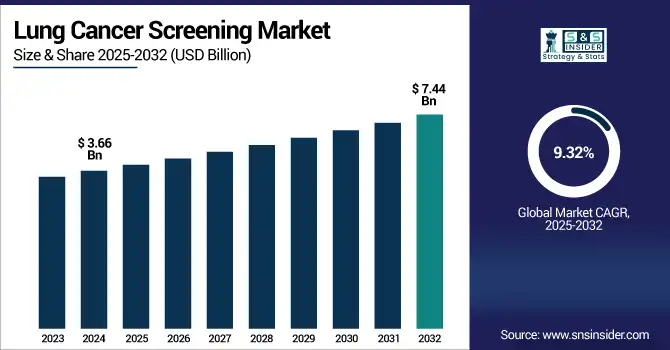

Lung Cancer Screening Market Size:

The Lung Cancer Screening Market was valued at USD 3.66 billion in 2024 and is expected to reach USD 7.44 billion by 2032, growing at a CAGR of 9.32% over the forecast period of 2025-2032.

To Get more information on Lung Cancer Screening Market - Request Free Sample Report

The global lung cancer screening market is growing rapidly, driven by factors such as the increasing incidence of lung cancer, growing awareness, growth in the aging population, and the adoption of low-dose CT scans as a screening test. As lung cancer is the most lethal type of cancer globally, governments and health agencies are encouraged to focus on extensive screening, especially among high-risk populations. There are technological improvements, mobile screening units, and AI-imaging tools that will add to the lung cancer screening market growth.

The U.S. lung cancer screening market size was valued at USD 1.12 billion in 2024 and is expected to reach USD 2.21 billion by 2032, growing at a CAGR of 8.89% over the forecast period of 2025-2032.

AstraZeneca and Qure recently reported on the implementation of AI in a new paper. Announced the processing of more than 5 million AI-powered chest X-rays across 20+ countries, proving scalability and accelerating adoption into clinical screening workflow.

The North American lung cancer screening market is witnessing a domination from the U.S. on account of widespread acceptance of low-dose computed tomography (LDCT) screening, clear payment policies, and developed healthcare infrastructure. Clear national screening guidelines, public awareness campaigns, and early introduction of screening programmes also contribute to its leadership role. Moreover, ongoing improvements in diagnostics and governmental initiatives for broader availability also ensure that it continues to be a leading market in the region.

In the United States, the American Cancer Society Cancer Facts & Figures 2025 estimates more than 2 million new cancer diagnoses in 2025, and lung cancer will comprise ~11–12% of those cases.

Lung Cancer Screening Market Dynamics:

Drivers

-

High Incidence of Lung Cancer is Propelling Market Growth

Lung cancer is highly diagnosed and a major cause of cancer-related deaths globally. Due to the diagnostic delay in later stages, since many are asymptomatic, rigorous screening is required for the early detection and prevention of lung cancer. The increasing incidence, mainly among high-risk populations such as chronic tobacco smokers and the aging population, has increased the urgent need for screening programs. The proliferating patient demographic has necessitated health systems to invest in lung cancer screening infrastructure, hence boosting the industry prospects.

In 2020, it was estimated that there would be around 2.2 million new cases (11.4% of the total number of cases) and 1.8 million deaths (18.4% of the total number of deaths) of lung cancer worldwide, and it is expected that by 2035, deaths will increase to nearly 3 million.

The National Cancer Institute reports a persistent decrease in lung cancer incidence and lung cancer-related mortality from 2018 to 2022: Men declined by 3.5% and women by 3.4% annually, demonstrating that prevention, early detection, or treatment can make a substantial difference.

-

Rising Screening Technologies are Driving the Market Growth

The effectiveness, efficiency, and availability of lung cancer screening have been greatly improved by technological advances. Since the advent of low-dose computed tomography (LDCT), early detection has taken a new turn in that smaller nodules in the lungs are being identified with less radiation dose. Furthermore, new tools, such as AI image analysis and biomarker-based liquid biopsies, are reducing false positives and increasing diagnostic confidence. These advances are helping to drive the increased attractiveness of lung cancer screening to both physicians and patients, driving uptake and market growth.

A meta-analysis and review published in Nature Oncology found that AI-augmented LDCT tools have a high diagnostic performance—94.6% sensitivity and 93.6% specificity, demonstrating how AI is elevating the level of screening accuracy while also trimming down the number of false positives and negatives.

At the 2025 ATS International Conference, a deep-learning model that analyzed LDCT scans of more than 21,000 subjects performed with impressive AUC scores (86% after 1 yr and 79% after 6 yr) and could even predict cancer risk in never-smokers, signaling a transition toward personalized predictive screening approaches

Restraint

-

High Cost of Screening Technologies is Hampering the Market from Growing

Penetration is also limited by the high price of advanced lung cancer screening technology, especially low-dose computed tomography (LDCT) and biomarker-based testing. These technologies call for sophisticated imaging systems, skilled radiologists, and sometimes specialized infrastructure with large funding and operational costs.

Moreover, patients could have to bear the personal cost for post-screening diagnostics after first-line screenings, exacerbating the cost burden. This impediment is particularly conspicuous in low‐ and middle‐income countries where health care budgets are restricted and health insurance coverage for cancer early detection is poor, or simply nonexistent. Accordingly, early detection is limited, and lung cancer screening programs are not widely adopted.

Lung Cancer Screening Market Segmentation Analysis:

By Type of Test / Modality

Low-dose computed tomography (LDCT) segment dominated the lung cancer screening market share with a 61.25% in 2024 on account of being a successful diagnostic alternative for early detection of lung cancer among at-risk individuals, including heavy, long-term smokers. LDCT is far more sensitive in detecting small nodules and abnormalities than conventional chest X-ray, and has been widely included in clinical guidelines and in national screening programs, in developed regions, such as the U.S. and some European countries. Its potential to lower the rate of death from lung cancer with early detection has earned it the favor of the provider community.

The biomarker-based tests segment is expected to grow at the highest CAGR during the forecast period, due to continuous developments in precision medicine and molecular diagnostics. These tests provide an opportunity for non-invasive early detection of lung cancer because they would detect genetic, proteomic, or epigenetic markers in blood, sputum, or other biological fluids. The growing popularity of personalized therapeutic decision-making processes, the rise in research funding, along the introduction of liquid biopsies in diagnostic regimes are driving the adoption of biomarker-based screening.

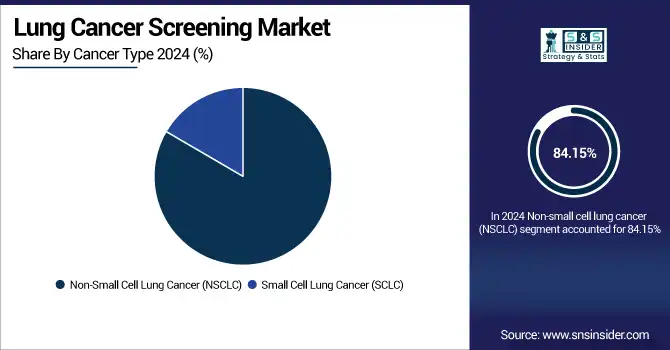

By Cancer Type

The non-small cell lung cancer (NSCLC) segment led the lung cancer screening market in 2024 with around 84.15% market share, since it is the most common type of lung cancer among all lung cancers. NSCLC tends to grow more slowly than small cell lung cancer, so there may be more time to find it with a screening test like LDCT. From a clinical perspective, NSCLC screening in high-risk populations is the main focus of CPG worldwide, which has the potential to increase demand for screening programs, especially dedicated to finding NSCLC. Public declared awareness programs and screening-driven targeting activities have further reflected its dominant market share.

The NSCLC is the fastest-growing segment lung cancer screening market growth is also anticipated over the forecast period, attributed to improved diagnostics capabilities, growing commitment to early detection approaches, and greater access to targeted drugs. The combination of molecular diagnostics and biomarker-based screening helps to improve the accuracy of early detection of NSCLC, and the continued development of targeted therapies will promote the advancement of precision oncology. Furthermore, the healthcare policies in most countries are providing a broader range of screening services, especially for the patients at risk, which in turn is increasing the development and progression of the NSCLC screening market.

By Age Group

The lung cancer screening market, based on age, was led by the 60–69 years segment in 2024, owing to higher risk populations in global clinical lung screening programs. People of this age group generally have a long history of cigarette and other carcinogenic exposure, resulting in a high risk of lung cancer. This population is often the subject of screening schedules in the healthcare system and among the insured by LDCT, so that they have a higher screening rate. Moreover, this segment is active in preventive health care programs, which also favours its strong position on the market.

The age group 50–59 years is anticipated to be the fastest growing segment over the forecast period, with a rising trend of early screening and a change in screening guidelines by healthcare organizations. A considerable body of evidence suggests that there may be a benefit in the early detection of lung cancer even before the usual age limit of 60+ years, especially in lung cancer patients who are smokers or have a history of occupational exposure. With the growing trend toward early detection and an increasing awareness of preventive health among 50-somethings, this group is increasingly screening regularly, driving fast growth in the market.

By End User

The lung cancer screening market is categorised into hospitals, diagnostic centres, and specialty clinics, and the hospitals segment led the market in 2024 on account of their established infrastructure, advanced imaging modalities such as LDCT, and experienced healthcare professionals. It is common that in hospitals, the first referral and diagnosis of patients under cancer screening occurs, and has more patients' confidence and an easier follow-up of the care. In addition, screenings have been reimbursed by government and private insurance programs when carried out in hospital settings, augmenting the stature of hospitals in organized lung cancer screening.

Among these, the 'others' segment (such as mobile screening units, NGOs, and community health programs) will witness the highest growth during the predicted period. This is a reflection of a growing number of initiatives designed to enhance delivery in underserved and remote communities where conventional healthcare infrastructure is sparse. There is an increasing number of mobile units and outreach services globally, particularly, low and middle-income areas, to close the gap in lung cancer identification. Flexible, community-based approaches such as these are low-cost and easily up-scaled, leading to fast market penetration.

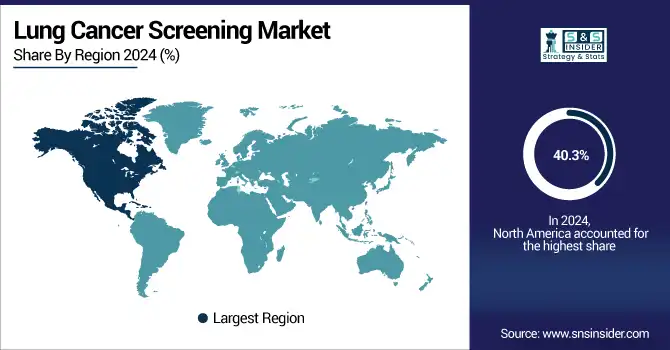

Lung Cancer Screening Market Regional Insights:

North America dominated the lung cancer screening market trend in 2024, with around 40.3% market share due to the presence of developed healthcare infrastructure, early LDCT screening adoption, and high reimbursement support from the government and private payers. In the US, the USPSTF recommendation and Medicare LDCT coverage have increased screening uptake substantially. Rise in awareness among healthcare professionals and the general population on early detection of lung cancer, leading players, and advancement of technologies in tracking devices in the screening process are propelling the market.

The Asia Pacific region is projected to register the highest growth rate in the lung cancer screening market analysis, with around 9.94% CAGR during the forecast period, primarily due to the increasing incidence of lung cancer, the growing healthcare expenditure, and the increasing focus of governments on early detection and prevention. China, Japan, and South Korea have initiated mass screening programs to tackle the unprecedented load of lung cancer. Growth of the market in the region is further driven by improvements in levels of healthcare access, growing use of AI-based diagnostic tools, and a rise in insurance coverage across the region. Furthermore, increasing awareness and public health programs are promoting patient enrolment in the screening, which is boosting the market growth in the Asia Pacific.

The lung cancer screening market in Europe is projected to expand at a significant CAGR, propelled by growing emphasis on preventive healthcare, high prevalence of lung cancer, and surge in use of various advanced screening methods such as low-dose computed tomography (LDCT). Many countries in the region have made serious progress in, or scaled up, the national lung cancer screening programmes (e.g., Germany, the UK, France, the Czech Republic, and Poland). By sponsored programs, pilot projects, and innovation in diagnostic imaging, the early detection power is evolving, thereby promoting market growth in the region.

Latin America is expected to grow at a steady pace for the lung cancer screening market analysis on account of increasing prevalence of lung cancer, increasing awareness, and slowly accepting new screening technologies such as low-dose computed tomography (LDCT) and liquid biopsies. Nevertheless, the region still experiences significant challenges such as poor health care infrastructure, expensive screening, and poor adaptation of the national screening programme.

The lung cancer screening market in the Middle East & Africa (MEA) is also witnessing significant growth due to advances in access to health care and the increasing knowledge of early cancer detection, which has contributed to the slow uptake of lung cancer screening programs. However, challenges including low awareness in the public, poor access to advanced diagnostics technologies, and a lack of organized screening programs in many countries still restrict market take-off. With these challenges, the market is set to grow steadily on the basis of heightened government commitment to managing non-communicable diseases.

Get Customized Report as per Your Business Requirement - Enquiry Now

Lung Cancer Screening Market Key Players:

The lung cancer screening market companies are GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Samsung Medison Co., Ltd., Carestream Health, Shimadzu Corporation, Vuno Inc., Zebra Medical Vision, Qure.ai, Aidoc, Riverain Technologies, Lunit Inc., Roche Diagnostics, Illumina, Inc., Guardant Health, Exact Sciences Corporation, Bio-Rad Laboratories, CT Screening International, and other players.

Recent Developments in the Lung Cancer Screening Market:

-

Jan 2024, GE HealthCare partners with Optellum to roll out the Virtual Nodule Clinic—a computer vision-based solution that interprets CT lung scans and gives each nodule an associated cancer-risk score, allowing for quicker and more accurate detection of nodules that may be malignant.

-

Nov 2023, Philips partnered with Roswell Park Comprehensive Cancer Center to introduce "Project Eddy" in Buffalo, New York, sending out mobile units with Philips Incisive CT scanners. The initiative importantly targets at-risk populations like firefighters, said to be approximately 60% more likely to get lung cancer due to occupational hazards.

Lung Cancer Screening Market Report Scope:

Report Attributes Details Market Size in 2024 USD 3.66 Billion Market Size by 2032 USD 7.44 Billion CAGR CAGR of 9.32% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Type of Test / Modality (Low-Dose Computed Tomography (LDCT), Chest X-ray, Sputum Cytology, Biomarker-based Tests, Others (e.g., PET scans, MRI))

• By Cancer Type (Non-Small Cell Lung Cancer (NSCLC), Small Cell Lung Cancer (SCLC))

• By Age Group (40–49 years, 50–59 years, 60–69 years, 70+ years)

• By End User (Hospitals, Diagnostic Centers, Cancer Research Institutes, Ambulatory Surgical Centers (ASCs), Others (mobile screening units, NGOs, etc.))Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles GE HealthCare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Samsung Medison Co., Ltd., Carestream Health, Shimadzu Corporation, Vuno Inc., Zebra Medical Vision, Qure.ai, Aidoc, Riverain Technologies, Lunit Inc., Roche Diagnostics, Illumina, Inc., Guardant Health, Exact Sciences Corporation, Bio-Rad Laboratories, CT Screening International, and other players.