Enterprise Networking Market Report Scope & Overview:

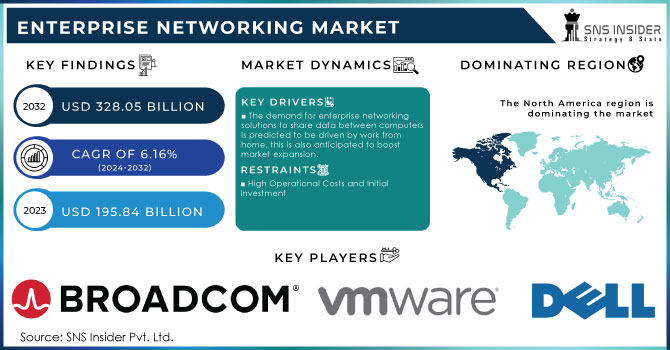

The Enterprise Networking Market Size was valued at USD 153.51 Billion in 2023 and is expected to reach USD 284.44 Billion by 2032 and grow at a CAGR of 7.1% over the forecast period 2024-2032.

Get more information on Enterprise Networking Market - Request Free Sample Report

The Enterprise Networking Market is a rapidly evolving sector that serves as the backbone of modern business operations, enabling seamless communication, data transfer, and resource sharing across organizations. With the proliferation of digital transformation initiatives, the demand for advanced networking solutions has surged, driving market growth. The market encompasses various components such as Ethernet switches, routers, wireless LAN (WLAN), software-defined networking (SDN), and security solutions.

The proliferation of artificial intelligence (AI) applications demands substantial networking infrastructure upgrades to handle the increased data traffic and low-latency requirements. Major industry players, including Nvidia, Cisco, and Lumen Technologies, are investing in advanced networking equipment and software to meet these demands. Cisco Systems, for instance, has raised its annual revenue forecast, attributing this to the heightened demand for data center products like Ethernet switches and routers, essential for AI workloads.

This growth is further supported by the increasing need for secure and efficient networking solutions to accommodate the rising number of connected devices and the expansion of cloud services. The integration of AI and machine learning into network management is also enhancing operational efficiency, contributing to the market's expansion. Overall, the enterprise networking market is poised for continued growth, driven by technological advancements and the escalating demand for high-performance networking infrastructure.

Enterprise Networking Market Dynamics

Key Drivers:

-

Increasing Adoption of Cloud Computing Solutions Across Industries Fuels the Growth of the Enterprise Networking Market

The increasing reliance on cloud computing is a major growth driver for the Enterprise Networking Market. As businesses continue to move their workloads to cloud platforms, there is an escalating need for high-performance, secure, and scalable networks to handle cloud traffic and support cloud-based applications. This shift is motivating enterprises to adopt software-defined networking (SDN) and cloud-based networking solutions like SD-WAN. These technologies optimize the performance of cloud applications, reduce operational costs, and enhance flexibility by offering centralized control over the network. Cloud adoption also increases the demand for infrastructure solutions that ensure smooth and secure data transfer between on-premises systems and cloud environments. As industries such as BFSI, healthcare, and education embrace cloud computing to improve operational efficiency and customer experiences, their need for robust networking infrastructure becomes more pronounced.

Additionally, cloud-based networking solutions allow businesses to scale their networks quickly and efficiently to meet growing demands, contributing significantly to the expansion of the enterprise networking market.

-

Proliferation of IoT Devices Across Various Sectors Drives Growth in the Enterprise Networking Market.

The proliferation of Internet of Things (IoT) devices is rapidly reshaping the Enterprise Networking Market. The growing adoption of IoT technologies in industries like healthcare, manufacturing, and transportation necessitates advanced networking solutions capable of handling large volumes of data generated by these connected devices. IoT deployments require networks that can support real-time data transfer, low latency, and high bandwidth to ensure efficient device communication and enable data analytics. For example, in healthcare, IoT-enabled devices such as wearables and remote monitoring systems generate continuous streams of data that need to be processed and analyzed in real time.

This demands highly efficient and reliable enterprise networks that can securely manage the vast amount of data coming from multiple IoT endpoints. To address these needs, businesses are investing in next-generation networking technologies such as 5G, edge computing, and advanced SDN. The need for more interconnected devices, smarter infrastructure, and improved automation is expected to fuel continued growth in the enterprise networking market.

Restrain:

-

High Initial Deployment Costs and Complexity of Managing Advanced Networking Solutions Limit Market Expansion.

Despite the rapid growth of the Enterprise Networking Market, high initial deployment costs and the complexity of managing advanced networking solutions pose significant challenges. The investment required to build and maintain robust networking infrastructures, especially for cutting-edge solutions like SD-WAN, 5G, and IoT integration, can be substantial. For small and medium-sized businesses (SMBs), the upfront costs of deploying these technologies may be prohibitive, limiting their ability to adopt such solutions.

Furthermore, the integration of modern networking solutions with legacy systems often involves technical challenges, requiring skilled professionals to manage network transitions smoothly. This complexity increases the overall operational costs for enterprises. The shortage of skilled networking professionals further compounds these challenges, leading to delays in network deployments and inefficient network management. Additionally, maintaining security across advanced, multi-layered networks adds another layer of complexity and cost, which can deter organizations from fully adopting next-generation networking solutions. These factors are limiting the widespread adoption of enterprise networking solutions, especially among smaller enterprises, and could slow market growth in the short term.

Enterprise Networking Market Segments Analysis

By Infrastructure Type

In 2023, the Outsourced Infrastructure segment of the Enterprise Networking Market captured the largest revenue share, accounting for 64.00%. This growth is attributed to the increasing trend of organizations outsourcing their network management and maintenance to specialized third-party service providers. Outsourcing offers businesses the ability to reduce costs, gain access to expertise, and leverage cutting-edge technologies without the overhead of managing the network in-house.

For instance, Cisco introduced Cisco SD-WAN solutions that allow enterprises to outsource their network management while benefiting from enhanced security and performance. Similarly, Fortinet has been expanding its FortiGate series, which integrates advanced firewall capabilities and is often deployed in outsourced networks to ensure security and compliance.

The In-House Infrastructure segment in the Enterprise Networking Market is experiencing rapid growth, with the largest CAGR of 7.89% projected over the forecast period 2024-2032. This growth is driven by the increasing preference of enterprises to retain control over their network infrastructure, ensuring data security, compliance, and the ability to customize network solutions according to specific business needs.

For example, Arista Networks has recently launched the Arista 7280R Series switches, designed for enterprise data centers and networks that demand high performance and low latency. These products cater to the growing demand for in-house network management, where enterprises require robust and flexible network solutions.

By Equipment

In 2023, the Ethernet Switch segment commanded the largest revenue share in the Enterprise Networking Market, holding 42.00%. This dominance is largely driven by the growing demand for reliable, high-performance networking infrastructure that can support the increasing volumes of data and interconnected devices within enterprise networks. Ethernet switches are essential components of modern networks, enabling seamless communication between devices and providing high-speed data transfer, which is crucial for businesses to maintain efficiency.

For instance, Cisco launched the Catalyst 9000 Series, a family of switches designed for enterprise-grade networks, offering enhanced security features, automation, and scalability.

The WLAN segment is poised to grow at the fastest rate within the Enterprise Networking Market, with an expected CAGR of 8.74% over the forecasted period. This growth can be attributed to the increasing need for flexible, scalable, and cost-effective network solutions that support mobile devices and remote work. WLANs provide enterprises with the ability to connect devices wirelessly, reducing the reliance on wired infrastructure and enabling greater mobility within the workplace.

Companies like Aruba Networks and Cisco have been driving innovation in the WLAN space. Aruba recently launched the Aruba 500 Series Access Points, which offer advanced security and improved performance for large-scale deployments.

Regional Analysis

In 2023, North America emerged as the dominant region in the Enterprise Networking Market, holding a significant market share of 37%. The region accounted for a substantial portion of the overall market due to the widespread adoption of advanced networking technologies, robust IT infrastructure, and the presence of leading technology companies. The presence of major players like Cisco, Juniper Networks, Hewlett Packard Enterprise, and Arista Networks has further driven the market’s growth. For instance, Cisco’s launch of advanced Ethernet switches and SD-WAN solutions has significantly contributed to the region's market share.

Additionally, the rise of cloud computing, and IoT, and the increasing need for secure networking solutions have spurred demand for enterprise networking products. Furthermore, North America’s mature infrastructure, rapid adoption of 5G, and growing data center needs continue to foster the market's expansion.

The Asia Pacific region is recognized as the fastest-growing region in the Enterprise Networking Market, with an estimated CAGR of 8.67% over the forecasted period. This rapid growth is driven by the region’s increasing digitalization, large-scale infrastructure development, and the growing adoption of cloud-based networking solutions. For example, companies in China and India are investing heavily in SD-WAN, WLAN, and IoT technologies to cater to the growing needs of businesses.

Furthermore, the rise of smart cities, digital enterprises, and increased internet penetration in emerging economies like India are creating new opportunities for enterprise networking solutions. As organizations in the APAC region embrace digital transformation, the demand for high-speed, reliable, and secure networking solutions is expected to grow, making APAC the fastest-growing region in the Enterprise Networking Market.

Need any customization research on Enterprise Networking Market - Enquire Now

Key Players

Some of the major players in the Enterprise Networking Market are:

-

Cisco Systems (Catalyst Switches, Meraki MX)

-

Broadcom Inc (StrataConnect Switch Chipsets, NetXtreme Ethernet Adapters)

-

Hewlett Packard Enterprise (Aruba CX Switches, HPE FlexNetwork Routers)

-

Juniper Networks (EX Series Switches, SRX Series Gateways)

-

Extreme Networks, Inc. (ExtremeSwitching, ExtremeCloud IQ)

-

Huawei (CloudEngine Switches, NetEngine Routers)

-

Fortinet (FortiSwitch, FortiGate NGFW)

-

Cloudflare, Inc. (Magic WAN, Magic Firewall)

-

Alcatel-Lucent Enterprise (OmniSwitch, OmniAccess WLAN)

-

Arista Networks (7000 Series Switches, CloudVision)

-

Riverbed Technology (SteelHead, SteelConnect EX)

-

Check Point Software Technologies Ltd. (Quantum Security Gateways, Harmony Connect)

-

SolarWinds Corporation (Network Performance Monitor, NetFlow Traffic Analyzer)

-

F5 Networks (BIG-IP, NGINX Controller)

-

Palo Alto Networks (Prisma SD-WAN, PA-Series Firewalls)

-

Pica8 (AmpCon Controller, PICOS Software)

-

Versa Networks (Versa Secure SD-WAN, Versa SASE)

-

Aryaka Networks Inc. (SmartConnect, SmartSecure)

-

A10 Networks, Inc. (Thunder Series, Harmony Controller)

-

Cato Networks Ltd. (Cato SASE Cloud, Cato SD-WAN)

Recent Trends

-

In April 2024, Fortinet unveiled the latest version of its FortiOS operating system alongside significant enhancements to its cybersecurity platform, the Fortinet Security Fabric. These updates integrate networking and security seamlessly, while the Security Fabric improvements introduce new capabilities, including generative AI, data protection, managed services, and unified agent features.

-

In February 2024, Broadcom subsidiary VMware announced advancements across its Software-Defined Edge portfolio, encompassing 5G, SD-WAN, SASE, and Edge Compute. These innovations are designed to help communication service providers (CSPs) modernize their networks and create new revenue-generating services.

-

In January 2024, Cisco Systems partnered with Kyndryl to develop scalable security solutions. The collaboration introduced a new security edge service, which, when combined with enterprises' existing SD-WAN offerings, provides a robust foundation for transitioning to SASE architecture.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 153.51 Billion |

| Market Size by 2032 | US$ 284.44 Billion |

| CAGR | CAGR of 7.1 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Equipment (Ethernet Switch, Enterprise Routers, WLAN, Network Security) • By Infrastructure Type (In-House, Outsourced) • By Deployment Mode (Cloud-based, On-premises) • By Organization Size (Large Enterprises, Small and Medium-sized) • By End User (Aerospace and Defense, Education, Media and Communication, Healthcare, BFSI, Transportation and Logistics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Cisco Systems, Broadcom, Hewlett Packard Enterprise, Juniper Networks, Extreme Networks, Inc., Huawei, Fortinet, Cloudflare, Inc., Alcatel-Lucent Enterprise, Arista Networks, Riverbed Technology, Check Point Software Technologies Ltd., SolarWinds Corporation, F5 Networks, Palo Alto Networks, Pica8, Versa Networks, Aryaka Networks Inc., A10 Networks, Inc., Cato Networks Ltd. |

| Key Drivers | • Increasing Adoption of Cloud Computing Solutions Across Industries Fuels the Growth of the Enterprise Networking Market • Proliferation of IoT Devices Across Various Sectors Drives Growth in the Enterprise Networking Market |

| Restraints | • High Initial Deployment Costs and Complexity of Managing Advanced Networking Solutions Limit Market Expansion |