Artificial Intelligence for IT Operations Platform Market Size & Overview:

Get More Information on Artificial Intelligence for IT Operations Platform Market - Request Sample Report

Artificial Intelligence For IT Operations Platform Market was valued at USD 10.73 billion in 2023 and is expected to reach USD 47.21 Billion by 2032, growing at a CAGR of 17.91% from 2024-2032.

The market for Artificial Intelligence for IT Operations (AIOps) platforms is rapidly growing, primarily due to the increasing complexity of IT systems and the need for greater operational efficiency. By integrating big data and machine learning, AIOps enhances IT operations by automating processes and managing large data volumes effectively. A significant driver of this growth is the demand for real-time monitoring and proactive issue resolution. According to a recent report, over 30% of large organizations are projected to adopt AIOps solutions by 2025. A prime example of AIOps in practice is IBM's Watson AIOps, which aids IT teams in minimizing downtime by detecting anomalies and automating solutions. IBM noted in 2023 that companies utilizing Watson AIOps experienced a 50% decrease in incident resolution times, resulting in improved operational efficiency and heightened customer satisfaction. Other companies, such as Splunk and Moogsoft, are also capitalizing on AIOps to refine IT operations and enhance visibility into their infrastructure.

The surge in cloud computing adoption and the growing dependence on digital services further drive the demand for AIOps solutions. As organizations transition to hybrid cloud environments, managing IT operations becomes more complex, making AIOps crucial for maintaining system performance and reliability. A recent survey revealed that 63% of IT leaders foresee AIOps playing a pivotal role in their IT operations in the coming years. Additionally, the rising emphasis on data security and compliance is fueling the adoption of AIOps, as organizations strive to mitigate risks and strengthen their security frameworks. These factors collectively indicate that the AIOps platform market is poised for ongoing growth, underscoring the essential role of AI in contemporary IT operations.

Artificial Intelligence For IT Operations Platform Market dynamics

Drivers

-

Organizations are seeking to automate IT operations to enhance efficiency and reduce manual workloads, driving AIOps adoption.

-

The rise of cloud computing and hybrid environments increases operational complexities, making AIOps essential for performance management

-

Growing concerns about data security and regulatory compliance drive the need for AIOps solutions to manage risks effectively

Factors such as increasing need for data security and stringent regulatory compliance are contributing immensely to the growth of Artificial Intelligence for IT Operations (AIOps) solutions. With organizations coming to depend on digital infrastructure and mogul services, they also find themselves being caretakers of higher amounts of sensitive data, raising the possibilites of a data breach and cyberthreats. A multi-cloud security AIOps platform detects vulnerabilities or anomalies in real-time, using AI and ML to improve an organization’s overall security posture. In addition, various regulatory frameworks including General Data Protection Regulation (GDPR) and Health Insurance Portability and Accountability Act (HIPAA) set severe compliance standards organizations are required to fulfil). Fail at it, and you could face an expensive fine — or worse. AIOps tools automate compliance monitoring, ensuring that data management practices are in accordance with the law. For instance, businesses can use AIOps to track audit trails, observe data access and control encryption processes — the latter two being essential for satisfying compliance obligations. Moreover, AIOps enhance incident response times, enabling IT teams to quickly respond to security threats. AIOps is capable of looking through enormous amounts of data to identify patterns linked to breaches so that proactive measures can be taken from the information gleaned. Given the sophistication of today's cyberattacks, possessing this capability is essential.

Thus implementing AIOps solutions enhances security and shows commitment towards data protection which in turn builds trust among customers and stake holders. The AIOps market is expected to see solid growth as organizations face increased pressure for data security and compliance in the IT environment, creating demand for more advanced technological solutions.

Restraints

-

Integrating AIOps with existing IT infrastructure and systems can be complex, requiring significant time and expertise, which may deter organizations from adoption.

-

Organizations may be hesitant to adopt AIOps due to fears about data privacy and security, especially with sensitive information being processed and analyzed.

-

The lack of skilled personnel who can effectively manage and utilize AIOps technologies can hinder market growth, as organizations struggle to find qualified staff.

A significant challenge to the growth of a market for AIOps is a lack of skilled personnel trained in managing and using AIOps technologies. As organizations continue to adopt AIOps for better IT operations, skilled professionals with knowledge of artificial intelligence and machine learning (ML) are in high demand, as well as people who understand the fundamentals of IT operations management. The problem is the current labour force is not well prepared for this, so there is a skills gap that prevents the market from growing. In a recent research study, 63% of IT leaders find difficulty in seeking an appropriate talent having adequate skills to deploy AIOps solutions perfectly.

This gap in skills not only affects the implementation of AIOps technologies, but also limits organizations from unleashing their true potential. Ensuring seamless working of AIOps with currently followed IT procedures is not easy without the proper expertise, hence also limiting its effective utilization for automation, data analytics and real-time insights. Moreover, AIOps undoubtedly arises complexity in the IT still it needs to be more than just an understanding based on traditional and functional processes of IT management that leads to a confounding solution. With the increasing dependence on digital technologies and data-driven decision-making, organizations are pressured to invest in training and development programs for skilling their existing workforce. But this process of upskilling is quite resource expensive and time consuming. To combat these issues, a lot of firms are teaming up with universities and training organizations to cultivate a pipeline for skilled talent. This can be a means to help address the skills gap, which is key to AIOps being realised and for organisations to effectively find their balance within the complexities of modern IT operations.

Artificial Intelligence For IT Operations Platform Market Segmentation

By Offering

In 2023, the platform offering segment led the AIOps market, securing 88.86% of global revenue. AIOps vendors deliver reliable, responsive, and innovative platforms that enable businesses to achieve a competitive edge. This substantial market share is attributed to several business benefits, such as enhanced decision-making, expedited digital transformation, efficient data processing, and increased agility. A critical factor driving the demand for AIOps platforms is automation, which aids in performing correlation analytics to identify and resolve issues within IT infrastructures effectively. For instance, in March 2023, when Cisco introduced its "Cisco SecureX" platform, which integrates AIOps capabilities to improve security operations. By utilizing AI and machine learning, Cisco SecureX helps IT teams identify threats faster and automate responses, thereby enhancing their overall security posture. This comprehensive platform brings together security tools and data, allowing organizations to manage their security operations more effectively. Moreover, various companies are advancing AI technologies for diverse IT applications, including real-time analytics, infrastructure management, and network management. For example, Dynatrace, a well-regarded application performance monitoring (APM) provider, has concentrated on various IT solutions ranging from application and microservices support to application security. They offer automated AIOps solutions like Davis, which analyzes dependencies and events through open APIs and AI to help detect IT issues and conduct root cause analysis.

Looking forward, the service offering segment is anticipated to experience the highest CAGR of 19.8% during the forecast period. The escalating complexity of IT environments and the increasing demand for real-time decision-making are expected to significantly boost the growth of AIOps services, creating notable market opportunities for service providers in the near future.

By Application

In 2023, the real-time analytics application segment dominated the market, claiming a notable revenue share of 35.8%. This segment plays a vital role in the manufacturing industry, enhancing production quality by improving vendor performance, ensuring data accuracy, and minimizing cost overruns. Additionally, it streamlines lead times by reducing cycle and customer service durations, enhances delivery reliability through adherence to schedules and vendor performance metrics, and effectively manages costs by decreasing waste rates and improving inventory turnover. The substantial market share is driven by the growing adoption of real-time analytics, which enables businesses to cultivate competitive intelligence. Moreover, real-time analytics equips organizations with a data-driven approach to quickly identify, prioritize, diagnose, and resolve operational challenges.

Conversely, the infrastructure management application segment is expected to achieve the highest compound annual growth rate (CAGR) during the forecast period, driven primarily by the increasing adoption of AI technologies within complex IT infrastructures. A notable advancement in this space is BMC Software's introduction of the TrueSight Infrastructure Management solution in January 2021, which integrates infrastructure monitoring, incident management, and operational analytics. This solution provides IT teams with a holistic view of their infrastructure, improving management and decision-making processes. These trends underscore the increasing significance of real-time analytics and infrastructure management in enhancing operational efficiency and securing competitive advantages across diverse industries.

By Deployment

In 2023, the on-premises deployment model led the market, achieving a substantial 69.3% share of global revenue. Organizations prefer on-premises deployment for AI models primarily due to security concerns associated with public cloud solutions. This preference stems from the enhanced security and privacy that on-premises systems provide for IT operations. Additionally, these solutions frequently incorporate edge analytics, which reduces bandwidth requirements. Implementing AIOps solutions on-premises boosts the speed and reliability of outcomes. A recent example of a strategic partnership in the realm of cloud services is the collaboration between IBM and Cisco announced in March 2023. This partnership aims to enhance hybrid cloud solutions by integrating Cisco’s networking and security capabilities with IBM’s AI and cloud technologies. The goal is to provide businesses with improved security and operational efficiency as they transition to hybrid cloud environments. This collaboration highlights the growing trend of organizations leveraging partnerships to enhance their technological offerings and streamline their IT operations.

Conversely, the cloud deployment model is projected to grow at the highest compound annual growth rate (CAGR) during the forecast period. This increase is fueled by cloud-based AIOps platforms, which remove firewall restrictions that may limit access to on-premises solutions. Moreover, cloud-based and Software-as-a-Service (SaaS) platforms reduce overhead and maintenance costs, making them appealing to organizations aiming to improve their IT operations. These trends highlight a significant shift in organizational strategies for AIOps deployment, where security needs are balanced against the benefits of cloud-based solutions.

Regional Analysis

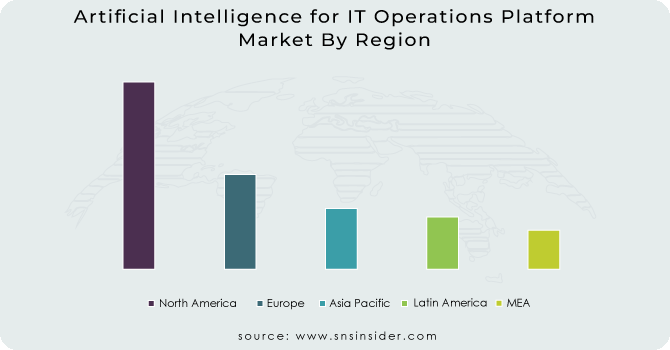

The North America dominated the market and accounted for 39.8% revenue share in 2023. The expansion of the AI-powered investment advisory applications within the region is boosting funding selections on account of excessive presence of AIOps platform sellers. Tech start-ups as well as established companies are working towards developing these industry specific AIOps solutions.

Asia Pacific expected to grow at highest CAGR over the forecast period. Lest you be moved from the rapid growth, then with the rapid adoption of automation across industries along with large data generation fuelling the development of AI-based solutions including but not limited to data analytics. For instance, Cisco's introduction of its Cisco Crosswork Cloud in June 2023, which combines AIOps capabilities with cloud-based networking solutions. This platform provides a unified view of network performance and automates troubleshooting processes through machine learning, helping IT teams reduce downtime and enhance operational efficiency.

Get Customized Report as per Your Business Requirement - Request For Customized Report

Key Players

The major key players are with their services

-

IBM: IBM Watson AIOps

-

ServiceNow: ServiceNow IT Operations Management (ITOM)

-

Splunk: Splunk IT Service Intelligence (ITSI)

-

Dynatrace: Dynatrace Software Intelligence Platform

-

Moogsoft: Moogsoft AIOps Platform

-

BMC Software: BMC Helix

-

Micro Focus: Micro Focus Operations Bridge

-

Cisco: Cisco AppDynamics

-

New Relic: New Relic One

-

Elastic: Elastic Observability

-

BigPanda: BigPanda AIOps Platform

-

PagerDuty: PagerDuty Event Intelligence

-

Atlassian: Atlassian Opsgenie

-

Cloudflare: Cloudflare Logpush

-

Zenoss: Zenoss Cloud

-

Sumo Logic: Sumo Logic Cloud SIEM

-

Qualys: Qualys Cloud Platform

-

Trend Micro: Trend Micro Cloud One

-

Zscaler: Zscaler Internet Access

-

Microsoft: Microsoft Azure Monitor

B2B User

-

Vodafone

-

Coca-Cola

-

The Home Depot

-

Trivago

-

BT Group

-

T-Mobile

-

DHL

-

NASA

-

Expedia

-

LinkedIn

-

DHL

-

NASA

-

eBay

-

Shopify

-

American Express

-

Nissan

-

Deloitte

-

Ford

-

AstraZeneca

-

Volkswagen

Recent Developments

September 2023: IBM announced enhancements to IBM Watson AIOps, focusing on improved AI capabilities for incident management and automation. They highlighted integration with their broader cloud services to streamline IT operations.

August 2023: ServiceNow launched updates to its IT Operations Management (ITOM) platform, introducing AI-driven insights to improve operational efficiency and automate IT workflows, enhancing incident response times.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.73 billion |

| Market Size by 2032 | USD 47.21 Billion |

| CAGR | CAGR of 17.91% from 2024-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Platform, Service) • By Deployment Mode (Cloud, On-premise) • By Application (Infrastructure Management, Application Performance Analysis, Real-Time Analytics, Network & Security Management, Others) • By Organization Size (SMEs, Large Enterprises) • By Vertical (BFSI, Healthcare & Life Sciences, Retail & E-commerce, IT & Telecom, Energy & Utilities, Government & Public Sector, Media & Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

IBM, ServiceNowSplunk, Dynatrace, Moogsoft, BMC Software, Micro FocusCisco, New Relic, Elastic, BigPanda, PagerDuty, Atlassian, Cloudflare, Zenoss |

| Key Drivers | •Organizations are seeking to automate IT operations to enhance efficiency and reduce manual workloads, driving AIOps adoption •The rise of cloud computing and hybrid environments increases operational complexities, making AIOps essential for performance management •Growing concerns about data security and regulatory compliance drive the need for AIOps solutions to manage risks effectively |

| Market Restrain | •Integrating AIOps with existing IT infrastructure and systems can be complex, requiring significant time and expertise, which may deter organizations from adoption. •Organizations may be hesitant to adopt AIOps due to fears about data privacy and security, especially with sensitive information being processed and analyzed •The lack of skilled personnel who can effectively manage and utilize AIOps technologies can hinder market growth, as organizations struggle to find qualified staff. |