Digital Therapeutics Market Report Scope and Overview:

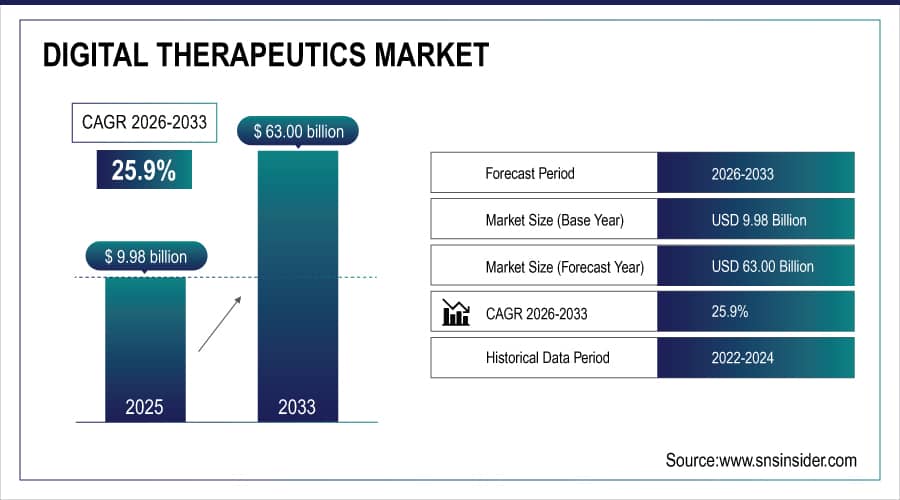

The Digital Therapeutics Market size was estimated at USD 9.98 billion in 2025E and is expected to reach USD 63.00 billion by 2033 at a CAGR of 25.9% during the forecast period of 2026-2033.

The Revolution in Patient Care: How Digital Therapeutics (DTx) are Transforming Healthcare

Advancements in Digital Therapeutics Driving Patient-Centric Innovations

Digital transformation in healthcare is fundamentally reshaping patient care and treatment through the rapid adoption of digital therapeutics (DTx). These innovative solutions use software programs to provide therapeutic interventions, representing a significant evolution from traditional clinical treatments. Digital therapeutics are increasingly being utilized for conditions such as diabetes, weight loss, chronic obstructive pulmonary disorder (COPD), developmental disorders, and post-traumatic stress disorder (PTSD). A National Library of Medicine study involving 146 participants demonstrated that those in the intervention group achieved notable reductions in weight and BMI, highlighting the effectiveness of digital therapeutics. Recent breakthroughs, such as AppliedVR's EaseVRx, which earned FDA approval in November 2021, exemplify the growing acceptance of DTx. EaseVRx, a VR headset offering an eight-week program, resulted in a 42% average reduction in pain intensity among users. Furthermore, research published in JMIR Human Factors showed that less than 1% of Kaia Health solution users experienced adverse events, underscoring the safety of these digital interventions.

To Get More Information On Digital Therapeutics Market - Request Free Sample Report

The regulatory landscape for DTx is evolving. The U.S. FDA classifies DTx as mobile medical applications (MMAs), with many falling under enforcement discretion and not requiring premarket review. However, the FDA's “Digital Health Innovation Action Plan” seeks to streamline the approval process and promote innovation, though challenges remain. The plan suggests evaluating digital health products based on company characteristics rather than individual product efficacy, which could speed up market entry but also complicate the assessment of algorithmic mechanisms. The FDA’s Digital Health Center of Excellence and the Software Precertification (Pre-Cert) Pilot Program are crucial in advancing DTx approvals. Despite progress, industry leaders stress the importance of rigorous clinical trials to validate the efficacy of digital therapeutics and avoid placebo effects. Overall, the digital therapeutics market is experiencing robust growth driven by technological advancements, increasing demand for innovative treatments, and evolving regulatory frameworks.

Digital Therapeutics Market Size and Forecast:

-

Market Size in 2025E: USD 7.93 Billion

-

Market Size by 2033: USD 50.07 Billion

-

CAGR: 25.9% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Digital Therapeutics Market Highlights:

-

Cost-effective, patient-centric solutions and rising smartphone/internet penetration drive adoption.

-

Advanced network infrastructure, including 5G, enables high-quality virtual care and remote monitoring.

-

Increasing prevalence of chronic diseases fuels demand for digital therapeutics.

-

Regulatory challenges and inconsistent reimbursement policies limit market growth.

-

Data privacy, cybersecurity concerns, and limited digital literacy hinder adoption.

-

Lack of long-term clinical validation reduces healthcare professional confidence.

| Parent & Related Markets | Description | Key Characteristics |

|---|---|---|

| Digital Health Market | Encompasses all digital solutions for improving health outcomes, including telemedicine, mobile health, and electronic health records (EHR). | - Comprehensive range of digital tools and platforms |

| - Focus on enhancing patient care and health management | ||

| Healthcare IT Market | Involves technology solutions used in healthcare settings, including EHR, health information systems, and IT services. | - Includes software, hardware, and services |

| - Aims at improving healthcare efficiency and data management | ||

| Health and Wellness Apps Market | Includes applications designed to promote physical and mental well-being, track health metrics, and support lifestyle changes. | - Wide range of applications |

| - Focus on user engagement and behavior change | ||

| Wearable Health Technology Market | Involves devices that monitor health metrics and deliver therapeutic interventions. | - Includes fitness trackers, smartwatches, and medical-grade wearables |

| - Emphasizes real-time health monitoring | ||

| Telemedicine Market | Covers remote healthcare services through digital communication tools, including virtual consultations and remote patient monitoring. | - Utilizes video calls, chat, and telehealth platforms |

| - Aims at increasing accessibility and convenience | ||

| Personalized Medicine Market | Focuses on tailoring medical treatments and interventions to individual characteristics, including genetic, environmental, and lifestyle factors. | - Emphasizes tailored treatment plans |

| - Integrates with digital health solutions for enhanced personalization | ||

| Health Information Exchange (HIE) Market | Involves the electronic sharing of health information across different healthcare systems and providers. | - Aims at improving coordination of care |

| - Enhances data accessibility and integration |

Digital Therapeutics Market Drivers:

-

Cost Efficiency, Technological Advancements, and Regulatory Support

The cost-effectiveness of digital health technologies for providers and patients is a significant driver of market growth, alongside the rising penetration of smartphones across developed and developing regions. The demand for patient-centric care and integrated healthcare systems further fuels market expansion. Smartphone adoption, projected to reach 92% by 2030 from 76% in 2022, enhances awareness and adoption of smart health monitoring solutions. Global internet penetration, with approximately 5.6 billion mobile subscribers in 2023 expected to grow to 6.3 billion by 2032, also supports market growth.

The expansion of network infrastructure, particularly with the advent of 5G technology, is anticipated to boost demand for digital therapeutics. With global 5G penetration expected to reach 54% by 2032, increased bandwidth and reduced latency will facilitate high-quality virtual interactions and remote patient care. The rising incidence of chronic diseases, affecting 6 in 10 American adults, further highlights the need for effective management solutions. For example, Amazon Health's Health Condition Programs target chronic conditions like diabetes and hypertension through digital health technologies.

Digital Therapeutics Market Restraints:

-

Limitations Affecting the Adoption of Digital Therapeutics

The adoption of digital therapeutics faces several limitations despite their growing potential in healthcare. One major challenge is the lack of widespread awareness and understanding among both patients and healthcare providers, which can slow acceptance. Regulatory hurdles and inconsistent reimbursement policies across regions also impede broader implementation, as coverage for digital therapies is often limited. Additionally, concerns regarding data privacy and cybersecurity can make users hesitant to engage with digital platforms. Technical barriers, such as limited access to smartphones, stable internet, or digital literacy, further restrict adoption, particularly in underserved populations. Finally, clinical validation and long-term efficacy data remain limited for some therapies, making healthcare professionals cautious about recommending them.

Digital Therapeutics Market Segment Analysis:

By End-Use

The diabetes segment led the digital therapeutics market with a 29.3% share in 2025 and is projected to experience the highest compound annual growth rate (CAGR) throughout the forecast period. This growth is driven by the increasing global prevalence of diabetes and related chronic conditions. According to a 2023 report from the Institute for Health Metrics and Evaluation, over 500 million people worldwide are affected by diabetes. The obesity segment, holding the second-largest market share, is also set to grow significantly due to rising global obesity rates. Digital therapeutics offer cost-effective treatments for various chronic diseases, fueling expansion in this segment. Cardiovascular diseases (CVDs) and smoking cessation are expected to see notable growth as well.

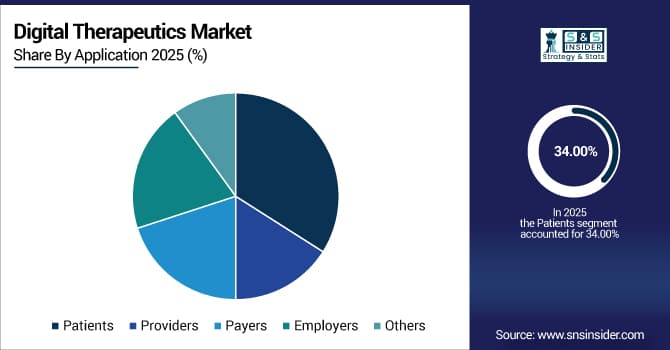

By Application

The patient segment dominated the market with a substantial 34.0% share in 2025 and is projected to grow at the fastest rate during the forecast period. This growth is driven by the rapid adoption of digital therapeutics among patients, who benefit from personalized, evidence-based care programs. These solutions improve access to care, especially for individuals in rural and remote areas, and allow real-time patient monitoring, gap identification in care, and timely interventions. By enhancing the efficiency of care delivery and reducing the need for frequent physician intervention, digital therapeutics offer significant advantages. The provider segment holds the second-largest market share, driven by the increasing use of digital therapeutics to deliver proven therapies outside traditional care settings and boost patient engagement. Payers are also showing growing interest in covering digital therapeutics due to business models that promote adherence, efficacy, and cost reduction.

Digital Therapeutics Market Regional Analysis:

North America Digital Therapeutics Market Trends:

North America led the digital therapeutics market with a commanding revenue share of 40.4% in 2025. The region is poised for significant growth due to the rising adoption of digital health products and favorable reimbursement policies that enhance quality of life through advanced tracking and diagnostics. Key drivers include rapid smartphone adoption, improvements in network coverage, a shortage of primary caregivers, an increasing prevalence of chronic diseases, and an aging population. The U.S. dominates the North American market, accounting for over 85% of the revenue, driven by a rapidly evolving digital landscape, heightened consumer healthcare expectations, and substantial investments like Click Therapeutics, Inc.'s USD 52 million Series B funding.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Digital Therapeutics Market Trends:

Europe is expected to see substantial growth in the digital therapeutics market, driven by increased adoption of health apps among providers and patients. Developed economies such as Germany, the UK, France, Spain, and Italy are key contributors. The European Commission's Digital Single Market Strategy aims to facilitate online access to services across Europe, supporting the growth of digital health networks. The UK market is expanding rapidly due to growing demand for evidence-based solutions for chronic diseases and rising smartphone penetration. Germany's market benefits from its advanced healthcare infrastructure and the Digital Healthcare Act of 2019, which streamlines the evaluation and reimbursement of digital health products.

Asia-Pacific Digital Therapeutics Market Trends:

Asia Pacific is anticipated to experience the fastest growth in the digital therapeutics market, fueled by increased government healthcare spending and high demand for IT services. The expansion of healthcare IT systems and rising smartphone usage are key factors driving this growth. Japan's market is growing due to advancements in digital infrastructure and an aging population, with initiatives like Jolly Good, Inc.'s specialized DTx Division enhancing digital therapeutics development. In China, the market is booming due to the high prevalence of chronic diseases and strong governmental support for digital health initiatives. Key players such as Alibaba Health, WeDoctor, and Omada Health are driving market growth, with recent advancements like NERVTEX’s AI-driven software receiving regulatory approval, further fueling market expansion.

Latin America Digital Therapeutics Market Trends:

Latin America is poised for steady growth in the digital therapeutics market, supported by increasing smartphone penetration and expanding internet connectivity. Countries like Brazil, Mexico, and Argentina are leading the adoption of digital health solutions. Government initiatives promoting telemedicine and digital healthcare integration are encouraging market growth. Rising awareness of chronic diseases and limited access to traditional healthcare facilities are driving patients and providers toward digital therapeutics. Local companies and partnerships with global players are accelerating the availability of evidence-based digital interventions, making the market increasingly attractive for investment and innovation.

Middle East & Africa Digital Therapeutics Market Trends:

The Middle East & Africa region is expected to witness gradual growth in digital therapeutics, fueled by healthcare modernization programs and government-backed digital health initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are focusing on integrating advanced healthcare technologies, including remote monitoring and mobile health platforms. High prevalence of lifestyle-related and chronic diseases, combined with a shortage of healthcare professionals in rural areas, is driving demand for digital therapeutics. Collaboration with global digital health companies and investments in telemedicine infrastructure are expected to enhance the adoption of these solutions across the region.

Digital Therapeutics Market Key Players:

-

OMADA HEALTH, INC.

-

Welldoc, Inc.

-

2Morrow, Inc

-

Livongo Health, Inc. (Teladoc Health, Inc.)

-

Propeller Health (ResMed)

-

Fitbit LLC

-

Mango Health

-

Jogohealth

-

CureApp, Inc.

-

Brain+ A/S

-

CANARY HEALTH

-

Noom, Inc.

-

Pear Therapeutics, Inc.

-

Akili Interactive Labs, Inc.

-

HYGIEIA

-

DarioHealth Corp.

-

BigHealth

-

GAIA AG

-

Limbix Health, Inc.

-

Kaia Health, Inc.

Digital Therapeutics Market Competitive Landscape:

Otsuka Precision Health, established in 2015 as a subsidiary of Otsuka Pharmaceutical Co., Ltd., advances personalized digital healthcare solutions. The company focuses on developing innovative digital therapeutics and precision health programs that integrate data-driven insights with patient-centered care. By leveraging technology, Otsuka Precision Health aims to improve disease management and enhance healthcare outcomes globally.

-

In May 2024, Otsuka launched Otsuka Precision Health, focusing on data and technology. The new subsidiary aims to commercialize Rejoyn, a digital therapeutic for major depressive disorder.

Eli Lilly and Company, established in 1876, is a global pharmaceutical leader focused on developing innovative therapies for patients worldwide. The company specializes in research-driven solutions across oncology, endocrinology, neuroscience, and immunology. By integrating advanced technologies and digital health initiatives, Eli Lilly aims to enhance patient outcomes, streamline healthcare delivery, and address unmet medical needs through personalized and effective treatment options.

-

In January 2024, Eli Lilly and Company introduced LillyDirect, a digital healthcare platform designed for U.S. patients managing obesity, migraine, and diabetes. LillyDirect includes personalized support, access to independent healthcare providers, and direct medication delivery through third-party pharmacies.

Curavit Clinical Research, established in 2010, is a specialized contract research organization (CRO) focused on providing comprehensive clinical trial services. The company offers end-to-end solutions, including study design, patient recruitment, data management, and regulatory support. By leveraging advanced technologies and expertise, Curavit Clinical Research aims to accelerate drug development, ensure compliance, and deliver high-quality clinical outcomes for pharmaceutical and biotechnology clients globally.

-

In November 2023, Curavit Clinical Research, a virtual contract research organization, launched a new service for clinical trials centered on Health Economics and Outcomes Research (HEOR). This service aims to provide pharmaceutical companies with deeper insights into their products' value and market potential.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.98 Billion |

| Market Size by 2033 | USD 63.02 Billion |

| CAGR | CAGR of 25.9% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By End Use (Patients, Providers, Payers, Employers, Others) • By Application (Diabetes, Obesity, CVD, Respiratory Diseases, Smoking Cessation, CNS Diseases, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | OMADA HEALTH, INC., Welldoc, Inc., 2Morrow, Inc, Livongo Health, Inc. (Teladoc Health, Inc.), Propeller Health (ResMed), Fitbit LLC, Mango Health, Jogohealth, CureApp, Inc., Brain+ A/S, CANARY HEALTH, Noom, Inc., Pear Therapeutics, Inc., Akili Interactive Labs, Inc., HYGIEIA, DarioHealth Corp., BigHealth, GAIA AG, Limbix Health, Inc., Kaia Health, Inc. |