Smart Pills Market Size & Trends:

To Get More Information on Smart Pills Market - Request Sample Report

The Smart Pills Market size was valued at USD 1.5 Billion in 2023 and is expected to reach USD 4.9 billion by 2032, growing at a CAGR of 14.0% over the forecast period 2024-2032.

The smart pills market has seen tremendous growth, with the advancement in healthcare technologies and growing stimulation for expanding the precision and adaptability of patient diagnostics by the government. As healthcare systems strive to address the increasing burden of non-communicable diseases (NCDs), the role of innovative diagnostic tools like smart pills has gained prominence. According to the World Health Organization (WHO), NCDs are responsible for approximately 74% of all global deaths, with gastrointestinal disorders being a notable contributor to this burden. These disorders affect around 20% of the global population annually, highlighting the urgent need for advanced diagnostic solutions. Governments worldwide have recognized the potential of smart pills in transforming diagnostics and monitoring. For instance, the U.S. Centers for Disease Control and Prevention (CDC) reported that nearly 60-70 million Americans suffer from digestive diseases annually, leading to significant healthcare expenditures. The European Commission’s Horizon 2023 program allocated over €500 million to support research and development in advanced diagnostic tools, including capsule endoscopy and ingestible sensors.

Various governments worldwide are implementing focused measures to accelerate the adoption of smart healthcare technologies. In countries such as the United States, the Food and Drug Administration's (FDA) approval of numerous novel capsule endoscopy devices in 2023 reflects an expansion of regulatory support for minimally invasive solutions that can improve the accuracy of diagnosis for gastrointestinal diseases. The European nations, using their firm health care policies, have highlighted the importance of bringing innovative technologies including smart pills into the clinical environment. In Germany, for example, higher funding is dedicated to healthcare innovation programs including minimally invasive diagnostic technologies.

In addition, the rising global geriatric population is accelerating smart pill solutions. With the UN estimating that there will be 1.4 billion people aged 60 and over by 2030, the need for non-invasive, patient-friendly diagnostic tools is only going to grow. In response, several governments are introducing programs aimed at meeting the healthcare needs of elderly populations. For example, the United Kingdom has launched initiatives focused on enhancing access to innovative diagnostics for its aging demographic, including the use of capsule endoscopy for early detection of gastrointestinal disorders. These concerted efforts by governments, coupled with advancements in healthcare technology, are set to propel the smart pills market further, providing enhanced diagnostic and therapeutic solutions for a range of medical conditions.

Market Dynamics

Drivers

-

Smart pills enable non-invasive diagnostic procedures, such as capsule endoscopy, which revolutionizes gastrointestinal disorder diagnoses by offering a less intrusive alternative to conventional methods like endoscopy.

-

With over 40% of individuals globally facing gastrointestinal issues, the demand for smart pills to monitor and diagnose these conditions has surged. They provide valuable insights into digestive health, driving market growth.

-

Innovative uses of technologies like Addressable Transmitters Operated as Magnetic Spins (ATOMS) and customizable smart pills are enhancing diagnostic accuracy and treatment delivery, positioning the market for growth.

The rising adoption rate of non-invasive diagnostic procedures is one of the key drivers fuelling the growth of the smart pills market. Smart pills are a non-invasive diagnostic technique alternative to conventional endoscopy, which is invasive with many side effects to the patient. The pills, loaded with micro-cameras and sensors, create a panorama of organs and how they function, helping doctors to detect precisely what is wrong with them. For instance, capsule endoscopy has become a groundbreaking application. The procedure involves a patient swallowing a capsule that contains a tiny camera that takes thousands of pictures as it passes through the GI (gastrointestinal) tract. The advantage of this technique, in addition to providing minimal discomfort, is that it is not invasive and therefore avoids the need for anesthesia and a recovery period, making it the ideal choice for both patients and providers.

Recent statistics underscore its relevance gastrointestinal issues affect over 40% of the global population, with conditions like irritable bowel syndrome and chronic constipation being prevalent. This emphasizes the urgent need for efficient non-invasive diagnostic tools. Combined with time- and space-resolved sensor technologies that have recently shown significant advancements by integrating them with drug formulations, the sensing capability of these smart pills can be extended to enable real-time monitoring of physiological parameters, such as pH, temperature, and pressure, offering clinically actionable data for treatment planning. These innovations are driving their adoption across global healthcare systems, especially in North America and Europe, which have technological infrastructures for advanced solutions

Restraints

-

The integration of advanced technologies, such as sensors and microchips, increases production costs, limiting affordability and adoption, particularly in underdeveloped regions.

-

Stringent regulations for ingestible medical devices, coupled with complex approval processes, act as barriers to the rapid commercialization of smart pills.

One of the major restraining factors for the smart pills market is the expensive cost of manufacturing smart pills due to the requirement of integration of advanced technologies such as microchips, sensors, and complex software systems. Now these parts guarantee accuracy in diagnostics and drug delivery but such components require a decent investment in their development and production. Moreover, there are relatively high production costs that stem from the complexity of its design process embedding these technologies into a suitable ingestible format is complicated. Consequently, smart pills are not always viable for implementation in under-resourced healthcare settings and in the developing world. Nonetheless, their clinical advantages do not translate into routine clinical use. It further discourages smaller companies from entering the market due to high production costs, resulting in lesser competition, and finally, lesser innovation. It will be essential to tackle these cost challenges where a larger economic scale or an advancing technology will play an important role in the commercialization phase of smart pills.

Segmentation Analysis

By Application

In 2023, capsule endoscopy was the largest segment in smart pills, with 53% of revenue share in the smart pills. This widespread acceptance is mainly due to its non-invasive and minimally invasive nature, revolutionizing gastrointestinal disease diagnosis and management. The capsule endoscopy system is more patient-friendly than standard endoscopies, which require sedation, scopes, and often multi-day hospital stays. Its ability to diagnose high-resolution imaging of the full gastrointestinal tract, containing regions like the small intestine which are high and difficult-rate after regular strategies, also endorses its use, as a result inducing the technology.

The prevalence of gastrointestinal disorders, including Crohn's disease, ulcers, and obscure gastrointestinal bleeding, drives more healthcare providers to turn to capsule endoscopy as a diagnostic tool of choice. More than 20% of the total world population suffers from gastrointestinal diseases each year according to WHO, which demonstrates the need for new types of diagnostic solutions. Moreover, innovations in capsule technology, like real-time data transmission and the utilization of AI-based images, have improved the efficiency and ease of diagnosis with capsule endoscopy, ensuring market dominance.

Thus, governments and health organizations all over the globe identified the potential of this technology for the betterment of patients. Various programmes such as Horizon 2023 of the European Commission are providing substantial funding to create innovative diagnostic instruments such as capsule endoscopy systems. Likewise, to regulatory agencies in other industries, the U.S. Food and Drug Administration (FDA) has fast-tracked several approvals of new and novel capsule endoscopy devices, showing a high level of regulatory support for emerging technology in the crippling disease space. This, along with other factors, continues to strengthen the importance of capsule endoscopy in the smart pills industry.

By Target Area

In 2023, the small intestine segment captured the largest revenue share, which can be attributed to the growing incidence of disorders such as small intestinal bacterial overgrowth (SIBO) and Crohn's disease. The World Health Organization (WHO) estimates that close to 2% of the world identifies as Crohn's disease patients, so the need for accurate diagnostic tools is evident. Targeted imaging and monitoring in the small intestine (which is critical to effective treatment) is achieved with the use of smart pills. In addition, the segment is witnessing a high share due to an increase in demand for minimally invasive types of procedures, and rising awareness about intestinal health. Governments have played a pivotal role, with the National Institutes of Health (NIH) allocating $1.2 billion in 2023 for digestive disease research, including innovations in smart pill technology. The funding goes to companies with technologies that improve patient outcomes while lowering the cost of care.

By Disease Indication

The celiac disease segment accounted for the largest share of the market in 2023, due to the increasing awareness and diagnosis of this autoimmune disorder. Approximately 1% of the global population suffers from celiac disease as observed by the Celiac Disease Foundation, with many going undiagnosed. In disease management, the adoption of smart pills for early detection and monitoring among other factors has transformed the standing of the businesses. During 2023, EU governments promoted public health campaigns advocating for early diagnosis of various conditions such as celiac disease, subsequently supplemented by subsidies for advanced diagnostic tools. Recent advances in these areas, along with technological innovations, have led to the ability of smart pills to provide high-resolution imaging of the intestinal villi, a key histological determinant of celiac disease diagnosis and management. Historical data from the National Health Service (NHS) in the UK indicates that the diagnosis rate of celiac disease increased by 15% between 2015 and 2023, correlating with the adoption of advanced diagnostic solutions like smart pills.

Regional Insights

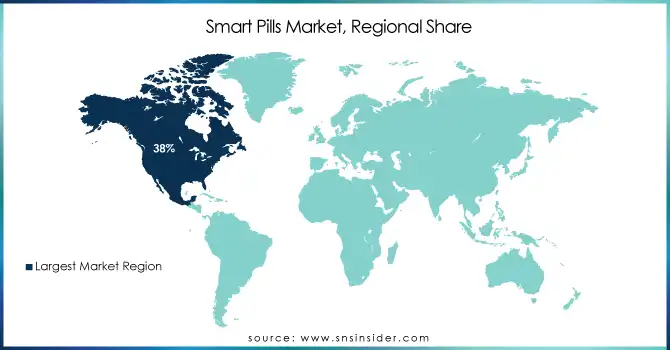

North America led the global smart pills market in 2023, with a 38% revenue share. The dominance was the result of various advanced technologies, a favorable regulatory framework, and the high prevalence of gastrointestinal disorders. According to the American Gastroenterological Association, around 25 million Americans face chronic digestive conditions every year, fueling the need for new diagnostic tools. The role of regulatory bodies such as the U.S. Food and Drug Administration (FDA) in the approval of technologically advanced devices as capsule endoscopy tools is also a major supportive factor for market growth. Additionally, Canada has been proactive in integrating smart healthcare technologies into its public health system, backed by government-funded research programs aimed at enhancing diagnostic precision.

The smart pills market in the Asia-Pacific region is projected to grow with the fastest compound annual growth rate (CAGR) during the forecast period. The growth is driven by increasing investments in healthcare such as assisting the growing number of older patients, and the rapidly growing population. The Indian Ministry of Health and Family Welfare, for example, recently increased the healthcare budget by 20% in 2023 and has emphasized using advanced medical devices to improve patient outcomes. Meanwhile, the Japanese government has placed a strong priority on innovation in medical technology through Society 5.0, which aims to incorporate smart technologies into the healthcare system. Following this theme, China, through its "Healthy China 2030" plan, aims to improve its diagnostic capabilities and healthcare access. A detailed plan of the smart pills market includes heavy investments in medical devices, and the effort to create the right atmosphere for such a market. We therefore anticipate that these government initiatives in Asia-Pacific will drive tremendous growth of smart diagnostic tools.

Do You Need any Customization Research on Smart Pills Market - Enquire Now

Recent Developments

-

In April 2024, PENTAX Medical EMEA launched the Digital Capture Module 9380, a commercially available pocket-sized device aimed at improving medical recording and documentation in ear, nose, and throat and speech-language pathology including voice pathology. It incorporates multi-camera video recording, and easy playback, and offers user-directed possibilities for stroboscopy, endoscopy, FEES, and VFSS.

-

In 2023, AnX Robotica Corp. launched the NaviCam Small Bowel System in the U.S., employing aspherical lens technology to minimize distortion and improve visualization for diagnosing small bowel diseases.

-

In January 2023, The U.S. FDA approved a new generation of capsule endoscopy devices with enhanced imaging capabilities, allowing for real-time data transmission.

Key Players

Key Service Providers/Manufacturers in the Smart Pills Market

-

Medtronic plc (PillCam SB 3, SmartPill Motility Capsule)

-

Olympus Corporation (EndoCapsule EC-10, EVIS EXERA III)

-

Capsovision, Inc. (CapsoCam Plus, CapsoView Software)

-

Proteus Digital Health, Inc. (Proteus Discover, Ingestible Sensor)

-

Check-Cap Ltd. (C-Scan System, Capsule Scanner)

-

IntroMedic Co., Ltd. (MiroCam Capsule Endoscope, MiroView Software)

-

PENTAX Medical (Digital Capture Module 9380, VNL Series Video Scopes)

-

AnX Robotica Corp. (NaviCam Small Bowel System, NaviCam Stomach Capsule)

-

Bio-Images Research Ltd. (CODES Drug Delivery Capsules, Dynamic Capsules)

-

Given Imaging (acquired by Medtronic) (PillCam Colon 2, Bravo pH Monitoring Capsule)

Key Users

-

Mayo Clinic

-

Cleveland Clinic

-

Johns Hopkins Medicine

-

Massachusetts General Hospital

-

University of Tokyo Hospital

-

Singapore General Hospital

-

Charité – Universitätsmedizin Berlin

-

Apollo Hospitals (India)

-

Mount Sinai Health System

-

St. Mary’s Hospital, London

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 4.8 Billion |

| CAGR | CAGR of 14.0% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Capsule Endoscopy, Drug Delivery, Vital Sign Monitoring) • By Disease Identification (Occult GI Bleeding, Crohn’s Disease, Small Bowel Tumors, Celiac Disease, Inherited Polyposis Syndromes, Neurological Disorders, Others) • By Target Area (Esophagus, Small Intestine, Large Intestine, Stomach) • By End-use (Hospitals, Outpatient Facilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Medtronic plc, Olympus Corporation, Capsovision, Inc., Proteus Digital Health, Inc., Check-Cap Ltd., IntroMedic Co., Ltd., PENTAX Medical, AnX Robotica Corp., Bio-Images Research Ltd., Given Imaging |

| Key Drivers | • Smart pills enable non-invasive diagnostic procedures, such as capsule endoscopy, which revolutionizes gastrointestinal disorder diagnoses by offering a less intrusive alternative to conventional methods like endoscopy. • Innovative uses of technologies like Addressable Transmitters Operated as Magnetic Spins (ATOMS) and customizable smart pills are enhancing diagnostic accuracy and treatment delivery, positioning the market for growth. |

| Restraints | • The integration of advanced technologies, such as sensors and microchips, increases production costs, limiting affordability and adoption, particularly in underdeveloped regions. |