Next Generation OSS & BSS Market Report Scope & Overview:

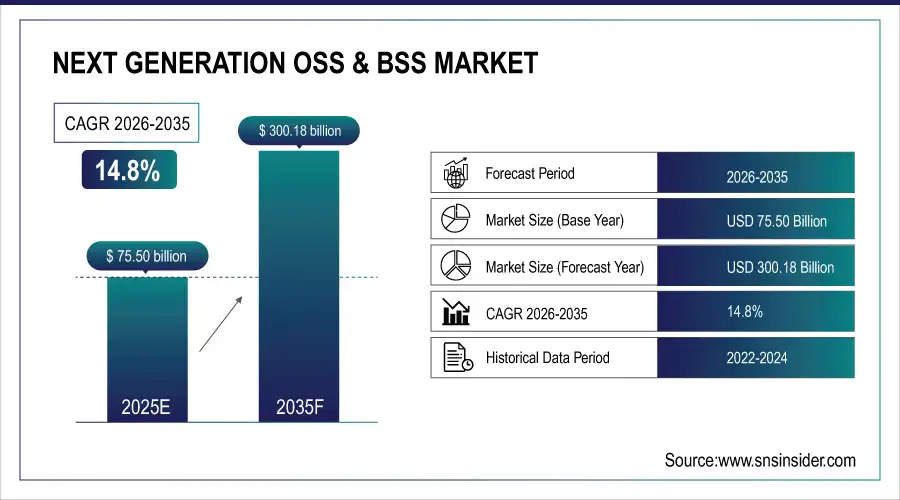

The Next Generation OSS & BSS Market size was valued at USD 75.50 billion in 2025 and is expected to reach USD 300.18 billion by 2035, expanding at a CAGR of 14.8% over the forecast period of 2026-2035.

Telecom operators across the globe are rapidly next next-generation OSS & BSS solutions to modernize their legacy systems and support advanced services such as 5G, 5G IoT, AI, cloud, real-time analytics, and big data-driven cloud monetization approach, leading to high growth in the telecom OSS and BSS market. These next-generation, cloud-native, AI-enabled, and API-driven platforms automate network operations and enhance customer engagement. OSS contains functions such as service assurance and network management, whereas BSS consists of billing, CRM, and revenue management. The advantage of reduced time to market, operational efficiency, and enhanced user experience is positively affecting the growth of the market. This aggregation of OSS and BSS into a single set of platforms is transforming how service providers innovate, scale, and compete in the highly connected digital landscape of the future.

According to research, in 2024, 62% of OSS/BSS deployments used microservices, driving 50 %+ process automation, 60% zero-touch provisioning, and 37% faster issue resolution through AI integration across telecom networks.

Market Size and Forecast: 2025

-

Market Size in 2025 USD 75.50 Billion

-

Market Size by 2035 USD 300.18 Billion

-

CAGR of 14.8% From 2026 to 2035

-

Base Year 2025

-

Forecast Period 2026-2035

-

Historical Data 2022-2024

To Get more information On Next Generation OSS & BSS Market - Request Free Sample Report

Next Generation OSS & BSS Market Trends:

• Rapid adoption of cloud-native, microservices-based OSS and BSS architectures for greater scalability and agility.

• Increasing integration of AI and machine learning to enable real-time analytics, predictive fault management, and automation.

• Accelerating 5G deployments driving demand for real-time, low-latency, and highly scalable OSS/BSS platforms.

• Growing partnerships between telecom operators and hyperscale cloud providers to modernize legacy systems.

• Rising adoption of open, standardized frameworks enabling interoperability, faster innovation, and new digital service monetization.

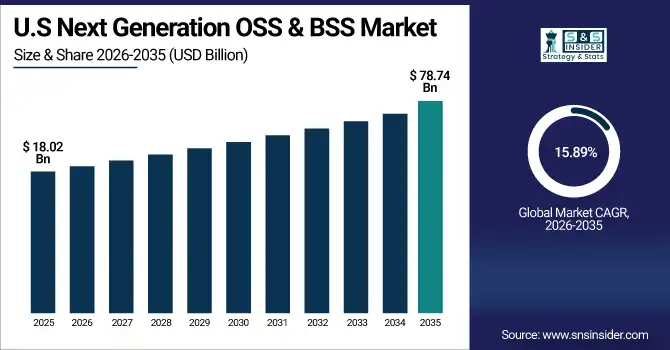

The U.S Next Generation OSS & BSS Market size reached USD 18.02 billion in 2025 and is expected to reach USD 78.74 billion in 2035 at a CAGR of 15.89% from 2026 to 2035. A robust telecommunications infrastructure, early 5G adoption, and the presence of leading OSS/BSS vendors like Oracle and IBM, as well as Hewlett-Packard Enterprise, have made the U.S. a dominant global market. The major drivers for the market are growing requirements for real-time billing and customer management, ongoing digital transformation among telecom operators, and the emergence of AI, cloud-native platforms, and API-based ecosystems. Moreover, increasing investments in automation and virtualization of networks are fostering the uptake of scalable and flexible OSS/BSS solutions in the country.

Next Generation OSS & BSS Market Growth Drivers:

-

Increasing Demand for Cloud-Native and AI-Integrated Platforms Accelerates Digital Transformation in Telecom Operations.

The combination of emerging Cloud-native OSS and BSS platforms, together with AI is driving fundamental changes in the ground dynamics of telecoms. These drive real-time analytics, dynamic service activation, predictive fault management enhanced customer engagement capabilities. As a result, 5G networks are growing extremely fast, pushing operators to provide agile, scalable, and intelligent telecommunications. Domestically, global trends are emerging with increasing partnerships of telecom providers with cloud vendors such as AWS and Microsoft Azure, as many operators are moving toward microservices-based architectures and containerized OSS/BSS solutions to future-proof their systems.

Next Generation OSS & BSS Market Restraints:

-

Legacy System Integration Complexity and High Transition Costs Restrict Technological Shift in Telecom Infrastructure.

The next generation OSS & BSS market growth is hindered by high complexity in integrating next-generation OSS and BSS with legacy systems. Most telecom operators run on legacy infrastructure, and it makes any project to modernize such infrastructure both technically complex and financially expensive. This shift typically involves costly upfront investments, long implementation times, and disruption risk to existing services. The challenges of transformation only complex when new platforms must also map to existing operational workflows and regulatory requirements. Smaller operators with limited IT budgets struggle to justify costly digital overhauls without immediate performance gains or measurable ROI.

Next Generation OSS & BSS Market Opportunities:

-

Expanding 5G Network Deployments Create Lucrative Opportunities for Scalable, Real-Time OSS and BSS Solutions.

The 5G rollout around the world is opening enormous windows for telecom operators to develop next-gen OSS and BSS platforms. With 5G bringing ultra-low latency, massive IoT, and network slicing, operators require extremely scalable, near real-time, and intelligent back-end systems to manage service complexity and customer expectations. Dynamic pricing is a new model that comes with modern BSS solutions, which unlock new revenue streams like network-as-a-service and edge computing. Key trends include growing OSS/BSS automation for 5G monetization and adoption of open architectures like TM Forum’s Open Digital Framework.

Next Generation OSS & BSS Market Segment Analysis:

By Architecture

The Service Fulfilment segment will account for the largest revenue share of 23.86%, as telecom operators start adopting automated solutions to meet demand requirements. Cloud Native and AI imbued, Intelligent service fulfilment platforms have been launched by large organisations such as Amdocs and Ericsson, who are relishing orchestration and provisioning augmentation. Such innovations allow new services to be rolled out faster, driving down operational costs while improving customer satisfaction.

The Account Management segment is expected to grow at the fastest CAGR of 18.35% as prominent players are focusing on supporting advanced customer data management, billing precision, and service personalisation. Analysts aside, dynamic pricing touted as AI account management automation is making its way into the enterprise in the form of accounts receivable and collections solutions from vendors like Oracle and IBM that automate invoice delivery and customer engagement to create an immediacy index affecting revenue assurance and churn.

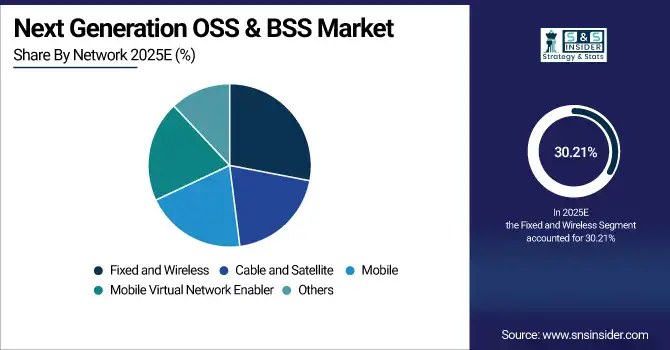

By Network

The Fixed and Wireless segment has the largest next-generation OSS & BSS market share at 30.21% in 2025, fueled by strong broadband penetration and wireless proliferation. Integrated next-generation OSS/BSS market Companies like Huawei and Nokia have this integrated OSS/BSS for wireless and fixed-optical networks, delivering broadband services and doing network service deliveries. This segment benefits from an increased demand for high-speed internet, as seen by the remote work trend and smart city initiatives. Those drivers are in line with the next generation OSS & BSS market trends of scaling flexible solutions to support heterogeneous network infrastructures.

The Mobile Virtual Network Enabler (MVNE) segment is the fastest-growing at a 21.27% CAGR as virtualised network services gain traction and mobile virtual network operators deploy in more regions. Here has been the emergence of MVNE-specific OSS/BSS platforms from companies like Sigma Software, or configuration agnostic OSS/BSS platforms focused on MVNE capabilities from companies like CSG Systems, focusing on multi-tenant, metered billing and rapid service launch. This growth can be attributed to telecom providers needing to diversify revenue streams and reduce CapEx through virtualisation.

Next Generation OSS & BSS Market Regional Analysis:

North America Next Generation OSS & BSS Market Insights

North America is expected to continue its Lead Position in the OSS & BSS Market with a Market Share of 39.30% in 2025. The leadership of the region is somewhat due to the availability of advanced telecommunication infrastructure in this region, the early adoption of 5G technology in this region, and the presence of major OSS/BSS solution providers such as Oracle, IBM, and Hewlett-Packard Enterprise.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. dominates North America due to its leadership in telecom technology innovation, early 5G rollouts, and the presence of key OSS/BSS vendors, driving rapid adoption of advanced digital platforms.

Asia Pacific Next Generation OSS & BSS Market Insights

Asia Pacific is the fastest-growing telecommunications region with a CAGR of 18.29% over the forecast period, attributable to increasing urbanization, an increase in mobile subscriber areas, and 5G network rollout in China, India, and Southeast Asia. To accommodate the exponential rise in data traffic generation and the proliferation of complex and diverse service demands, governments and private players are investing heavily in digital infrastructure and cloud-native OSS/BSS platforms.

China is dominating the Asia Pacific region due to its vast mobile subscriber base, aggressive 5G rollout, strong government support, and leading telecom firms like Huawei driving OSS/BSS advancements.

Europe Next Generation OSS & BSS Market Insights

Europe is moving ahead on Network Virtualization and Automation with GDPR-Compliant OSS/BSS increasing 5G deployments and AI adoption, spurring investment in scalable and interoperable platforms to improve operational efficiency and enhance customer experience across wide service portfolios.

Germany leads Europe owing to its robust telecom infrastructure, extensive 5G coverage, and significant investments by operators to modernize OSS/BSS systems for improved service delivery.

Latin America (LATAM) and Middle East & Africa (MEA) Next Generation OSS & BSS Market Insights

The Middle East & Africa and Latin America are also moving ahead in developing telecom infrastructure through 5G, cloud-native OSS/BSS adoption, and digital initiatives. Regional leaders UAE and Brazil, the UAE leads the MENA region, supported by significant investments, growth in mobile, and a proactive approach towards digital transformation.

Next Generation OSS & BSS Market Key Players:

The major key players of the Next Generation OSS & BSS Market are

- Hewlett-Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Capgemini

- Accenture

- Amdocs

- Oracle

- IBM

- CSG Systems, Inc.

- Sigma Software

- CHR Solutions

Competitive Landscape for Next Generation OSS & BSS Market:

Amdocs is a global provider of next-generation OSS and BSS software and services, enabling telecom operators to manage 5G, cloud, and digital services. Its AI-driven, cloud-native platforms support service orchestration, billing, customer experience management, and real-time analytics, helping operators accelerate digital transformation and monetize advanced network capabilities.

-

In September 2024, Amdocs introduced its Cloud BSS Platform, combining automation, real-time analytics, and customer journey orchestration that empowers telecom operators to provide a better customer experience and faster service deployment.

IBM is a leading technology provider in the next-generation OSS and BSS market, offering AI-powered, cloud-native solutions for telecom operators. Through platforms such as hybrid cloud, automation, and advanced analytics, IBM enables service orchestration, network optimization, billing modernization, and enhanced customer experience, supporting efficient 5G operations and digital service monetization.

-

In June 2024, IBM partnered with Telefónica Tech to strengthen AI, Analytics, and Data Governance Solutions in Spain. The two organizations plan to deliver the open hybrid multi-cloud platform powered by IBM Watson AI and Data platform

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 75.50 Billion |

| Market Size by 2035 | USD 300.18 Billion |

| CAGR | CAGR of 14.8% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Architecture (revenue management, service fulfilment, customer management, account management, service assurance, network management systems) •By Network (cable and satellite, fixed and wireless, mobile, mobile virtual network enabler, others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Hewlett-Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Capgemini, Accenture, Amdocs, Oracle, IBM, CSG Systems, Inc., Sigma Software, CHR Solutions,and others. |