Spray Pyrolysis Market Report Scope & Overview:

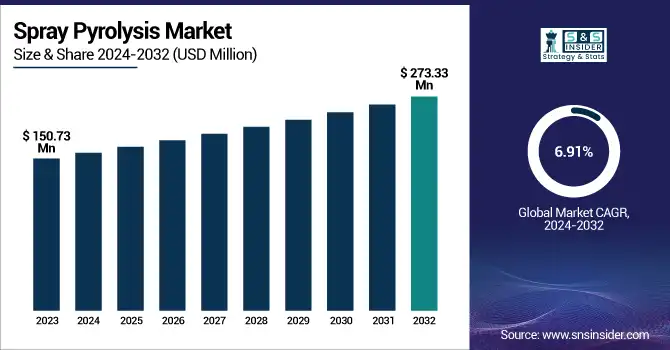

The Spray Pyrolysis Market Size valued at USD 150.73 Million in 2023 and is expected to reach USD 273.33 Million by 2032, growing at a CAGR of 6.91% during the forecast period 2024-2032.

To Get more information on Spray Pyrolysis Market - Request Free Sample Report

The Spray Pyrolysis Market is experiencing rapid growth due to its wide range of applications in thin-film production, nanoparticle synthesis, and new coating technologies. The method allows for controlled material synthesis and deposition at the micro- and nano-level, which makes it suitable for use in energy, electronics, and biotechnology industries. Growing investments in clean energy technologies, semiconductors, and pharmaceutical research are driving market growth. It also analyzes key players, emerging opportunities, and challenges, presenting an overall picture of how the changing landscape unfolds until 2032.

The U.S. Spray Pyrolysis Market was valued at USD 22.12 Million in 2023 and is expected to reach USD 44.31 Million by 2032, registering a CAGR of 8.10% during the forecast period of 2024 to 2032. The United States Spray Pyrolysis Market is growing strongly as demand for next-generation materials for energy storage, semiconductors, and biotechnology grows. Spray pyrolysis is being taken up by more U.S. research institutions and manufacturers for synthesizing nanoparticles and depositing thin films, especially in battery production and photovoltaics. Support from the federal government for clean energy technologies and innovation is further driving adoption. In addition, the extensive presence of the electronics and pharmaceutical industries is driving localized demand.

Spray Pyrolysis Market Dynamics

Key Drivers:

-

Trends in the growing application of nanomaterials for energy and electronics applications drive the spray pyrolysis market growth.

The increasing application of nanomaterials in energy storage devices, solar cells, and semiconductor fabrication is immensely fueling the uptake of spray pyrolysis. The technique allows the controlled preparation of nanoparticles and thin films with high purity and homogeneity necessary for future battery electrodes, fuel cells, and microelectronic devices. U.S. and international R&D organizations are ramping up investment in nanotechnology, and spray pyrolysis is now a method of choice for cost-effective, scalable production. As industries move towards miniaturization and improved material performance, the need for precision coating and material deposition is likely to propel future market growth.

Restrain:

-

High Capital Costs Involved with Equipment and Process Setup Restrain the Spray Pyrolysis Market Growth.

One of the major restraints on the spray pyrolysis industry is the huge initial outlay for the installation of equipment, automation, and facilities. The process requires high-specialty systems to achieve high-temperature conditions, precise spray systems, and atmospheres, thus being capital intensive. Furthermore, systems suitable for research and industrial production vary significantly in terms of price and sophistication, and their adoption by small and medium-scale enterprises can be impeded. Although long-term operating effectiveness and product uniformity are beneficial, the initial expenditure discourages large-scale market access, particularly in developing economies. The cost obstacle is a critical problem for new market entrants and restricts access to technology across industries.

Opportunities:

-

Growing Use of Spray Pyrolysis in Biotech and Pharma Industries Presents Lucrative Growth Opportunities.

The expanding application of spray pyrolysis in pharmaceutical and biotech industries offers a viable growth prospect for the industry. This technique enables accurate formulation of nanoparticles for drug delivery, vaccine carriers, and biocompatible coatings. With biologics and targeted therapies on the rise, the need for uniform nano-scale carriers is increasing. Spray pyrolysis provides scalable and reproducible manufacturing of active ingredients and encapsulated agents, making it extremely appropriate for next-generation pharma applications. The increasing emphasis on personalized medicine and nanomedicine, together with increased R&D expenditures in the U.S. and Europe, set this market segment up for robust future growth.

Challenge:

-

Achieving Uniformity and Reproducibility in Large-Scale Spray Pyrolysis Systems Continues to Present a Fundamental Operational Challenge.

Although spray pyrolysis performs excellently at laboratory-scale and pilot-scale utilization, consistent performance in large-scale manufacturing situations continues to be technically problematic. Even droplet uniformity, temperature control, and reaction kinetics are hard to achieve at scale. Any fluctuation can cause non-uniform particle sizes, faulty films, or compromised material efficiency. Product performance is affected, especially in high-stakes applications such as semiconductors and energy storage. Producers have to spend on sophisticated monitoring, control systems, and process optimization to counteract scale-related variations. This operational complexity incurs cost and time and represents a significant obstacle towards extensive industrial take-up of the technology.

Spray Pyrolysis Market Segments Outlook

By Device Type

The Ultrasonic Spray Pyrolysis System segment dominated the Spray Pyrolysis Market in 2023 with a 31.59% revenue share due to its high accuracy in the manufacture of uniform particle sizes and thin films. The system finds extensive application in research and large-scale production for photovoltaic, sensor, and battery material applications. In recent trends, organizations such as Sono-Tek Corporation have developed their ultrasonic coating systems specifically designed for nano-material deposition. Similarly, PI-KEM Ltd introduced scalable ultrasonic systems targeting academia and industry. With rising demand for advanced material synthesis in electronics and clean energy, the ultrasonic segment is expected to maintain its dominance in the overall market.

The Flame Assisted Spray Pyrolysis System segment is projected to grow at the fastest CAGR of 9.60% during the forecast period, fueled by its ability to rapidly produce high-purity nanoparticles and metal oxides. This technology is gaining acceptance in energy storage, catalysis, and environmental sectors because of its cost savings and high thermal efficiency. New product developments, for instance, NOVA SCIENTIFIC's flame-assisted reactors for the bulk synthesis of metal oxides, and Promethean Particles' research on flame-based nanoparticle synthesis, have boosted adoption. With industries demanding scalable and efficient deposition technologies, this segment's growth tracks perfectly with the changing needs of the Spray Pyrolysis Market.

By Process

The slow Pyrolysis system segment led the Spray Pyrolysis Market with a revenue market share of 38.57% in 2023 due to its broad use in manufacturing thick films, battery coatings, and catalysts owing to its accurate thermal control and stability. Advanced slow pyrolysis equipment specific to material R&D and low-rate deposition requirements were introduced by firms such as ULVAC Technologies and PI-KEM. Recent product advances by Buchi Labortechnik AG also focused on enhanced temperature homogeneity and gas flow systems. These advances are indicative of industry confidence in slow pyrolysis for reproducible film quality and intricate layering, well in accordance with energy and electronics market requirements in spray pyrolysis.

The Flash Pyrolysis segment is anticipated to expand with the highest CAGR of 8.25% over the forecast period due to rising demand for fast nanoparticle synthesis and high-throughput thin-film deposition. Flash pyrolysis allows for near-instantaneous thermal reactions, which are suitable for mass production in next-generation photovoltaics and biomedical coatings. Players such as Nabertherm GmbH and Carbolite Gero have introduced compact, high-temperature flash pyrolysis units that are compatible with automated spray systems. These developments add scalability and process speed, closely matching market requirements for low-cost, high-efficiency manufacturing.

By Application

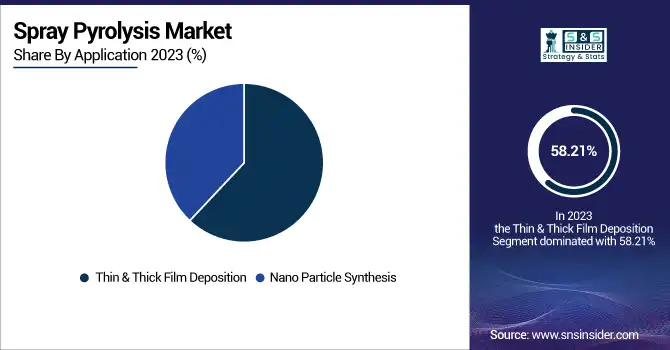

The Thin & Thick Film Deposition segment led the Spray Pyrolysis Market with a revenue share of 58.21% in 2023, supported by universal use in photovoltaics, sensors, and electronics. The method allows the accurate deposition of homogeneous films at a low cost, which is crucial for manufacturing solar cells and display panels. Applied Materials and ULVAC Technologies, among other firms, have improved film deposition through the incorporation of spray-based coating systems into thin-film production lines. ULVAC's product improvements in oxide film deposition, for example, fit with the capabilities of spray pyrolysis. This segment's growth is a testament to the increasing need for efficient and scalable material deposition solutions across the world.

The Nano Particle Synthesis segment is expected to advance at the highest CAGR of 10.39% over the forecast period, driven by its application in drug delivery, catalysis, and battery technologies. Spray pyrolysis allows for the precise control of particle morphology and composition, which is critical for next-generation material innovation. Firms such as Avantor and American Elements are investing in nano-formulation facilities through spray pyrolysis for bespoke powders and nano-oxides. Avantor, in 2024, broadened its high-purity nanomaterial product line applied to biomedical research. The growth of the segment highlights how spray pyrolysis is becoming a go-to tool in the R&D of advanced materials, especially in pharmaceuticals and clean energy industries.

By End Use Industry

In 2023, the Energy & Utilities segment was the leading revenue share of 36.65% in the Spray Pyrolysis Market due to increasing demand for efficient energy storage and renewable technologies. Spray pyrolysis is extensively employed for the fabrication of thin films in solar cells and the synthesis of battery electrode materials. First Solar and Contemporary Amperex Technology Co., Limited (CATL) are some examples of companies that have escalated R&D into spray-based coating technologies to increase energy output and battery life. The introduction of high-performance thin-film solar modules and solid-state battery materials has also increased the significance of spray pyrolysis for large-scale clean energy applications.

The Pharmaceutical & Biotechnology segment is expected to advance at the highest CAGR of 8.84% during the forecast period, driven by the growing use of nanotechnology in drug delivery and vaccine development. Spray pyrolysis facilitates the synthesis of uniform nanoparticles and encapsulated materials essential for next-generation therapeutics. In 2023, Pfizer and Moderna, among other companies, broadened their nanomedicine R&D pipelines, with innovations aimed at targeted drug release and bioavailability. Product innovations like nanoparticle-vaccine and aerosolize treatment highlight the role of scalable and reproducible synthesesomething for which spray pyrolysis is well suited—a critical technology in next-gen.

Spray Pyrolysis Market Regional Analysis

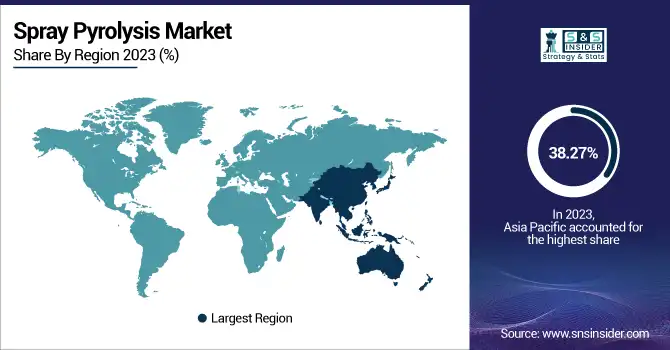

In 2023, the Asia Pacific region dominated the Spray Pyrolysis Market with 38.27% of the total revenue, powered by strong electronics, solar energy, and advanced materials demand. China, Japan, and South Korea are among the countries that have large semiconductor and photovoltaic companies investing in thin-film deposition and nanoparticle synthesis. For example, Panasonic and TSMC have increased research and development of nano-coating methods, while Japanese universities launched spray pyrolysis technologies for solar coatings. The robust manufacturing base of the region, positive government initiatives, and increasing use of precision materials all continue to underpin its dominance in this emerging market.

North America is expected to advance at the highest CAGR of 8.49% during the forecast period, driven by developments in nanotechnology, biomedical engineering, and energy storage. Companies in the U.S. such as Applied Materials and Thermo Fisher Scientific are pioneering nanoparticle manufacturing and surface alteration with spray pyrolysis methods. Recent product releases addressing lithium-ion batteries and bio-compatible coatings indicate heightened commercialization in high-tech areas. Furthermore, high federal support for clean energy and biotech R&D provides an enabling environment for the adoption of spray pyrolysis. The growth demonstrates the region's focus on scalable, high-performance material processing for novel industrial and medical use.

Get Customized Report as per Your Business Requirement - Enquiry Now

Spray Pyrolysis Market Key Players are:

-

Sono-Tek Corporation – (ExactaCoat OP400, FlexiCoat Ultrasonic Spray System)

-

Holmarc Opto-Mechatronics Pvt. Ltd. – (Spray Pyrolysis Equipment HO-TH-04, Automated Thin Film Coating System HO-TH-06)

-

Chemat Technology Inc. – (Spin-Coater SC-200, Spray Pyrolysis Unit SP-100)

-

S3 Alliance GmbH – (Custom Spray Coater Systems, Nano Particle Deposition Tools)

-

Nanosonic Inc. – (NanoSpray Thin Film Coater, Smart Coating Solutions)

-

Apex Instruments Co. Pvt. Ltd. – (Thermal Spray Coating Unit, Automated Pyrolysis Coater)

-

EFD Induction – (Induction Heating Spray Systems, Precision Coating Units)

-

Beneq Oy – (TFS 200 Thin Film System, EasySpray Coating System)

-

Crest Ultrasonics Corp. – (Ultrasonic Spray Coating Systems, Nano Particle Deposition Units)

-

Mott Corporation – (Porous Metal Spray Diffusers, Gas Distribution Coating Solutions)

-

Hansun – (Ultrasonic Atomizing System, Nano Spray Pyrolysis Coater)

-

MTI Corporation – (EQ-SP-100 Spray Pyrolysis System, EQ-SC-200 Coating System)

-

Zhengzhou CY Scientific Instrument Co., Ltd. – (CY-SP-500 Spray Pyrolysis Coater, CY-TH-04 Film Deposition Unit)

-

Acmefil Engineering Systems Pvt. Ltd. – (Thermal Spray Drying System, Advanced Pyro-Coating Plant)

-

Cheerssonic Ultrasonic Equipments Co., Ltd. – (CU-700 Ultrasonic Spray Nozzle, Ultrasonic Coating System CU-500)

-

Siansonic – (SNG2000 Spray Coater, SNC1000 Thin Film System)

-

Navson Technologies Pvt. Ltd. – (NanoSpray Film Coater, NavCoat Pro-Series Spray Unit)

-

Shanghai Huashao Intelligent Equipment Co., Ltd. – (HS-SPX Spray Pyrolysis Equipment, HS-TFC Thin Film Coating Machine)

Recent Development

-

March 2025 – Sono-Tek announced the launch of a new ultrasonic spray pyrolysis system designed specifically for nanoparticle coatings on battery electrodes and fuel cells. This system offers enhanced control over droplet size and substrate uniformity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 150.73 Million |

| Market Size by 2032 | US$ 273.33 Million |

| CAGR | CAGR of 6.91% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type – (Ultrasonic Spray Pyrolysis System, High-Throughput Spray Pyrolysis System, Vacuum Spray Pyrolysis System, Flame Assisted Spray Pyrolysis System) • By Process – (Slow Pyrolysis, Fast Pyrolysis, Flash Pyrolysis) • By Application – (Thin & Thick Film Deposition, Nano Particle Synthesis) • By End Use Industry – (Energy & Utilities, Electronics and Semi-Conductors, Chemical & Petrochemical, Pharmaceutical & Biotechnology) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sono-Tek Corporation, Holmarc Opto-Mechatronics Pvt. Ltd., Chemat Technology Inc., S3 Alliance GmbH, Nanosonic Inc., Apex Instruments Co. Pvt. Ltd., EFD Induction, Beneq Oy, Crest Ultrasonics Corp., Mott Corporation, Hansun, MTI Corporation, Zhengzhou CY Scientific Instrument Co., Ltd., Acmefil Engineering Systems Pvt. Ltd., Cheerssonic Ultrasonic Equipments Co., Ltd., Siansonic, Navson Technologies Pvt. Ltd., Shanghai Huashao Intelligent Equipment Co., Ltd. |