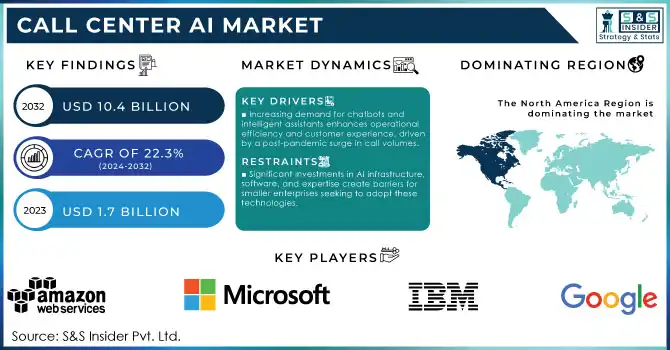

Call Center AI Market Size & Overview:

Call Center AI Market Size was valued at USD 1.7 Billion in 2023 and is expected to reach USD 10.4 Billion by 2032, growing at a CAGR of 22.3% over the forecast period 2024-2032.

Get more information on Call Center AI Market - Request Free Sample Report

Call Center AI Market growth is driven due to the growing adoption of AI-powered customer service solutions to improve efficiency and customer satisfaction. This highlights the significance of AI for governments all around the globe who are now integrating them to transform their call center operations. U.S. Department of Commerce in 2023, federal funding of $2 billion was directed toward customer service improvement technologies related to AI. The European Commission designated €1.5 billion for AI research as part of the Digital Europe Program with a focus on customer interaction system applications, such as call centers. According to the Ministry of Electronics and Information Technology, AI adoption across public services has increased by 28% in India, with a significant portion of it devoted to improvements to call centers. Such developments highlight an imminent demand across organizations for advanced technologies such as predictive analytics, natural language processing (NLP), and conversational AI to handle the rising number of customer inquiries effectively. Call center AI has a unique potential to automate, cut costs, and provide excellent user experiences with the expectation that 85% of customer interactions will be managed without human agents by 2025.

Global organizations are heavily investing in leveraged advanced technologies in order to improve customer experiences and retain a competitive edge In fact, these tools are incorporated in many industries such as IT, telecom, BFSI, healthcare, and retail for predictive modeling, process automation, and optimization. It helps businesses manage heavy traffic by streamlining customer service operations, ensuring consistent solutions, and putting less strain on support channels during peak hours, which ultimately means more reliable service.

Market dynamics

Drivers

-

Increasing demand for chatbots and intelligent assistants enhances operational efficiency and customer experience, driven by a post-pandemic surge in call volumes.

-

Enhanced natural language processing and sentiment analysis tools provide personalized and empathetic customer interactions, boosting satisfaction and adoption.

-

AI solutions reduce operational costs while enabling seamless multi-channel customer support across voice, chat, and email platforms. Features like voice biometrics and inclusive design ensure secure, user-friendly interactions, meeting diverse customer needs and regulatory demands.

With the evolution of conversational AI, businesses are now able to provide and offer humanized, personalized, interactive, context-aware, empathetic support and customer interaction. Equipped with advanced natural language processing (NLP) and machine learning (ML) technologies, these systems are capable of understanding context, interpreting emotions, and responding in a human-like manner. For example, the GPT-based models of OpenAI are now able to handle complex queries while determining user sentiment mixed in within chatbots. As per a recent report, organizations implementing conversational AI solutions experience a 30–40% decrease in time to respond to their customers. Industry standards now include toolings such as Google Dialogflow and Microsoft Azure Bot Service, which enables us to talk to users via voice and text channels in real-time. Sentiment analysis, one of the subsets of these AI abilities, aids in identifying customer emotions frustration or satisfaction allowing agents to prioritize their responses and escalate issues proactively.

As an example, H&M implemented a sentiment-driven AI system to manage and respond to more than 1.5 million customer queries per month, leading to a 15% increase in first-contact resolution rates. Likewise, Vodafone uses AI virtual agents with sentiment detection capabilities and has been able to improve customer experience by 20% in one year of deployment. Such advancements not only keep the operations smooth and efficient but also add a layer of gratitude and delight for customers underlining the role of emotional intelligence in modern AI tools.

Restraints

-

Significant investments in AI infrastructure, software, and expertise create barriers for smaller enterprises seeking to adopt these technologies.

-

The handling of sensitive customer information raises compliance challenges with global and regional data protection laws.

-

A lack of trained professionals for deploying and managing AI solutions limits scalability, particularly in emerging markets.

The high cost of implementation is a major restraint for the Call Center AI market. AI solutions demand investment in complex infrastructure, software, and hardware (cloud resources, machine learning models). And, a lot more customization to suit unique organizational needs usually requires even more funding. Apart from the initial setup, maintenance and regular updates of the AI systems demand technical skills, which are an additional cost in the long run. These are larger obstacles for small and medium-sized enterprises (SMEs) which may not have the budgets to be able to deploy these technologies. In addition, the shift from traditional systems to AI-driven operations can introduce unforeseen expenses, particularly in an environment where there is legacy infrastructure that needs to be complemented. Such financial obstacles delay the adoption rate of smaller organizations and create a situation for larger companies to calculate ROI before moving to such changes.

Segment analysis

By Component

The solutions segment accounted for the largest revenue share of more than 74% in 2023, owing to its imperative in revolutionizing traditional call center activities. At the forefront of the transformation are AI-driven solutions, including chatbots, virtual assistants, and speech analytics. A report from the U.S. Bureau of Labor Statistics revealed that using AI solutions in their call centers resulted in 40% less average handling time and 35% higher resolution rates. Government-led efforts, such as the UK's Artificial Intelligence Strategy, boosted the adoption of such technologies by offering grants and subsidies to businesses moving from legacy to AI-based solutions. With the growing dependency on these technologies in supporting seamless customer interactions, their capacity to manage millions of calls every day, comprehend data in real-time, and develop actionable insights, has solidified their dominance in the market.

By Application

In 2023, the predictive call routing segment accounted for the largest market share of over 23% since it increases the efficiency of a call center and customer satisfaction. Using AI and a combination of data post-processing metrics on customer profiles, intent, and agent performance, it intelligently determines which agent is best suited to handle a call instantaneously, predictive call routing can direct a call to the right agent. The report also noted a 30% increase in customer satisfaction scores and a 20% improvement in first-call resolution rates amidst businesses that leveraged predictive call routing, as per the World Economic Forum 2023 AI Impact Report. The deployment of such technologies has been accelerated by government support, such as the Singapore Smart Nation Initiative, which has also provided infrastructure and funding for the integration of AI in customer service areas.

By Channel

In 2023, the phone channel represented more than 42% of the market share and continues to be the most favored customer interaction channel. While digital channels, including chat and email, are seeing an increase in customer use, for many customers particularly in older demographics the immediacy and reliability of speaking to someone on the phone trumps those other solutions. A survey by the Australian Government Department of Communications found that 68% of citizens aged 45 and above still opt for phone interactions over digital alternatives. AI technologies such as speech recognition and sentiment analysis improving phone-based interactions only add to the strength of this segment. These technologies together with the notion of better telecommunication infrastructure supported by government policies have kept the Phone channel popular in customer service.

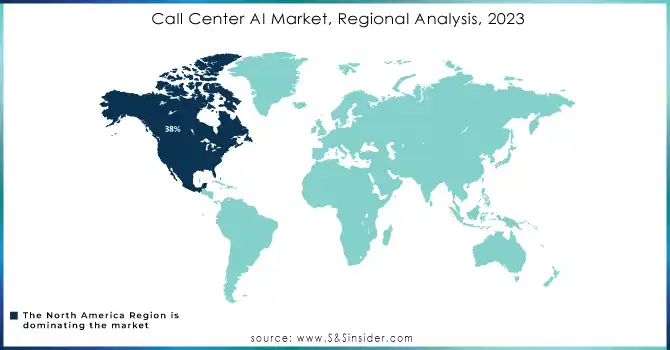

Regional Analysis

North America dominated the Call Center AI market, accounting for a significant market share of more than 38% in 2023. This is due to the technological advances in the region, IT infrastructure & strong government initiatives supporting AI integration. The U.S. National Artificial Intelligence Initiative has contributed significantly to this growth, catalyzing the adoption of AI technologies across different sectors, such as customer care. North America's position is driven by the high levels of investments in research and development, the availability of a skilled workforce, and a well-developed digital ecosystem. NA companies are utilizing AI to boost their customer experiences, operational performance, and call center processes.

On the other hand, Asia-Pacific is the fastest-growing CAGR during the forecast period. This growth is driven by quick improvements in AI infrastructure and higher government funding. In China, the AI Development Plan allocated $5 billion to boost AI applications, including call center automation, signaling a strong commitment to technological transformation. Similarly, India's Digital Transformation Strategy emphasizes the integration of AI across public and private sectors to improve service delivery and efficiency. The growing digital economy, rising consumer demand for seamless support, and supportive government policies are positioning Asia-Pacific as a significant player in the global Call Center AI market.

Need any customization research on Call Center AI Market - Enquiry Now

Key Players

Service Providers / Manufacturers:

-

Google LLC (Dialogflow, Contact Center AI)

-

IBM Corporation (Watson Assistant, Watson Discovery)

-

Amazon Web Services (AWS) (Amazon Lex, Amazon Connect)

-

Microsoft Corporation (Azure Bot Services, Dynamics 365 AI for Customer Service)

-

Salesforce (Einstein Bots, Service Cloud Voice)

-

Genesys (Genesys Cloud CX, Predictive Engagement)

-

NICE Ltd. (NICE Enlighten AI, CXone)

-

Five9, Inc. (Five9 IVA, Five9 Digital Engagement)

-

Zendesk (Zendesk Chatbot, Answer Bot)

-

Avaya Inc. (Avaya Conversational AI, Avaya Experience Platform)

-

Bright Pattern (Bright Pattern Contact Center, Bright Pattern AI Chatbot)

Key Users of Call Center AI Services/Products:

-

AT&T

-

American Express

-

Verizon Communications

-

UnitedHealth Group

-

Delta Air Lines

-

Walmart Inc.

-

HSBC Holdings plc

-

Amazon.com, Inc.

-

Marriott International

-

Tesla, Inc.

Recent development

-

In February 2024: Zendesk announced the acquisition of Klaus, enhancing its workforce engagement management (WEM) portfolio, including Tymeshift. This move aims to deliver top-tier automated quality assurance solutions for businesses.

-

In February 2024: Bright Pattern partnered with Grupes, a certified contact center software provider in EMEA, to deliver advanced solutions and enhance customer experience throughout the consumer journey in various industries.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.7 Billion |

| Market Size by 2032 | USD 10.4 Billion |

| CAGR | CAGR of 22.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions, Services) • By Application (Predictive Call Routing, Journey Orchestration, Quality Management, Sentiment Analysis, Workforce Management & Advanced Scheduling, Others) • By Channel (Phone, Social Media, Chat, Email Or Text, Website) • By Enterprise Size (Small & Medium Enterprise, Large Enterprise) • By Industry (BFSI, IT & Telecommunication, Healthcare, Retail & E-commerce, Energy & Utilities, Travels & Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Google LLC, IBM Corporation, Amazon Web Services (AWS), Microsoft Corporation, Salesforce, Genesys, NICE Ltd., Five9, Inc., Zendesk, Avaya Inc., Bright Pattern. |

| Key Drivers | •Increasing demand for chatbots and intelligent assistants enhances operational efficiency and customer experience, driven by a post-pandemic surge in call volumes. •Enhanced natural language processing and sentiment analysis tools provide personalized and empathetic customer interactions, boosting satisfaction and adoption •AI solutions reduce operational costs while enabling seamless multi-channel customer support across voice, chat, and email platforms. Features like voice biometrics and inclusive design ensure secure, user-friendly interactions, meeting diverse customer needs and regulatory demands |

| Market Restraints | •Significant investments in AI infrastructure, software, and expertise create barriers for smaller enterprises seeking to adopt these technologies •The handling of sensitive customer information raises compliance challenges with global and regional data protection laws •A lack of trained professionals for deploying and managing AI solutions limits scalability, particularly in emerging markets |