A2P Messaging Market Size & Overview:

Get more information on A2P Messaging Market - Request Sample Report

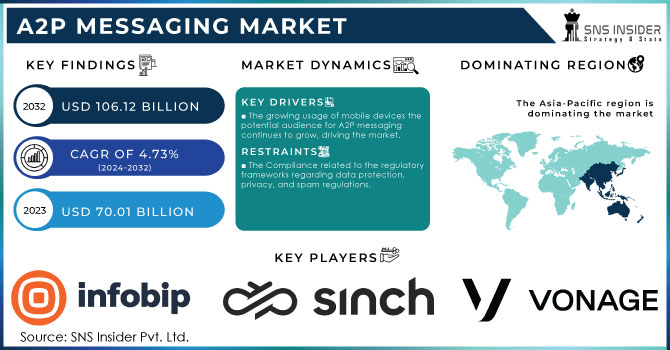

A2P Messaging Market Size was valued at USD 70.01 Bn in 2023 and is expected to reach USD 106.12 Bn by 2032, while growing at a CAGR of 4.73% by 2024-2032.

This growth in the A2P (Application-to-Person) messaging market has been attributed to increased demand for customer engagement, marketing, and authentication services across various sectors, including banking & finance, retail & e-commerce, healthcare & pharmaceutical. A significant contributor has been the rise of mobile phone networks globally. In addition, smartphone penetration is another direct element for the growth of A2P messaging because it reached 74.3% worldwide in 2023 which brought more usage of this kind of messaging for transaction, promo, and verification purposes. The increased number of digital transformation projects undertaken by governments and private sectors around the world has encouraged the usage of A2P messaging to enhance customer engagement. Smart governments are using A2P messaging for public alerts, healthcare updates, and transactional services like COVID-19 vaccination reminders and eGov services to integrate a strong growth base. Furthermore, the rise in strict regulatory frameworks like the EU's General Data Protection Regulation (GDPR) and the U.S. Telephone Consumer Protection Act (TCPA) are incentivizing enterprises to adopt authenticated & secure messaging channels which helps in growing the market. These advancements are likely to further uplift the global A2P messaging market, taking it to newer heights in the next few years.

The growing mobile usage and demand for secure, instant communication are some of the major factors that drive the growth of the A2P messaging market. The growing need for personalized and targeted communication fuels the expanding market. Businesses understand the importance of personalized messages and how they create an impact on individual end-users, leading to greater customer engagement and improved conversion rates. The same goes for secure and transactional messages as well like two-factor authentication (2FA)/Account verification. The increasing importance of A2P messaging in facilitating secure and efficient communication between businesses and their customers.

| Category | Key Statistics |

|---|---|

| Top Use Cases | Banking alerts (40%), Two-factor authentication (30%), Marketing promotions (20%) |

| Global Traffic Volume (2023) | 2 trillion messages globally |

| Preferred A2P Messaging Channel | SMS (80%), Rich Communication Services (RCS) (15%), Others (5%) |

| Message Delivery Success Rate | SMS: 98%, RCS: 85% |

| Average Latency (SMS) | 5 seconds |

| Industries Driving Usage | Financial Services (35%), Retail & E-commerce (25%), Healthcare (15%) |

| Global Reach (Countries) | SMS A2P messaging reaches over 190 countries |

| Security Concerns (2023) | 30% of enterprises reported security threats related to A2P messaging |

| Customer Engagement Rate | SMS has a 45% response rate within the first 3 minutes |

| Regulatory Compliance | 70+ countries have specific regulations for A2P messaging use |

A2P Messaging Market dynamics

Drivers

-

Businesses increasingly use A2P messaging for customer engagement, promotions, and marketing campaigns, driving the demand for personalized and interactive messaging services.

-

The global increase in smartphone penetration and mobile internet usage contributes to the growth of A2P messaging services, especially in emerging markets.

-

A2P messaging is widely used for transaction confirmations, alerts, and authentication in sectors like e-commerce, banking, and healthcare, leading to an increase in messaging volumes.

One of the key factors driving the A2P messaging market is the increased focus on mobile marketing. Enterprises use mobile messaging as the most direct, efficient, and personalized way to connect with their customers. As per the recent survey, mobile marketing takes a share of more than 60% of digital ad spending in 2023, emphasizing its contemporary role in communication strategies. This growth can be attributed to several reasons, including increasing consumer inclination for mobile-first interactions. As smartphone penetration is 83 percent globally in 2023, A2P messaging will give access to a more significant audience. SMS campaigns are best for time-sensitive promotions and transactional updates. E-commerce companies often use A2P message services to send order confirmations, shipping notifications & promotional offers to keep customers updated in real-time.

Similarly, A2P messaging is important in the case of customer loyalty programs and personalized marketing as well. For instance, the retail giant Walmart utilizes A2P messaging to notify customers about special deals and discounts based on their preferences. Also banking sector is using A2P messages to send security alerts, and transaction confirmations, which has immensely increased user engagement and trust. With wide appeal in mobile marketing, the immediacy high open rate (97% for SMS), and personalization features make A2P an important aspect of any business-focused mobile solution to improve customer interactions.

Restraints:

-

Regulations around spam and unsolicited messaging, such as GDPR and DND (Do Not Disturb) lists, can limit the use of A2P messaging, restricting market growth.

-

The rise of Over-the-Top (OTT) messaging services offering similar functionalities poses a significant challenge to traditional A2P messaging platforms.

The growing popularity of Over-the-Top (OTT) messaging like WhatsApp, Facebook Messenger, Viber, etc is one major hindrance to the A2P messaging market. Instead of traditional SMS networks, these allow users to send messages through the internet rather than relying on traditional SMS networks, often at little or no cost to the user. Some functions such as notifications, marketing campaigns, and customer engagement have started reducing the dependability on A2P messaging. OTT platforms also offer much better messaging features, including multimedia support and real-time chat which SMS lacks. These platforms provide avenues for a more dynamic and interactive way of communicating; hence businesses are increasingly making use of them for customer interactions. In addition, OTT services that support encryption provide an additional element of security as privacy concerns continue to grow. That forces A2P messaging providers to evolve and differentiate their services to remain relevant in a fast-changing digital communications landscape, especially with the competition from OTT services.

A2P Messaging Market Segment analysis

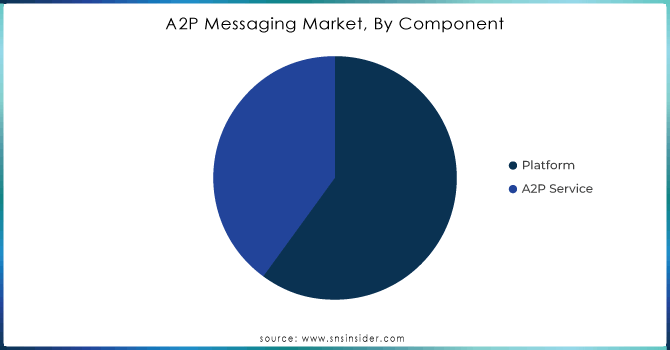

By Component

The platform segment dominated the A2P (Application-to-Person) messaging market, and held over 60% share due to its pivotal role in facilitating message delivery across various channels such as SMS, OTT messaging, and RCS. Platforms provide comprehensive solutions for enterprises to manage, analyze, and optimize their A2P messaging campaigns, offering features like bulk messaging, analytics, and integration capabilities, making them indispensable for businesses seeking effective communication with their customers. This dominance underscores the significance of robust platforms in driving the efficiency and reach of A2P messaging strategies.

Need any custom research on A2P Messaging Market - Enquiry Now

By Deployment

In 2023, the cloud segment accounted for a revenue share of over 56.0% and dominated the A2P messaging market. Cloud-based solutions have become increasingly popular, as organizations seek scalable and flexible deployment models that can rapidly adjust to growing messaging volumes. This growth has also been fueled by governmental policies backing the expansion of cloud infrastructure. The Cloud Smart Strategy of the U.S. Federal Government emphasizing cloud-based service for federal agencies has led to increased momentum to adopt cloud across the sectors, including the communication sector. The European Union has also earmarked USD 6.47 billion for cloud infrastructure through its Digital Europe Program. Cloud-based A2P messaging solutions offer increased data security, cost efficiency, and operational scalability to accommodate massive customer communication requirements, all of which have massively driven demand for these investments.

By Application

CRM (Customer Relationship Management) was the largest revenue-generating segment of the A2P messaging market, accounting for more than 31% share of revenue in 2023. The growing requirement to retain customers and give them personalized services has boosted the demand for A2P messaging in CRM applications. Digital customer services getting backed by various government initiatives have also pushed growth. For instance, the Digital India program of the Indian government intends to make India a digitally empowered digital customer life across sectors. When combined with A2P messaging, the CRM system helps to automate engagements such as appointment reminders, order confirmations, and delivery notifications as well as customer feedback to create a personalized customer experience. Customer-centric business models are gaining momentum, which bodes well for the CRM application segment of the A2P messaging market.

By Vertical

The BFSI (Banking, Financial Services, and Insurance) segment dominated the A2P messaging market which captured around 26% share in 2023 due to its stringent security requirements and need for real-time communication with customers. Banks and financial institutions rely heavily on A2P messaging for transaction alerts, account notifications, and authentication purposes, driving significant demand within this vertical. A2P messaging solutions offer secure and compliant channels for disseminating sensitive information, ensuring adherence to strict regulations such as GDPR and PCI DSS. By leveraging A2P messaging, BFSI institutions can mitigate the risks associated with unauthorized access to customer data and maintain regulatory compliance, thereby bolstering trust and confidence among their clientele.

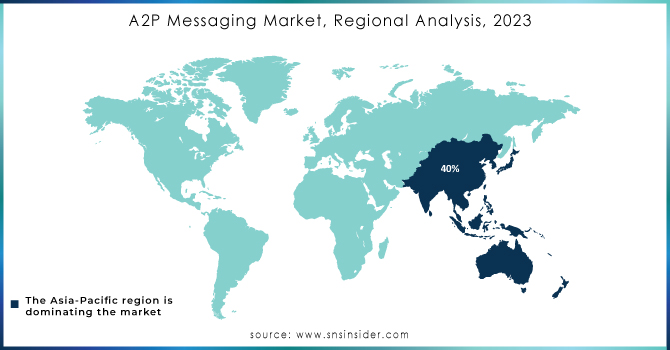

A2P Messaging Market Regional Analysis

The Asia-Pacific (APAC) region led the global A2P messaging market in 2023 and held the highest market share of about 40%, driven by increased penetration of mobile services and government assistance for digital transformation projects. The rise of mobile subscriptions and the growing application of mobile communication in sectors like banking, retail, healthcare, and public services are the major factors driving APAC's dominance. Government data provided by the Indian Ministry of Electronics and Information Technology indicates that India's mobile subscriber base exceeded 1.1 billion in 2023, with mobile internet users representing nearly 66% of the population. The tremendous amount of mobile penetration has provided a big impetus for A2P messaging in the region across transactional services, customer engagement, and marketing.

Additionally, China, Japan, and South Korea have heavily invested in the expansion of digital communication infrastructure, thereby accelerating market growth. China has more than 1.6 billion mobile subscribers, as the Ministry of Industry and Information Technology (MIIT) witnessed a significant rise in A2P messaging traffic, especially in the e-commerce and financial services sectors. These datasets are not available for organizations around the world until October 2023 through leveraged data from programs like the Digital Economy Development Plan which recently encouraging digital payments and online shopping have contributed to increasing demand for A2P messaging services across China,

North America is the fastest-growing market for A2P messaging and is also expected to have a high CAGR during the forecast period due to its advanced digital infrastructure and increased demand from several industries using mobile messaging services. The U.S. has been a key player, bolstered by aggressive government support of digital communication services that include federal rules requiring secure messaging in the bank and healthcare sectors. U.S. Government data reveals that mobile messaging traffic exceeded 2.1 trillion messages in 2023, indicating increasing dependence within the region for critical communications needs via A2P messaging services.

Recent Developments in the A2P Messaging Market

-

In March 2024, The Indian government unveiled a new collaboration with top telecom service providers aimed at boosting its Digital India initiative centered around amplifying the A2P messaging landscape for public services communication. It estimates this program will help drive a 25% rise in A2P messaging traffic in the coming year.

-

In July 2023, the U.S. Federal Communications Commission (FCC) introduced new laws obligating telecom operators to block illegitimate A2P messages, emphasizing the significance of safe and validated messaging channels for both companies as well as government services nationwide.

-

In March 2023, DIDWW, a leading global provider of top-notch VoIP communications and SIP trunking services for businesses and operators worldwide, expanded the reach of its A2P SMS service by introducing alphanumeric sender IDs. With the addition of 21 new European countries, DIDWW now offers its clients the ability to send SMS messages with a sender ID that reflects their brand identity, enhancing their communication capabilities.

Key Players

Key Service Providers/Manufacturers:

-

Twilio Inc. (Twilio Programmable Messaging, Twilio Conversations)

-

Sinch AB (Sinch MessageMedia, Sinch SMS API)

-

Infobip Ltd. (Infobip SMS API, Infobip Conversations)

-

Tata Communications (Tata Messaging Hub, Tata Global SIP Connect)

-

Route Mobile Limited (Route SMS Hub, Route OTT Messaging)

-

Nexmo (Vonage) (Nexmo SMS API, Vonage Conversations API)

-

Syniverse Technologies (Syniverse Messaging Gateway, Syniverse CPaaS)

-

Kaleyra Inc. (Kaleyra SMS API, Kaleyra Voice Solutions)

-

Silverstreet (Silverstreet SMS, Silverstreet MMS Gateway)

-

Clickatell (Clickatell SMS Gateway, Clickatell Platform API)

Key Users of A2P Messaging Services:

-

Amazon

-

Google

-

Walmart

-

Uber Technologies

-

Facebook (Meta)

-

PayPal

-

Airbnb

-

Alibaba Group

-

Netflix

-

HSBC Bank

| Report Attributes | Details |

| Market Size in 2023 | US$ 70.01 Bn |

| Market Size by 2032 | US$ 106.12 Bn |

| CAGR | CAGR of 4.73% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Platform, Service) • By Deployment Mode (On-premise, Cloud) • By SMS Traffic (National, Cross-border) • By Enterprise Size (Large Enterprises, Small & Medium Enterprises) • By Application (Pushed Content Services, Interactive Services, Promotional Campaigns, Customer Relationship Management Services, Others) • By Vertical (BFSI, Healthcare, Media & Entertainment, Retail & E-commerce, Travel & Tourism, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Twilio Inc., Sinch AB, Infobip Ltd., Tata Communications, Route Mobile Limited, Nexmo (Vonage), Syniverse Technologies, Kaleyra Inc., Silverstreet, Clickatell |

| Key Drivers | • Businesses increasingly use A2P messaging for customer engagement, promotions, and marketing campaigns, driving the demand for personalized and interactive messaging services. • The global increase in smartphone penetration and mobile internet usage contributes to the growth of A2P messaging services, especially in emerging markets. • A2P messaging is widely used for transaction confirmations, alerts, and authentication in sectors like e-commerce, banking, and healthcare, leading to an increase in messaging volumes. |

| Market Restraints | • Regulations around spam and unsolicited messaging, such as GDPR and DND (Do Not Disturb) lists, can limit the use of A2P messaging, restricting market growth. • The rise of Over-the-Top (OTT) messaging services offering similar functionalities poses a significant challenge to traditional A2P messaging platforms. |