Blockchain Technology in Healthcare Market Report Scope & Overview:

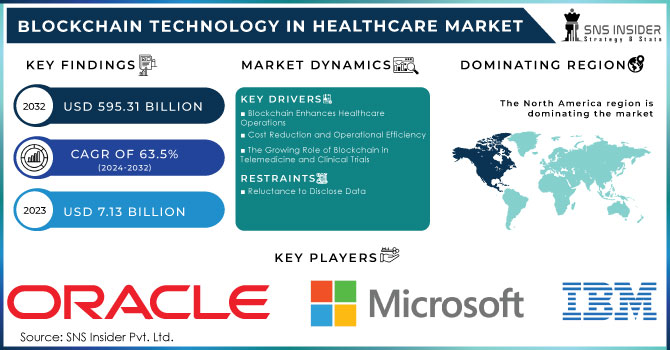

The Blockchain Technology in Healthcare Market was valued at USD 11.65 billion in 2025E and is expected to reach USD 595.31 billion by 2033 and grow at a CAGR of 63.5% over the forecast period 2026-2033.

The growing need for secure and transparent data management systems is driving healthcare organizations to embrace blockchain technology. Blockchain’s decentralized and immutable ledger ensures data integrity, minimizes breach risks, and is ideal for managing sensitive patient information. This demand is increasing as healthcare systems aim for efficient processes in billing, claims processing, and supply chain management. Blockchain boosts operational efficiency by providing a secure solution to these administrative challenges, guaranteeing privacy and security amid rising concerns over healthcare data breaches.

Market Size and Forecast:

-

Market Size in 2025E USD 11.65 Billion

-

Market Size by 2032 USD 595.31 Billion

-

CAGR of 63.5% From 2025 to 2032

-

Base Year 2024

-

Forecast Period 2025-2032

-

Historical Data 2021-2023

Get more information on Blockchain Technology In Healthcare Market - Request Sample Report

Blockchain technology offers a decentralized and secure platform for managing Electronic Health Records (EHRs), facilitating secure data sharing across healthcare providers. This enhances collaboration, improves data transparency, and reduces fraud risk. In supply chain management, particularly for pharmaceuticals and medical devices, blockchain is transforming the sector. By offering transparency throughout the supply chain, blockchain combats the increasing issue of counterfeit drugs. The World Health Organization (WHO) estimates that around 10% of global medicines are counterfeit, with developing countries at higher risk. Blockchain’s ability to track and audit pharmaceuticals mitigates these risks and enhances system security.

The rise in healthcare data breaches further accelerates blockchain adoption. Traditional centralized systems are increasingly vulnerable to cyberattacks, compromising sensitive patient data. For example, India experienced 1.9 million cyberattacks in 2022, primarily targeting outdated healthcare systems. Blockchain’s robust cryptographic security and decentralized nature provide a solution to these vulnerabilities, safeguarding sensitive information from cyber threats.

Blockchain Technology in Healthcare Market Trends:

-

Rising adoption of blockchain for secure patient data sharing across telemedicine and digital health platforms.

-

Growing use of blockchain in clinical trials to improve data transparency, integrity, and patient consent management.

-

Increasing focus on blockchain-enabled pharmaceutical supply chains to mitigate fraud and counterfeit risks.

-

Expanding role of blockchain in automating claims, billing, and administrative healthcare processes for cost savings.

-

Integration of blockchain solutions to strengthen compliance with healthcare regulations such as HIPAA and GDPR.

The U.S. Blockchain Technology in Healthcare market size was valued at an estimated USD 4.35 billion in 2025 and is projected to reach USD 225.80 billion by 2033, growing at a CAGR of 63.1% over the forecast period 2026–2033. Market growth is driven by the increasing need for secure data sharing, interoperability of electronic health records (EHRs), and improved transparency across healthcare systems. Rising concerns over data breaches, fraud prevention, and regulatory compliance, along with growing adoption of decentralized solutions for clinical trials, supply chain management, and medical billing, are accelerating market expansion. Supportive government initiatives, rapid digital transformation in healthcare, and continuous advancements in blockchain platforms further reinforce the strong growth outlook of the U.S. market during the forecast period.

Blockchain Technology in Healthcare Market Growth Drivers:

-

Blockchain Enhances Healthcare Operations

Blockchain technology addresses the critical need for data security in healthcare. With the rise in data breaches and cyberattacks, ensuring patient data remains secure and tamper-proof is a top priority. Blockchain’s decentralized ledger provides strong encryption, enhancing privacy while meeting regulatory requirements like HIPAA and GDPR. Additionally, blockchain improves the authenticity and integrity of pharmaceuticals and medical devices by offering real-time, end-to-end supply chain visibility. This transparency helps mitigate fraud, reduces counterfeit risks, and strengthens regulatory compliance, especially in the biopharmaceutical and medical device sectors.

-

Cost Reduction and Operational Efficiency

Reducing healthcare costs and enhancing operational efficiency are key drivers for blockchain adoption. Blockchain eliminates intermediaries, automates administrative tasks, and improves data accuracy, resulting in significant cost savings associated with manual record-keeping, billing errors, and fraud. It also streamlines processes such as claims management, patient data exchange, and clinical trial management, generating substantial savings for healthcare providers and payers.

-

The Growing Role of Blockchain in Telemedicine and Clinical Trials

The rapid growth of telemedicine and digital health platforms has increased the demand for secure data-sharing solutions. Blockchain ensures the secure exchange of patient health information across digital platforms, facilitating data interoperability, privacy, and trust among healthcare providers and patients. Blockchain’s role in clinical trials is expanding, offering enhanced data integrity, transparency, and patient consent management. Initiatives like the Mayo Clinic’s integration of blockchain for multicenter trials demonstrate the technology’s growing impact on pharmaceutical research and clinical trial management.

Blockchain Technology in Healthcare Market Restraints:

-

Reluctance to Disclose Data

A major restraint in blockchain adoption in healthcare is the reluctance to disclose data, especially in emerging markets. This hesitation arises from a lack of robust regulations governing medical data exchange. Healthcare providers and payers often view data retention as a competitive advantage, fearing that sharing information could lead to reduced reimbursement rates and compromise their competitive edge. This reluctance to share accurate data, combined with competitive dynamics, presents a challenge for implementing transparent technologies like blockchain.

Blockchain Technology in Healthcare Market Segment Analysis:

By Network Type

The public segment led the market in 2025 with a 43.1% share. Public blockchain networks are valued for their transparency, security, and immutability, which are crucial in healthcare applications like patient records and supply chain management. These networks enable participants to access and verify data, fostering trust and reducing risks associated with centralized data storage. Public blockchains’ transparency and accountability drive their broad adoption and market dominance.

Conversely, the private segment is projected to grow at the fastest CAGR of 64.6% during the forecast period 2026-2033. Private blockchains operate within a closed network, offering similar benefits to public blockchains but on a smaller scale. They are particularly suited for healthcare’s stringent privacy and compliance requirements, such as HIPAA and GDPR. This controlled environment is expected to fuel the growth of the private blockchain segment.

By Application

The supply chain management segment dominated the market in 2025, holding a 35.6% share, and is expected to grow at the highest CAGR during the forecast period. Blockchain technology offers comprehensive visibility across the supply chain, enabling real-time verification of medical product origin, manufacturing processes, and distribution routes. This transparency helps prevent fraud, minimize counterfeit risks, and improve regulatory compliance. Additionally, blockchain enhances inventory management and logistics by reducing inefficiencies and costs associated with manual record-keeping.

The Clinical Trials & eConsent segment is also projected to experience substantial growth. Blockchain improves pharmaceutical research by managing clinical trial databases more effectively and reducing reliance on outdated data management systems. This approach enhances oversight by regulatory bodies and research institutions, increasing the credibility of clinical studies. For instance, in September 2024, the Mayo Clinic adopted a blockchain-powered platform developed by Triall for a multicenter pulmonary arterial hypertension trial, ensuring data integrity and transparency.

By End-Use

In 2025, the biopharmaceutical and medical device companies segment held the largest market share of 44.5%. Blockchain addresses complex supply chain challenges by providing secure tracking of drugs and medical devices, ensuring data privacy, and enhancing quality control and counterfeit detection. Blockchain's features, such as encryption and decentralized storage, support data privacy and authorized access, driving market growth in these sectors.

The payer segment is expected to grow at the fastest CAGR. Payers, including insurance companies and government agencies, are adopting blockchain to streamline operations, improve transparency, and reduce fraud. Blockchain’s decentralized ledger ensures accurate and verifiable transaction records, helping eliminate discrepancies in billing and claims processing.

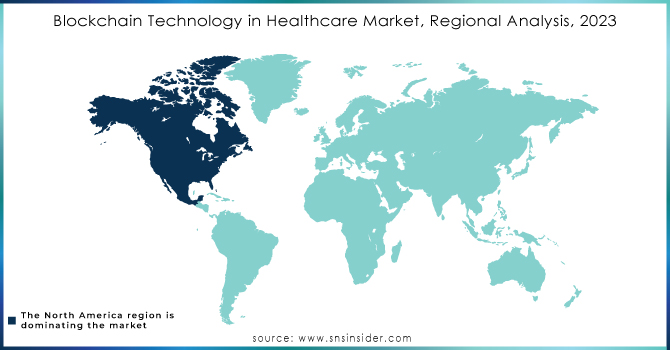

Blockchain Technology in Healthcare Market Regional Analysis:

North America Blockchain Technology in Healthcare Market Insights

In 2025, North America held a significant share of the global blockchain technology in the healthcare market. The region’s regulatory landscape, which mandates stringent compliance and patient data protection, drives blockchain adoption. Major initiatives aim to reduce healthcare costs and improve data security, making blockchain technology increasingly relevant in the U.S. healthcare sector. Europe also emerged as a key region, capturing 34.8% of the global market share in 2025.

Asia Pacific Blockchain Technology in Healthcare Market Insights

The Asia Pacific blockchain in healthcare market is witnessing strong growth, driven by government support for digital health, rising medical data digitization, and increasing adoption of telemedicine platforms. Countries like China, India, and Japan are investing in blockchain to enhance data security, reduce fraud, and streamline healthcare operations, making the region highly attractive for technology providers.

Europe Blockchain Technology in Healthcare Market Insights

Europe’s blockchain in healthcare market is expanding rapidly due to strict regulatory frameworks such as GDPR, encouraging secure data management and interoperability. The region’s focus on precision medicine, cross-border healthcare collaboration, and clinical trials is boosting blockchain adoption. Strong investments from public and private sectors position Europe as a leader in blockchain-enabled healthcare innovation and compliance-driven solutions.

Latin America (LATAM) and Middle East & Africa (MEA) Blockchain Technology in Healthcare Market Insights

LATAM and MEA are emerging markets for blockchain in healthcare, driven by the need to combat counterfeit drugs, ensure secure patient data exchange, and improve healthcare accessibility. Rising government initiatives, growing private investments, and the adoption of digital health technologies are fostering blockchain integration, particularly in pharmaceutical supply chains, patient record management, and telemedicine applications.

Need any customization research on Blockchain Technology in Healthcare Market - Enquiry Now

Blockchain Technology in Healthcare Market Key Players:

-

Guardtime

-

IBM

-

Medicalchain SA

-

PATIENTORY INC.

-

iSolve, LLC

-

Solve. Care

-

Oracle

-

BurstIQ

-

Blockpharma

-

Chronicled

-

Gem

-

Hashed Health

-

Microsoft

-

Factom

-

PokitDok

-

SimplyVital Health

-

FarmaTrust

-

Proof.Work.

Competitive Landscape for Blockchain Technology in Healthcare Market:

Solve.Care is a global healthcare technology company leveraging blockchain to improve care coordination, data security, and patient engagement. Its decentralized platform connects patients, providers, insurers, and employers through secure digital health networks. By enhancing transparency, interoperability, and trust, Solve.Care drives efficiency in healthcare administration and patient-centered service delivery.

In October 2023, Solve. Care collaborated with Binance to integrate cryptocurrency within the healthcare sector, expanding cryptocurrency use as a payment method for healthcare services.

In August 2023, Solve. Care introduced the Care. Trials Network, powered by blockchain and Zero-knowledge (ZK) technology, offers innovative solutions for conducting clinical trials.

| Report Attributes | Details |

| Market Size in 2025E | USD 11.65 Billion |

| Market Size by 2033 | USD 595.31 Billion |

| CAGR | CAGR of 63.5% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Network Type (Private, Public, Others) • By Application (Clinical Data Exchange & Interoperability, Claims Adjudication & Billing, Supply Chain Management, Clinical Trials & eConsent, Others) • By End-user (Providers, Payers, Biopharmaceutical & Medical Device Companies, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Change Healthcare (acquired by UnitedHealth Group's Optum), Guardtime, IBM, Medicalchain SA, PATIENTORY INC., iSolve, LLC, Solve. Care, Oracle, BurstIQ, Blockpharma, Chronicled, Gem, Hashed Health, Microsoft, Factom, PokitDok, SimplyVital Health, FarmaTrust, Proof.Work and others. |