Process Analyzer Market Scope & Overview:

To get more information on Process Analyzer Market - Request Free Sample Report

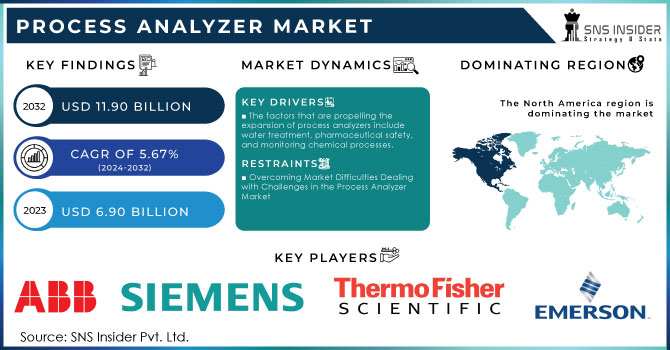

The Process Analyzer Market size was estimated at USD 6.90 billion in 2023 and is expected to reach USD 11.90 billion by 2032 at a CAGR of 5.67 % during the forecast period of 2024-2032.

The process analyzer market is experiencing significant growth driven by the increasing demand for sustainable water management and stringent regulatory compliance. In 2023, the sales of advanced water quality analyzers saw a notable 50 % increase, reflecting a heightened focus on managing potable and wastewater supplies more sustainably amidst shifting weather patterns and stricter regulations. This surge in demand underscores the growing importance of accurate and reliable water measurement to ensure environmental protection and regulatory adherence. For instance, water analyzers like the Aztec 600, which can measure parameters such as ammonia, iron, and phosphate, play a crucial role in optimizing water treatment processes and maintaining water quality. This rise in analyzer adoption is fueled by the need to manage extremes in weather conditions that affect water quality, necessitating continuous and precise monitoring. Regulatory pressures, such as the reduction of phosphate consent levels to 0.1 mg/l, further drive the market, compelling utilities to implement advanced treatment processes and monitor parameters with high accuracy. Additionally, the trend towards incorporating optical sensor technology and other innovations enhances the capabilities of water analyzers, contributing to the market’s expansion. The process analyzer market’s growth is closely linked to these factors, as it addresses the critical need for real-time data collection and analysis in a rapidly evolving environmental landscape. The acquisition of companies specializing in water analysis and optical sensor technologies also highlights the sector’s potential and its pivotal role in advancing sustainable water management practices.

The process analyzer market is experiencing robust growth, driven by increasing regulatory requirements and the need for enhanced safety and efficiency in handling volatile components. This surge is exemplified by a 50 % increase in sales of advanced water quality analyzers in 2023, highlighting the industry's response to stricter environmental and safety regulations. Modern process analyzers are critical in various sectors, including petrochemicals, pharmaceuticals, and environmental management, where they provide high-speed, accurate measurements of volatile substances like gases and liquids. The necessity for such precision is underscored by regulatory frameworks such as OSHA's Hazard Communication Standard (29 CFR 1910.1200), which mandates comprehensive worker education and training on chemical hazards, and establishes permissible exposure limits (PELs) to safeguard worker health against toxic substances. For example, OSHA's standards set enforceable PELs for airborne concentrations of hazardous chemicals, with over 500 limits established to protect workers from health effects like irritation, sensitization, and carcinogenicity. Additionally, agencies like NIOSH and Cal/OSHA provide supplementary guidelines and recommendations, further emphasizing the need for advanced analytical tools to comply with these standards. In the context of process analyzers, these regulations drive the demand for technologies capable of delivering precise and real-time data, crucial for managing hazardous chemicals and ensuring workplace safety. The growth in the process analyzer market reflects the increasing emphasis on regulatory compliance and the need for accurate, high-speed analysis in volatile and hazardous environments.

MARKET DYNAMICS

-

The factors that are propelling the expansion of process analyzers include water treatment, pharmaceutical safety, and monitoring chemical processes.

A significant factor is the increasing need for more advanced water and wastewater treatment options. Process analyzers are crucial in these situations as they constantly observe and evaluate the chemical makeup of water and wastewater, guaranteeing that treatment procedures are efficient and meet strict environmental laws. The use of process analyzers has become crucial due to rising worries about water pollution and the importance of sustainable water resource management. The EPA states that stricter regulations for water quality call for precise and dependable analytical instruments. In the pharmaceutical sector, the increasing focus on drug safety and quality control is driving up the need for process analyzers. These analyzers are crucial for ensuring pharmaceutical products adhere to strict standards and regulations. Accurate measurements of important factors are given during the manufacturing of drugs, playing a vital role in upholding top-notch quality and safety. The FDA stresses the significance of strong analytical techniques in pharmaceutical production to adhere to good manufacturing practices (FDA).Moreover, the growth of the chemicals and petrochemicals sectors plays a major role in the rising demand for process analyzers. These sectors need precise and live monitoring of chemical procedures to improve efficiency and ensure safety regulations are upheld. As the industries expand and develop, there is an increasing need for sophisticated analytical tools that can manage intricate and changing chemical processes.

-

The Function of Analytical Instruments in Achieving Water Quality Regulations

The significant growth of the process analyzer market is largely due to the increasing industrial use in water treatment, pharmaceuticals, and petrochemicals. The increasing desire for advanced analytical instruments is mainly caused by the requirement for accurate and dependable measurement systems to enhance operations, guarantee product excellence, and comply with strict regulatory guidelines. Process analyzers are essential for overseeing and controlling water quality in the water and wastewater treatment sector, as emphasized by the U.S. Environmental Protection Agency (EPA). The EPA's strict regulations on water quality, as outlined in Section 304(a)(1) of the Clean Water Act, mandate the use of sophisticated analytical tools to meet water quality standards (EPA Water Quality Standards). These guidelines, which outline standards for pollutants like nutrients and chemicals, require accurate measuring to safeguard aquatic life, wildlife, and human health from the harmful impacts of pollution. Rising worries about water pollution and the promotion of sustainable water management practices are heightening the need for advanced water analysis technologies. Process analyzers allow for continuous monitoring of water quality parameters, guaranteeing the effectiveness of treatment processes and compliance with regulations. The demand for these tools is shown in the increasing market as industries strive to incorporate high-tech solutions to handle complicated water quality issues and adhere to changing regulations. As the need for better water treatment options increases due to regulations and environmental issues, the market for process analyzers is predicted to grow as technology advances and they are used more in different industries.

Restraints

-

Overcoming Market Difficulties Dealing with Challenges in the Process Analyzer Market

Although the process analyzer market shows promising growth, there are various obstacles hindering its expansion. A major challenge is the expensive initial investment required for buying and setting up advanced process analyzers. These advanced tools frequently have a high cost, making them difficult for small businesses or organizations with restricted funds. Moreover, the complicated installation and operation of these analyzers make it even more difficult for them to be adopted. The complex setup processes and the requirement for compatibility with current systems may discourage potential purchasers and postpone implementation. Another problem involves the continuous need for maintenance and the necessity of having skilled personnel to effectively operate these systems. Process analyzers need to be calibrated, serviced, and supported regularly to ensure their accuracy and reliability. The lack of skilled professionals with the required knowledge to handle and fix these intricate devices can restrict their efficient utilization. Moreover, the swift rate of technological progress in the industry introduces an additional level of complication. Organizations need to consistently spend on improvements and education to stay current with advancing technologies, which can require a significant amount of resources. Nevertheless, there is hope that continuous progress in technology will eventually solve these difficulties. Efforts to simplify installation procedures, lower expenses, and create more accessible systems are anticipated to alleviate some of these obstacles.

KEY MARKET SEGMENTATION

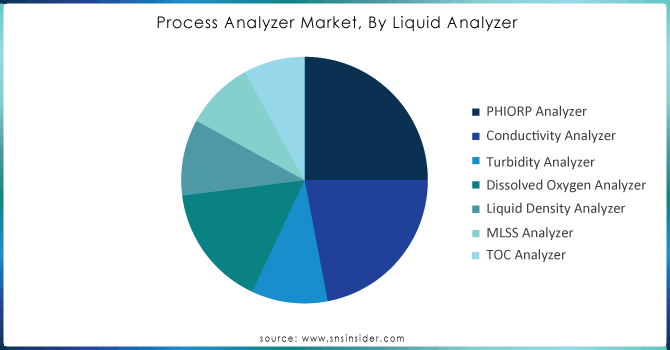

By Liquid Analyzer

Based on Liquid Analyzer, PHIORP Analyzer is holding the largest share in Process Analyzer with 25% of share in 2023. Their importance is due to their key function in a variety of industrial uses, such as water treatment, chemical processing, and the food and beverage sectors. pH/ORP analyzers play a crucial role in determining the acidity, alkalinity, and redox potential of liquids, which is essential for maintaining efficiency and following regulations. Endress+Hauser and Emerson Electric are leading the way in innovation within this industry. Endress+Hauser provides pH/ORP sensors with Memosens technology for accurate, stable measurements and increased dependability in challenging conditions. Their pH 300 and ORP 300 products incorporate advanced digital communication to simplify calibration and maintenance. Emerson Electric's Rosemount 3051S series showcases innovation as well, with intelligent sensor technology that improves precision and lowers maintenance requirements. Their analyzers are created for various uses, providing strong performance even in difficult situations. Moreover, Yokogawa Electric Corporation and other companies are enhancing pH/ORP measurement technology through their analytical solutions, with a specific emphasis on enhancing sensor durability and measurement stability. These advancements are expanding the limits of liquid analysis, enhancing the efficiency and user-friendliness of pH/ORP analyzers. The ongoing advancements in sensor technology and digital communication are anticipated to strengthen the position of pH/ORP analyzers in the market by aligning with changing industrial needs and upholding their vital role in maintaining process quality and safety.

Need any customization research on Process Analyzer Market - Enquiry Now

By Air Analyzer

Based on Air Analyzer, Oxygen Analyzer is dominate the Process Analyzer market with 25% of share in 2023. This control originates from the important function oxygen analyzers serve in different sectors like petrochemicals, power generation, and environmental monitoring. These tools are vital for gauging oxygen levels in both gases and liquids, a critical factor for regulating processes, ensuring safety, and meeting regulatory standards. Siemens, Thermo Fisher Scientific, and ABB are leading the way in innovation in this industry. Siemens' Siprocess GA700 exemplifies their progress with precise zirconia sensors that provide dependable and precise oxygen readings, even in challenging environments. This model seamlessly merges with digital platforms to improve data analysis and streamline processes. In the same way, the Oxygen Analyzer Model 7000 Series by Thermo Fisher Scientific utilizes advanced paramagnetic technology, providing enhanced sensitivity and stability. This new development enables accurate oxygen measurement in a variety of uses, ranging from environmental monitoring to industrial processes. ABB's AZ Instrumentation boosts market dominance with their extremely dependable Rosemount 6888 Oxygen Analyzer, utilizing cutting-edge electrochemical sensors for accurate data and strong performance in tough conditions. The widespread use of oxygen analyzers is being propelled by advances in technology that enhance measurement accuracy, operational efficiency, and integration with current systems. With a focus on safety, efficiency, and environmental compliance, the market for oxygen analyzers is expected to continue growing due to ongoing innovations that enhance their importance in process management and control within industries.

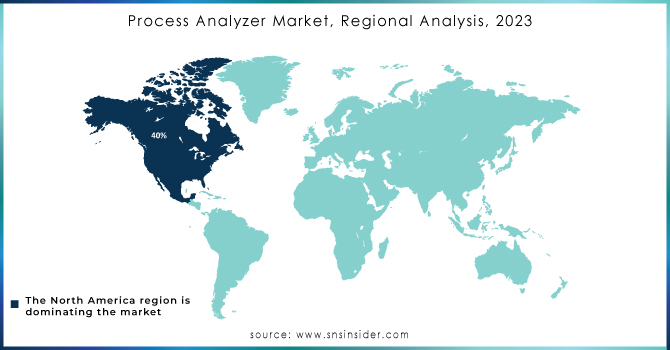

REGIONAL ANALYSES

North America is capturing the largest share revenue in process Analyzer market with 40% of share in 2023. The region's strong industrial foundation, strict regulations, and high need for advanced process control technologies contribute to its dominance. Prominent firms in the area, like Emerson Electric, Honeywell International, and Endress+Hauser, play a crucial role in upholding North America's market dominance with ongoing innovation and strategic release of products. Emerson Electric improved its position with the launch of the Rosemount 8800 Series, which includes advanced diagnostics and real-time analytics to enhance process accuracy and operational efficiency. Honeywell International's latest Experion Process Knowledge System combines high-tech analyzers with cutting-edge software solutions, allowing for improved process monitoring and management. The release of the Proline 300 series by Endress+Hauser showcases their innovation in providing advanced analyzers that are easier to use and maintain. The dedication of these companies to technological advancements such as digitalization, artificial intelligence integration, and automation strengthens North America's prominent position in the process analyzer market. Their advancements cater to intricate industry demands and comply with changing regulations and sustainability goals, boosting the region's market share and growth potential.

Europe is the second fastest growing region with CAGR OF 5.67% over the forecast period of 2024-2032. This significant expansion is fueled by various factors, such as the region's emphasis on industrial automation, strict environmental rules, and the rising use of advanced analytical technologies in different sectors. European nations are focusing on improving process effectiveness and following environmental regulations, resulting in a rise in the need for advanced process analyzers. Breakthroughs from top European firms are essential for this expansion. An example of this is the SITRANS FS230 from Siemens, a state-of-the-art flow analyzer that offers precise readings for important process tasks, improving precision and effectiveness. ABB has introduced the OPTIMAX 5000, a multi-parameter analyzer that incorporates real-time data integration and process optimization, enhancing operational reliability and minimizing downtime. Moreover, the European Union's Green Deal expansion and other sustainability efforts are speeding up the uptake of process analyzers, with industries striving to comply with strict environmental regulations and cut down on carbon emissions. Endress+Hauser and VEGA Grieshaber are enhancing technologies like integrated digital solutions and wireless communication, contributing to the growth of the European market through increased research and development investments. With Europe increasingly adopting technological advancements and regulatory improvements, the process analyzer market in the region is poised for strong growth, highlighting its crucial contribution to industrial development and sustainability initiatives.

Key Players

The major key players are ABB, Emerson, Siemens, Endress+Hauser, Yokogawa Electric Corporation, Mettler-Toledo, Suez, Thermo Fisher Scientific, Ametek, Anton Paar, Hach, Shimadzu, Jumo, Applied Analytics, Vega Grieshaber and others.

RECENT DEVELOPMENT

-

In June 2022, Process Insights, a company in the Union Park Capital portfolio, bought the assets of the Process Analyzers department from Schneider Electric. Through this purchase, Process Insights has increased and enhanced its range of technology and analytical instruments.

-

In September 2022, the Seattle-Tacoma airport met pollution standards by utilizing a TOC analyzer. The evaluation relies on detection through UV persulfate oxidation. The airport engineers opted for the TOC Analyzer to replace the current equipment on site.

-

In 2021, Endress+Hauser To increase accuracy and save maintenance costs, Endress+Hauser introduced the "Memosens 2.0" line of liquid analysis sensors. For LoT, the brand-new Memosens 2.0 technology is perfect.

| Report Attributes | Details |

| Market Size in 2023 | USD 6.90 Billion |

| Market Size by 2032 | USD 11.90 Billion |

| CAGR | CAGR of 5.67 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Liquid Analyzer (PHIORP Analzyer, Conductivity Analyzer, Turbidity Analyzer, Dissolved Oxyen Analyzer, Liquid Density Analzyer, MLSS Analyzer, TOC Analyzer) • By Air Analyzer (Oxygen Analyzer, Carbon Dioxide Analyzer, Moisture Analyzer, Toxic Gas Analyzer, Hydrogen Sulfide Analyzer) • By Industry (Oil & Gas, Petrochemicals, Pharmaceuticals, Water & Wasterwater, Power, Food & Beverages, Paper & Pulp, Metals & Mining, Cement & Glass, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Emerson, Siemens, Endress+Hauser, Yokogawa Electric Corporation, Mettler-Toledo, Suez, Thermo Fisher Scientific, Ametek, Anton Paar, Hach, Shimadzu, Jumo, Applied Analytics, Vega Grieshaber and others |

| Key Drivers | • The factors that are propelling the expansion of process analyzers include water treatment, pharmaceutical safety, and monitoring chemical processes. • The Function of Analytical Instruments in Achieving Water Quality Regulations |

| RESTRAINTS | • Overcoming Market Difficulties Dealing with Challenges in the Process Analyzer Market |