Broth Market Report Scope & Overview:

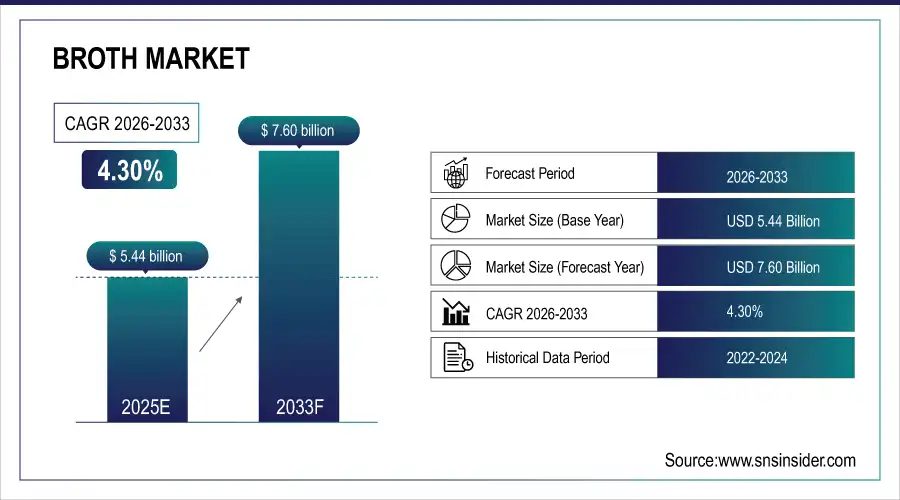

The global broth market size was valued at USD 5.44 billion in 2025E and is projected to reach USD 7.60 billion by 2033, growing at a CAGR of 4.30% during the forecast period 2026–2033.

The broth market is experiencing consistent growth as consumers increasingly prioritize health, convenience, and natural flavor enhancers in their diets. Increasing preference for protein rich and low-fat food bases and surging popularity of organic & clean label products are the major drivers of this market. Broth is offered in a variety of forms to service industry and consumer needs. So, the growth of retail, specialty, and online channels is creating inand-outs for innovation and premiumization and for greater global access.

Nearly 50% of consumers use broth as a base for meals, with rising demand for organic and convenient formats. Supermarkets and online platforms dominate distribution.

Market Size and Forecast:

-

Market Size in 2025: USD 5.44 Billion

-

Market Size by 2033: USD 7.60 Billion

-

CAGR: 4.30% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Broth Market - Request Free Sample Report

Broth Market Trends:

-

Transition toward organic and clean-label broths is faster with organic alternatives anticipated to contribute to around 32% of new product introductions in 2025.

-

Flavor development is growing beyond chicken and beef and vegetable and seafood broths are expected to realize a 22% increase in retail sales in 2025.

-

Product innovation continues, expecting over 650 new broth SKUs worldwide by 2025, including low-sodium, collagen infused and functional offerings.

-

Distribution channels are changing, with online broth sales projected to increase by 19% in 2025, as consumer interest in convenience and bulk packs grows.

-

Market trends include sustainability and premiumization influence purchasing, and over 45% of leading brands plan to use recyclable packaging in 2025 as well as responsibly sourced ingredients.

U.S. Broth Market Insights

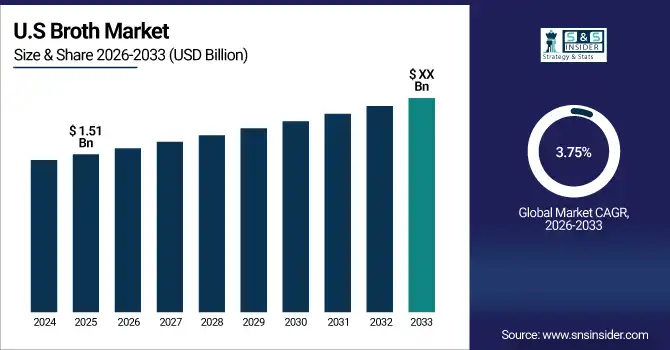

The U.S. broth market was valued at USD 1.51 billion in 2025E and is projected to grow at a CAGR of 3.75% during 2026–2033. Demand is also driven by such trends as a wave of ready-to-use liquid broths, and organic, low-sodium and plant-based choices. Rising retail presence, private-label innovation and e-commerce expansion are further broadening consumer access, while health and convenience trends leave the U.S. as the largest and most affluent broth market in North America.

Broth Market Growth Drivers:

-

Preference for Protein-Rich, Functional Broths Drives Growth, Supported by Consumer Focus on Health and Immunity.

The increasing preference for protein-rich and functional broths is a key growth driver for the broth market. Consumers are looking for meals that are nutritionally beneficial and support immunity, gut health and overall well-being. Collagen enhanced, bone flavoured, and vitamin mineral fortified broths have emerged to meet that need and flavour their appeal to the health enthusiasts and the aging populations. Aside from traditional cooking applications, functional broths are being marketed as easy grab-and-drink wellness beverages, guaranteeing broad consumer acceptance and sustained growth of the category.

In 2025, nearly 48% of broth consumers preferred protein-rich or functional varieties such as collagen and bone broths, making it one of the fastest-growing segments in the category.

Broth Market Restraints:

-

Dependence on Animal Ingredients Restrains Broth Market as Plant-Based Diets and Sustainability Concerns Grow.

Dependence on animal ingredients acts as a major restraint in the broth market. Traditional chicken, beef and bone broths are based on a strong reliance on animal-based sourcing, which is at odds with the growing movement towards plant-based diets and sustainability-focused consumption. Since consumers are becoming increasingly focused on ethical sourcing, environmental impact, and vegan friendly products, relying solely on meat-based broths can restrict market growth. Any brands not embracing plant-based or other protein alternatives risk irrelevance and a loss of market to health and eco-conscious consumers.

Broth Market Opportunities:

-

Demand for Ready-To-Use, Clean-Label Broths Drives Opportunities in Packaging, Organic, and Plant-Based Innovation.

The expanding demand for ready-to-use and clean-label broths presents a significant opportunity for market growth. As consumers continue to desire easy, organic and plant-based options, manufacturers can differentiate by adding on-trend nutrient-dense formulas, functional benefits such as collagen or immune-boosting ingredients and environmentally friendly packaging. This transition mirrors the changing wellness and sustainability focus, giving brands an opportunity to set themselves apart and capture the attention of health-conscious consumers while fortifying their positions in retail and foodservice globally.

Over 52% of global consumers are willing to pay a premium for clean-label and ready-to-use broths, driving demand for organic, plant-based, and functional varieties in both retail and foodservice.

Broth Market Segmentation Analysis:

-

By Product Type, the market’s volume could trace to chicken broth in 2025E and it reaches 32.72% in terms of share, with vegetable broth registering the highest CAGR of 5.32%.

-

By Form, liquid broth holds 54.63% and powdered broth is the highest increasing at 5.95% CAGR.

-

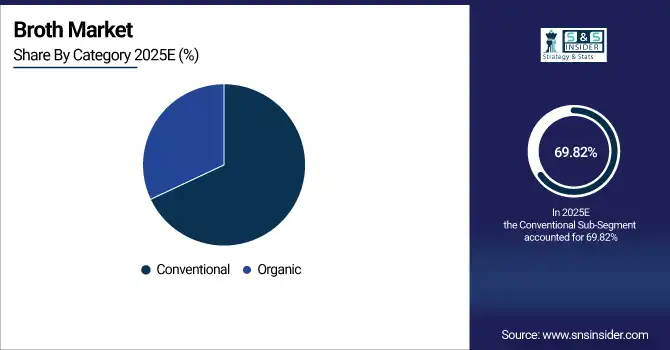

By Category, conventional broth is estimated to lead with 69.82% share in 2025E; and organic broth expands at the highest CAGR of 7.89%.

-

By Application, household use is the leading segment that holds 64.71% shares in 2025E and foodservice is growing by fastest CAGR 6.42%, on the back of increasing application in restaurants and cafes.

-

By Distribution Channel, supermarkets & hypermarkets market in 2025E and it reaches 44.82%, with online retail posting the fastest growth at an 8.57% CAGR.

By Product Type, Chicken Broth Dominates While Vegetable Broth Grows Rapidly:

Chicken broth maintains dominance due to its traditional culinary use, rich flavor, and wide adoption in both households and foodservice kitchens. The most common type is enough predominant in soups, sauces, and ready-to-eat meals. But vegetable broth is catching on fast, thanks to plant-based diets, vegan lifestyles and concerns about sustainability. The growth of vegetable stock is driven due to increasing consumer preference for healthier, lighter, and environmentally friendly products across the world.

By Form, Liquid Broth Dominates While Powdered Broth Grows Rapidly:

Liquid broth leads the market with its convenience, rich taste, and strong retail penetration in cartons, pouches, and ready-to-use packaging. It can be incorporated naturally into cooking, being chosen as the most widely used processing method in homes and catering systems as well. Powdered broth, however, is growing faster because of its extended shelf life, lower storage cost and increased demand among foodservice and institutional customers. The versatility it offers and the benefit of portion control make it popular for commercial kitchens and health-conscious individuals.

By Category, Conventional Broth Dominates While Organic Broth Grows Rapidly:

Conventional broth continues to dominate the market because of its affordability, accessibility, and presence in mass-market retail channels. It is the preferred offer for consumers who are price sensitive and continues to be the default choice for buyers in households and in foodservice. Organic broth, however, is expanding quickly, fueled by clean label trends and burgeoning worldwide demand for healthy and sustainable foods. With growing consumer awareness for natural ingredients and free-of chemicals way of farming, along with sensitivity toward tracing of the ingredients, the demand for organic broth will increase in premium segments.

By Application, Household Use Dominates While Foodservice Grows Rapidly:

Household consumption dominates as broth is an everyday staple in cooking soups, stews, sauces, and quick meals. Versatile and available in all retail formats, this oil is a kitchen staple. Foodservice, by contrast, is the fastest growing of the two segments as eateries and catering businesses increasingly seek convenient, consistent-flavored broth, time savings, and bulk supplies. Increasing urbanization, proliferation of dining-out culture, and need for fast menus, is fostering broth consumption in the commercial food outlet segment.

By Distribution Channel, Supermarkets & Hypermarkets Dominate While Online Retail Grows Rapidly:

Supermarkets & hypermarkets dominate broth sales thanks to their wide product availability, strong brand presence, and consumer preference for one-stop shopping. They’re still where most purchases are made, especially by households. Online retail, though, is growing the fastest as e-commerce use expands worldwide. The convenience of home delivery, expanded product selection, subscription-based models, and digital promotions are all driving more subscriptions, particularly with younger, health conscious and urban consumers who want easy access to specialty broths.

Broth Market Regional Analysis:

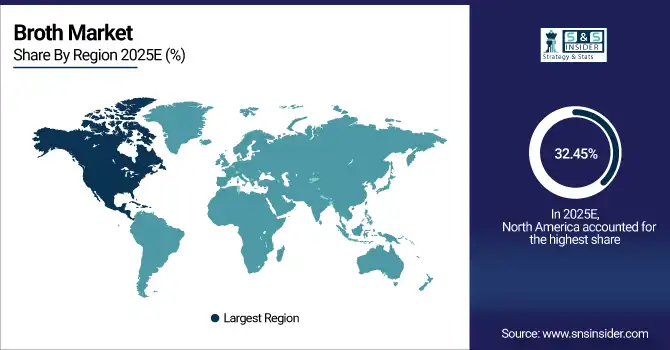

North America Broth Market Insights:

North America dominates the global broth market, accounting for 32.45% share in 2025E. And the region’s lead derives from the comprehensive reliance on chicken and beef broth in every day-of-the-week cooking from soups and sauces to instant dishes. Rising health consciousness also spurs demand for low-sodium, organic, and clean-label broths, while plant-based vegetable varieties pick up steam with vegans and flexitarians. Strong packaged food industry, retail penetration, and increasing adoption of e-commerce further solidify North America’s dominance.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Broth Market Insights:

The United States is the largest market for broths in North America and consumption of chicken and beef broths is robust in everyday cooking. The popularity of organic, low-sodium and vegetable-based options rides the coattails of health and plant-based eating. Growing wealth, innovation, surging packaged food production and a presence in retail and e-commerce means the U.S. continues to be the primary growth engine.

Asia-Pacific Broth Market Insights:

The Asia-Pacific broth market is projected to grow at a 5.29% CAGR during 2026–2033, making it the fastest-growing region. Innovation and growth will be fuelled by the region’s dependence on broths in soups, noodles and stews, coupled with urbanisation and busy lives driving demand for convenient ready-to-use products. An increasing number of consumers prefer organic, low-sodium and vegetable-based broths, and as modern retail and e-commerce channels continue to expand rapidly, access to and growth of the overall soups market is enhanced.

China Broth Market Insights:

China dominates the Asia-Pacific broth market, driven by its strong culinary tradition of soups, noodles, and hot pots. Increasing per capita income, urbanization, and a fast-paced lifestyle are driving the demand for instant broths. This has been reinforced by stronger regional leadership in China, given increasing preference for organic, low sodium and vegetable-based products and strong e-commerce and retail channels.

Europe Broth Market Insights:

Europe dominates the global broth market, supported by its long culinary tradition of soups, stews, and ready-meal consumption. Strong at-home usage, foodservice demand and consumers’ desire for premium, organic and clean-label items support its dominance. Low-sodium and plant-based vegetable broths have become popular in Western Europe, as part of the health and sustainability movement. High penetration in supermarkets, private-label launches and e-commerce development reinforce Europe overall dominance in the global broth category.

Germany Broth Market Insights:

Germany is Europe’s largest broth market, driven by its strong culinary tradition and high demand for soups and ready meals. Rising demand for organic, clean-label, and low-sodium broths is in line with health aware consumers. With strong supermarket networks, discounters and online retailers all make products easily accessible helping to consolidate Germany’s lead in Europe’s broth market.

Latin America Broth Market Insights:

Latin America’s broth market is expanding, driven by traditional culinary practices and rising demand for convenient, ready-to-use meal solutions. Brazil and Mexico lead the market, due to large urban populations, expanding retail infrastructure, and changing foodservice needs. Prefer no product/toxic and low-sodium/organic and plant-based broths indicate a growing demand for healthier, portable alternatives in the region.

Middle East and Africa Broth Products Market Insights:

The Middle East and Africa broth market is growing, driven by urbanization, rising disposable incomes, and demand for convenient meal bases. The use of traditional broth has waned but vegetarian versions and other types are trending with health-minded shoppers. Growing modern retail and internet retail expand product availability in the region.

Broth Market Competitive Landscape:

Campbell Soup Company dominates the global broth market with its well-established Swanson brand, widely recognized for chicken and beef broths. Its leadership position is supported by a strong North American retail platform, diversified product portfolio and organic/low sodium broth innovation. Campbell’s agility in responding to shifting consumer preferences for convenience and clean labels has also helped it succeed. And with their brand heritage built over generations of trust, consumers continue to seek and buy Campbell just as it is an irreplaceable ingredient in their favorite meals.

-

In Augest 2025, The Campbell’s Co. launched a new broth blend with garlic, ginger, soy, and chicken stock, now sold in 32-oz boxes at major retailers.

Kettle & Fire leads the premium segment of the broth market, focusing on bone broths made from grass-fed and organic ingredientsIts wares are marketed as protein rich, collagen rich and nutrient rich, akin to wellness, keto and paleo diets. The brand is available through e-commerce, direct-to-consumer and luxury retail. Leveraging health-focused innovation, eco-friendly packaging, and the booming functional nutrition movement Kettle & Fire is hands down the ultimate leader in shaping today's health-driven broth industry worldwide.

-

In May 2025, Kettle & Fire opened its 167,000-square-foot KettleWorks facility in Lancaster, enhancing bone broth production, quality control, and supply chain efficiency.

Pacific Foods is another influential player, excelling in organic and plant-based broths. Best known for its vegetable, chicken, and bone broth varieties, the company serves consumers who seek clean-label, sustainable, non-GMO products. Pacific Foods is helped along by an expanding retail presence in both natural food stores and conventional grocery stores. Its secret sauce is striking the right balance of tradition and innovation, with gluten-free and vegan products that resonate with health-conscious consumers. Pacific Foods expands its distribution and market circular within Campbell Soup Company.

-

In March 2025, Pacific Foods launched 4 new organic products, including 3 soups and 1 chicken bone broth, expanding its clean-label portfolio.

Broth Market Key Players:

Some of the Broth Market Companies are:

-

Campbell Soup Company

-

Kettle & Fire Inc.

-

Pacific Foods of Oregon

-

General Mills (Progresso)

-

Unilever (Knorr)

-

Bonafide Provisions

-

Bare Bones Broth

-

The Manischewitz Co.

-

Imagine Foods

-

College Inn

-

Del Monte Foods

-

McCormick & Company

-

Nestlé S.A.

-

Swanson

-

Osso Good

-

The Stock Merchant

-

Health Valley

-

Epic Provisions

-

Manischewits

-

Barebones Ventures LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 5.44 Billion |

| Market Size by 2033 | USD 7.60 Billion |

| CAGR | CAGR of 4.30% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type: Vegetable, Chicken, Beef, Seafood, Others •By Form: Liquid, Powder, Cubes, Concentrates •By Category: Organic, Conventional •By Application: Household, Foodservice, Institutional, Industrial •By Distribution Channel: Supermarkets & Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Direct Sales |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Campbell Soup Company, Kettle & Fire Inc., Pacific Foods of Oregon, General Mills (Progresso), Unilever (Knorr), Bonafide Provisions, Bare Bones Broth, The Manischewitz Co., Imagine Foods, College Inn, Del Monte Foods, McCormick & Company, Nestlé S.A., Swanson, Osso Good, The Stock Merchant, Health Valley, Epic Provisions, Manischewits, Barebones Ventures LLC |