Commercial Vehicle Telematics Market Size

Get More Information on Commercial Vehicle Telematics Market - Request Sample Report

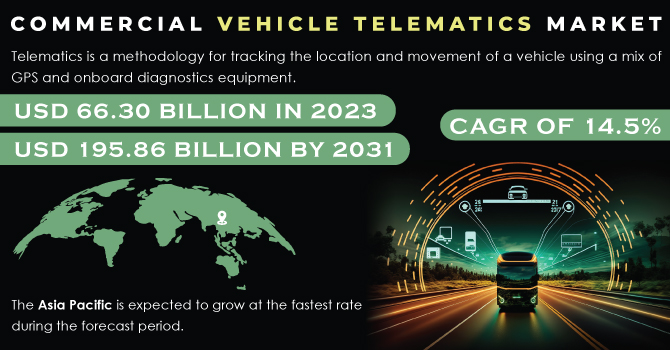

The Commercial Vehicle Telematics Market Size was valued at USD 66.30 billion in 2023 and is expected to reach USD 195.86 billion by 2031 and grow at a CAGR of 14.5% over the forecast period 2024-2031.

Faster internet, better smartphones, and the ever-growing need for safety have radically changed the telematics industry. Automakers (OEMs) are now packing advanced telematics features into all commercial vehicles, unlocking benefits like theft prevention and improved fuel efficiency. This, coupled with stricter safety regulations, rising incomes, and more affordable internet, is propelling the global commercial vehicle telematics market. However, concerns about hacking and data privacy, along with a lack of awareness about telematics, are acting as roadblocks. Thus, the surging demand for connected cars, the insurance industry's growing embrace of telematics, and the rise of emerging economies are expected to keep the market accelerating in the coming years.

| Report Attributes | Details |

|---|---|

| Market Segmentation | • by Type (Solutions, Services), • by Provider Type (OEM, Aftermarket) • by Verticals (Transportation and Logistics, Healthcare, Vehicle Manufacturers/Dealers, Insurance, Media & Entertainment, Government Agencies) |

| Regional Analysis | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Omnitracs, LLC, PTC, Inc., TomTom Telematics BV, Trimble Inc., Verizon Telematics, Inc., Mix Telematics International (PTY) Ltd., OCTO Telematics Ltd., Zonar Systems, Masternaut Limited, Microlise Group Ltd |

MARKET DYNAMICS:

KEY DRIVERS:

-

Stricter safety regulations are pushing manufacturers to adopt telematics for improved commercial vehicle safety.

The commercial vehicle telematics market is being driven by the increasing pressure for improved safety. Stricter regulations are mandating many safety features, and telematics offers a valuable tool for manufacturers to meet these requirements. By integrating telematics systems, manufacturers can gain real-time insights into vehicle health, driver behaviour, and even potential hazards. This data can then be used to improve vehicle design, implement preventative maintenance, and encourage safer driving practices, ultimately leading to a safer overall driving experience.

-

Increasing smartphone penetration facilitates communication and data access for telematics systems.

RESTRAINTS:

-

Rising hacking and privacy concerns raise security risks for commercial vehicles using telematics.

-

High upfront costs for hardware installation and software subscriptions can be a barrier for some businesses.

OPPORTUNITIES:

-

Growing consumer interest in connected car features can drive telematics adoption as a core functionality.

-

Integration with ADAS features like lane departure warnings can enhance safety and create a more comprehensive telematics package.

CHALLENGES:

-

Hacking and privacy concerns raise security risks for commercial vehicle telematics systems.

The increasing connectivity of these systems raises concerns about hacking and data privacy. Unauthorized access to vehicle data could compromise security and expose sensitive information. Additionally, concerns exist regarding how this data is collected, stored, and used. Stricter regulations and robust cybersecurity measures are crucial to ensure the safe and responsible use of telematics technology within the commercial vehicle industry.

-

High initial investment costs for hardware, software, and installation may be a barrier for some businesses.

IMPACT OF RUSSIA-UKRAINE WAR

The Russia-Ukraine war has disrupted the commercial vehicle telematics market's growth projections. Disruptions in the supply chain due to Ukraine's role in supplying key semiconductor materials could lead to a 5-10% decline in hardware production potentially delaying implementation. Thus, surging fuel prices triggered by sanctions on Russia, a major energy producer, are squeezing fleet budgets, potentially pushing telematics adoption down the priority list as businesses focus on core expenses. The war has also discouraged the economic uncertainty worldwide, leading businesses to adopt a cautious approach to new technology investments like telematics. This could cause a 2-3% dip in the projected CAGR for the market over the next two years. The governments in some regions might be forced to divert resources away from infrastructure projects that would support telematics implementation, such as smart roadways.

IMPACT OF ECONOMIC SLOWDOWN

An economic slowdown impacts the growth of the Commercial Vehicle Telematics Market. Businesses limiting their budgets in uncertain times might lead to a 5-7% decline in investments towards telematics technology. Fleet managers, wary of initial hardware, software, and installation costs, could prioritize maintaining existing operations over adopting new systems. Furthermore, a weakened demand for goods due to a slowing economy could translate to a decline in new commercial vehicle purchases, a key driver for telematics adoption as most new vehicles come pre-equipped. This could cause a reduction in the market's CAGR. Cash flow constraints during downturns can further hinder existing fleets, making it difficult to invest in upgrades or expand telematics deployments. Businesses might prioritize basic system maintenance over integrating advanced functionalities. Thus, companies might postpone fleet expansion plans due to economic uncertainty, further impacting the demand for telematics hardware and services.

KEY MARKET SEGMENTS:

By Type

-

Solutions

-

Services

Solutions is the dominating sub-segment in the Commercial Vehicle Telematics Market by type holding around 65-70% of market share. Telematics solutions offer a comprehensive package that includes hardware, software, and data analysis capabilities. This one-stop-shop approach is attractive for fleet managers seeking a complete solution for their needs. Solutions often come with features like GPS tracking, fuel management, driver behaviour monitoring, and vehicle diagnostics, providing valuable insights to optimize fleet operations.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By Provider Type

-

OEM

-

Aftermarket

OEM (Original Equipment Manufacturer) is the dominating sub-segment in the Commercial Vehicle Telematics Market by provider type. OEM telematics systems are pre-installed on new commercial vehicles during the manufacturing process. This offers several advantages for both manufacturers and fleet operators. Integration with the vehicle's onboard diagnostics system is seamless, and manufacturers can leverage economies of scale to offer cost-effective solutions. Additionally, OEM systems often come with extended warranties and manufacturer support, ensuring smooth operation.

By Verticals

-

Transportation & Logistics

-

Government & Utilities

-

Travel & Tourism

-

Construction

-

Education

-

Healthcare

-

Others

Transportation & Logistics (T&L) is the dominating sub-segment in the Commercial Vehicle Telematics Market by verticals. The T&L industry relies heavily on efficient fleet management to meet delivery deadlines and optimize costs. Telematics plays a crucial role in achieving these goals by providing real-time location tracking, route optimization, driver behaviour monitoring, and maintenance alerts. This translates to significant cost savings and improved operational efficiency for T&L companies.

REGIONAL ANALYSES

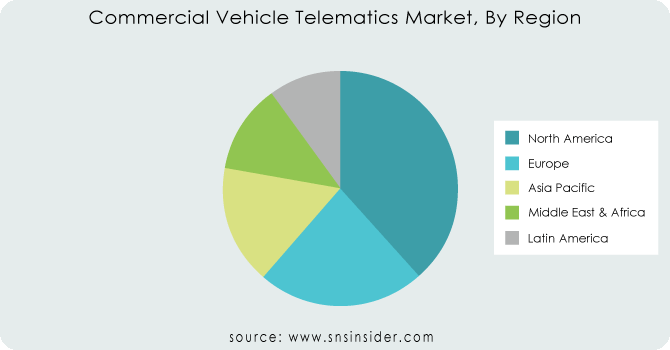

The North America is the dominating region in the commercial vehicle telematics market holding around 30-35% of market share, boasting a powerful automotive industry churning out advanced technology-equipped vehicles. Supportive government regulations mandating safety features and a well-developed infrastructure with high-speed internet and cellular networks create a fertile ground for telematics adoption.

Europe is the second highest region in this market with its own strong automotive industry actively integrating telematics solutions. Stringent safety regulations in the EU further push telematics adoption, while government initiatives promoting connected and autonomous vehicles paint a bright future for the market.

The Asia Pacific region is the fastest growing region in this market fueled by rapid economic expansion, particularly in China and India, leading to a sharp rise in commercial vehicle demand. Increasing disposable incomes and urbanization are driving the adoption of telematics for fleet management and logistics optimization.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are Omnitracs, LLC, PTC, Inc., TomTom Telematics BV, Trimble Inc., Verizon Telematics, Inc., Mix Telematics International (PTY) Ltd., OCTO Telematics Ltd., Zonar Systems, Masternaut Limited, Microlise Group Ltd. and other key players.

Vontier Corporation-Company Financial Analysis

RECENT DEVELOPMENTS

-

In Dec. 2023: Verizon Connect has improved its GPS fleet tracking software with a variety of updates. This includes additional language support for the vehicle management section within user accounts, along with more comprehensive address details in CARB reports. Additionally, the update addresses any existing software bugs.

-

In Dec. 2023: Trimble's TMT Fleet Management Platform received a significant update. The new version boasts an improved application programming interface (API) capable of handling large amounts of data. This ensures the system accurately generates the next inspection ticket number without any issues.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 66.30 Billion |

| Market Size by 2031 | US$ 195.86 Billion |

| CAGR | CAGR of 14.5% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Type (Solutions, Services), • by Provider Type (OEM, Aftermarket) • by Verticals (Transportation and Logistics, Healthcare, Vehicle Manufacturers/Dealers, Insurance, Media & Entertainment, Government Agencies) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Omnitracs, LLC, PTC, Inc., TomTom Telematics BV, Trimble Inc., Verizon Telematics, Inc., Mix Telematics International (PTY) Ltd., OCTO Telematics Ltd., Zonar Systems, Masternaut Limited, Microlise Group Ltd |

| Key Drivers | •Increased NGTP deployment would improve telematics service delivery. •One of the primary factors driving the global market's growth is the rising number of traffic accidents. |

| RESTRAINTS | •Increased communication has resulted in security and privacy concerns. •Telematics has yet to enter several countries as a young technology, further impeding the market growth. |