Blockchain in Agriculture and Food Supply Chain Market Size:

Get More Information on Blockchain in Agriculture and Food Supply Chain Market - Request Sample Report

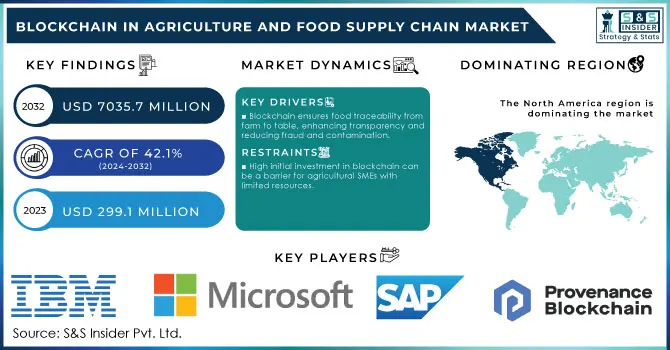

The Blockchain in Agriculture and Food Supply Chain Market Size was valued at USD 299.1 Million in 2023 and is expected to reach USD 7035.7 Million by 2032, growing at a CAGR of 42.1% over the forecast period 2024-2032.

Increasing consumer demand for traceability and transparency in food production and distribution is supporting the growth of the agriculture and food supply chain blockchain market. UN has estimated the global food waste to stand at around 1.3 billion tons per year which highlights the need for improvement in food supply chain efficiency. Governments worldwide are recognizing this need, as seen in the USDA's 2022 report, which indicated that implementing blockchain technology can potentially reduce food waste by up to 50% by improving traceability from farm to fork. In addition, the FDA is now begging for some digital footprints to guarantee food safety leading stakeholders to adopt blockchain solutions. The changes in regulatory frameworks, governments are also beginning to invest in digital infrastructures enabling a better integration of blockchain this is further driving the market growth. For instance, the European Union's Farm to Fork Strategy emphasizes the need for transparent supply chains, aiming to implement digital labeling across food products by 2025. This governmental support is pivotal in shaping market dynamics, making blockchain technology a vital component for modernizing the agricultural sector and enhancing food safety standards.

Blockchain is gaining ground in agriculture and food supply chains, with its traceability and transparency providing opportunities, as well as smart contracts that facilitate transactions between parties. There is growing integration with IoT and AI too, because IoT sensors can collect data throughout the supply chain while AI focuses on optimizing processes for increased efficiency. Blockchain’s decentralized, tamper-proof design boosts supply chain resilience by enhancing transparency, reducing fraud risks, and supporting quick responses to disruptions. Industry players are forming consortiums and partnerships to collaborate on blockchain initiatives, promoting data sharing, standardized protocols, and cross-platform interoperability. Such collaborations are tackling obstacles such as scalability, data silos, and regulatory compliance.

Market Dynamics

Drivers

-

Blockchain technology provides an immutable ledger that ensures the traceability of food products from farm to table. This enhances transparency and allows stakeholders to verify the authenticity of food, thereby reducing instances of fraud and contamination.

-

With increasing consumer awareness and regulatory pressures for safe food practices, blockchain is being adopted to improve food safety measures. This includes tracking the movement of food products and quickly identifying contamination sources during foodborne illness outbreaks.

One of the key drivers for the adoption of blockchain in the agriculture and food supply chain market is enhanced traceability and transparency. With this technology, stakeholders can follow food products as they pass through each stage of the supply chain, with every transaction recorded in an unchangeable ledger. Blockchain offers a transparent solution for people who are demanding traceability of their food supply, allowing the customer to verify the authenticity of food products. A survey from the Food Marketing Institute found that 73 % of consumers would pay more for food products with full transparency in their sourcing and handling. In addition, Walmart uses blockchain to trace the origins of food, for example mangoes and pork, cutting produce-tracing time from six days to seconds. Such rapid traceability is critical for shortening response times to food safety issues, thereby reducing health risks.

The increasing focus on food safety regulations is also driving the demand for blockchain solutions by companies. According to a report by the World Economic Forum, blockchain can help eliminate food fraud, which costs the global food system around USD 40 billion dollars a year. With blockchain technology, businesses can establish authenticity and safety of food products which create customer trust along with meeting the demands by regulatory standards.

Restraints

-

The initial investment required for implementing blockchain technology can be a barrier for many agricultural businesses, especially small and medium enterprises (SMEs) that may lack the resources to adopt such technologies.

-

The absence of standardized protocols for blockchain in agriculture can hinder its widespread adoption. Different stakeholders may use various platforms, complicating interoperability and data sharing across the supply chain.

The lack of standardization across platforms is one of the key restraints for blockchain adoption in agriculture. Several blockchain solutions are being proposed by different stakeholders, resulting in disparate systems that do not communicate with each other effectively. This fragmentation results in data non-interoperability, thus making it challenging for the farmers, processors and retailers to exchange information easily across the underlying supply chain. When entities cannot access or trust information provided by different blockchain systems, the possible benefits of improved traceability and efficiency are degraded. Moreover, the absence of standardized protocols can confuse and make stakeholders hesitant to invest in these technologies. This barrier highlights the need for collaborative efforts to establish standards that facilitate greater interoperability and cooperation across the agricultural sector.

Segment analysis

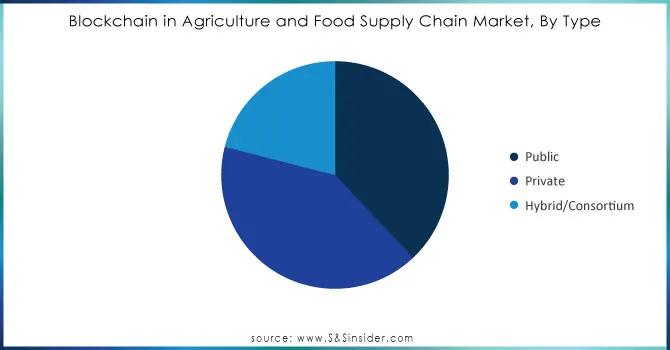

By Type

In 2023, a private segment of blockchain in the agriculture and food supply chain market accounted for the largest revenue share of 41%. This may be ascribed to rising private investment in blockchain for operational efficiencies. A report from the Food and Agriculture Organization (FAO) indicates that private sector investment in agriculture technology has risen sharply, surpassing USD 2 billion in 2022 alone. Businesses are aware of the blockchain possible to provide chain management, fraction fraud, and replenish food safety. Governments are also preserving some funds, such as grants and subsidies, to encourage the private sector to participate in technology adoption at agriculture. The collaboration between private companies and governments is creating a conducive environment for the widespread implementation of blockchain solutions. Furthermore, the shift towards sustainable and transparent food systems has led businesses to prioritize investments in blockchain, allowing them to meet consumer demands for traceable and ethically sourced products. As more stakeholders realize the competitive advantages of adopting blockchain technology, the private segment's growth is expected to continue, reinforcing its pivotal role in the market.

Need Any Customization Research On Blockchain in Agriculture and Food Supply Chain Market - Inquiry Now

By Provider

In 2023, the application provider segment of the blockchain in agriculture and food supply chain market captured about 42% revenue share. Such growth demonstrates the reliance on application-specific providers to drive blockchain for agricultural and food supply chain solution deployment. The increasing adoption of digital technologies in agriculture can increase productivity by over 30%, according to recent statistics from the World Bank, which in turn will create demand for application-specific solutions. The USDA, for example, allocated USD 100 million of the funds it announced in 2022 to be used in 2023 for digital agriculture projects focused on using digital tools and approaches to make the agricultural sector more efficient and sustainable. Application providers play a key role in building bespoke blockchain solutions to help farmers and food distributors track their products across the entire supply chain to ensure quality control and compliance with safety regulations. Increased consumer awareness of food safety and quality also drives this need for customized solutions. This drives application providers to become an important partner for agricultural market businesses looking to expand their existing operations while meeting emerging regulatory standards, resulting in high market share.

By Application

In 2023, blockchain in the agriculture and food supply chain market was dominated by the product traceability, tracking, and visibility segment with a 35% share. The increasing focus on food safety and quality assurance by consumers and regulatory bodies is directly linked to the significance of this segment. According to the FDA, approximately 48 million people in the United States fall ill from foodborne illnesses each year, which underscores the need for robust tracking systems to enhance food safety. With blockchain technology, the introduction of an immutable and transparent ledger allows all players in a supply chain to track products from farm to table and thus mitigate against risks associated with contamination and fraud. Government initiatives such as the FDA's New Era of Smarter Food Safety blueprint emphasize the importance of traceability in ensuring public health and safety. The demand for enhanced visibility in the supply chain is further supported by consumer preferences for knowing the origin of their food, leading to an increased adoption of blockchain solutions. Growing demand for effective traceability systems as a result of increasing awareness about food safety issues will further boost segment growth, leading it to retain its position over the future.

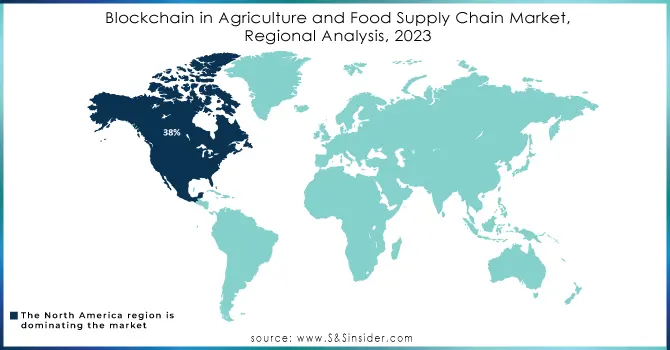

Regional Insights

In 2023, North America led the blockchain in the agriculture and food supply chain market with a 38% share of the market. This dominance can be attributed to strong food safety regulations and large investments realized in agricultural technology by both the public and private sectors. As per the U.S. Department of Agriculture, technology adoption is essential for overcoming such supply chain disruptions exacerbated after COVID-19 and making it more resilient. Additionally, the region is witnessing rapid advancements in blockchain applications aimed at improving traceability and operational efficiency.

On the other hand, the Asia-Pacific region is expected to record the highest CAGR during 2024-2032 owing to increasing agricultural production coupled with rising demand for food safety. Countries like China and India are investing heavily in blockchain technology to tackle food security challenges and improve supply chain management. Investments in digital agriculture can bring a major boost to productivity and sustainability in the region, said the Asian Development Bank. As these regions continue to innovate and adapt to new technologies, they will significantly shape the future landscape of the blockchain in the agriculture and food supply chain market.

Recent Developments and News

-

Microsoft and ITC launched the AI copilot app Krishi Mitra at World Agri-Tech 2024 in April 2024. Created to aid 300,000 farmers across India by giving them tailored and timely information that will boost productivity, profitability, and climate resilience.

-

FDA New Era of Smarter Food Safety Blueprint (July 2023): The FDA published its updated blueprint highlighting the important role of blockchain technology in enhancing food traceability and safety, and encouraged stakeholders to adopt a digital solution.

-

Britannia Life Sciences Inc. recently released the Green Bridge Gateway together with the Association for the Cannabinoid Industry (ACI), ADSL, Chem ID, Shweed & GRS in December 2023. The purpose of this network is to promote the CBD market in the EU and UK by providing an extensive suite of services covering everything from toxicology data, lab testing services, regulatory advice and supply chain expertise, as well as track-and-trace blockchain tech.

Key Players

Key Service Providers or Manufacturers

-

IBM (IBM Food Trust, IBM Blockchain Platform)

-

Microsoft (Azure Blockchain Workbench, Azure IoT)

-

SAP (SAP Blockchain, SAP Leonardo)

-

ChainPoint (ChainPoint Platform, ChainPoint Data)

-

TE-FOOD (TE-FOOD Platform, TE-FOOD Blockchain)

-

Provenance (Provenance Platform, Provenance Ledger)

-

Ripe.io (RipeChain, Ripe.io Traceability)

-

Ambrosus (AMB-NET, AMB-DATA)

-

AgriLedger (AgriLedger App, AgriLedger Platform)

-

Everledger (Everledger Wine Platform, Everledger Supply Chain)

Users of Blockchain Services/Products

-

Walmart

-

Nestlé

-

Cargill

-

Unilever

-

Tyson Foods

-

Dole Food Company

-

McDonald's

-

Kraft Heinz

-

Coca-Cola

-

Olam International

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 299.1 Million |

| Market Size by 2032 | USD 703.5.7 Million |

| CAGR | CAGR of 42.1% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By type (Public, Private, Hybrid/Consortium) • By stakeholders (Growers, Food manufacturers/processors, Retailers) • By providers (Application providers, Middleware providers, Infrastructure providers) • By Enterprise size (Small and medium-sized enterprises, Large enterprises) • By application (Product traceability, tracking, and visibility, Payment and settlement, Smart contract, Governance, risk, and compliance management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM, Microsoft, SAP, ChainPoint, TE-FOOD, Provenance, Ripe.io, Ambrosus, AgriLedger, Everledger. |

| Key Drivers | • Blockchain technology provides an immutable ledger that ensures the traceability of food products from farm to table. This enhances transparency and allows stakeholders to verify the authenticity of food, thereby reducing instances of fraud and contamination. • With increasing consumer awareness and regulatory pressures for safe food practices, blockchain is being adopted to improve food safety measures. This includes tracking the movement of food products and quickly identifying contamination sources during foodborne illness outbreaks. |

| RESTRAINTS | • The initial investment required for implementing blockchain technology can be a barrier for many agricultural businesses, especially small and medium enterprises (SMEs) that may lack the resources to adopt such technologies. |