Building Management System Market Report Scope & Overview:

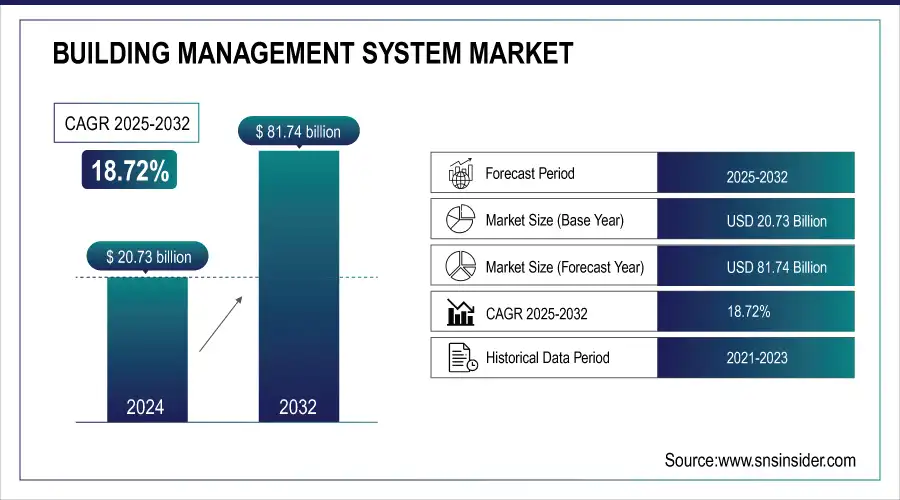

The Building Management System Market size was valued at USD 20.73 billion in 2024 and is expected to reach USD 81.74 billion by 2032, expanding at a CAGR of 18.72% over the forecast period of 2025-2032.

The Building Management System (BMS) Industry is rapidly growing owing to escalating energy efficiency requirements, increasing safety concerns, and growing demand for smart infrastructure. BMS systems unify heating, ventilation, and air conditioning (HVAC), lighting, fire, safety, and security systems to provide centralized monitoring and management. Energy management software is the most popular type of software, followed by security management which is the fastest growing. Service Professional services take the lead by service type, while managed services are emerging. The commercial segment has the number one market share, and the residential segment is catching up fast. North America leads the market, while Asia Pacific is growing the fastest due to urbanization and smart city projects.

To Get more information on Building Management System Market - Request Free Sample Report

According to the resources, buildings equipped with Building Management Systems (BMS) can reduce energy consumption by 30-40% and cut carbon emissions by up to 25%. In 2024, over 60% of BMS installations incorporated IoT-enabled sensors, enabling real-time data analytics and enhanced control.

Building Management System Market Trends

-

Rising demand for energy-efficient and sustainable infrastructure is driving building management system (BMS) adoption.

-

Integration of IoT, AI, and cloud platforms is enhancing real-time monitoring and automation.

-

Increasing focus on smart buildings and green certifications is boosting market growth.

-

Growing need for centralized control of HVAC, lighting, security, and energy systems is expanding applications.

-

Adoption of wireless and mobile-enabled BMS solutions is improving flexibility and scalability.

-

Rising construction of commercial complexes, hospitals, and smart homes is fueling demand.

-

Collaborations between technology providers, real estate developers, and facility managers are accelerating innovation.

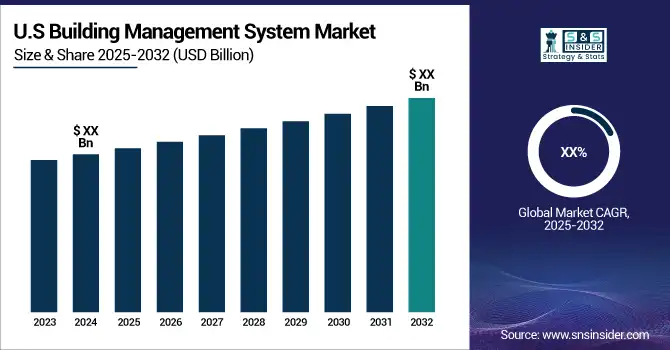

The U.S building management system market size reached USD 5.58 billion in 2024 and is expected to reach USD 20.41 billion in 2032 at a CAGR of 17.60% from 2025 to 2032.

The U.S. is one of the leading countries in the BMS market around the world as it has taken an early lead in the adoption of smart building technologies, particularly in major cities, with its advanced urban infrastructure, and the growing emphasis on sustainability and energy efficiency. The nation has a developed commercial and industrial sector, and a more modern residential sector that is adopting building management systems to optimise performance and efficiency.

In addition, key industry leaders, such as Honeywell, Johnson Controls, and Schneider Electric, promote innovation and mass roll-out.

Building Management System Market Growth Drivers:

-

Increasing Integration of IoT and AI Technologies Enhances Operational Efficiency Across Commercial and Residential Building Infrastructures.

Increasing adoption of IoT and AI is the key factor driving the demand for smart building systems. These capabilities enable initiatives such as real-time monitoring, proactive maintenance using predictive analytics, and driving energy usage and energy consumption decisions to lower an operator’s energy footprint and conserve more of its capital. A new tendency is the adoption of digital twins in smart buildings, which is proposed to analyse building performance through simulation. Moreover, AI-driven analytics are also being used extensively to automate building systems such as lighting, HVAC, and security, and operate in smarter and more sustainable building environments. Leading market vendors are focusing on R&D for machine learning to ensure dynamic energy optimization and space utilization.

Building Management System Market Restraints:

-

High Implementation and Integration Costs Pose Barriers for Small and Medium-Sized Enterprises.

One of the major barriers that is preventing the general adoption of smart building systems is the high cost of setting up and integrating smart building systems. The costs for implementing smart sensors, network infrastructure, and training personnel can be formidable, especially for small and medium-sized enterprises (SMEs). These costs are even more increased older structures that need extensive updating, such as updating old buildings. While long-term energy and maintenance savings justify these investments, the short-term ROI is typically insufficient to justify widespread adoption at budget-constrained organizations, contributing to slow penetration of the market for BMS technologies in the SME market.

Building Management System Market Opportunities:

-

Emergence of Smart Cities and Government Sustainability Mandates Creates Robust Market Expansion Potential Globally.

The global market for smart cities is also undergoing growth, under the influence of government-led energy efficiency and carbon reduction programs. Governments in North America, Europe, and Asia are encouraging green building standards and requiring energy-efficient infrastructure, driving the need for upgraded building systems. In addition, the US Infrastructure Investment and Jobs Act and the EU Green Deal are driving the widespread deployment of BMS. New trends involve greater public-private cooperation for the integration of BMS into urban infrastructure projects. These promotional initiatives are propelling the adoption of smart buildings and are increasingly making BMS offerings more affordable within mature and emerging economies, thereby expanding market potential.

Building Management System Market Challenge:

-

Cybersecurity Risks and Data Privacy Concerns Challenge the Adoption of Connected Building Systems Worldwide

With the growth of IoT in buildings and the acceleration of cloud-based platforms, cybersecurity and data privacy concerns continue to grow. When digital infrastructure is integrated into the shell of buildings, operational data and systems infrastructure get more exposed. Weak networks can be exploited by attackers who want to interrupt operations inside a building, or gain unauthorised access to control rooms via the security systems. Even where encryption and authentication protocols have been improved, many legacy systems are not safeguarded. Stiff regulatory regulations (i.e., GDPR, CCPA) continue to force companies to remain compliant with data. Thus, these issues present a critical hurdle for BMS proliferation, primarily in the case of the highly regulated industries.

Building Management System Market Segment Analysis

By Software, Energy Management segment dominated the market, Security Management segment is projected to grow at the fastest CAGR

The Energy Management segment leads the software category with a 34.36% revenue share in 2024, due to increasing requirements for energy-efficient building operations and cost-effective solutions. The likes of Schneider Electric and Honeywell have recently come to market with energy management platforms that deploy AI and IoT to help kick power consumption down and lower carbon footprints. These new developments are a response to growing regulations and requirements for sustainable buildings, which turn energy management into a standard part of Building Management Systems. Growth of this segment is driven by increasing energy costs and the sustainability goals of corporations, further underscoring the importance of enhancing energy management solutions throughout commercial and industrial verticals.

The Security Management segment is projected to expand at the CAGR of 20.06%, driven by rising concerns for building safety and the induction of advanced surveillance and access control technologies. Some of the big players, including Johnson Controls and Bosch, have implemented BMS and AI-based video analytics and biometric authorization support to boost security monitoring. Real-time threat discovery and automated incident response are also the stars of recent product rollouts, growing evidence that cybersecurity is increasingly about completing the security puzzle rather than solving security point problems. The increase in safety-centric rules and regulations and the growing need for unified safety management are the factors that are driving the growth of this segment.

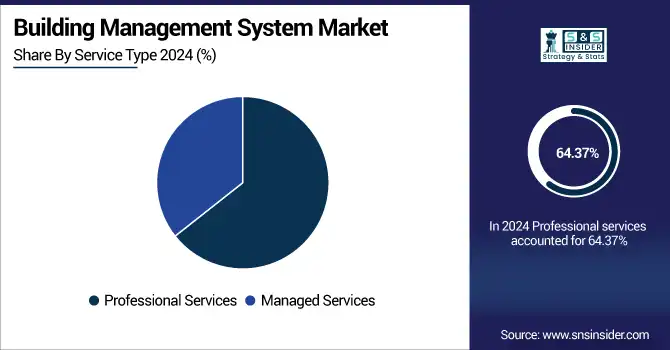

By Service Type, Professional services segment dominated the market, Managed services segment is projected to grow at the fastest CAGR

Professional services is the largest revenue segment with a share of 64.37%, which is indicative of the importance of consulting, system integration, and maintenance services in the deployment and enhancement of BMS solutions. Large players such as Siemens and Honeywell have broadened their suite of services with specialised offerings in the form of energy audits, system design, and compliance consulting. The complexity of systems, as well as the request for tailored solutions, calls more and more for experienced and professional support. These offerings are designed to lift BMS to new levels of transparency and efficiency in a way that brings you to compliance and supports the client – these are key ingredients to maintaining market leadership in BMS.

The managed services segment is the fastest growing segment at a CAGR of 19.47% due to the increasing trend among organizations of outsourcing building operations to third-party specialists to minimize cost, so as to achieve better system operation. Organizations such as Johnson Controls and Schneider Electric have launched cloud-based managed BMS platforms that provide remote access, predictive maintenance, and cybersecurity. This category is benefiting from the rise of demand for flexible, scalable services that require decreased reliance on in-house expertise and asset investments. The rise of IoT integration and real-time data analytics has increased the adoption of managed services, which is shaping up to be one of the fastest-growing segments of the BMS landscape.

By Application, Commercial segment dominated the market, Residential segment is projected to grow at the fastest CAGR

The commercial segment is leading the segment and accounted for about 49.56% revenue share in terms of revenue in and high demand for BMS in office spaces, shopping malls, airports and other larger capacities are boosting commercial application. Major firms like Honeywell and Siemens had developed state-of-the-art BMS applications specifically for commercial buildings that incorporated both energy management as well as security and comfort control for the occupants. The market for the segment is driven by trends in urbanization, the enforcement of energy efficiency laws and regulations, and corporate sustainability programs. The growing complexity of commercial establishments is expected to drive advanced control systems in this segment and is one of the major factors driving the global BMS market.

The residential sector is expected to exhibit the fastest growth in terms of CAGR at 20.20% due to the increasing penetration of smart home devices and growing consumer interest in energy conservation and safety. Some companies, such as Johnson Controls and Delta Electronics, have made recent investments in a combined residential BMS offering for HVAC control, lighting automation, and security surveillance. The growth trend is further supported by the increasing number of IoT-powered gadgets and smart thermostats. Moreover, the BMS adoption in the residential sector is rising rapidly, due to the growing emphasis on the development of energy-efficient buildings by governments across the world and rising preference for connected homes.

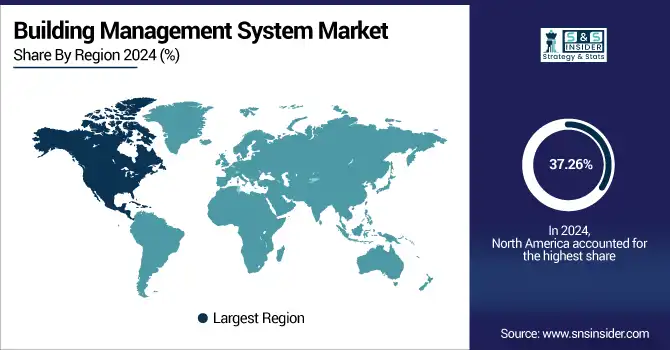

Building Management System Market Regional Analysis

North America Building Management System Market Insights

North America leads the Building Management System (BMS) market with a 37.26% share, driven by early adoption of advanced technologies, stringent energy efficiency regulations, and well-established infrastructure. The region is experiencing significant growth due to increasing investments in smart buildings and sustainable solutions that demand integrated, intelligent building management systems.

The US dominates in North America owing to the presence of a developed commercial real estate sector, stringent energy efficiency regulations, and the presence of key BMS solution providers, which have led to early adoption and innovation.

Europe Building Management System Market Insights

The BEMS market in Europe is exhibiting continuous growth, due to strict environmental regulations and a rising number of smart cities projects. The area’s focus on energy conservation and green building has spurred demand for innovative BMS solutions in commercial and industrial applications.

In Europe, Germany is the leading country due to a strong manufacturing economy, extensive energy efficiency to offer rebates, and strong government support for smart building integration.

Asia Pacific Building Management System Market Insights

Asia Pacific is the fastest-growing region with a CAGR of 19.98% owing to increasing urbanization, industrialization, and growing smart city projects. Growing government investment in infrastructure development and growing awareness about energy conservation are anticipated to further accelerate the demand for BMS solutions.

China is the key country in the region where significant factors contributing towards the regional growth are large-scale urban development, the government’s favorable policies for green buildings, and the establishment of several industrial parks in the country, which in turn, would drive the regional market for building management systems.

Middle East & Africa and Latin America Building Management System Market Insights

The Middle East & Africa and Latin America markets are also growing at a healthy rate due to increasing energy costs, the need for infrastructural modernization, and government initiatives to support sustainability, among others. In the region, Saudi Arabia, Egypt, and Qatar are some of the top markets for smart building solutions as those countries strive to meet the goals of their smart city projects and provide incentives to governments and other demand-driving factors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Building Management System Market Competitive Landscape:

Schneider Electric

Schneider Electric, founded in 1836, is a global leader in energy management and automation, playing a pivotal role in the building management system (BMS) market. The company offers innovative solutions that integrate building automation, energy efficiency, and sustainability. Its EcoStruxure™ Building platform provides intelligent control, real-time monitoring, and analytics, enabling smart, efficient, and connected buildings. Schneider Electric drives digital transformation, ensuring operational efficiency, occupant comfort, and reduced environmental impact in modern infrastructure.

-

2025: Schneider Electric launched EcoStruxure™ Building Activate in Australia and New Zealand. This plug-and-play, open platform empowers mid-sized facilities—like retail, healthcare, and education—to optimize energy use, enhance occupant comfort, and meet compliance with minimal technical skills.

-

2025: Siemens Smart Infrastructure at ISH 2025 showcased Desigo BMS alongside a Wireless Plug-and-Play Automation bundle and Connect Box IoT solution, enabling fast, sustainable digitalization for small to mid-sized buildings.

-

2025: In April, Schneider Electric collaborated with Nvidia on creating digital twins of AI data centers to boost electricity efficiency. This agreement facilitates Schneider's data center growth, bolstered by the acquisition of liquid cooling technology provider Motivair.

Johnson Controls

Johnson Controls, founded in 1885, is a global leader in smart and sustainable building solutions, holding a strong presence in the building management system (BMS) market. Its Metasys platform integrates HVAC, lighting, security, and energy management into a unified system, driving efficiency and occupant comfort. With advanced analytics and IoT-enabled solutions, Johnson Controls empowers buildings to be more resilient, energy-efficient, and future-ready.

-

2024: Johnson Controls introduced Metasys 14.0, the latest version of its Building Automation System, enhancing energy management, network performance, and security. It accommodates up to 800 IP devices and provides new energy consumption dashboards.

Key Players

Some of the Building Management System Market Companies

-

Schneider Electric

-

Cisco Systems, Inc.

-

Delta Electronics, Inc.

-

Robert Bosch GmbH

-

Hubbell Inc.

-

Johnson Controls

-

Honeywell International Inc.

-

Siemens

-

Azbil Corporation

-

Emerson Electric Co.

-

Legrand

-

United Technologies Corporation (Carrier)

-

Trane Technologies

-

Distech Controls Inc.

-

Crestron Electronics, Inc.

-

KMC Controls

-

Automated Logic Corporation

-

Daikin Industries, Ltd.

-

Ingersoll Rand

-

Lennox International Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 20.73 Billion |

| Market Size by 2032 | USD 81.74 Billion |

| CAGR | CAGR of 18.72% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Software, (Facility Management, Emergency Management, Energy Management, Security Management, Infrastructure Management) •By Service Type, (Professional Services, Managed Services) •By Application, (Residential, Industrial, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Schneider Electric, Cisco Systems, Inc., Delta Electronics, Inc., Robert Bosch GmbH, Hubbell Inc., Johnson Controls, Honeywell International Inc., Siemens, Azbil Corporation, Emerson Electric Co., Legrand, United Technologies Corporation (Carrier), Trane Technologies, Distech Controls Inc., Crestron Electronics, Inc., KMC Controls, Automated Logic Corporation, Daikin Industries, Ltd., Ingersoll Rand, Lennox International Inc. |