Polyols Market Report Scope & Overview:

The Polyols Market Size was valued at USD 34.39 Billion in 2023 and is expected to reach USD 57.55 Billion by 2032, growing at a CAGR of 5.89% over the forecast period of 2024-2032.

To Get more information on Polyols Market - Request Free Sample Report

The Polyols Market is evolving with growing demand across construction, automotive, and consumer goods industries. Our report explores the production capacities of key manufacturers, revealing regional supply strengths and competitive landscapes. A thorough pricing analysis of polyols highlights cost variations driven by raw materials, energy expenses, and trade policies. Investment patterns shape market expansion, and the report uncovers investment and funding trends, tracking capital flows and R&D initiatives. Efficiency remains a critical factor, making the yield and efficiency of different polyol types a focal point, comparing production processes and cost-effectiveness. Additionally, regulatory frameworks like REACH and EPA regulations influence sustainability and compliance costs. Our analysis delivers a comprehensive view of these essential factors shaping the polyols industry.

Polyols Market Dynamics

Drivers

-

Increasing Demand for High-Performance Polyurethane Foams in Furniture and Bedding is Driving Market Growth

The rising consumer preference for high-quality and durable furniture and bedding products has significantly increased the demand for polyurethane foams, which are primarily derived from polyols. These foams offer superior cushioning, comfort, and resilience, making them ideal for use in mattresses, sofas, and ergonomic seating solutions. The furniture and bedding industry have witnessed a shift toward premium and luxury products, particularly in developed economies, driving the adoption of high-performance polyols-based foams. Additionally, growing urbanization and rising disposable incomes in emerging markets have fueled the expansion of the furniture industry, further boosting polyol consumption. Technological advancements in foam production, including the development of low-emission and non-toxic polyurethane foams, have enhanced their appeal among health-conscious consumers. The increasing adoption of memory foams and pressure-relieving mattresses in the healthcare sector is another key factor contributing to market growth. With an increasing number of consumers prioritizing sleep quality and ergonomic comfort, the demand for polyols-based foams in furniture and bedding applications is expected to continue rising.

Restraints

-

Volatility in Raw Material Prices and Supply Chain Disruptions are Hampering the Polyols Market Growth

The polyols market is highly dependent on the availability and pricing of raw materials, particularly petrochemical-based feedstocks such as propylene oxide and ethylene oxide. Fluctuations in crude oil prices, driven by geopolitical tensions, trade policies, and supply chain disruptions, significantly impact the production costs of synthetic polyols. The ongoing global supply chain crisis, exacerbated by the COVID-19 pandemic and geopolitical conflicts, has led to transportation bottlenecks and increased procurement costs for raw materials. Moreover, stringent environmental regulations on petrochemical refineries and carbon emissions have resulted in fluctuating production capacities, further affecting the supply and pricing of polyols. Small and medium-sized manufacturers, in particular, face challenges in maintaining stable profit margins due to unpredictable raw material costs. These uncertainties hinder long-term investment decisions and limit the expansion of polyols production facilities, slowing overall market growth.

Opportunities

-

Advancements in Bio-Based Polyols and Green Chemistry are Creating New Market Growth Avenues

The growing focus on sustainability has led to significant research and development efforts in bio-based polyols, presenting a major growth opportunity for the market. Innovations in green chemistry, including the development of polyols derived from plant oils, castor oil, and lignocellulosic biomass, are gaining traction as viable alternatives to petroleum-based counterparts. Several manufacturers are investing in next-generation bio-polyols with improved performance characteristics, lower carbon footprints, and cost competitiveness. The increasing demand for biodegradable and non-toxic polyurethane applications in packaging, healthcare, and automotive industries is expected to drive the adoption of bio-based polyols. Moreover, favourable government policies promoting bio-based chemicals and financial incentives for sustainable product development are accelerating market expansion.

Challenge

-

High Initial Investment Costs for Bio-Based Polyols Production is Slowing Market Adoption

Despite the growing demand for sustainable alternatives, the production of bio-based polyols requires significant capital investment in feedstock processing, specialized equipment, and advanced refining technologies. The high costs associated with research and development, along with limited commercial-scale production facilities, have made bio-based polyols more expensive than their synthetic counterparts. Additionally, the complexity of raw material sourcing and processing poses challenges in achieving consistent quality and supply reliability. These cost barriers hinder the widespread adoption of bio-based polyols, particularly among small and medium-sized manufacturers with limited financial resources.

Polyols Market Segmental Analysis

By Source

Synthetic polyols dominated the polyols market in 2023 with a market share of 85.2%. The dominance of synthetic polyols is attributed to their cost-effectiveness, superior performance characteristics, and widespread availability compared to bio-based alternatives. Synthetic polyols, primarily derived from petrochemicals such as propylene oxide and ethylene oxide, offer consistent quality and higher efficiency in polyurethane foam production, which is crucial for industries such as automotive, construction, and furniture. According to the American Chemistry Council (ACC), synthetic polyols continue to witness strong demand due to their application in energy-efficient insulation foams and high-performance adhesives. Additionally, despite increasing environmental concerns, regulatory bodies such as the Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) have provided exemptions or phased regulations for certain synthetic polyols, ensuring their continued market dominance.

By Type

Polyether polyols dominated the polyols market in 2023 with a market share of 72.3%. Polyether polyols are preferred due to their superior hydrolytic stability, flexibility, and compatibility with various polyurethane applications. Their dominance is driven by their extensive use in both flexible and rigid polyurethane foams, which are essential in construction insulation, automotive seating, and furniture applications. The U.S. Department of Energy (DOE) has emphasized the importance of energy-efficient insulation materials in green building initiatives, further fueling demand for polyether polyols in rigid foam production. Additionally, major polyurethane foam manufacturers, including BASF and Dow, have continued investing in polyether polyols production, strengthening their market position. Their cost-effectiveness and ease of processing make them the preferred choice over polyester polyols in various industrial applications.

By Application

Rigid foam dominated the polyols market in 2023 with a market share of 38.5%. The increasing demand for rigid polyurethane foam in insulation applications across the construction and refrigeration industries has been a major growth driver. Government regulations, such as the U.S. Department of Energy’s energy efficiency standards, have encouraged the adoption of high-performance insulation materials to reduce energy consumption in buildings. Additionally, the European Union’s directive on nearly zero-energy buildings (NZEB) has further increased the need for polyurethane-based rigid foams. Organizations such as the American Society of Heating, Refrigerating and Air-Conditioning Engineers (ASHRAE) have highlighted the effectiveness of rigid polyurethane foam in thermal insulation, supporting its growing adoption. The expansion of cold storage facilities and refrigeration infrastructure globally has also contributed to its dominance in the polyols market.

By End-Use Industry

Building & construction dominated the polyols market in 2023 with a market share of 36.5%. The growing emphasis on energy-efficient infrastructure, coupled with increasing urbanization, has driven the demand for polyurethane-based insulation materials in the construction sector. Regulatory bodies such as the International Energy Agency (IEA) and the U.S. Green Building Council (USGBC) have been actively promoting the use of high-performance insulation solutions, including polyurethane rigid foams, to enhance building energy efficiency. Additionally, government initiatives such as tax incentives for green buildings in North America and Europe have further accelerated the adoption of polyols-based construction materials. The rising investments in smart cities, sustainable housing projects, and commercial infrastructure development continue to reinforce the dominance of the building and construction sector in the polyols market.

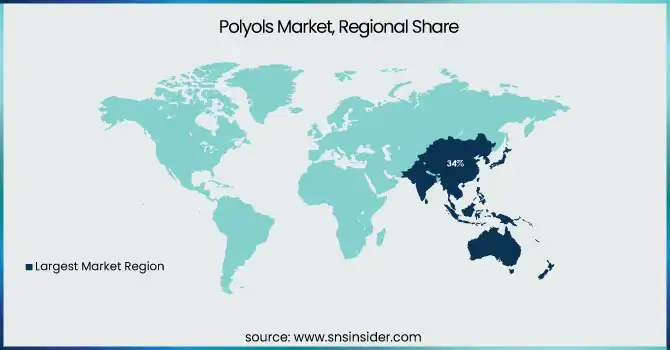

Polyols Market Regional Outlook

Asia Pacific dominated the polyols market in 2023 with a market share of 34%. The region's dominance is driven by its expanding construction, automotive, and consumer goods industries, which heavily rely on polyols-based polyurethane products. China leads the market due to its vast polyurethane foam production capacity, with the China Polyurethane Industry Association reporting steady growth in domestic consumption, particularly in insulation and furniture applications. The automotive sector in China, the world’s largest vehicle producer, further boosts polyols demand for seating and interior applications. India follows, witnessing a surge in polyurethane foam usage in residential and commercial construction, fueled by government-led infrastructure initiatives such as "Housing for All." Additionally, Japan and South Korea remain key players, with significant investments in high-performance polyurethane applications for electronics and automotive manufacturing. The presence of global manufacturers like BASF, Covestro, and Wanhua Chemical, which continue expanding production facilities in the region, reinforces Asia Pacific’s leading position in the polyols market.

North America emerged as the fastest-growing region in the polyols market, with a significant growth rate during the forecast period. The region’s growth is driven by increasing demand for sustainable and energy-efficient polyurethane-based products, particularly in insulation and automotive applications. The U.S. dominates the North American polyols market, supported by stringent energy efficiency regulations from the Environmental Protection Agency (EPA) and the U.S. Department of Energy (DOE), which promote the adoption of polyurethane insulation materials in buildings. The U.S. automotive industry also significantly contributes to polyols demand, with major manufacturers such as Ford and General Motors incorporating polyurethane foams for lightweighting initiatives. Canada follows with rapid growth in green building projects and government incentives for eco-friendly construction materials. Meanwhile, Mexico’s expanding automotive manufacturing sector, supported by foreign investments from companies like Volkswagen and Toyota, further fuels the regional demand for polyols, positioning North America as the fastest-growing polyols market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

BASF SE (Lupranol, Lupraphen, Pluracol)

-

Coim Spa (Diexter, Isoexter, Novacote Polyol)

-

Covestro AG (Arcol, Desmophen, Acclaim)

-

Emery Oleochemicals (EMEROX, Infigreen, LOXIOL)

-

Huntsman Corporation / Huntsman International LLC (Jeffol, Terol, Rubinate)

-

Jayant Agro-Organics Pvt. Ltd. (Jaypol, Bioprene, Pripol)

-

KPX Chemical Co., Ltd. (KPX Polyol, Terol, KPX Rigid Polyol)

-

Manali Petrochemicals Limited (Manol, Manapol, MPL Polyol)

-

Mitsui Chemicals (TAFMER, Excerex, Mitsui Polyol)

-

Perstorp Holding AB (Boltorn, Curalite, Polyolester)

-

PCC Group (Rokopol, Rokoflex, Rokopol RF)

-

Polygreen Chemicals (Greenpolyol, Biopolyol, Ecoflex Polyol)

-

Purinova Sp. z o.o. (Purios, Polios, Purinova Polyol)

-

Repsol SA (Repsol Pol, Repsolflex, Alcupol)

-

Shell Chemicals / Shell Plc (Caradol, Helios, Shell Polyglycol)

-

Stepan Company (Stepanpol, Stepanol, STEP-FLEX)

-

The Dow Chemical Company / Dow Inc. (Voranol, VORAPEL, VORASTAR)

-

Tosoh Corporation (Tolonate, Tocomate, Tosoh Polyol)

-

Wanhua Chemical Group Co., Ltd. (WANOL, Wannate, Wanhua Polyol)

-

Yadong Chemical Group (YD-Flex, Yadong Polyol, YD-PU Polyol)

Recent Highlights

-

October 2024: Manali Petrochemicals expanded its propylene glycol and polyester polyol production capacity in India to meet rising demand for polyurethane products across various industries, reinforcing its position in the polyols market.

-

April 2024: Sanyo Chemical partnered with Econic Technologies to develop CO₂-based polyols, promoting carbon neutrality by incorporating CO₂ into polyol production and reducing reliance on fossil fuels for more sustainable polyurethane applications.

-

May 2024: MOL inaugurated a €1.3 billion polyols complex in Hungary, enhancing Europe’s polyols industry by producing high-quality polyols for automotive and construction applications, aiming to reduce import dependency and strengthen MOL’s market position.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 34.39 Billion |

| Market Size by 2032 | USD 57.55 Billion |

| CAGR | CAGR of 5.89% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Source (Synthetic, Bio-based) •By Type (Polyether Polyols, Polyester Polyols) •By Application (Rigid Foam, Flexible Foam, Coatings, Adhesives & Sealants, Elastomers, Plasticizers, Others) •By End-Use Industry (Building & Construction, Automotive, Furnishings & Bedding, Packaging, Electronics & Electricals, Consumer Goods, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dow Inc., BASF SE, Covestro AG, Shell Plc, Huntsman International LLC, Wanhua Chemical Group Co., Ltd., Stepan Company, Repsol SA, Mitsui Chemicals, Perstorp Holding AB and other key players |