Pharmaceutical and Life Sciences in Global Capability Centers Market Size:

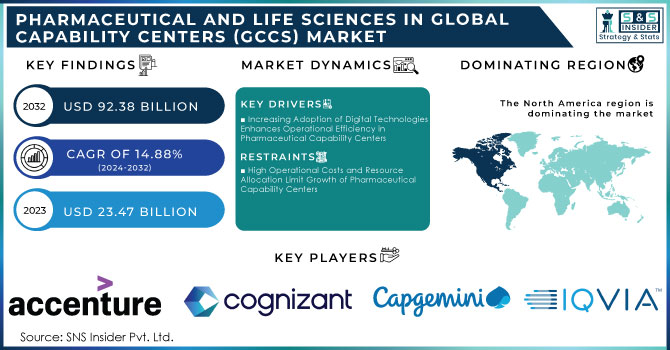

The Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Size was valued at USD 26.96 billion in 2024 and is expected to reach USD 92.38 billion by 2032 and grow at a CAGR of 14.88% over the forecast period 2025-2032.

The Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) market are increasingly pivotal in enhancing operational efficiencies, fostering innovation, and accelerating the drug development process. These centers serve as strategic hubs that leverage technology, data analytics, and industry expertise to support various functions within pharmaceutical and life sciences organizations. As companies seek to adapt to rapidly changing market conditions and consumer demands, capability centers are becoming essential for driving competitive advantage. This shift is largely driven by the rising need for digital transformation, increased regulatory scrutiny, and the growing importance of personalized medicine. Organizations are focusing on optimizing their supply chains, improving research and development efficiency, and utilizing advanced technologies to meet these demands.

Get More Information on Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market - Request Sample Report

Key Pharmaceutical & Life Sciences GCC Market Trends:

-

GCCs are evolving from cost-efficient back offices into strategic hubs for R&D, digital, and innovation.

-

AI, GenAI, and advanced analytics are being embedded to accelerate drug discovery, clinical documentation, and regulatory processes.

-

India is consolidating its position as the global hub for Pharma & Life Sciences GCCs, attracting major investments.

-

Expansion into regulated, high-value domains such as clinical trials support, pharmacovigilance, and regulatory affairs is accelerating.

-

Talent priorities are shifting from transactional roles to data science, cloud, bioinformatics, and product engineering expertise.

-

Growing emphasis on compliance, data security, and digital-first operations to meet global regulatory and patient safety standards.

In September 2024, L&T Technology Services launched a new capability center focusing on generative AI to transform global research processes. This center aims to accelerate innovation by utilizing generative AI models that can synthesize new compounds, predict drug interactions, and optimize clinical trial designs. By collaboration between cross-functional teams and harnessing advanced technologies, the center intends to enhance the speed and efficiency of research initiatives. The establishment of this center signifies a strategic investment in next-generation technologies, underscoring the industry's shift towards a more integrated and innovative approach to drug development and patient care.

Pharmaceutical and Life Sciences in GCC Market Dynamics:

Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Drivers:

-

Increasing Adoption of Digital Technologies Enhances Operational Efficiency in Pharmaceutical Capability Centers

The increasing adoption of digital technologies is significantly enhancing operational efficiency within pharmaceutical capability centers. Organizations are leveraging advanced technologies like artificial intelligence (AI), machine learning (ML), and big data analytics to streamline their processes. These digital tools facilitate better data management, real-time insights, and automation of repetitive tasks, allowing teams to focus on more strategic initiatives. For instance, AI algorithms can analyze vast datasets to identify potential drug candidates more quickly than traditional methods, thus expediting the research and development phase. Moreover, automation can optimize supply chain logistics, improving inventory management and reducing operational costs. By embracing these technologies, pharmaceutical companies can enhance their responsiveness to market changes and consumer needs, leading to improved product quality and shorter time-to-market for new therapies. As a result, the demand for capability centers that support digital transformation is likely to grow, positioning organizations to maintain a competitive edge in a rapidly evolving industry landscape.

-

Growing Focus on Patient-Centric Approaches Drives Innovation in Pharmaceutical Capability Centers

The growing focus on patient-centric approaches in healthcare is driving innovation within pharmaceutical capability centers. As patients become more informed and involved in their treatment decisions, pharmaceutical companies are prioritizing the development of therapies that cater to individual needs. Capability centers play a crucial role in this transformation by fostering collaborative environments that bring together multidisciplinary teams, including clinicians, researchers, and data scientists. These teams work together to gather patient insights, analyze treatment outcomes, and refine drug development processes based on real-world data. The emphasis on personalized medicine encourages the creation of tailored therapies, which can significantly enhance patient adherence and satisfaction. Additionally, capability centers are instrumental in conducting patient engagement initiatives, ensuring that patients' voices are heard throughout the drug development lifecycle. By prioritizing patient-centricity, pharmaceutical companies can improve their reputation, drive loyalty, and ultimately achieve better health outcomes, further validating the importance of capability centers in the modern pharmaceutical landscape.

Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Restraint:

-

High Operational Costs and Resource Allocation Limit Growth of Pharmaceutical Capability Centers

High operational costs and resource allocation challenges are significant restraints impacting the growth of capability centers in the pharmaceutical sector. Establishing and maintaining these centers often requires substantial investments in technology, infrastructure, and skilled personnel. The need for advanced technological tools, such as sophisticated data analytics platforms and AI systems, demands ongoing financial commitment, which can be prohibitive for smaller organizations or startups. Additionally, attracting and retaining top talent in data science and analytics can further strain budgets, as competition for skilled professionals intensifies. Resource allocation becomes a critical issue when companies must balance investments in capability centers with other business priorities, such as research and development or marketing initiatives. Consequently, the pressure to achieve rapid return on investment may lead some organizations to reconsider or delay their plans to develop capability centers. This dynamic can stifle innovation and limit the potential benefits of enhanced operational efficiency, ultimately impacting the overall competitiveness of firms in the pharmaceutical industry.

Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Opportunities:

-

Expanding Regulatory Support for Innovation in Drug Development Enhances Capability Center Potential

The expanding regulatory support for innovation in drug development presents a significant opportunity for capability centers within the pharmaceutical sector. Regulatory agencies are increasingly recognizing the need to streamline approval processes and encourage the adoption of innovative technologies that can improve patient outcomes. Initiatives such as accelerated approval pathways and guidance on the use of real-world evidence are paving the way for pharmaceutical companies to bring new therapies to market more efficiently. Capability centers are uniquely positioned to leverage this regulatory support by integrating cutting-edge technologies into their operations and adapting their strategies to comply with evolving regulations. By focusing on innovative solutions, these centers can enhance collaboration with regulatory bodies, ensuring that their research methodologies align with regulatory expectations. This proactive approach not only expedites the development of new drugs but also enhances the credibility of pharmaceutical companies in the eyes of regulators and patients alike. As a result, the potential for capability centers to drive innovation and facilitate faster access to ground breaking therapies is becoming increasingly pronounced.

Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Challenges:

-

Navigating Complex Regulatory Landscapes Poses Significant Hurdles for Capability Centers

Navigating complex regulatory landscapes remains a significant challenge for Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) market. The pharmaceutical industry is subject to stringent regulations that vary by region, requiring companies to adapt their operations accordingly. This complexity can hinder the efficiency of capability centers, as teams must ensure compliance with a multitude of guidelines and standards throughout the drug development process. Moreover, as technology continues to evolve, regulatory bodies are also adapting their frameworks, creating additional uncertainties for organizations trying to stay ahead of the curve. The need to constantly update protocols, invest in compliance training, and monitor regulatory changes can divert resources and attention away from innovation and operational improvements. Consequently, capability centers may struggle to strike a balance between adhering to regulatory requirements and fostering an environment that encourages experimentation and rapid development. This ongoing challenge necessitates a strategic approach to compliance, collaboration with regulatory agencies, and a commitment to staying informed about regulatory changes to mitigate potential disruptions to their operations and growth trajectories.

Pharmaceutical and Life Sciences in GCC Market Segmentation Overview:

By Service, IT and Digital Transformation Services Lead GCC Market with 38.6% Share in 2024

In 2024, the IT and Digital Transformation Services segment dominated the Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market, holding an estimated market share of approximately 38.60%. This dominance is driven by the rapid adoption of advanced digital technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing to streamline operations, enhance data management, and drive innovation. For instance, Pfizer’s investment in AI-driven platforms and Roche’s digital health initiatives exemplify how IT and digital transformation services are being utilized to accelerate research and development, improve drug discovery processes, and optimize patient engagement strategies. These advancements are crucial in maintaining competitiveness, especially as companies aim to reduce costs and increase the efficiency of their operations.

By Function, R&D Function Dominates Pharmaceutical GCCs, Capturing 36.8% Market Share

In 2024, the Research & Development function segment dominated the Capability Centers within the Pharmaceutical and Life Sciences Market, accounting for an estimated market share of around 36.80%. This dominance is attributed to the increasing focus on innovation and personalized medicine, as well as the rising demand for faster drug development and clinical trials. Pharmaceutical giants like Boehringer Ingelheim and Novartis have heavily invested in their R&D capabilities through capability centers that focus on advanced analytics, AI, and real-world evidence to expedite the drug discovery process. The establishment of R&D-focused capability centers allows companies to harness cutting-edge technologies, optimize their research workflows, and shorten time-to-market for critical therapies, aligning with evolving healthcare demands.

By Organizational Model, Captive Centers Drive GCC Market with 58.3% Share, Ensuring Control and Compliance

In 2024, the Captive Centers segment dominated the Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market, holding an estimated market share of approximately 58.30%. Captive centers, owned and operated directly by pharmaceutical companies, provide greater control over sensitive operations such as R&D, regulatory compliance, and data security. Companies like Roche and Pfizer have established captive centers to centralize their innovation efforts and maintain intellectual property control while ensuring alignment with company-wide strategies. The focus on in-house expertise and proprietary technologies in these centers enables pharmaceutical companies to better manage risk, enhance innovation, and ensure compliance with regulatory requirements, which is crucial in this highly regulated industry.

Pharmaceutical and Life Sciences in GCC Market Regional Analysis:

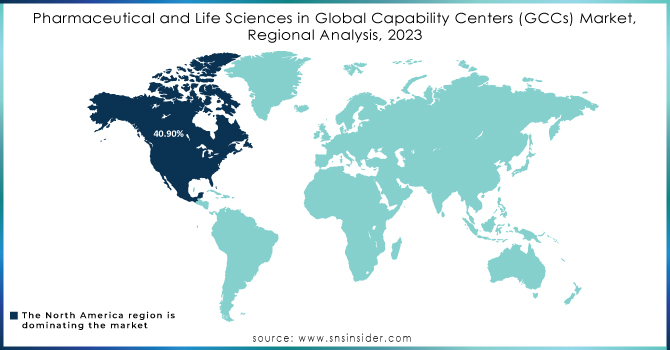

North America Dominates Pharmaceutical and Life Sciences in GCC Market in 2024

North America is the dominant region in the Pharmaceutical and Life Sciences GCC Market, holding an estimated 41.5% market share in 2024. This leadership is driven by massive R&D investment, robust digital infrastructure, and strict compliance requirements that push companies to centralize operations. The region benefits from advanced clinical research ecosystems and a strong presence of global pharmaceutical leaders. These advantages position North America as the most mature and innovation-driven hub for GCC activities, especially in digital transformation, regulatory management, and advanced R&D functions.

-

United States Leads North America’s Pharmaceutical and Life Sciences GCC Market

The United States is the leading country in the North American market due to its dominant pharmaceutical industry, advanced regulatory framework, and investment in AI-enabled R&D. Companies like Pfizer, Johnson & Johnson, and Merck have significantly expanded their GCC operations to enhance innovation, manage regulatory compliance, and accelerate clinical trials. Access to top-tier scientific talent, coupled with a highly digitalized healthcare ecosystem, makes the U.S. the epicenter of global pharmaceutical GCC activities, ensuring it remains the strategic leader in innovation, compliance, and commercialization.

Asia Pacific is the Fastest-Growing Region in Pharmaceutical and Life Sciences in GCC Market in 2024

Asia Pacific is the fastest-growing region in the Pharmaceutical and Life Sciences GCC Market, with an estimated CAGR of 13.2% from 2024–2029. This rapid growth is fueled by digital adoption, cost-efficient talent, and strong demand for R&D outsourcing. Global pharmaceutical companies are increasingly leveraging Asia Pacific for advanced analytics, clinical documentation, and pharmacovigilance support. With governments encouraging biotech investments and multinational firms expanding their footprints, the region is evolving into a critical innovation hub, driving future global growth for pharmaceutical capability centers.

-

India Leads Pharmaceutical and Life Sciences GCC Market Growth in Asia Pacific

India dominates the Asia Pacific market with its vast pool of skilled professionals, cost advantages, and robust technology ecosystem. Global giants like Novartis, Sanofi, and Eli Lilly have expanded their Indian GCCs to focus on advanced analytics, AI-driven R&D, and regulatory services. The presence of world-class IT talent, government incentives for pharma and biotech innovation, and thriving collaborations with startups make India the preferred hub for large-scale digital transformation. Its ability to combine low costs with high-value innovation cements India’s leadership in the region.

Europe Pharmaceutical and Life Sciences GCC Market Insights

Europe holds an estimated 23.7% market share in 2024 in the Pharmaceutical and Life Sciences GCC Market. Driving Factor: Stringent EU regulations and a strong biotech ecosystem fuel GCC adoption, as companies centralize compliance and clinical trial operations. Germany dominates the European market with its highly skilled workforce, leading pharmaceutical players like Bayer and Boehringer Ingelheim, and strong government support for biotech research. Germany’s leadership in innovation and regulatory excellence makes it the most attractive European destination for pharmaceutical GCC activities.

Middle East & Africa and Latin America Pharmaceutical and Life Sciences GCC Market Insights

In 2024, the Pharmaceutical and Life Sciences GCC market in the Middle East & Africa (MEA) and Latin America remains emerging, holding modest shares compared to mature regions. In MEA, the UAE and South Africa are gradually attracting GCC setups due to investments in healthcare IT and compliance support, though limited scale and talent gaps constrain rapid expansion. In Latin America, Brazil and Mexico lead adoption as pharmaceutical firms explore cost-efficient clinical trial and pharmacovigilance support. Both regions show long-term potential but remain at an early development stage compared to North America, Europe, and Asia Pacific.

Need Any Customization Research On Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market - Inquiry Now

Competitive Landscape for the Pharmaceutical and Life Sciences in GCC Market:

Sanofi

Sanofi is a France-based global biopharmaceutical leader, with significant presence in global capability centers (GCCs) focused on digital health, data analytics, and clinical trial support. Through its GCCs in India and other strategic locations, Sanofi leverages artificial intelligence (AI), real-world evidence, and advanced analytics to accelerate drug discovery and strengthen regulatory compliance. Its role in the GCC market is vital, as it integrates digital transformation with R&D operations, optimizing efficiency and patient engagement strategies across therapeutic areas like oncology, immunology, and vaccines.

-

In 2024, Sanofi expanded its Hyderabad GCC, adding AI-driven platforms to enhance pharmacovigilance, digital health solutions, and patient engagement programs.

Novartis

Novartis, headquartered in Switzerland, is a multinational pharmaceutical giant that operates large-scale GCCs, particularly in India, to advance innovation in R&D, analytics, and cloud-based platforms. Its GCCs play a central role in digital transformation, focusing on accelerating clinical trial operations, improving real-world evidence generation, and enabling faster regulatory submissions. Novartis leverages its capability centers as engines for scalable innovation, positioning itself as a pioneer in AI-enabled drug discovery and digital-first healthcare models.

-

In 2024, Novartis invested further in its Hyderabad and Bengaluru GCCs, building advanced analytics hubs for clinical trial optimization and personalized medicine initiatives.

Pfizer

Pfizer, a U.S.-based pharmaceutical leader, has strategically expanded its GCC footprint to strengthen R&D, regulatory, and digital innovation. Its GCC operations focus on AI-driven platforms, cloud computing, and advanced data management systems, enabling faster drug discovery and improved patient-centric healthcare solutions. Pfizer’s role in the GCC market is crucial, as its centers drive global transformation projects, ensure compliance with stringent regulatory requirements, and deliver end-to-end digital solutions to support commercial and clinical operations.

-

In 2024, Pfizer expanded its GCC in Chennai to support large-scale digital health initiatives, AI-driven trial documentation, and regulatory automation.

Merck

Merck (MSD outside the U.S. and Canada) is a global pharmaceutical leader with robust GCC operations designed to strengthen compliance, digital innovation, and R&D efficiency. Its capability centers focus on clinical development, advanced analytics, and IT-enabled transformation projects. Merck leverages these centers to accelerate drug development timelines, improve pharmacovigilance processes, and enhance real-world evidence studies. By embedding cutting-edge AI/ML tools into its GCC ecosystem, Merck is redefining digital transformation within pharma.

-

In 2024, Merck enhanced its Bengaluru GCC, deploying advanced data science platforms to support clinical trials, regulatory submissions, and AI-driven research initiatives.

Pharmaceutical and Life Sciences in Global Capability Centers (GCCs) Market Companies:

-

Sanofi

-

Novartis

-

Pfizer

-

Merck

-

Amgen

-

AstraZeneca

-

GlaxoSmithKline (GSK)

-

Roche

-

Eli Lilly

-

Teva Pharmaceuticals

-

Genentech

-

Johnson & Johnson

-

AbbVie

-

Biogen

-

Gilead Sciences

-

Julphar

-

SPIMACO Addwaeih

-

Qatar Life Pharma

-

Dallah Pharma

-

Neopharma

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 26.96 Billion |

| Market Size by 2032 | US$ 92.38 Billion |

| CAGR | CAGR of 14.88% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (IT and Digital Transformation Services, Business Process Management (BPM), Knowledge Process Outsourcing (KPO)) • By Function (Research & Development, Manufacturing & Operations, Sales & Marketing, Regulatory Compliance & Quality Assurance) • By Organizational Model (Captive Centers, Hybrid Centers, Outsourced Centers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Sanofi, Novartis, Pfizer, Merck, Amgen, AstraZeneca, GlaxoSmithKline (GSK), Roche, Eli Lilly, Teva Pharmaceuticals, Genentech, Johnson & Johnson, AbbVie, Biogen, Gilead Sciences, Julphar, SPIMACO Addwaeih, Qatar Life Pharma, Dallah Pharma, Neopharma, and other key players. |