Video Laryngoscope Market Report Scope & Overview:

Get more information on Video Laryngoscope Market - Request Sample Report

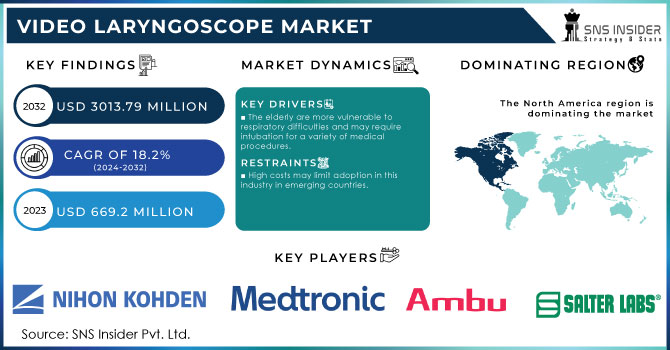

The Video Laryngoscope Market was valued at USD 669.2 million in 2023. It is projected to reach USD 3013.79 million by 2032, growing at a compound annual growth rate (CAGR) of 18.2% from 2024 to 2032.

The Video Laryngoscope Market refers to the global market for video laryngoscopes, which are medical devices used for visualizing the larynx during intubation procedures. Intubation is a common medical procedure in which a tube is inserted into a patient's windpipe to facilitate breathing, and video laryngoscopes assist in achieving a clear view of the vocal cords and the airway. Video laryngoscopes consist of a handle with a display screen and a blade or camera at the tip. The camera captures the video image of the larynx, which is displayed on the screen, allowing healthcare professionals to guide the endotracheal tube into the correct position. This technology offers several advantages over traditional direct laryngoscopes, such as better visualization, improved success rates, and reduced complications.

The video laryngoscope market has experienced significant growth in recent years due to the increasing adoption of these devices in hospitals, ambulatory surgical centres, and emergency medical services. The market growth is driven by factors such as the rising incidence of respiratory diseases, the growing geriatric population, and the need for advanced airway management techniques. Additionally, the development of portable and handheld video laryngoscopes has expanded their usage in pre-hospital and emergency settings.

The companies compete in terms of product innovation, technological advancements, and pricing strategies. The market is also influenced by regulatory frameworks, reimbursement policies, and the overall healthcare infrastructure in different regions. The video laryngoscope market is expected to continue growing in the coming years as the demand for advanced airway management techniques and the need for improved patient outcomes persist. Technological advancements, such as the integration of artificial intelligence and wireless connectivity in video laryngoscopes, are also expected to drive market growth. However, it's important to note that specific market data, such as revenue figures or growth rates, may vary depending on the time period and the region of analysis. As respiratory disorders become increasingly widespread, the market is growing. Robot-assisted technologies help the automation of anaesthetic treatment by easing the strain on anaesthesiologists and improving all areas of patient care. Numerous manufacturers and researchers are investigating robotics for use in a range of laryngoscopy procedures.

MARKET DYNAMICS

DRIVERS:

-

The elderly are more vulnerable to respiratory difficulties and may require intubation for a variety of medical procedures.

-

possessing more benefits than direct laryngoscopy devices to increase demand in this industry.

Failure to intubate with a direct laryngoscope frequently leads to serious problems such as tooth damage, laryngeal spasm, bronchospasm, dysrhythmias, cardiac arrest, brain injury, or even death. As a result, the use of modern laryngoscopes with visualisation capabilities is expanding in healthcare settings across the world to prevent these disorders.

RESTRAIN:

-

Video laryngoscopes require routine maintenance and cleaning to guarantee maximum performance and infection prevention. Proper sterilization and disinfection operations might take time and may necessitate the use of additional resources and expertise.

-

High costs may limit adoption in this industry in emerging countries.

The lower adoption of anaesthetic video laryngoscopes in developing countries as a result of high costs and a lack of advantageous reimbursement policies to give coverage is one of the major factors inhibiting the growth of the video laryngoscope market. According to Medtronic statistics, the cost of reusable devices ranges from USD 1,200 to USD 8,500 depending on their technological speciality, compared to the cost of a single-use standard laryngoscope, which is USD 20.

OPPORTUNITY:

-

In emerging markets, where healthcare infrastructure and access to innovative medical equipment are expanding, there is a huge prospect for market development.

-

In this sector, there is a big possibility for telemedicine and remote patient monitoring.

With the rise of telemedicine and remote patient monitoring, video laryngoscopes are finding new applications. These gadgets can be used in remote consultations, where healthcare practitioners can remotely advise and aid intubation operations. Built-in connectivity in video laryngoscopes can improve real-time communication and the capacity to deliver remote healthcare services.

CHALLENGES:

-

Patients with problematic anatomical variations, restricted airways, or deformed anatomy may create obstacles for video laryngoscopy.

-

The greatest demand in this industry is for training and skill development.

Proper training and skill development among healthcare workers are required for the effective use of video laryngoscopes. It might be difficult to incorporate video laryngoscopy methods into current training programmes and ensure expertise in interpreting video pictures. The availability of comprehensive training programmes and resources varies by location.

IMPACT OF RUSSIA-UKRAINE WAR

Due to the fact that the majority of medical gadgets are imported from the US and Europe, the Russia-Ukrainian War will have a severe effect on the Russian medical device industry. The financial choice to stop doing business with Russia has social repercussions as well. The findings by Global Data show that the media has responded favorably to Conformist actions. However, these choices appear to be more politically motivated than economically motivated, as minimal financial damage is anticipated from the loss of exported Russian medical products, which, according to Global Data, represent less than 0.04% of the total value of medical devices sold internationally.

There was a huge flight of Ukrainians, mostly to Poland, as a result of the conflict and humanitarian catastrophe there. In terms of providing these individuals with medical, social, and economic care, the armed war in Ukraine and the flood of refugees into Poland provide a unique challenge for the Polish public health system. Some of the issues and difficulties associated with the humanitarian catastrophe brought on by war, the effects of which are being and will also be felt by Poland, include the organization of education and the labour market as well as risks related to the destruction of the social lives and environments of the migrants. As a result, the prices of equipment and related services will also increase in the video Laryngoscope market.

IMPACT OF ONGOING RECESSION

Medical equipment businesses are prepared to withstand a downturn in the economy even as they continue to struggle with pandemic-related issues including employee shortages and a broken supply chain. Although the business should be somewhat resilient to a deeper recession, gadget makers aren't fully immune to possible recessionary challenges. Effects of the ACA may contribute to more steady procedure volumes. The Department of Health and Human Services reports that 30.1 million individuals were uninsured in the fourth quarter of 2022 and that a record number of over 38 million people received insurance under the ACA in early 2023. About all the databases no major impact ongoing recession of the Video Laryngoscope Market.

KEY MARKET SEGMENTATION

By Type

-

Flexible

-

Rigid

By Usability

-

Disposable

-

Reusable

By End User

-

Clinics

-

Hospitals

-

Others

REGIONAL ANALYSIS

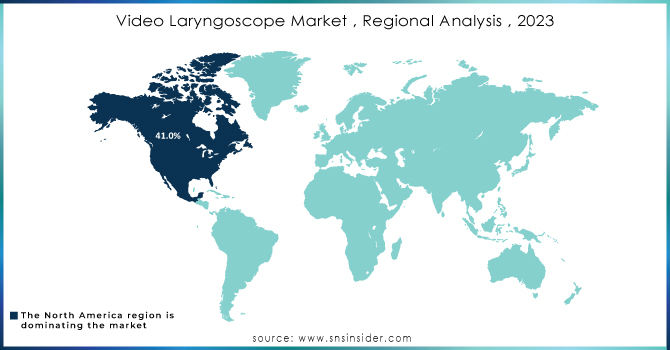

North America: North America dominated the video laryngoscopes market, accounting for about 41.0% of sales in 2023. The increase can be linked to the increased frequency of respiratory illnesses in both adults and children. Furthermore, growth in air pollution and cigarette smoke exposure, which causes respiratory illnesses, is expected to boost the market. The existence of strong practice standards set by the American Society of Anaesthesiologists (ASA) and other healthcare organisations, as well as expanding governmental efforts in the area, are projected to drive market expansion.

Asia Pacific: Over the projection period, Asia Pacific is predicted to have the fastest growth rate. It may be ascribed to the region's high illness load, vast unmet patient requirements, regular infrastructural and technical advancements in the medical device sector, and growth in healthcare expenditure. According to WHO research, the increase in morbidity and death rates owing to COPD is most pronounced in the Asian area, with the prevalence rate of COPD expected to reach approximately 8.5% in 2023.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some major players in Video Laryngoscope Market are Medtronic, Ambu A/S, Nihon Kohden Corporation, Olympus Corporation, KARL STORZ SE & Co. KG, Salter Labs, Verathon Inc., AAM Healthcare, VDO Medical Inc. Hebei Vimed Medical Device Company, Ltd., and other players.

RECENT DEVELOPMENTS

Intersurgical Ltd: In 2021, Intersurgical Ltd announced the introduction of the Universal Video Laryngoscopy web page, with the goal of increasing i-view product awareness internationally.

ZEISS: In 2020, ZEISS International launched the ZEISS NURA video laryngoscope, with the goal of assisting clinicians in maintaining a safe distance from patients during the Covid-19 epidemic.

| Report Attributes | Details |

| Market Size in 2023 | US$ 669.2 Mn |

| Market Size by 2032 | US$ 3013.79 Mn |

| CAGR | CAGR of 18.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Flexible, Rigid) • By Usability (Disposable, Reusable) • By End User (Clinics, Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Medtronic, Ambu A/S, Nihon Kohden Corporation, Olympus Corporation, KARL STORZ SE & Co. KG, Salter Labs, Verathon Inc., AAM Healthcare, VDO Medical Inc. Hebei Vimed Medical Device Company, Ltd. |

| Key Drivers | • The elderly are more vulnerable to respiratory difficulties and may require intubation for a variety of medical procedures. • possessing more benefits than direct laryngoscopy devices to increase demand in this industry. |

| Market Restraints | • Video laryngoscopes require routine maintenance and cleaning to guarantee maximum performance and infection prevention. Proper sterilization and disinfection operations might take time and may necessitate the use of additional resources and expertise. • High costs may limit adoption in this industry in emerging countries. |