Brake Lathe Machine Market Report Scope & Overview:

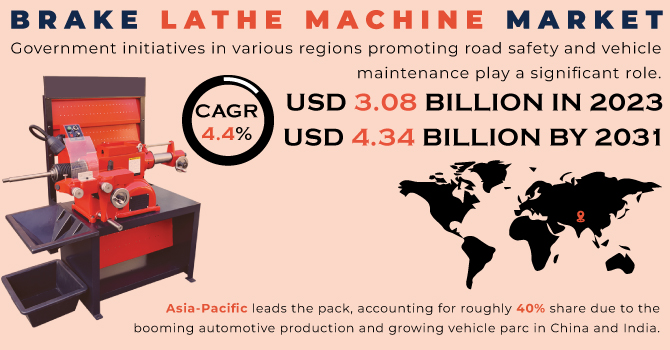

The Brake Lathe Machine Market Size was estimated at USD 3.08 billion in 2023 and is expected to arrive at USD 4.66 billion by 2032 with a growing CAGR of 4.7% over the forecast period 2024-2032. The Brake Lathe Machine Market report provides insights into production output and utilization rates across key regions, highlighting efficiency trends and operational benchmarks. It covers maintenance and downtime metrics, revealing industry best practices and reliability insights. The report also explores technological adoption, showcasing automation and digital integration trends. Additionally, export/import data presents global trade dynamics, identifying key exporting and importing nations. Emerging trends such as AI-powered diagnostics, predictive maintenance, and sustainability-driven innovations further shape the market landscape.

To get more information on Brake Lathe Machine Market - Request Free Sample Report

Market Dynamics

Drivers

-

The growing automotive industry drives demand for brake lathe machines due to the increasing need for vehicle brake system maintenance and repair services.

The growing automotive industry is a key driver of the brake lathe machine market, as the increasing number of vehicles globally leads to a higher demand for maintenance and repair services. The brake system requires periodic maintenance as the vehicle ages, including resurfacing the brake rotors for better performance. This drives the demand for brake lathe machines, which are imperative in vehicle brake repair & servicing. This has also contributed towards the development of the brake lathe machine with precision manufacturing of advanced models in the market as supported by innovations in the automotive repair technology. Additionally, through electric and hybrid vehicles that possess different brake system needs, it creates new opportunities for brake lathe machine producers. Globally, automotive sector growth and advancements in repair technology will continue to drive the demand for brake lathe machines over the forecast period.

Restraint

-

The high initial investment required for brake lathe machines can deter small and medium-sized enterprises (SMEs) from purchasing, limiting market growth.

The high initial investment required for brake lathe machines can be a significant barrier to entry, particularly for small and medium-sized enterprises (SMEs) in the automotive repair and maintenance industry. These are capital-intensive machines that need a high amount of funding for purchase, installation, and training. Because of limited budgets, the financial burden associated with advanced brake lathe machine acquisition may be hard for SMEs to absorb compared to larger firms, which can absorb such a cost. This poses a challenge to its growth, since a significant share of the target market, particularly smaller repair shops, lack resources to invest in those indispensable machines. This, in turn, may be a significant deterrent to brake lathe machines being widely adopted in emerging markets, as financial constraints are tightly strapped, which can stymie growth of the market as a whole, along with innovation in the industry at large.

Opportunities

-

The rise of electric and hybrid vehicles creates an opportunity for brake lathe machines tailored to the unique maintenance needs of their regenerative braking systems.

The shift toward electric and hybrid vehicles (EVs and HEVs) presents a significant opportunity for the brake lathe machine market. EVs and HEVs also commonly use regeneration braking systems, which aren't used in conventional vehicles, which can help minimize wear on brake components, making maintenance requirements different. However, those cars still may need brake rotor resurfacing and maintenance, especially as they age or for high-wear elements in more traditional braking systems. The increasing demand for specialized maintenance tools opens the door for brake lathe machine manufacturers to develop their respective models specific to the requirements of electric vehicles (EV) and hybrid electric vehicles (HEV). They could include precision instruments for new brake materials and automation and diagnostic capabilities to meet the particular needs of contemporary systems. With the proliferation of electric and hybrid vehicles, the requirement for such specialized equipment will only increase, benefitting the manufacturers in the brake lathe machine market.

Challenges

-

Environmental concerns about waste and emissions from brake system repairs are driving manufacturers to develop eco-friendly, sustainable brake lathe machine solutions.

Environmental concerns are increasingly influencing the automotive industry, including brake system repairs. Brake lathe machines are an essential part of brake rotor resurfacing, creating waste materials that include metal shavings and brake dust, as well as chemicals that could pose danger to the environment if not properly managed. Moreover, machinery emissions and energy consumption in operations, which are also counted as pollution. To address these issues, regulators are implementing stricter environmental standards and encouraging manufacturers to adopt sustainable practices. The increased focus is to develop more sustainable solutions like brake lathe machines with less energy consumption, less waste generation, and better waste disposal methods, to the environment and climatic conditions. Overall, machines designed for transporting and lifting can be designed to be respectful of their environment by replacing the materials used for brake rotor resurfacing, for example, as well as the components involved in the process. With these regulations becoming more and more stringent, manufacturers that focus on environmental sustainability will gain a competitive edge and stay ahead of the curve of future environmental standards.

Segmentation Analysis

By Type

The On-Car Brake Lathe Machine segment dominated with a market share of over 68% in 2023, due to its significant advantages in convenience and cost efficiency. The machine is also capable of resurfacing individual brakes while the vehicle is still on the car, reducing wheel removals and wait times. It is the favored approach for automotive theft and recovery among repair shops, saving time and labor costs while increasing operational efficiency. They can also be tailored to handle a wide range of vehicles and will be a favourite amongst garages with large and varied customers. With their user-friendliness and quick and reliable resurfacing services, On-Car Brake Lathe Machines have become the go-to option, making them the dominant player in the market.

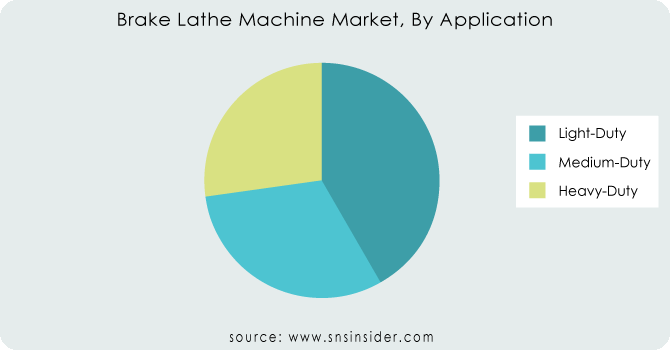

By Application

The Medium-Duty segment dominated with a market share of over 42% in 2023, due to its versatile application across a wide range of industries. Built for moderate workload, these machines find their applications in such places as automotive repair, service centers, small-to-medium production units. They are a cost-effective solution that meets performance needs, delivering enough power for multidimensional brake repair jobs without the added investment of heavy-duty machines. This gives them a way in as far as reliability, yet they are still available to businesses that get moderate volume demands. The medium-duty brake lathes are perfect for standard automotive lathes, helping them to form a dominant market presence. Their ability to meet diverse industry needs further solidifies their leading position.

By Vehicle Type

The Passenger Car segment dominated with a market share of over 62% in 2023, due to the high volume of passenger vehicles on the road globally. As cars need regular brake work, the brake lathe machine demand always prevails. New tools you need include brake drum aftermarket resurfacing and brake rotor aftermarket resurfacing machines. Brake wear is an inevitable phenomenon in daily driving, related especially to high-roading vehicles, which makes the requirement of brake lathe machines in workshops and service centers a constant one. Additionally, the increasing adoption of passenger cars, alongside greater awareness of the need for vehicle maintenance, fuels steady dominance of this segment on the brake lathe machine market. And this trend is likely to continue in the coming years.

Need any customization research on Brake Lathe Machine Market - Enquiry Now

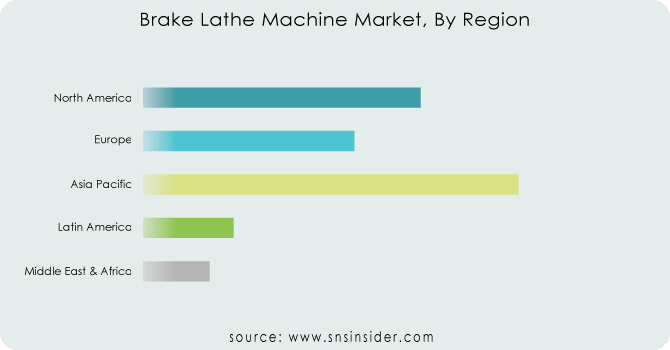

Regional Analysis

Asia-Pacific region dominated with a market share of over 42% in 2023. This is primarily due to the presence of major manufacturing hubs, particularly in countries like China, India, and Japan, which are leaders in automotive production. The rapid industrialization of the region has led to increased demand for machinery and equipment, including brake lathes, which are critical to maintaining and repairing vehicles. A growing number of automotive industries in these developing nations, coupled with increasing industrialization rates, continue to drive the demand for surface prep brake lathe machines. Asia-Pacific is a major player in this market due to the presence of many large manufacturing bases and affordable labor along with an established automotive sector.

North America is the fastest-growing region in the Brake Lathe Machine Market, fueled by a rising demand for brake lathe machines in the automotive repair and maintenance industries. With the growing demand for vehicles, and the subsequent need for servicing them at regular intervals, the need for efficient, high-performance brake lathe machines is increasing. Also, the growth of the region can be attributed to the growing advancements in technology for improving the accuracy, efficiency, and automation of brake lathe machines. The growing number of automotive repair facilities, as well as the growing acceptance of automatic solutions at auto repair facilities, are also contributing to the rapid growth of the market. Countries like the U.S. and Canada will continue to support the demand for advanced brake lathe machines, owing to infrastructure development & robust automotive sector.

Some of the major key players in the Brake Lathe Machine Market

-

Multipro Machines Pvt Ltd (Brake Lathe Machines, Drum and Disc Brake Lathes)

-

Hunter Engineering Company (Brake Lathes, Tire Changers, Wheel Aligners)

-

BendPak Inc. (9” Brake Lathes, 10” and 12” Brake Lathes, Automotive Lift Equipment)

-

Hennessy Industries, Inc. (Ammco Brake Lathes, Brake Drum/Disc Lathes)

-

ACCU−TURN (Lathe Machines for Brake Rotors and Drums)

-

Atlas Auto Equipment (Brake Lathes, Tire Changers, Wheel Balancers)

-

Sino Star Automotive Equipment Co., Ltd (Disc and Drum Brake Lathes, Tire Changers)

-

Pro-Cut International (On-car Brake Lathes, Brake Rotor Resurfacing Machines)

-

AUTOPRO-UP Co., Ltd (Brake Lathes, Tire Changers, Wheel Alignment Equipment)

-

KUKA AG (Brake Lathe Machines for Automotive Applications)

-

FARO Technologies, Inc. (3D Measurement and Brake Lathes)

-

Schwabe Maschinenbau GmbH (Brake Rotor Lathes, Disc Brake Lathes)

-

Nussbaum Automotive Solutions (Universal Brake Lathes, Disc and Drum Brake Lathes)

-

Snap-on Incorporated (Brake Lathes, Diagnostic Tools)

-

Ravaglioli S.p.A. (Brake Disc and Drum Lathes, Vehicle Lifting Equipment)

-

Bernhard Maschinenbau GmbH & Co. KG (Brake Lathes for Drums and Discs, Diagnostic Machines)

-

IRT (International Repair Technologies) (Advanced Brake Lathe Solutions, On-Car Brake Lathes)

-

Heinrich Huhn GmbH & Co. KG (Brake Lathe Machines for Cars and Commercial Vehicle)

-

TEXA S.p.A. (Brake Lathes, Diagnostic Equipment for Automotive Repairs)

-

CEMB Group (Brake Lathes, Wheel Balancing Equipment, Alignment Tools)

Suppliers for (high-quality brake lathe machines that ensure precise and accurate machining for brake discs and drums, improving vehicle safety and performance) on the Brake Lathe Machine Market

-

Hofmann (Bosch Automotive Service Solutions)

-

Tiger Tool International Inc.

-

Schwamborn Maschinen GmbH

-

Pneumatech

-

Cimcool Fluid Technology

-

Pro-Cut International

-

Lortone

-

Apex Machine Group

-

Oemeta Chemisch-Technische Spezialitäten GmbH

-

Corghi S.p.A

Recent Development

In July 2023: BendPak, Inc. expanded its operations by developing a large light industrial space in Mobile County, Ala. The new BendPak Industrial Complex, located near its East Coast campus, includes multi-use buildings for manufacturing, assembly, product testing, and distribution. The facility features advanced logistics systems designed to enhance supply chain efficiency and speed up customer deliveries.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.08 Billion |

| Market Size by 2032 | USD 4.66 Billion |

| CAGR | CAGR of 4.72% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (On-Car Brake Lathe Machine, Off-Car Brake Lathe Machine) • By Application (Light-Duty, Medium-Duty, Heavy-Duty) • By Vehicle Type (Passenger Car, Commercial Vehicle) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Multipro Machines Pvt Ltd, Hunter Engineering Company, BendPak Inc., Hennessy Industries, Inc., ACCU−TURN, Atlas Auto Equipment, Sino Star Automotive Equipment Co., Ltd, Pro-Cut International, AUTOPRO-UP Co., Ltd, KUKA AG, FARO Technologies, Inc., Schwabe Maschinenbau GmbH, Nussbaum Automotive Solutions, Snap-on Incorporated, Ravaglioli S.p.A., Bernhard Maschinenbau GmbH & Co. KG, IRT (International Repair Technologies), Heinrich Huhn GmbH & Co. KG, TEXA S.p.A., CEMB Group. |