in the coming years.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

-

Aqua-Pure Ventures Inc. (Bioremediation for wastewater treatment, Bioremediation solutions for hydrocarbon cleanup)

-

Aquatech International Corporation (Biological treatment systems, Wastewater treatment technologies)

-

Biosafe Systems LLC (Bioremediation products for oil spills, Environmental cleanup solutions)

-

Biological Remediation Technologies (Bioremediation solutions, Environmental remediation products)

-

Biorem Technologies Inc. (Bioremediation air filtration systems, Biological treatment for environmental cleanup)

-

Clean Harbors Inc. (Oil spill response services, Waste management and hazardous waste disposal with bioremediation solutions)

-

Drylet, Inc. (Bioaugmentation products for wastewater treatment, Environmental remediation products)

-

Eco-Balance Systems (Bioremediation solutions for soil and groundwater, Oil spill remediation products)

-

Envirogen Technologies, Inc. (Environmental remediation systems, Bioremediation for industrial wastewater treatment)

-

Geosyntec Consultants, Inc. (Consulting and bioremediation services for contaminated sites, Environmental consulting services)

-

Hydrocarbon Technologies Inc. (Hydrocarbon spill bioremediation products, Waste oil recovery solutions)

-

MicroGen Biotech Ltd. (Microbial bioremediation products, Oil spill cleanup solutions)

-

Newterra Ltd. (Water treatment systems, Bioremediation technologies for water)

-

Oil Spill Eater International, Inc. (Bioremediation products for oil spills, Hydrocarbon cleanup solutions)

-

Probiosphere, Inc. (Bioremediation products for environmental cleanup, Bioremediation solutions for wastewater)

-

Regenesis Corporation (In-situ bioremediation products, Soil and groundwater remediation solutions)

-

Remedial Solutions Ltd. (Bioremediation services for contaminated sites, Remediation and soil cleanup solutions)

-

Sumas Remediation Service, Inc. (Bioremediation services for soil and water, Environmental cleanup services)

-

Xylem, Inc. (Water treatment solutions, Bioremediation technologies for water)

-

Yanmar Environmental Solutions (Environmental solutions, Wastewater treatment technologies)

Recent Developments

-

November 2024: Bodoland University researchers secured an Indian patent for a bioremediation technique using natural microbes and native plants to clean petrochemical-contaminated soils. The innovation highlights Northeast India’s rich biodiversity and its potential for sustainable environmental solutions.

-

September 2024: Ahmedabad Municipal Corporation approved bioremediation to treat sewage entering the Sabarmati River. Five firms were selected for a pilot project. Despite a ₹50.20 crore budget, delays emerged by March 2025, prompting notices to contractors for slow progress.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 14.86 Billion |

| Market Size by 2032 | USD 35.30 Billion |

| CAGR | CAGR of 10.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Type (In Situ, Ex Situ) •By Technology (Biostimulation, Phytoremediation, Bioreactors, Fungal Remediation, Bioaugmentation, Land-based Treatment, Others) •By Services (Soil Remediation, Oilfield Remediation, Wastewater Remediation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Regenesis Corporation, Drylet, Inc., Probiosphere, Inc., Oil Spill Eater International, Inc., MicroGen Biotech Ltd., Newterra Ltd., Sumas Remediation Service, Inc., Biosafe Systems LLC, Eco-Balance Systems, Biorem Technologies Inc. and other key players |