Fluoropolymer Tubing Market Report Scope & Overview:

Get More Information on Fluoropolymer Tubing Market - Request Sample Report

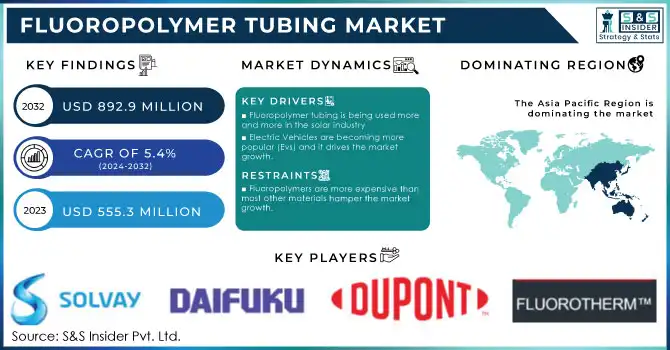

The Fluoropolymer Tubing Market Size was USD 555.3 Million in 2023 and is expected to reach USD 892.9 Million by 2032 and grow at a CAGR of 5.4% over the forecast period of 2024-2032.

Fluoropolymer tubing is used in devices such as catheters, intravenous delivery systems, and fluid monitoring tools due to its unique biocompatibility and permeability of residential or commercial properties. The biocompatibility of this technology provides safety when being in contact with bodily fluids and tissues, which is a key issue for all medical procedures. In addition, the resistance to chemicals is superior, ensuring durability when exposed to aggressive cleaning agents and pharmaceuticals, guaranteeing functionality for the long term.

The performance stability of this tubing under continuous stress (temperature swings and repeated sterilizations) will increase the suitability of this tubing for healthcare applications. Historically, fluoropolymer tubing is considered essential in modern healthcare solutions to fulfill the increasing demand for advanced medical technologies and address the growing focus on patient safety.

For instance, in 2023, Chemours launched Teflon product portfolio to meet the growing demand in healthcare and pharmaceutical sectors. The company introduced enhanced PTFE materials designed for use in critical applications such as medical catheters and surgical instruments, focusing on properties like flexibility and chemical inertness.

Fluoropolymer tubing is an essential material used in semiconductor processing because of its high chemical resistance, thermal stability, and purity. This is to prevent any aggressive chemicals used in the wafer cleaning, etch, and deposition processes during fabrication from corroding the tube and contaminating semiconductor materials. Ultra-purity standards of fluoropolymers including PTFE and PFA for transporting ultra-clean fluids and gases, factors vital for obtaining microchip fabrication precision. The semiconductor fabrication process keeps progressing to smaller node sizes and finer designs, which in turn requires more reliable, high-performance materials such as fluoropolymer tubing.

PFA tubing is resistant to a wide range of aggressive chemicals and can withstand extreme temperatures from -200°C to +260°C, making it an ideal choice for environments that demand both cleanliness and chemical stability.

Fluoropolymer Tubing Market Dynamics

Drivers

-

Fluoropolymer tubing is being used more and more in the solar industry

-

Electric Vehicles are becoming more popular (Evs) and it drives the market growth.

The rapid rise in the end-users for electric vehicles (EVs) is one of the primary drivers for market growth specifically within clean energy, automotive technologies, and materials such as fluoropolymer tubing. With widespread EV adoption on the horizon, the industry will require abundant high-performance components particularly for battery systems, power electronics, and fluid management systems, as well. Fluoropolymer tubing is essential for these applications due to its chemical resistance, strength, and high-temperature/high-pressure capabilities right where your electric vehicle systems need them. From 26 million vehicles above, an almost 60% year-on-year increase as per the International Energy Agency (IEA) in 2022, and still rising, as carbon-neutralizing policies will keep driving the demand side throughout the planet. Moreover, the improved efficiency and safety of EV batteries and charging systems will also drive the demand for materials with better insulating and thermal properties like fluoropolymer tubing, as they are required in cables and wiring systems.

The expansion of the EV market is creating demand for certain materials while also spurring larger economic changes, especially in terms of how the automotive industry innovates and how quickly we can shift to better energy solutions.

Restraint

-

Fluoropolymers are more expensive than most other materials hamper the market growth.

Fluoropolymer is costlier as compared to most of its rivals, which can be an important roadblock in the growth of the fluoropolymer market, especially in sectors that are cost-sensitive. Fluoropolymer materials have a higher price and are due to their very complex manufacturing processes, the high costs of raw materials for these materials, and the specialized equipment needed to manufacture them, such as PTFE (polytetrafluoroethylene) and PFA. Though these materials provide outstanding characteristics such as chemical resistance, high-temperature stability, and electrical insulation, the high price of such compounds prevents their widespread adoption relative to other alternatives, like PVC, rubber, or metal alloys, in cost-sensitive applications.

In relevant industries like automotive or construction, where cost control is a major driver, the initial capital expenditure of fluoropolymer parts would be a deterrent for their uptake. Though these materials promise years of reliability and performance, their high cost of entry continues to limit them to products where cheaper alternatives will not do, and in many high-volume markets where margin pressure is aplenty, this just means the relentless drive to optimize production cost.

Fluoropolymer Tubing Market Segmentation Overview

By Material

The PTFE segment held the largest market share around 32% in 2023. It possesses the most remarkable properties in comparison to other materials, which makes it the choice of material for most of the applications. Well known for its superior mechanical performance, high thermal stability, and excellent electrical insulating properties, PTFE is a suitable material in critical industries including semiconductor parent, health care, and automotive. These traits enable PTFE to work under extreme conditions that would cause other materials to wear down or break down. An example of such is polyethylene, it is commonly used for catheters and drug delivery devices owing to its biocompatibility and resistance to many solvents and bodily fluids. Furthermore, it dominates due to its capacity to withstand high temperatures and pressures in fluid transport systems, particularly evident in the semiconductor-use process.

By Application

The medical segment held the largest market share around 22% in 2023. It has the unique properties of fluoropolymers (PTFE (polytetrafluoroethylene) and PFA). Due to its biocompatibility, chemical resistance, and flexibility fluoropolymer tubing is increasingly used in medical devices such as catheters, fluid management systems, and drug delivery systems. They are made from long-lasting materials that resist the harsh chemicals commonly found in healthcare environments. Also, the fact that they do not react to any elements in any way, whether it is a drug or any bodily fluid, and hence they act as an important element in a system where precision is the key, and maintaining a high level of hygiene is also critical.

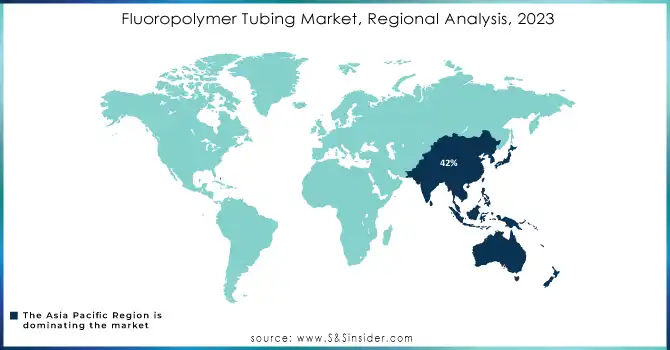

Fluoropolymer Tubing Market Regional Analysis

Asia Pacific held the highest market share around 42% in 2023. It is owing to the rapid growth of industrialization, the fast-growing sector for technological advancements, and increasing demand for high-quality materials for quality services in major industries, including healthcare, automotive, and semiconductor. Strong demand for fluoropolymer-based products for use in medical devices such as catheters and drug delivery systems, due to the region's growing healthcare infrastructure and increasing investment in medical technologies. In addition, notable countries such as China, Japan, and South Korea are key stakeholders in the semiconductor and automotive industries wherein a need for fluoropolymer tubing.

The dominance of the Asia Pacific region can also be explained by its relatively favorable government policies encouraging R&D and improved manufacturing, and a growing middle class wanting better medical treatment and consumer goods. As an example, there are policies that China has taken to improve accessibility to healthcare and support the growth of the pharmaceutical industry, and Japan remains a leader in high-tech manufacturing and continues to drive demand for exotic materials such as fluoropolymer tubing. Asia Pacific is estimated to continue to lead the fluoropolymer tubing market over the forecast period, with the region projected to be driven by economic growth and the growth of industries dependent on precision materials.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players in Fluoropolymer Tubing Market

-

Solvay SA

-

Fluorotherm

-

Optinova

-

TE Connectivity

-

3M Company

-

Honeywell International Inc.

-

Ametek

-

Swagelok

-

Kimble Chase Life Science and Research Products LLC

-

Nordson Corporation

-

Saint-Gobain Performance Plastics

-

Furon (Saint-Gobain)

-

SABIC

-

Extron

-

Advanced Fluoropolymer Products Inc.

-

Resiflex

Recent Development:

-

In 2023, Saint-Gobain expanded its range of fluoropolymer-based tubing products by launching a new high-performance PFA tubing line designed specifically for use in critical applications within the pharmaceutical and biotechnology sectors.

-

In 2023, Parker Hannifin launched a new range of high-temperature-resistant fluoropolymer tubing designed for fluid transport in industries such as aerospace and automotive.

-

In 2022, 3M Company unveiled a new PTFE-based tubing material with enhanced flexibility and durability for use in medical devices and semiconductor manufacturing. The updated formulation of 3M's fluoropolymer tubing is intended to support more demanding applications that require both chemical resistance and flexibility.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 555.3 Million |

| Market Size by 2032 |

USD 892.9 Million |

| CAGR | CAGR of 5.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (PTFE, FE,PFA, ETFE, PVDF, Others) • By Application (Medical, Semiconductor, Energy, Oil & gas, Aerospace, Automotive, Fluid Management, General Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries Ltd., Solvay SA, Fluorotherm, Dupont De Nemours, Saint-Gobain, Optinova TE Connectivity, 3M Company, Honeywell International Inc., Parker Hannifin, Ametek, Swagelok |

| DRIVERS | • Increase in Number of Older People • Fluoropolymer tubing is being used more and more in the solar industry. • Electric cars are becoming more popular (Evs) |

| Restraints | • Fluoropolymers are more expensive than most other materials. • Environmental Sustainability |