Geriatric Medicine Market Size & Overview

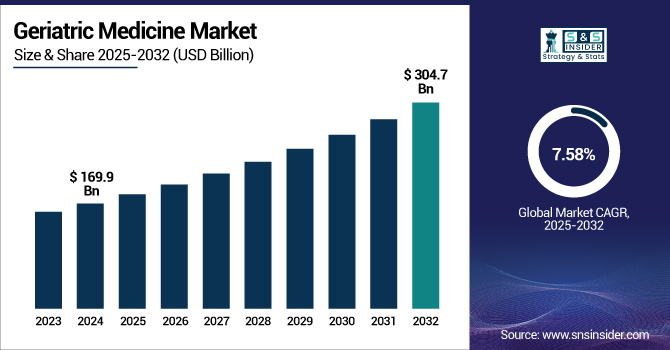

The Geriatric medicine Market size is projected to grow from USD 169.9 billion in 2024 to USD 304.7 billion by 2032, at a CAGR of 7.58% during the forecast period 2025-2032.

To Get more information on Geriatric Medicine Market - Request Free Sample Report

Rising global aging population and growing frequency of chronic disorders among seniors are driving a strong rise in the geriatric medicine market. The United Nations estimates that the global population aged 65 and above, up from 761 million in 2021, will reach 1.6 billion by 2025, underscoring the increasing need for tailored healthcare solutions for elderly persons. Government agencies are responding with enlarged insurance schemes and policy incentives.

For instance, India's proposed expansion of Ayushman Bharat to cover all individuals over 70 and the U.S. Inflation Reduction Act's Medicare Part D reforms, which cap out-of-pocket prescription drug costs for seniors.

Driven by advanced healthcare infrastructure, high chronic disease prevalence, and favourable reimbursement policies, the U.S. geriatric medicine market held 78% of the North American market share and valued USD 50.30 billion in 2023 and is expected to reach USD 89.43 billion by 2032 with a CAGR of 7.46% over the forecast period. 1 in 6 Americans is above 65 years old. These developments are influencing present geriatric medicine market trends and driving the notable increase in the geriatric medicine market.

The growing elderly population and rising incidence of chronic diseases, including diabetes, cardiovascular diseases, and neurological ailments, are driving fast expansion in the global geriatric medicine market. The World Health Organization emphasizes the vital requirement of efficient medicine for older adults and thorough chronic disease care in elderly populations, since over 50% of all fatalities in persons aged 65 and above are linked to chronic diseases. Government programs improving access to geriatric healthcare solutions include increased insurance coverage and the building of specialized geriatric healthcare solutions.

Geriatric Medicine Market Dynamics

Drivers:

-

Rising Global Geriatric Population and Prevalence of Chronic Diseases Drive Demand for Specialized Medicines and Healthcare Solutions

The global elderly population is expanding at a historic pace, with those aged 65 and above representing the fastest-growing demographic segment globally. The rising frequency of chronic ailments include neurological problems, diabetes, arthritis, and cardiovascular diseases, which are disproportionately common among older adults. Growing rates of hypertension and other age-related diseases drive the global market. The demand for long-term and specialized pharmacological treatment increases as populations in nations including China, India, and the U.S. age rapidly. These changes drive pharmaceutical companies to create customized treatments and creative drug delivery systems, thereby assuring that the particular medical needs of the elderly are satisfied with more effectiveness and safety. The combination of demographic changes and the weight of chronic illness is fundamentally changing the terrain of geriatric healthcare. Therefore, this sector is becoming a focus point for industry investment and global health policy.

Restraints:

-

Significant Obstacles to Innovation and Market Entry Created by High Drug Development Costs and Strict Regulatory Requirements

The development of geriatric medicines is fraught with high costs and complex regulatory hurdles, which significantly restrain market growth. Especially considering the higher risk of adverse effects and polypharmacy in senior patients, bringing a new drug to market calls for thorough research, rigorous clinical studies, and strict adherence to regulatory criteria. Often making it difficult for smaller pharmaceutical companies to compete, regulatory authorities want thorough safety and efficacy data, which extends research timelines and increases expenses.

These obstacles may hinder the introduction of new treatments and slow down the speed of innovation. Further complicating the clearance procedure is the necessity of designing research considering several co-morbidities and different physiological reactions in older people. These difficulties not only restrict the number of new competitors but also discourage research and development investment, therefore influencing the availability of sophisticated treatment choices for the aging population.

Geriatric Medicine Market Segmentation Analysis

By Therapeutic Category

Antihypertensive therapeutics accounted for 21% of the geriatric medicine market share in 2024. The great frequency of hypertension in elderly people is reflected in the dominance of antihypertensive pharmaceuticals in the elderly care pharmaceuticals market. With over two-thirds of Americans aged 60+ diagnosed with hypertension, cardiovascular drugs for the elderly is an essential geriatric care tool. Frequent government health screenings and the incorporation of combination medicines to solve polypharmacy in geriatric patients fuel the expansion of the geriatric medicine market. Innovations and recent legislative changes are influencing the trends in the geriatric medicine market.

For instance, in May 2023, the U.S. FDA authorized a new triple-combining antihypertensive therapy meant to lower tablet load and boost senior adherence.

The Inflation Reduction Act of 2022, implemented in 2024, eliminated the 5% coinsurance requirement for Medicare Part D enrollees in the catastrophic phase, capping out-of-pocket drug costs and making Prescription Drugs for Seniors more affordable.

According to the International Diabetes Federation estimates that over 25% of persons aged 65+ globally have diabetes, anti- diabetic treatments are showing interesting Geriatric Medicine Market Growth. Adoption in this market is being driven by the introduction of improved GLP-1 receptor agonists and SGLT2 inhibitors, which offer renal and cardiovascular advantages. Reflecting the focus of the market on customized geriatric healthcare solutions, the European Medicines Agency approved a once-weekly injectable antidiabetic medication with proven cardiovascular advantages for seniors in June 2024.

The 2024 budget for India suggested expanding Ayushman Bharat to cover all seniors over 70, boost insurance coverage, and provide medication for older adults’ access.

By Condition

Cardiovascular illnesses led with 33% of the geriatric medicine market share in 2024 as cardiovascular diseases remain the leading cause of morbidity and mortality among the elderly. The World Health Organization drives demand for cardiovascular medications for the elderly since over half of their deaths are attributed to heart-related diseases. Expanding coverage for cardiac rehabilitation in 2024, the U.S. Centers for Medicare & Medicaid Services supports the geriatric medicine market expansion and increases medicare beneficiary involvement.

For instance, the European Commission's "Active Aging" initiative allocated €500 million in 2023 for age-friendly healthcare infrastructure, supporting cardiovascular and diabetes management for seniors.

Diabetes and metabolic disorders experienced exponential growth. With the CDC estimating 27% of Americans aged 65+ have diabetes as of 2024, diabetes and metabolic diseases are also expanding. Government-backed digital health projects, such as the U.K. NHS's statewide digital diabetes care program for seniors, which has improved glycemic control and lowered hospital admissions, drive the segment's exponential growth.

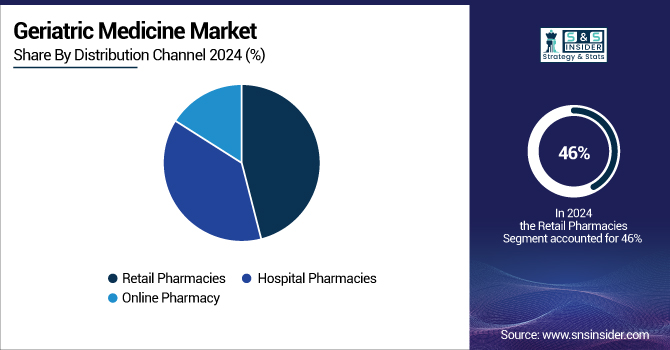

By Distribution Channel

With a 46% share in 2024, retail pharmacies dominated the market and remain the main source of prescription pharmaceuticals for seniors. Reflecting their important position in medication adherence and chronic disease management, the U.S. Department of Health and Human Services notes that 85% of persons aged 65+ fill prescriptions at retail pharmacies. The expansion of pharmacy-driven health services, such as medication therapy management and immunizations, is further strengthening this segment.

For instance, the establishment of Jan Aushadhi Kendras and e-Pharmacy projects by the Indian government in 2024 has enhanced pharmaceutical availability for urban and rural elderly, thereby supporting geriatric medicine market trends.

Online pharmacies segment is growing significantly driven by the acceptance of telemedicine and digital health systems, further increasing their popularity in the market. While India's "e-Pharmacy" project provided digital access to vital medications for over 10 million seniors, the U.K. NHS reported in 2024 a 35% increase in online pharmacy registrations among seniors. The 2024 recommendations for online prescription drug dispensing by the European Medicines Agency are projected to improve patient safety and assist the geriatric medicine market growth.

Geriatric Medicine Market Regional Outlook

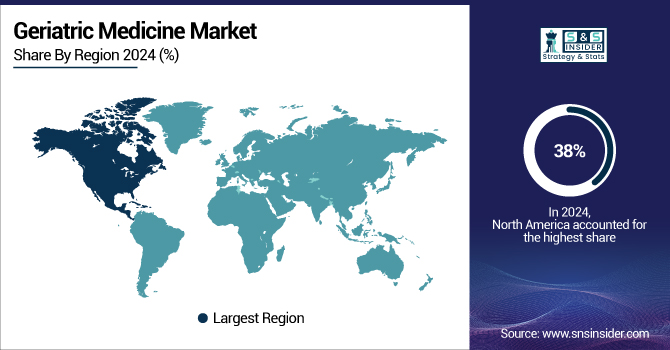

With a 38% market share in 2024, North America still dominates the global geriatric medicine market. The U.S. held 78% of the North American region's share.

Several factors, such as a strong government backing, significant healthcare expenditure, and an advanced and developed healthcare infrastructure are responsible for region’s growth in the market. Among the aged in the area, chronic diseases, such as diabetes, arthritis, and cardiovascular diseases are rather common, which increases the demand for specific treatments and thorough chronic disease management in elderly.

Further driving market expansion are favourable reimbursement policies of the U.S. government, regular FDA drug approvals, and tax incentives for geriatric medicine companies. Furthermore, technology innovations including digital health records, remote patient monitoring, and telemedicine, are improving the effectiveness of geriatric healthcare solutions. Canada, while smaller in market size, also benefits from universal healthcare and targeted elderly care programs, contributing to the region’s overall dominance.

Europe holds the second-largest share in the geriatric medicine market, with significant variations across countries. With an estimated 30% of the overall population by 2025, the elderly population of the region aged 65 and above is significant and expanding. Since older persons are the main users of prescription drugs for seniors and often need several medications-over 10% of Europe's elderly population receives 10 or more drugs routinely, this demographic change is a main driver of market demand. Public insurance programs and government projects abound, promoting medication for older adults and encouraging pharmaceutical innovation. Leading nations in the acceptance of robot-assisted surgical procedures, advanced treatments, and senior-specific customized therapy are Germany and the U.K. By providing rules that guarantee the special needs of elderly patients are met in drug research and certification, the European Medicines Agency (EMA) plays an important role.

Asia Pacific is the fastest-growing region in the market with a CAGR of 8.11% over the forecast period. This growth is driven by the older population, especially in China, Japan, and India fuels this fast growth. China leads the region with its large and rising aging population, government changes meant to enhance elder care, and higher senior insurance coverage. Driven by urbanization, increasing healthcare expenditures, and state support for elder care, India is also becoming a major market.

For instance, India’s 2024 budget proposals for senior healthcare coverage are expected to significantly boost the aging population healthcare market in Asia Pacific.

The region benefits from improving the infrastructure for healthcare, including both generic and patented medications, and raising knowledge of preventative care and good living. Governments are aggressively funding healthcare institutions and starting projects to make geriatric medications more reasonably priced and easily available. The great frequency of chronic diseases, such as Parkinson's, Alzheimer's, diabetes, and cardiovascular diseases among the elderly drives an even greater need for geriatric healthcare solutions. Growing disposable incomes and the rise of medical sectors in underdeveloped nations also help to explain the growth of the Asia Pacific region.

The LAMEA region, while smaller in overall market share, is experiencing steady growth in the market. Investing in healthcare reforms, increasing insurance coverage, and starting public health projects targeted at the elderly are Brazil, Mexico, and Middle Eastern nations. Under its "Healthy Aging" campaign, the Brazilian government has raised senior vaccination rates and conducted chronic disease tests, therefore encouraging market growth. The area presents special difficulties, including differences in infrastructure and healthcare access, but constant investments and international partnerships are progressively improving the landscape.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Geriatric Medicine Market

The key geriatric medicine companies are F. Hoffmann-La Roche Ltd., Takeda Pharmaceutical Company Ltd., Eli Lilly & Company, AbbiVie, Inc, Amgen, Inc, Pfizer, Inc, Novartis AG, Abbott Laboratories Inc., Bristol-Myers Squibb Company, UCB, Inc., Merck and Co., Inc, Sanofi, GSK plc, Johnson and Johnson Services, Inc., AstraZeneca PLC, and others.

Recent Developments

-

A significant development in geriatric healthcare solutions came when the U.S. FDA approved Pfizer's ABRYSVO, a bivalent RSV vaccination for individuals aged 60+, in May 2023.

-

FDA approved Pfizer Inc.'s bivalent RSV vaccine, ABRYSVO, in May 2023 to help adults 60 years of age and above avoid lower respiratory tract sickness brought on by RSV.

Geriatric Medicine Market Report Scope:

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 169.9 Billion |

| Market Size by 2032 | USD 307.4 Billion |

| CAGR | CAGR of 7.58% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Condition (Cardiovascular Diseases, Cancer, Arthritis & Bone Health, Respiratory Diseases, Neurological Disorders, Diabetes and Metabolic Disorders, and Others) • By Therapeutics (Analgesics, Antihypertensive, Proton Pump Inhibitors, Statins, Antidiabetic, Anticoagulant, Antipsychotic, and Others) • By Distribution Channel (Hospital Pharmacy, Online Pharmacy, and Retail Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | F. Hoffmann-La Roche Ltd., Takeda Pharmaceutical Company Ltd., Eli Lilly & Company, AbbiVie, Inc, Amgen, Inc, Pfizer, Inc, Novartis AG, Abbott Laboratories Inc., Bristol-Myers Squibb Company, UCB, Inc., Merck and Co., Inc, Sanofi, GSK plc, Johnson and Johnson Services, Inc., AstraZeneca PLC, and others. |