BOPET Film Market Report Scope & Overview:

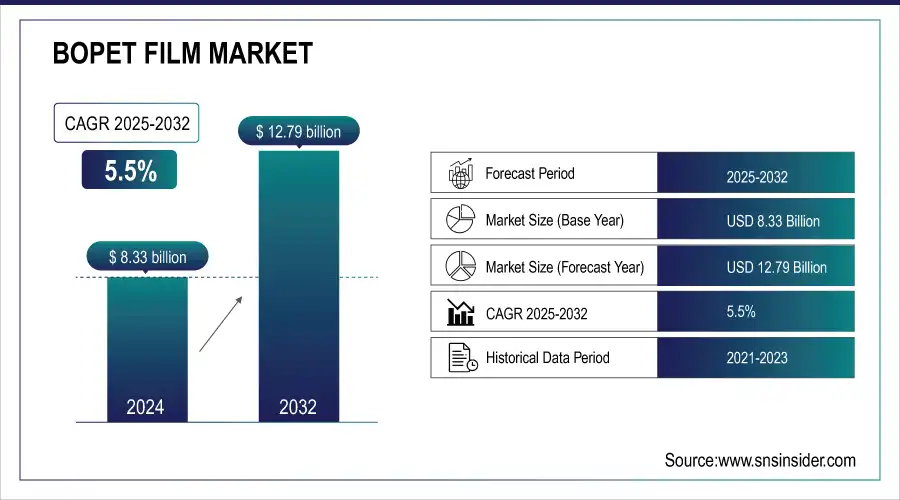

The BOPET Film Market was valued at USD 8.33 billion in 2024 and is expected to reach USD 12.79 billion by 2032, growing at a CAGR of 5.5% from 2025-2032.

Get More Information on BOPET Film Market - Request Sample Report

The BOPET (Biaxially Oriented Polyethylene Terephthalate) Film market encompasses the production and distribution of high-performance films widely used across packaging, electronics, and industrial sectors. Known for superior tensile strength, chemical resistance, optical clarity, and barrier properties, BOPET films ensure product integrity and are ideal for flexible packaging and electronic displays. Technological advancements, including precise biaxial orientation, coating techniques, and nanotechnology integration, have enhanced heat resistance, dimensional stability, and specialty functionalities like antibacterial properties. Despite strong demand, the market faces challenges from volatile raw material costs, environmental concerns, and competition from alternative substrates, prompting focus on sustainability and recycling initiatives.

BOPET Film Market Size and Forecast

-

BOPET Film Market Size in 2024: USD 8.33 Billion

-

BOPET Film Market Size by 2032: USD 12.79 Billion

-

CAGR: 5.5% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

BOPET Film Market Trends

-

Rising demand for flexible packaging and labeling in food, beverage, and pharmaceutical industries is driving the BOPET film market.

-

Increasing use in electrical, insulation, and industrial applications is boosting market growth.

-

Advancements in metallized, coated, and high-barrier BOPET films are enhancing durability, transparency, and moisture resistance.

-

Focus on lightweight, recyclable, and sustainable packaging solutions is shaping adoption trends.

-

Expansion of e-commerce and consumer goods sectors is accelerating demand for packaging films.

-

Technological innovations in film extrusion, coating, and surface treatment are improving product performance.

-

Collaborations between film manufacturers, converters, and end-use industries are fostering innovation and market penetration.

BOPET Film Market Growth Drivers:

-

Rising Demand for Lightweight, Flexible, and High-Performance Packaging Boosts BOPET Film Adoption Across Multiple Industries

The demand for lightweight, durable, and versatile packaging in food, beverages, pharmaceuticals, cosmetics, and industrial sectors is a key growth driver. BOPET films provide excellent mechanical strength, chemical resistance, thermal stability, and transparency, making them ideal for lamination, labeling, and electrical insulation applications. Increasing consumer preference for recyclable and eco-friendly packaging, along with growth in electronics, solar energy, and battery applications, further fuels adoption. Technological advancements in coated and functional films enhance barrier performance, UV resistance, and printability, supporting broader industrial applications and global BOPET Film Market expansion.

BOPET Film Market Restraints:

-

High Production Costs and Technical Limitations Challenge BOPET Film BOPET Film Market Growth

High manufacturing costs and energy-intensive production processes limit BOPET Film Market expansion. Specialized coatings, surface treatments, and precision processing increase unit costs, restricting adoption in price-sensitive regions. Limited recyclability of multi-layer BOPET films, vulnerability to UV degradation, and competition from alternative materials such as polypropylene and polyethylene act as major restraints. Strict environmental regulations, fluctuating raw material prices, and complex production processes further challenge manufacturers. These factors increase operational costs and reduce profit margins, requiring companies to focus on efficiency, sustainability, and innovation to maintain competitiveness in a rapidly evolving global packaging and industrial film BOPET Film Market.

BOPET Film Market Opportunities:

-

Expanding Applications in Renewable Energy, Electronics, and Smart Packaging Offer Significant Growth Potential

Emerging applications in flexible electronics, solar panels, lithium-ion batteries, and smart packaging create lucrative opportunities for BOPET film manufacturers. High-barrier, UV-resistant, and printable films are increasingly adopted in food and pharmaceutical packaging for enhanced shelf life and product safety. The renewable energy sector, especially photovoltaic modules, drives specialized film requirements. Increasing focus on sustainable, recyclable, and bio-based film solutions allows companies to tap into new BOPET Film Markets. Innovations in functional coatings, metallization, and surface treatments also enable entry into high-growth industrial applications. These factors collectively position the BOPET film BOPET Film Market for long-term expansion globally.

BOPET Film Market Segment Analysis

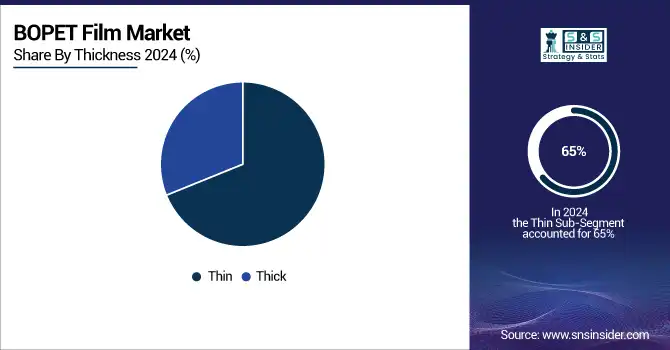

By Thickness, Thin films dominate the BOPET Film Market due to lightweight, versatility, and cost-efficiency.

Thin films dominated the BOPET Film Market in 2024 with around 65% share due to their lightweight and versatile characteristics. These films are extensively used across packaging, labeling, lamination, and electrical insulation applications. The increasing demand for lightweight, flexible, and cost-effective packaging solutions in food, cosmetics, and industrial sectors continues to drive their adoption globally, reinforcing their dominant position in the BOPET film BOPET Film Market.

By Coating Type, Coated films lead globally, offering enhanced barrier, printability, and chemical resistance.

Coated films held a dominant share of approximately 58% in 2024. Coatings enhance barrier properties, printability, and chemical resistance, making them highly suitable for food, pharmaceutical, and industrial packaging applications. They ensure protection against moisture, oxygen, and UV exposure while maintaining high-quality printing. Rising demand for protective, durable, and aesthetically appealing packaging solutions supports the widespread adoption of coated BOPET films globally.

By Product Type, Sachets dominate, driven by convenience, portion control, and low material usage.

Sachets accounted for the largest BOPET Film Market share of around 42% in 2024. Their convenience, portion control, and efficient material usage make them a preferred choice in food, beverage, pharmaceutical, and personal care packaging. Single-use and small-pack applications, especially for snacks, condiments, and sachet-based liquid products, drive demand. Increasing consumer preference for compact, hygienic, and easy-to-carry packaging continues to reinforce the dominance of sachets in the BOPET film BOPET Film Market.

By Application, Food & Beverages segment dominates, fueled by demand for protective, durable, and convenient packaging solutions.

The Food & Beverages segment dominates applications, driven by the rising demand for flexible, durable, and protective packaging solutions. BOPET films provide excellent barrier, clarity, and heat-seal properties, ensuring product freshness, safety, and extended shelf life. Increasing consumer preference for convenience, ready-to-eat, and processed foods, along with regulatory emphasis on packaging safety, supports their wide adoption. BOPET films are crucial in meeting global food packaging needs efficiently

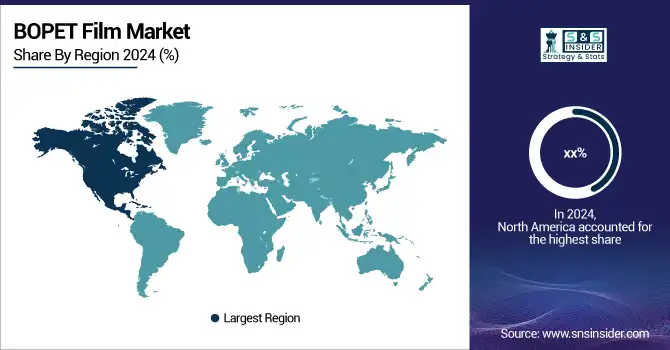

BOPET Film Market Regional Analysis

North America BOPET Film Market Insights

North America holds a significant share in the BOPET film market, driven by strong demand from packaging, electronics, and industrial sectors. The region benefits from advanced manufacturing infrastructure, high adoption of innovative films, and increasing use in flexible packaging, labeling, and electrical insulation. Rising consumer awareness for product protection, combined with technological advancements in coated and specialty films, is fueling market growth across the United States and Canada.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Asia Pacific BOPET Film Market Insights

Asia-Pacific dominates the BOPET film BOPET Film Market, accounting for the largest share due to rapid industrialization, growing packaging demand, and expansion of electronics and automotive sectors. Rising consumption in countries like China, India, and Japan drives production and adoption of BOPET films for flexible packaging, electrical insulation, and optical applications. Increasing investments in manufacturing facilities and technological advancements further strengthen the region’s leadership in the global BOPET film BOPET Film Market.

Europe BOPET Film Market Insights

Europe accounts for a substantial share in the BOPET film market, driven by demand from packaging, automotive, and electronics sectors. The region emphasizes sustainable and high-performance films, with manufacturers focusing on coated, metallized, and specialty BOPET films. Growing adoption in food, beverage, and pharmaceutical packaging, along with innovations in barrier properties, printability, and durability, is fueling market growth across countries like Germany, France, Italy, and the UK.

Middle East & Africa and Latin America BOPET Film Market Insights

The Middle East & Africa and Latin America are emerging markets in the BOPET film industry, driven by increasing packaging, automotive, and industrial applications. Rising demand for flexible, durable, and high-performance films supports growth, with food, beverage, and electronics sectors leading adoption. Investments in manufacturing facilities and expansion by key global players are further boosting market penetration. Growing awareness of product protection and quality is shaping market trends across these regions.

BOPET Film Market Competitive Landscape:

Polyplex Corporation

Polyplex Corporation, founded in 1984 and headquartered in Noida, India, is a leading manufacturer of polyester films, including BOPET (biaxially oriented polyethylene terephthalate) films for packaging, industrial, and electronic applications. The company focuses on innovation, high-quality production, and global expansion to meet increasing demand in flexible packaging and industrial sectors. Polyplex emphasizes sustainability, energy efficiency, and technological advancement in film manufacturing to strengthen its presence in domestic and international markets.

-

January 2025: Polyplex Corporation announced a ₹558 crore investment to build a new BOPET film manufacturing plant, aiming to meet the growing global demand for BOPET films.

Uflex Limited

Uflex Limited, founded in 1983 and headquartered in Noida, India, is a global leader in flexible packaging solutions and polymer-based packaging films. The company produces high-quality BOPET, BOPP, and specialty films for packaging, printing, and industrial applications. Uflex focuses on innovation, sustainability, and value-added products to meet evolving market needs, enhance product performance, and maintain a strong competitive position in the global packaging and flexible film industry.

-

February 2024: Uflex reported strong demand for its value-added BOPET films, highlighting the company's focus on innovation to maintain its market position amid a positive outlook for the packaging industry.

Key Players

Some of the BOPET Film Market Companies

-

DuPont Teijin Films U.S. Limited

-

Ester Industries Limited

-

Fatra A.S.

-

Fuwei Films (Holdings) Co., Ltd.

-

Garware Polyester Ltd

-

Jiangsu Xingye Polytech Co., Ltd.

-

Jindal Poly Films Ltd.

-

Kolon Industries, Inc.

-

Mitsubishi Polyester Film, Inc.

-

POLİNAS Plastik Sanayi ve Ticaret A.S.

-

Polyplex Corporation Ltd.

-

RETAL Industries Ltd.

-

SRF Limited

-

Sumilon Industries Ltd.

-

Terphane LLC

-

Toray Plastics (America), Inc.

-

Uflex Ltd.

-

TOYOBO CO. LTD.

-

SKC Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 8.33 Billion |

| Market Size by 2032 | US$ 12.79 Billion |

| CAGR | CAGR of 5.5% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Thickness (Thin, Thick) • By Coating Type (Coated, Non-coated) • By Product Type (Sachets, Pouches, Bags, Shrink Films, Stretch Wraps, Others) • By Application (Food & Beverages, Cosmetics, Electrical and Electronics, Industrial, Imaging, Pharmaceutical, Automotive, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | JBF RAK LLC, Polyplex, Jindal Poly Films, Toray Plastics, Uflex Ltd, Terphane LLC, Fatra A.S., Futamura Chemical, SRF Limited, Dupont Teijin Films, RETAL Industries, and other players. |

| DRIVERS | • Increase in demand for advanced packaging. • Increase in demand for BOPET packaging. • Increasing demand for Cosmetic industry. |

| RESTRAINTS | • Variation in product availability and raw material cost • Increasing awareness of environmental issues may drive demand for sustainable packaging alternatives. |