Butter Market Report Scope & Overview:

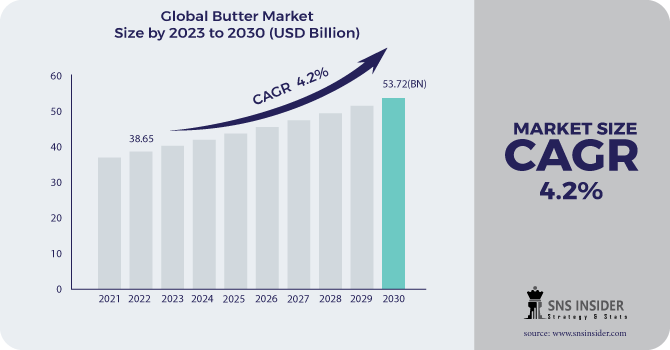

Butter Market Size was valued at USD 38.65 billion in 2022 and is expected to reach USD 53.72 billion by 2030, and grow at a CAGR of 4.2% over the forecast period 2023-2030.

Butter is broadly utilized in the food business for assembling different food items and for sauce production and searing. It is utilized in enhancing different bundled food sources or snacks like treats and wafers.

Interest for exceptional taste profiles and surfaces by millennials is supposed to set out open doors for producers of butter. Additionally, the interest for butter is filling in the foodservice business because of the rising utilization of cheap food in creating economies because of more occupied ways of life, and higher use over out-of-home food utilization.

The majority of the more youthful age and common segment eat inexpensive food no less than one time each day. This developing pattern of utilization of cheap food fundamentally affects the butter market, as butter is generally utilized for broiling and for enhancing an assortment of inexpensive food items.

Butter is additionally a staple in families, henceforth makers are sending off different butter-based items like butterable butter, seasoned butter, low-fat butter, and numerous others to draw in buyers.

Table butter is arranged to utilize purified cream that is acquired from endlessly milk items. It likewise incorporates normal salt, annatto, or carotene for adding variety and diacetyl as an enhancing specialist. It goes through changes in structure contingent upon the encompassing temperature. For example, it stays strong under refrigeration, mellow to a butterable consistency at room temperature, and melts into a fluid consistency at a higher temperature. Table butter has niacin, calcium, phosphorus, riboflavin, cell reinforcements, and nutrients A, B and E. Accordingly, its satisfactory utilization helps with working on safe capacity, supporting heart wellbeing, and safeguards cells against harm brought about by free revolutionaries.

Market Dynamics:

Driving Factors:

-

The premiumization pattern and interest for natural items.

-

Expanding interest for cooking fixings from the foodservice business and family customers.

Restraining Factors:

-

Buyers know about the advantages of sound items

-

Decide to buy them despite exorbitant costs.

Opportunities:

-

The rising interest in bundled food has moved the interest for butter items.

-

Customers are requesting more assortments in butter.

Challenges:

-

As milk creation falls, produces are frequently lose because fewer spot loads are accessible, and those that convey a premium.

Impact of Covid-19:

Because of COVID-19 limitations, the butter market encountered a rising interest pattern because of the frenzy of purchasing and storing a few food things by the customers. There was additionally a critical inventory shock because of interruptions in sending out business sectors because of unofficial laws. The COVID-19 pandemic has fundamentally affected how individuals shop, eat and live. Lockdowns and café terminations have added to an expansion in the number of suppers made and polished off at home, bringing about critical volume expansions in dairy items like butter and liquid milk. These shopper designs have helped retail-confronting dairy firms.

Key Market Segments:

By Nature:

-

Organic

-

Conventional

By Source:

-

Dairy

-

Plant-based

By Form:

-

Butterable

-

Non-Butterable

By End Use:

-

Food Processing

-

Foodservice

-

Retail/Household

By Distribution Channel:

-

Business to Business

-

Business to Consumer

-

Hypermarkets/Supermarkets

-

Specialty Stores

-

Convenience Stores

-

Online Retail

.png)

Regional Analysis:

-

North America

-

The USA

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

The UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

-

-

Asia-Pacific

-

Japan

-

south Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

-

-

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of Middle East & Africa

-

-

Latin America

-

Brazil

-

Argentina

-

Rest of Latin America

-

The Asia-Pacific butter supply has forever been exceptionally affected, in expanding amounts, by the homegrown market. Butter handling plants in the Asia-Pacific area have been essentially extended to satisfy the customer's needs, thusly, energizing business sector development. Additionally, while the butter is principally connected with Western foods, its possible use in Chinese cooking has been vigorously advanced by significant makers like Fonterra, accordingly further expanding its application in Asian cooking, and in this way, in the Asian market. The market for nut butter is leaned toward peanut butter items. Be that as it may, the greater part of the butter market is taken special care of by brands managing chocolate butter, like Nutella. The nut butter interest, rather than being in butter itself, has collected interest as a preparing element for dinners. The development of high-quality nut butter is filling in nations where brands are zeroing in on making special recipes having natural crude fixings as a base material. In August 2020, KP Snacks sent off its palm sans oil peanut butter range, with the container and top being 100 percent recyclable, irreproachable with 35% less salt, and no added sugar or counterfeit flavors.

Key Players:

Key Players in Global Butter Market are Nestlé, Lactalis, Danone, Fonterra, Fries land Campina, Dairy Farmers of America, Arla Foods, Yili Group, Saputo Inc., and Mengniu Dairy.

Nestlé-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2022 | USD 38.65 Billion |

| Market Size by 2030 | USD 53.72 Billion |

| CAGR | CAGR 4.2% From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2020-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Product Type (Cultured butter, Uncultured Butter, and Other Product Types) • by Distribution Channel (Supermarkets/Hypermarkets, Convenience stores, Specialty Stores, Online Retail Stores, and Other Distribution Channels) |

| Regional Analysis/Coverage | North America (USA, Canada, Mexico), Europe (Germany, UK, France, Italy, Spain, Netherlands, Rest of Europe), Asia-Pacific (Japan, South Korea, China, India, Australia, Rest of Asia-Pacific), The Middle East & Africa (Israel, +D11UAE, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Global Butter Market are Nestlé, Lactalis, Danone, Fonterra, Fries land Campina, Dairy Farmers of America, Arla Foods, Yili Group, Saputo Inc., and Mengniu Dairy. |

| Key Drivers | •The premiumization pattern and interest for natural items. •Expanding interest for cooking fixings from the foodservice business and family customers. |

| Market Restraints | •Buyers know about the advantages of sound items •Decide to buy them despite exorbitant costs. |