Financial Wellness Software Market Report Scope & Overview:

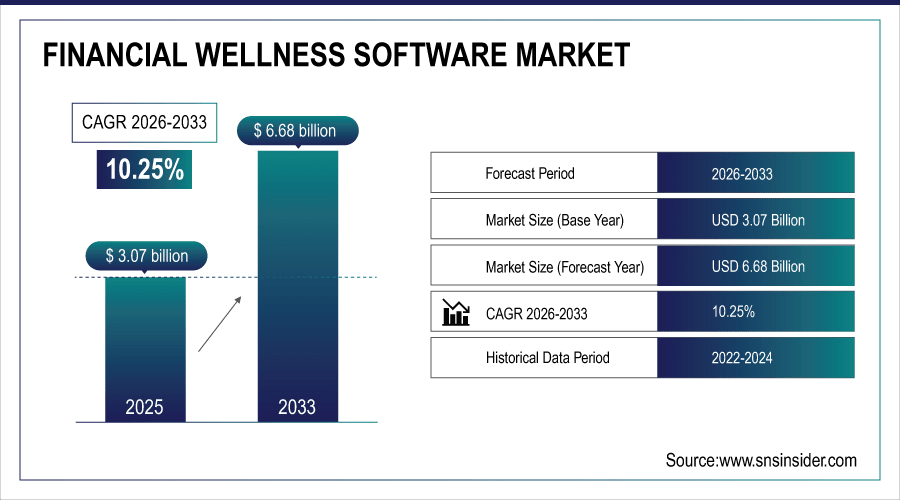

The Financial Wellness Software Market Size was valued at USD 3.07 Billion in 2025E and is expected to reach USD 6.68 Billion by 2033 and grow at a CAGR of 10.25% over the forecast period 2026-2033.

One of the major drivers for the financial wellness software market is the growing emphasis of organizations on employee financial wellness. Cost of Financial Wellness Platforms Financial wellness platforms are highly demanded These days, companies have realized that financially stable employees are more productive, engaged, and loyal, which is why financial wellness platforms are very widely used. Continued growth in the personalized financial management tools, including tools for budgeting, debt management, savings, and investment are placing further growth pressure. Furthermore, cloud-based solutions, mobile-first applications, and AI-based advisory services have made it possible for organizations to develop scalable and affordable financial wellness programs, which is accelerating the market acceptance in large- and medium-enterprises. According to study, Companies with financial wellness programs report higher employee engagement and loyalty, with a potential 10–15% increase in workforce productivity.

To Get More Information On Financial Wellness Software Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 3.07 Billion

-

Market Size by 2033: USD 6.68 Billion

-

CAGR: 10.25% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Financial Wellness Software Market Trends

-

Large enterprises globally increasingly adopt financial wellness programs for employees.

-

AI-powered personalized financial advisory tools see rapidly growing demand worldwide.

-

Employee productivity and engagement improve significantly through financial wellness adoption.

-

Cloud-based, mobile-first solutions enable scalable deployment across organizations efficiently.

-

SMEs rapidly adopt affordable SaaS financial wellness solutions, driving market growth.

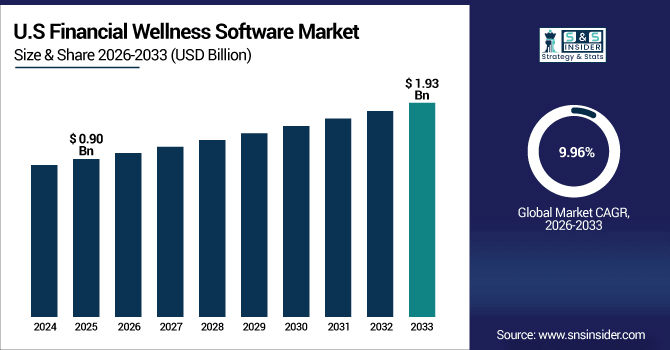

The U.S. Financial Wellness Software Market size was USD 0.90 Billion in 2025E and is expected to reach USD 1.93 Billion by 2033, growing at a CAGR of 9.96% over the forecast period of 2026-2033, driven by increasing employee financial stress awareness, adoption of cloud-based and AI-powered platforms, focus on productivity, and growing demand for personalized, scalable employee well-being solutions.

Financial Wellness Software Market Growth Drivers:

-

Rapid Cloud Adoption Fuels Demand for Real-Time Monitoring Solutions

The primary driver of the Financial Wellness Software Market is the organizations are beginning to realize that financially well employees tend to be more productive, more engaged, and more loyal. Their presence at work becomes less efficient and they are less retained and absent from work because of the stress that the finances bring. To this point, organizations are leveraging financial wellness technology that can allow personalized tools for budgeting, savings, debt management, investment assistance and retirement planning. The increasing adoption of cloud-based and mobile-first platforms along with AI-powered financial advisory solutions further fuelling this uptake. This is most evident within large enterprises and SMEs that need adaptive and low-cost solutions to improve employee retention and moral0065.

70% of employees prioritize budgeting, debt management, savings, and investment guidance, making these core features.

Financial Wellness Software Market Restraints:

-

High Implementation Costs Challenge Widespread Cloud Monitoring Adoption

Despite the benefits, the Financial Wellness Software can be a challenge for organizations to implement from a cost standpoint especially for small to medium-sized enterprises (SMEs) with limited budgets. Connecting it with the existing HR, payroll, and benefits systems can be difficult, which means that more technical resources and a long time are required. In addition, issues of data privacy, security, and regulatory compliance (for example, GDPR or CCPA), can it also delay adoption. However, in these particular circumstances, lacking commitment to employee financial wellness schemes shall be witnessed as they will not put any effort into rolling out the software neglecting that performing their core business function will restrict their general market growth.

Financial Wellness Software Market Opportunities:

-

AI-Powered Monitoring Solutions Present Significant Growth Opportunities Globally

Emerging Opportunities, especially in the Asia Pacific region, is a ripe growth market. This is fuelling growth for solutions that deliver wellness oriented on personal well-being, and for employees, across the segments of increasing digitalization, growing awareness of financial literacy, and expanding middle-class population. On the other hand, small & medium enterprises (SMEs) are increasingly turning to SaaS cloud-based services as a viable alternative due to relatively lower initial capital costs and the ability to scale up services. By providing customized solutions customized content, language options and integration with biggest payroll or HR solutions providers an opportunity exists to expand customer footprint to drive sustainable growth in this segment over the long-term time period.

Rising digital infrastructure drives 15–20% annual growth in platform adoption in emerging markets.

Financial Wellness Software Market Segmentation Analysis:

-

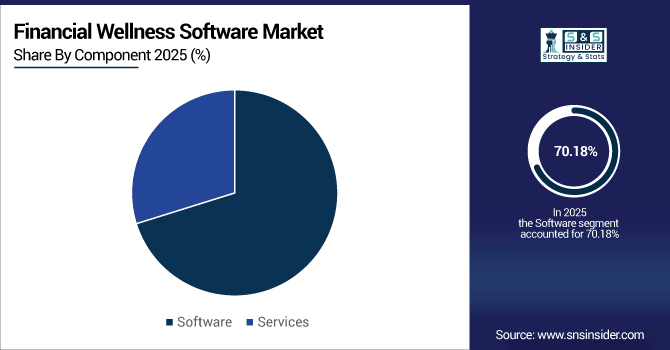

By Component: In 2025, Software led the market with share 70.18%, While Services is fastest-growing segment with a CAGR 10.56%.

-

By Deployment Model: In 2025, Cloud-based the market 54.30%, with the fastest-growing segment with a CAGR 11.07%.

-

By Organization Size: In 2025, Large Enterprises led the market with share 66.50%, with the fastest-growing segment with a CAGR 10.64%.

-

By Solution: In 2025, Financial assessment and health scoring led the market with share 34.20%, while Savings and investment guidance is the fastest-growing segment with a CAGR 11.65%.

-

By End Use: In 2025, BFSI led the market with share 30.06%, while IT & Telecom is the fastest-growing segment with a CAGR 11.74%.

By Component, Software Leads Market While Services is Fastest Growth

Financial Wellness Software Market Among the component, Software accounted for a larger share of market revenue due to increasing implementation of digital platforms that offers budgeting, savings, debt management, investment guidance and retirement planning tools. Regardless of the size of the company- big or SME, software solutions are preferred merely because of their scalability, easy deployment, and integration with a cloud-based, mobile-first, and AI-powered advisory platform. Simultaneously, The Services segment is also the fastest-growing segment, driven by increased demand for consulting, training, implementation assistance, and personalized financial coaching. While a dominating share of financial wellness offerings are software, services is a significant growth driver as organizations invest in professional services to secure optimal adoption, increase employee engagement and to drive the ROI of financial wellness programs.

By Deployment Model, Cloud-based Leads Market with Fastest Growth

The Cloud-based deployment model dominated the Financial Wellness Software Market with the largest market share as it is scalable, cost-effective and offers easy integration with enterprise HR, payroll, and benefits systems. Cloud solutions enable organizations to deploy easy-to-use, mobile-first, and AI-enabled financial wellness platforms thereby improving employee engagement and accessibility. Cloud deployment is likewise the most rapidly-expanding segment, propelled by increasing small-to-medium enterprise utilization, paired with emerging economies desiring inexpensive subscription-software. Cloud solutions offer different looks that are flexible with low upfront costs and accessible from anywhere, allowing large enterprises and SMEs to partner in achieving financial wellness goals.

By Organization Size, Large Enterprises Lead Market with Fastest Growth

Large Enterprises hold the highest share in Financial Wellness Software Market as they have more budgets and structured HR systems to manage employee benefits programs. More employers are turning to holistic financial wellness software to increase employee productivity, engagement and retention through budgeting, debt management, savings management, and retirement planning. Concurrently, Large Enterprises also constitute the highest growth segment as platforms that are cloud-based, scalable and AI-enabled, make it easy for these enterprises to deploy solutions across the workforce at scale. Enterprise adoption key to market growth as this dual dominance highlights.

By Solution, Financial Assessment & Health Scoring Leads Market While Savings & Investment Guidance Fastest Growth

Based on Components, Financial Assessment and Health Scoring is the largest segment for Financial Wellness Software Market and is estimated to occupy the highest market share owing to its significant value in the analysis of work staff financial health and offering key pointer feedback. These tools help organizations identify areas of concern in budgeting, savings, debt and investments, making financial wellness interventions more targeted. Meanwhile, Savings and Investment Guidance is the fastest-growing segment due to increasing needs for long-term wealth planning, retirement preparation and tailored investment advisory features. In addition, with the increasing need for AI driven and cloud-based platforms, adoption is expected to accelerate further, forming a significant growth horizon within this segment.

By End Use, BFSI Leads Market While IT & Telecom Fastest Growth

Due to high adoption of financial wellness solutions to support employee engagement, retention, and productivity, BFSI (Banking, Financial Services, and Insurance) has the largest market share in the Financial Wellness Software Market. Financial tools like budgeting, debt management, savings, investment, and retirement planning help improve workforce satisfaction and financial stress reduction, thus, become the focal point of financial institutions. Meanwhile, IT & Telecom is the fastest-growing segment due to growing interest of technology companies towards employee well-being, increasing adoption of cloud-based and mobile-first solutions of software and rise of interest for AI-powered advisory platforms. This growth indicates the importance of IT & Telecom in market growth.

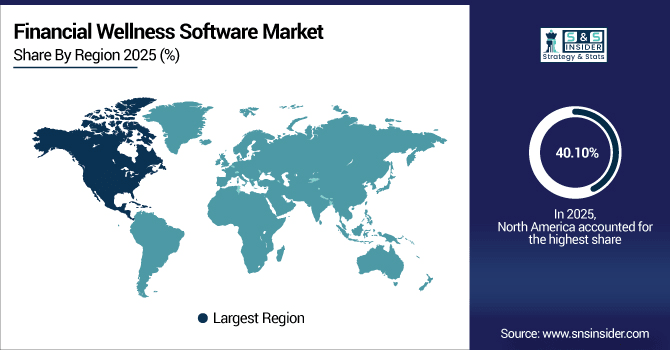

Financial Wellness Software Market Regional Analysis:

North America Financial Wellness Software Market Insights

North America accounted for the largest share 40.10%of the Financial Wellness Software Market in 2025, due adoption of digital financial wellness platforms coupled with a high emphasis on employee Benefits and Wellbeing. To improve productivity, engage employees and retain them inside the organization, Organizations are now implementing software solutions that offer budgeting, debt management, savings, investment guidance and retirement planning. The region has the necessary foundation — modern cloud infrastructure, mobile proliferation, and introduction of AI-focused advisory tools. North America is the deepest and most competitive market for financial wellness solutions among industries, fuelled by high awareness of financial literacy at a consumer level, coupled with supportive regulations.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Canada and U.S. Drive Financial Wellness Software Market Through Digital Transformation.

Canada and the U.S. are driving the Financial Wellness Software Market through widespread digital transformation, leveraging cloud-based platforms, AI-powered advisory tools, and mobile-first solutions to enhance employee financial well-being, engagement, and productivity across organizations.

Asia-Pacific Financial Wellness Software Market Insights

In 2025, Asia-Pacific is the fastest-growing Financial Wellness Software Market with a CAGR 12.19%, due growing digital penetration, growing financial literacy awareness and growing middle class population. Regional organizations are deploying cloud-based, mobile-first, and AI-enabled platforms that deliver budgeting, savings, debt management, and investment guidance solutions. SaaS models are being adopted among small and medium enterprises at lower costs and they are tailored for large organizations with enterprise-wide scalable and sustainable deployments. Growing end user demand for customized financial wellness tools, multilingual assistance, and integration with HR and payroll systems will continue to drive market growth. Collectively, the region remains one of the fastest-growing market for financial wellness software in the world.

China and India Propel Rapid Growth in Financial Wellness Software Market

China and India are propelling rapid growth in the Financial Wellness Software Market through increasing digital adoption, expanding middle-class populations, rising financial literacy awareness, and growing demand for cloud-based, mobile-first, and AI-enabled employee financial wellness solutions.

Europe Financial Wellness Software Market Insights

The growing emphasis on employee well-being, financial literacy and productivity in the workplace, the current Europe Financial Wellness Software Market is witnessing a gradual growth. Use of cloud-based, AI-enabled, and mobile-first platforms for budgeting, savings, debt management, investment guidance and retirement planning solutions are widely adopted by organizations in the region. Adoption is led by large enterprises, while Small and Medium Enterprises (SMEs) are slowly transitioning to cost-effective SaaS-based models. Market growth is primarily driven by the favourable regulatory frameworks and the growing employee awareness regarding financial wellness programs. While Europe is somewhat of a mature market on the global financial wellness software map, it is dripping with integrations with HR and payroll systems and a focus on personalization and price point flexibility.

Germany, U.K. Lead European Market in Financial Wellness Software Market Insights

Germany and the U.K. lead the European Financial Wellness Software Market, driven by widespread adoption of cloud-based, AI-enabled, and mobile-first platforms, increasing employee financial literacy, and strong organizational focus on productivity, engagement, and scalable wellness solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Financial Wellness Software Market Insights

The Financial Wellness Software market in Latin America and Middle East & Africa is slowly growing as awareness about employee financial wellness rises and digitization picks up while demand for low-cost cloud and mobile-first solutions gain traction across the broader financial wellness software market. Across both regions, organizations are investing in budgeting, savings, debt management, and investment advisory platforms to boost workforce productivity and engagement. Scalability is becoming a core focus area for SaaS especially SMEs and Enterprises are focusing on integrated and autonomous AI-enabled solutions. Market penetration still lags behind that of the more mature regions, but positive regulatory initiatives, financial literacy, and technology adoption into the consumer base will continue to drive steady growth throughout the LATAM and MEA markets in the next couple of years.

Financial Wellness Software Market Competitive Landscape

PlanSource Holdings Inc. provides innovative cloud-based financial wellness and benefits administration solutions. Its AI-enabled platforms and virtual assistants streamline benefits selection, payroll integration, and employee engagement. The company’s focus on scalable, personalized, and mobile-first solutions positions it as a significant contributor to the growing financial wellness software market.

-

In May 15, 2025, PlanSource unveiled game-changing AI innovations at Eclipse 2025, transforming how HR leaders manage benefits and how employees choose them. These advancements aim to enhance the benefits experience for both employers and employees.

Alight Solutions LLC delivers comprehensive financial wellness solutions through its Worklife platform, integrating benefits management, retirement planning, and employee engagement tools. By leveraging AI, analytics, and cloud-based systems, Alight empowers organizations to optimize financial wellness programs, reduce employee stress, and enhance overall workforce satisfaction across large enterprises and SMEs.

-

In July 28, 2025, Alight released the second major release of Alight Worklife for 2025, incorporating over 60 new features.

Intuit Inc. is a leading provider of financial management software, offering solutions that enhance employee financial wellness through budgeting, savings, and retirement planning tools. Its AI-driven platforms and cloud-based offerings enable organizations to improve workforce productivity, engagement, and loyalty, solidifying its position as a key market player.

-

In July 1, 2025, Intuit launched AI-driven agents integrated into QuickBooks, automating workflows in payments, accounting, and customer relationship management. These agents aim to save users up to 12 hours monthly on bookkeeping tasks.

Financial Wellness Software Market Key Players:

Some of the Financial Wellness Software Market Companies are:

-

Intuit Inc.

-

Voya Financial Inc.

-

Alight Solutions LLC

-

MoneyLion Inc.

-

PlanSource Holdings Inc.

-

DailyPay Inc.

-

Wealthfront Corporation

-

PayActiv Inc.

-

Tapcheck Inc.

-

Wellable Labs Inc.

-

ZayZoon Inc.

-

BrightPlan LLC

-

Ramsey Solutions – SmartDollar

-

SmartPath

-

Aztec Software

-

Sum180 Inc.

-

LearnLux Inc.

-

Savology Inc.

-

Prudential Financial

-

Financial Finesse

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 3.07 Billion |

| Market Size by 2033 | USD 6.68 Billion |

| CAGR | CAGR of 10.25% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment Mode (Cloud-based, On-Premises, Hybrid) • By Organization Size (Large Enterprises, Small and Medium Enterprises (SME)) • By Solution (Financial Assessment and Health Scoring, Budgeting and Expense Management, Savings and Investment Guidance, Debt Management and Credit Improvement, Financial Education and Coaching) • By End Use (BFSI, IT & Telecom, Healthcare, Manufacturing, Retail & E-commerce, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Intuit Inc., Voya Financial Inc., Alight Solutions LLC, MoneyLion Inc., PlanSource Holdings Inc., DailyPay Inc., Wealthfront Corporation, PayActiv Inc., Tapcheck Inc., Wellable Labs Inc., ZayZoon Inc., BrightPlan LLC, Ramsey Solutions – SmartDollar, SmartPath, Aztec Software, Sum180 Inc., LearnLux Inc., Savology Inc., Prudential Financial, Financial Finesse, and Others. |