Spine Biologics Market Report Scope & Overview:

Get More Information on Spine Biologics Market - Request Sample Report

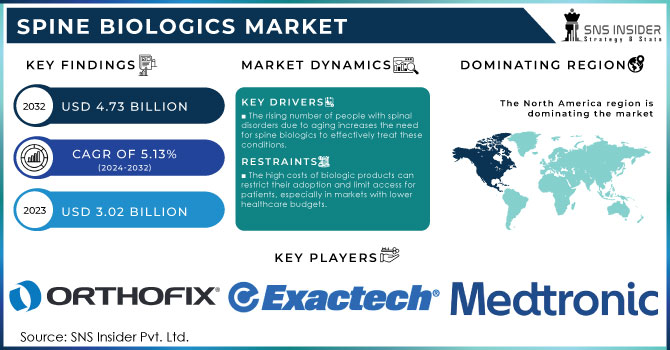

The Spine Biologics Market size was estimated at USD 3.02 billion in 2023 and is expected to reach USD 4.73 billion by 2032 at a CAGR of 5.13% during the forecast period of 2024-2032.

The factors driving the spine biologics market include personalized medicine that is tailored according to the patient’s genetics. The increasing focus on improving quality of life drives demand for minimally invasive and effective therapies. Regenerative medicine, including stem cell therapy, holds promise for innovative treatments. Government initiatives and public-private partnerships are fostering research and development, while emerging markets with growing healthcare needs offer new growth opportunities. These factors collectively contribute to the expansion of the spine biologics market. The market is increasing due to the increase in the number of old individuals who need treatment or rather the diagnosis that is having problems. The number of spine injuries among individuals who are over 50 is also in high demand because they are prone to have changes in their spine structure. They are also at an equal disadvantage in issues of their spinal and the changes. The market will therefore increase due to the above reasons that take place in the predicted period. The increase in rate of treatment in the world is also a major reason that is contributing to the increase in spine biologics market.

The spinal biologics are all the materials that can be used in case of the spine fusion surgery, spinal cord injury, and degenerative disk disease. The metals are inert materials, and therefore, they cannot stimulate the bone regeneration. According to the study published on ScienceDirect, April 2023, spinal degeneration is something that is common to human. In addition to the article, we obtain that the prevealence of the spinal degeneration is about 266 million populations (3.63 %) in 1 year across the globe.

The surgeons nowadays are dealing with advanced biological mechanisms in treating the deformities of spine, for instance, the direct lateral interbody fusion and the extreme lateral interbody fusion. According to the article published on Barrow Neurological Institute on May 2023, the extreme lateral interbody fusion is a type of a minimal invasive lumbar spinal fusion surgery where by the surgeon uses the abdomen to enter the back bone. There are several advantages of using XLIF, for instance, it has less surgery time, less blood loss, less hospital days, the surgery pain is little, and last but not least, it can be used in treating many types of the spinal disorder, for example, Lumbar spinal stenosis, mild scoliosis, and degenerative disk disease with instability.

MARKET DYNAMICS

DRIVERS

The rising number of people with spinal disorders due to aging increases the need for spine biologics to effectively treat these conditions.

Spinal disorders are becoming increasingly prevalent among the aging population, highly contributing to the demand for spine biologics. Aging is associated with degeneration of a person’s spinal structures as they age such as reduction in the bone density and elasticity of cartilages. Associated with the decrease in disc height, this causes a wide array of conditions such as osteoarthritis, spinal stenosis and degenerative disc diseases. Therefore, the need for biologics is instrumental as it offers solutions that address these degenerative biological processes and provide further therapeutic avenues. Aged persons with these spinal conditions undergo very severe and excruciating pains, limiting their physical movement and negatively affecting their life quality. They need to be treated with high technologies that can offer remedies for spinal degeneration occurring with age. They live abundantly in the world, which creates the necessity to have well-developed spine biologics. They include stem cell treatments, PRP, gene therapies among others. For instance, the use of stem cell therapy repairs worn out discs and aids in the regeneration of the spinal cells. PRP reduces inflammation in both the disc and other injuring areas accelerating the healing process.

The high rate of aging and the resultant increase the cases of spinal disorders, call for more innovative treatments in spine biologics. The aging generation is continuing to increase; thus, the cases of each of these complications will increase. Considering the current trends globally, therefore, we can deduce that the market for these biologics will keep increasing too notwithstanding the decline at twelve months rate in usage. Payloads. Hence, there is a call for more research and innovations in the same solutions to ensure all aging spinal disorders victims are given a chance to lead a normal life free from too much pain.

Technological advancements, including advanced bone grafts and stem cell therapies, are driving market growth by enhancing treatment options and patient outcomes.

The market growth in the spine biologics industry is significantly facilitated by technological advancements that expand the scope and the quality of treatments. In particular, the development of such interventions, as advanced bone grafts and, stem cell therapies have revolutionized the treatment of spinal problems. Advanced bone grafts include synthetic and bioengineered options that are more compatible and performative than the traditional ones. These grafts also allow bones to heal faster and stronger with shorter healing and recovery times. On the other hand, stem cell therapies provide a way to employ our own regenerative abilities to fix spinal problems from the inside. Consequently, such types of interventions as the culture-expanded mesenchymal bone marrow stem cells are utilized to treat spinal issues at the level of their roots. These developed forms of biologic products offer an alternative to treatments of the condition, providing lasting solutions rather than simply alleviating the symptoms.

Overall, these technologies offer both a more effective treatment for the patient and better outcomes. Moreover, by treating the conditions from the inside rather than attempting to fight the consequences, these interventions can help eliminate the causes of the problem more efficiently. Therefore, as the technologies keep developing and improving, the technologies will likewise experience growth. The technologies will keep expanding the demand for more effective solutions to spinal problems, and in so doing, they will promote greater quality of life for those affected.

RESTRAIN

The high costs of biologic products can restrict their adoption and limit access for patients, especially in markets with lower healthcare budgets.

The biologics such as advanced therapies like stem cell treatments and complex bone grafts should be more expensive than more traditional alternatives because they are typically harder to produce, requiring more sophisticated manufacturing processes and often specialized storage. In areas with limited healthcare resources, the high price of these treatments serves as an insurmountable economic barrier imposing limitations on the therapy’s availability. Thus, overall similar inequalities to those discussed previously, related to advanced surgeries and other interventions, result in the inability of healthcare systems to implement these advanced therapies as standard treatment options despite defenses about their objective feasibility. Consequently, given the context, handling the cost-related challenges of biologic products is a key to improving healthcare accessibility and ensuring that patients from different types of markets can benefit from the latest advancements in spinal care.

KEY MARKET SEGMENTATION

By Product

The spinal allografts segment dominated the market and accounted for 59.60% of the market revenue in 2023. This dominance can be attributed to the numerous benefits associated with the usage of allografts. The adoption of allografts over autografts is swiftly increasing owing to properties such as osteoconductivity and immediate structural support. In addition, allografts do not need another surgery to harvest the bone, which results in decreased surgery time and wound healing.

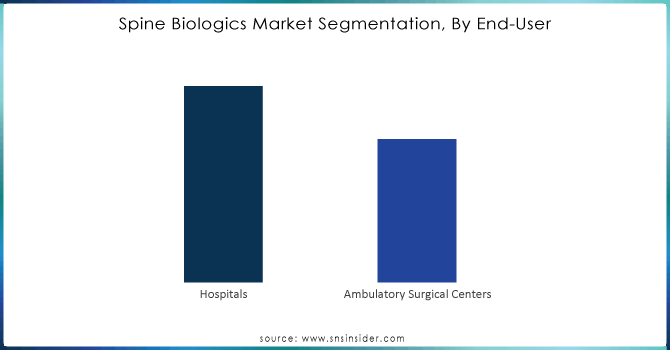

By End-use

The hospital segment dominated the market and accounted for 62.4% of the market revenue in 2023. The segment is primarily driven by an increased number of spine fusion surgeries performed in these facilities. In addition, the availability of several hospitals like the George Washington University Hospital and Massachusetts General Hospital offering services for spinal surgeries is expected to boost the segment growth over the forecast period.

Need any customization research on Spine Biologics Market - Enquiry Now

REGIONAL ANALYSES

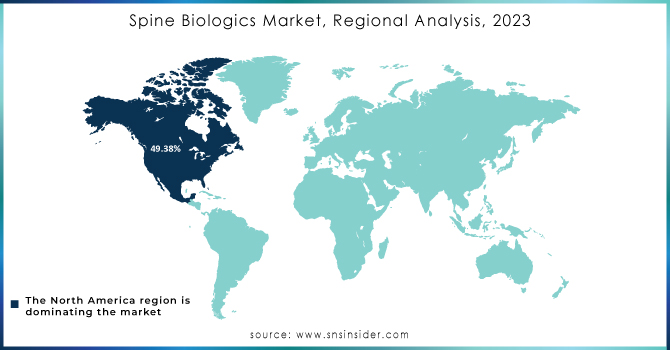

North America region dominated the market and accounted for a 49.38% share in 2023. The growth of the market can be attributed to the stable economic growth, increased adoption of minimally invasive surgeries, and rising prevalence of the spine disorders such as disc-related problems, spinal stenosis, and spondylolisthesis.

Asia Pacific region is expected to witness the fastest growth of the market due to the presence of the large patient pool and increasing awareness of biologics benefits among the patients and surgeons. The advancements in healthcare infrastructure in the Asia Pacific region, increased healthcare expenditure, and the rising number of the spine injuries, primarily due to the road accidents, are the aspects boosting the regional market.

KEY PLAYERS

The major players are Orthofix, DePuy Synthes (Johnson & Johnson), Exactech, Inc., Arthrex, Inc., Medtronic, Stryker, NuVasive, Inc., Organogenesis Inc., Kuros Biosciences, Zimmer Biomet, and others players

RECENT DEVELOPMENT

In October 2023: One of the leading providers of spine and orthopedics products, Orthofix Medical Inc., completed the full commercial launch and 510k clearance of an advanced bioactive synthetic graft, OsteoCove, for the use in orthopedic and spine procedures. This graft is available in strip and putty formats.

In July 2023: Cerapedics Inc., expanded its reservation at the Denver metro area. The agreement is expected to support the company’s other products offered on the market, with i-FACTOR bone grafts being among products for cervical spinal fusion.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.02 Billion |

| Market Size by 2032 | USD 4.73 Billion |

| CAGR | CAGR of 5.13% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Spinal Allografts, Bone Graft Substitutes, Cell-based Matrix) • By End-use (Hospitals, Outpatient Facilities) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Orthofix, DePuy Synthes (Johnson & Johnson), Exactech, Inc., Arthrex, Inc., Medtronic, Stryker, NuVasive, Inc., Organogenesis Inc., Kuros Biosciences, Zimmer Biomet |

| Key Drivers | • The rising number of people with spinal disorders due to aging increases the need for spine biologics to effectively treat these conditions. • Technological advancements, including advanced bone grafts and stem cell therapies, are driving market growth by enhancing treatment options and patient outcomes. |

| RESTRAINTS | • The high costs of biologic products can restrict their adoption and limit access for patients, especially in markets with lower healthcare budgets. |