Bronchoscopy Market Key Insights:

Get More Information on Bronchoscopy Market - Request Sample Report

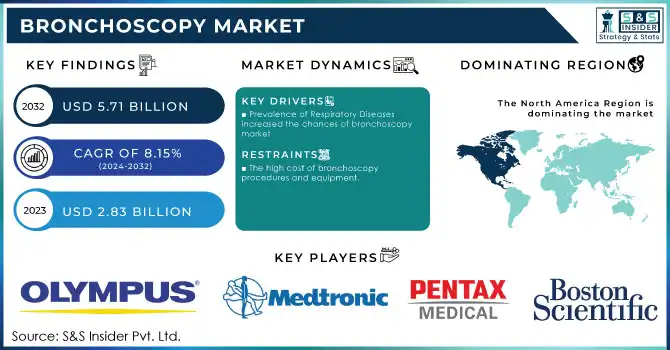

The Bronchoscopy Market size was valued at USD 2.83 billion in 2023 and is expected to reach USD 5.71 billion by 2032, growing at a CAGR of 8.15% over the forecast period of 2024-2032.

The bronchoscopy market is witnessing significant growth, primarily driven by the increasing demand for advanced diagnostic and therapeutic options for respiratory diseases. Bronchoscopy, a procedure used to examine and treat the airways, is vital for diagnosing conditions such as lung cancer, chronic obstructive pulmonary disease (COPD), and pulmonary infections. As the global prevalence of these diseases rises due to factors like lifestyle changes and environmental pollution, the need for accurate and minimally invasive procedures has surged, fueling market demand for bronchoscopy devices.

Technological advancements, such as high-definition imaging systems and flexible bronchoscopes, have significantly enhanced the capabilities of bronchoscopy, enabling more precise diagnoses and effective treatments. Flexible bronchoscopes, in particular, are gaining preference due to their ability to navigate complex airway structures with ease, offering broader applications for both diagnostic and therapeutic interventions. Additionally, the increasing adoption of disposable bronchoscopes addresses growing concerns about infection control, making them an essential component in clinical settings.

Furthermore, the increasing preference for reusable devices, alongside the recognition of bronchoscopy's essential role in both diagnostic and therapeutic contexts, is expected to fuel the market’s expansion in the coming years. However, risks associated with aerosol generation during procedures highlight the need for strict infection control measures to ensure safety and prevent cross-contamination.

Bronchoscopy Market Dynamics

Drivers

-

Prevalence of Respiratory Diseases increased the chances of bronchoscopy market

The increasing incidence of chronic respiratory diseases, such as Chronic Obstructive Pulmonary Disease (COPD), lung cancer, and asthma, is a major driver of the bronchoscopy market. More than 300 million people worldwide are impacted by asthma and chronic obstructive pulmonary disease (COPD). Bronchoscopy is a crucial diagnostic and therapeutic tool in managing these conditions, particularly for procedures like tumor biopsies and clearing airways. As the global burden of respiratory diseases continues to rise, especially with aging populations in developed regions and increasing urbanization in emerging markets, the demand for bronchoscopy procedures is expected to grow significantly.

-

Technological Advancements in Bronchoscopy Devices

The development of more advanced, flexible, and minimally invasive bronchoscopy systems has made these procedures safer and more effective. The number of robotic bronchoscopy procedures at Stanford rose from 44 in 2019 to 400 in 2023. They are currently investigating the use of robotic bronchoscopy for microwave ablation therapy in the treatment of metastatic lung tumors.

Innovations such as high-definition imaging systems, disposable bronchoscopes, and bronchoscopy-assisted navigation systems have improved the accuracy and efficiency of diagnoses and treatments. These technological advancements not only enhance patient outcomes but also expand the use of bronchoscopy in outpatient settings, further fueling market growth.

Restraint

-

The high cost of bronchoscopy procedures and equipment

Despite technological advancements in bronchoscopes and imaging systems, the associated costs remain a challenge, particularly in low- and middle-income regions. These high costs limit the affordability and accessibility of bronchoscopy procedures, especially disposable bronchoscopes, which are increasingly being adopted for infection control. As a result, healthcare systems with budget constraints may face difficulties in providing these advanced diagnostic and treatment options. This restraint is compounded by the lack of reimbursement policies in some regions, further limiting market growth.

Bronchoscopy Market Segment Analysis

By Product

The endoscope segment maintained a dominant position accounting for around 41% in 2023, with projections indicating it will achieve the highest earnings throughout the forecast period. This particular segment has traditionally been at the forefront of the market and is expected to continue having the highest compound annual growth rate (CAGR) in the future. The rising occurrence of lung cancer in different areas will continue to increase the need for endoscopy. Furthermore, the continuous improvement of endoscopic equipment technology will play a key role in the continued expansion and development of this market sector, improving both diagnostic and treatment abilities.

By Usability

The disposable equipment segment dominated a major portion of the market in 2023. One important factor contributing to this increase is the lower chance of spreading infections between patients, which is crucial in medical environments. Single-use disposable devices reduce the risk of contamination, making them more attractive to users. This feature is anticipated to make a significant impact on revenue generation in the coming future. On the other hand, hospitals and surgical centers find reusable equipment less appealing due to the high maintenance costs it incurs. Moreover, healthcare providers are at a greater risk of infection transmission when using reusable devices, which reinforces the move towards disposable options.

By End User

The hospital segment is forecasted to maintain a substantial market share as a result of the large number of patients seeking treatment for different ailments. As chronic illnesses become more common, hospitals anticipate a rise in patient visits, leading to an increase in the need for bronchoscopy procedures. Hospitals are well-prepared to address the increasing demand for procedures that open airways and treat lung cancer, as they have the required facilities for complex surgeries. This will aid in the market's expansion and result in significant earnings over the projected period.

Similarly, the clinic segment is poised for significant expansion due to the growing number of diagnostic tools for respiratory issues. It is anticipated that clinics that provide specialized care for diseases related to the respiratory system will have an increase in the number of patients requesting bronchoscopy for diagnostic reasons. The increasing need for early identification and treatment will continue to drive growth in this sector in the upcoming years.

Bronchoscopy Market Reginal Overview

North America has been the primary force in the bronchoscopy market and is dominating to maintain its lead in the forecasted period in 2023. The increase is mainly caused by the higher occurrence of chronic respiratory illnesses and the presence of beneficial reimbursement policies, particularly in the United States. These reimbursement policies play a major role in encouraging the use of bronchoscopy procedures. Furthermore, the growing number of lung cancer cases in the United States and Canada is also aiding in the expansion of the market, with the need for bronchoscopy increasing for diagnostic and therapeutic uses. Continued investment in hospital infrastructure in North America will remain crucial for maintaining dominance in the market.

Meanwhile, the Asia-Pacific region is becoming the fastest-growing market for bronchoscopy. The rapid progress in healthcare infrastructure, especially in countries like China, India, Japan, and South Korea, is driving this growth. The increased need for bronchoscopy procedures is driven by higher rates of respiratory illnesses, urban development, and an aging populace. Moreover, the region is expected to see an increase in adoption rates due to the cost-effectiveness of disposable bronchoscopes and their capacity to improve infection control. Asia-Pacific is expected to have the largest increase in growth rate by 2032 compared to other regions, driven by increased investments in healthcare and a greater focus on respiratory issues.

Need Any Customization Research On Bronchoscopy Market - Inquiry Now

Key Players in Bronchoscopy Market

-

Olympus Corporation (BF-P190 Bronchoscope, EVIS EXERA III Imaging System)

-

Medtronic (Flexible Bronchoscopes, Karl Storz® Video Bronchoscope System)

-

Pentax Medical (EB-1970T Video Bronchoscope, EG-2990i Video Bronchoscope)

-

Smith & Nephew (Bronchial Brush Biopsy Kit, Endoscopic Submucosal Dissection Kits)

-

Boston Scientific (Lung Cancer Bronchoscopy Kit, Interlock® 35 Mechanical Rotating Biopsy Forceps)

-

Richard Wolf GmbH (Wolf Video Bronchoscope, Wolf Endoscopic Ultrasound (EUS))

-

Cook Medical (Endobronchial Biopsy Forceps, Flexible Bronchoscopes)

-

Conmed (Electrosurgical Bronchoscopy Instruments, Bronchoscopy Forceps and Biopsy Tools)

-

Hoya Group (Pentax Medical) (EC-3830i Video Bronchoscope, EB-1980T Bronchoscope)

-

Stryker Corporation (Bronchoscope Systems, Surgical Scissors for Bronchoscopy Procedures)

-

KARL STORZ (Rigid Bronchoscope, Flexible Bronchoscope with Light Source)

-

Intuitive Surgical (da Vinci Surgical System, Endoscopic Surgical Tools for Bronchoscopy)

-

Medivators Inc. (Endoscopic Biopsy Forceps, Reusable Bronchoscope Handles)

-

Xion GmbH (Flexible Endoscopes for Bronchoscopy, Video Endoscope System for Diagnostics)

-

Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (UMEC-500 Flexible Video Bronchoscope, Endoscopic Imaging System)

-

Allergan (Aspiration Bronchoscopy Tools, Lung Biopsy Forceps)

-

EndoChoice (Endoscopy Ultrasound for Bronchoscopy, Bronchoscopic Biopsy Systems)

-

Biosense Webster (Johnson & Johnson) (Endoscopy-Integrated Electrophysiology Bronchoscopy Tools, Bronchial Mapping Catheter System)

-

Sonic Healthcare (Biopsy Forceps for Bronchoscopy, Endoscope Accessories)

-

Micro-Tech (Nanjing) (Flexible Video Bronchoscope, Biopsy Forceps and Accessories for Bronchoscopy)

Key Suppliers

These suppliers play a critical role in providing essential components and tools that are used across various bronchoscopy products and systems in the medical field.

-

GE Healthcare

-

Philips Healthcare

-

Fujifilm

-

Hitachi Healthcare

-

Karl Storz

-

Ambu A/S

-

Stryker Corporation

-

Olympus Corporation

-

Cook Medical

-

Medtronic

Recent Developments

-

In November 2024, the Richard Wolf Centre for ICU Bronchoscopy, situated at Sharda Hospital in Greater Noida, India, stands as an innovative facility focused on enhancing acute bronchoscopy care skills within ICU environments. This partnership between Sharda Hospital and the Prima Vista - Richard Wolf Academy from Germany is the initial one in India.

-

In May 2024, Medtronic revealed new initial findings from the VERITAS clinical trial with its ILLUMISITE™ fluoroscopic navigation system for diagnosing lung nodules during the ENB procedure. Clinical researchers from Vanderbilt University Medical Center, funded by Medtronic, presented the initial findings of VERITAS at the American Thoracic Society conference in San Diego.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.83 Billion |

| Market Size by 2032 | US$ 5.71 Billion |

| CAGR | CAGR of 8.15% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product (Endoscopy, Visualization, and Documentation System, Accessories, Others) •By Usability (Reusable Equipment, Disposable Equipment) •By Application (Bronchial Diagnosis, Bronchial Treatment) •By End User (Hospitals and Ambulatory Surgical Centers, Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Olympus Corporation, Medtronic, Pentax Medical, Smith & Nephew, Boston Scientific, Richard Wolf GmbH, Cook Medical, Conmed, Hoya Group (Pentax Medical), Stryker Corporation, KARL STORZ, Intuitive Surgical, Medivators Inc., Xion GmbH, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., Allergan, EndoChoice, Biosense Webster (Johnson & Johnson), Sonic Healthcare, Micro-Tech (Nanjing), and other players. |

| Key Drivers | •Prevalence of Respiratory Diseases increased the chances of bronchoscopy market •Technological Advancements in Bronchoscopy Devices |

| Restraints | •The high cost of bronchoscopy procedures and equipment. |