Carbon Black Market Report Scope & Overview:

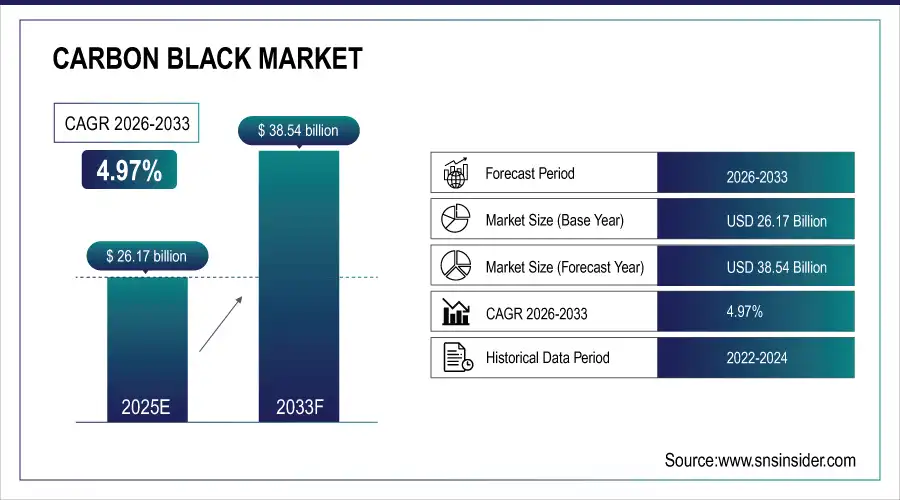

The Carbon Black Market Size was valued at USD 26.17 Billion in 2025E and is expected to reach USD 38.54 Billion by 2033 and grow at a CAGR of 4.97% over the forecast period 2026-2033.

The Carbon Black Market analysis, driven by its extensive use in the automotive industry, particularly in tire manufacturing. The largest end-user of carbon black is tires in which carbon black is used as a reinforcing filler that enhances durability, wear resistance, and performance. Moreover, the growing production of vehicles across the globe and increasing replacement demand for automotive tires are still benefiting carbon black consumption. According to study, over 75% of carbon black used in tires is directly linked to automotive vehicle production and replacement demand.

Market Size and Forecast:

-

Market Size in 2025: USD 26.17 Billion

-

Market Size by 2033: USD 38.54 Billion

-

CAGR: 4.97% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Carbon Black Market - Request Free Sample Report

Carbon Black Market Trends

-

Growing automotive production fuels increased carbon black demand for tire manufacturing globally.

-

Electric vehicle adoption drives need for high-performance, durable specialty carbon black tires.

-

Rising replacement tire demand supports steady growth in global carbon black consumption.

-

Specialty carbon black adoption expands rapidly in electronics, batteries, and conductive plastics.

-

Advanced coatings and UV-resistant plastics drive demand for higher-quality carbon black grades.

-

Investment in R&D enables manufacturers to diversify portfolios and capture high-growth markets.

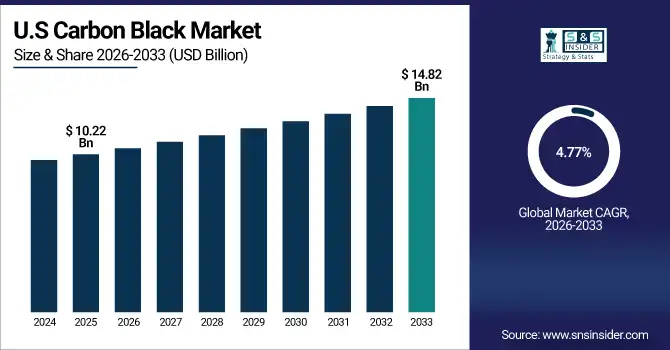

The U.S. Carbon Black Market size was USD 10.22 Billion in 2025E and is expected to reach USD 14.82 Billion by 2033, growing at a CAGR of 4.77% over the forecast period of 2026-2033, rising demand in high-performance tires, specialty plastics, and conductive applications, coupled with increasing sustainability efforts, advanced manufacturing technologies, and innovation in specialty grades, driving growth across automotive and industrial sectors.

Carbon Black Market Growth Drivers:

-

Automotive Tire Demand Sparks Global Carbon Black Market Growth Surge

The Carbon Black Market growth driven by, its increased usage in the automotive sector, especially in tire production. Carbon black represents a significant amount of end-use by its application as a reinforcing filler, which assists in enhancing tire durability, wear resistance, traction, and performance, thus making tires the largest carbon black consuming application. An indirect factor boosting the growth of this market is the increasing production of electric vehicles (EVs) even though they utilise lower-performance tires than conventional vehicles, EV tires usually need to be made with higher-performance materials to manage additional weight and torque, end product carbon black.

EV tire production requires 10–15% more carbon black per tire due to heavier weight and higher torque requirements.

Carbon Black Market Restraints:

-

Environmental Regulations Challenge Traditional Carbon Black Production Expansion Globally

The Strict environmental regulations regarding production processes are a major restraint for the carbon black market. The conventional way to make carbon black is through furnace black production, with high CO₂, PM, and VOCs emissions. Regulators in North America, Europe, and part of Asia have implemented high emission standards, such as the reach law in Europe, increasing the cost of compliance for manufacturers. Furthermore, the demand for biodegradable and sustainable solutions, such as bio-based fillers or ones based on recycled feedstock is on the rise, and that might restrain the global carbon black market growth for conventional carbon black in some regions. These regulatory pressures increase capital expenditure and operational costs, potentially restraining market expansion.

Carbon Black Market Opportunities:

-

Specialty Carbon Black Unlocks High-Growth Potential In Emerging Technologies

The major Opportunity in a specialty carbon black market growing for lithium-ion batteries, electronics, conductive plastics, and advanced coatings Specialty grades give better electrical conductivity, UV resistance, and mechanical strength for applications such as EV batteries, solar panels, printed electronics, and smart devices. With many industries now embracing advanced technologies along with the rapid pace of electrification, manufacturers can look to expand on traditional tire and rubber-based applications. The ability to invest in R&D and specialty products gives companies an opportunity to capture higher margins along with high-growth emerging markets, making this an attractive growth pathway for the coming decade.

Demand from lithium-ion batteries and electronics contributes around 25% annual growth in specialty carbon black.

Carbon Black Market Segmentation Analysis:

-

By Type: In 2025, Furnace Black led the market with a share of 40.24%, while Acetylene Black is the fastest-growing segment with a CAGR of 7.80%.

-

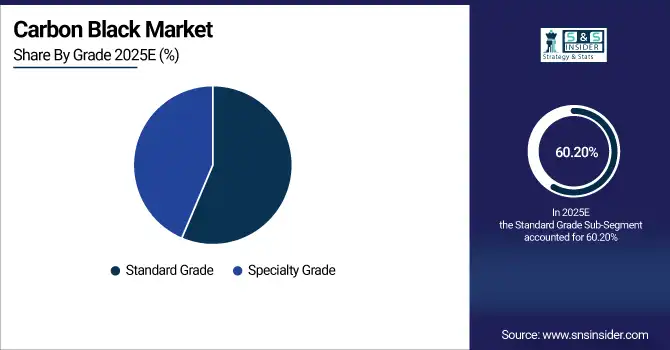

By Grade: In 2025, Standard Grade led the market with a share of 60.20%, while Specialty Grade is the fastest-growing segment with a CAGR of 6.85%.

-

By Application: In 2025, Tire led the market with a share of 67.80%, while Plastics is the fastest-growing segment with a CAGR of 7.60%.

-

By End-User: In 2025, Automotive led the market with a share of 64.30%, while Electronics is the fastest-growing segment with a CAGR of 7.90%.

By Type, Furnace Black Leads Market and Acetylene Black Fastest Growth

The Furnace Black leads the market in 2025, Due to primarily used for tire and rubber products. The great reinforcing characteristics of carbon black, along with its low cost and flexibility of application, grant it the leading position among reinforcing agents in industries, especially in automotive. Meanwhile, Acetylene Black is the fastest-growing segment due to its high electrical conductivity and unique characteristics, and it is becoming more prominent in lithium-ion batteries, electronics, conductive plastics, and advanced coatings. The increasing demand for electric vehicles, high-performance plastics, and smart devices will quickly expand the attraction of Acetylene Black, providing manufacturers further opportunities in these developing, high-tech applications.

By Grade, Standard Grade Leads Market and Specialty Grade Fastest Growth

The Standard Grade lead the market in 2025, due to widespread use in the manufacturing of tires, in non-tire rubber products, and for general industrial use Due to its cost-effectiveness and reliable performance, it is the preferred control option for many conventional applications, within automotive applications, in particular. In Meanwhile, Specialty Grade is the fastest growing segment, driven by increasing demand in lithium-ion batteries, electronics, conductive plastics, and advanced coatings. Specialty Grade carbon black has garnered higher functionality and value, helping manufacturers to seize high-growth niches and higher profit margins in light of rising adoption of electric vehicles, high-performance materials, and smart devices.

By Application, Tire Leads Market and Plastics Fastest Growth

The Tire leads the market in 2025, owing to carbon black is a major reinforcing filler in this application and it helps improve durability, wear resistance, and traction, thereby contributing to improved tire performance. The automotive industry is the largest carbon black consumer as it accounts for most of carbon black demand in tires due to increasing vehicle production and. Meanwhile, Plastics is growing the fastest as sustainable demand for conductive, high-strength, and UV-resistant plastic materials augments the key industries like consumer goods, packaging, and electronics. This may offer lucrative opportunities for carbon black market in plastics as the industries are progressively adopting to advanced materials and high-performance plastics.

By End-User, Automotive Leads Market and Electronics Fastest Growth

The Automotive leads the market in 2025, Due to use in tires, seals, gaskets, and other rubber parts in the automotive sector. This segment features strong consumption as a result of increasing car production, replacement demand, and the increasing number of high-performance and specialty tires. Meanwhile, electronics constitutes the fastest-growing end-user due to the enhancing deployment of printed electronics, lithium-ion batteries, conductive plastics, and futuristic electronic gadgets. While expansion of carbon black in electronics will lead to potential lucrative opportunities for manufacturers, industries are continuing to realize electrification, accompanied by the utilization of smart technologies and high-performance materials.

Carbon Black Market Regional Analysis:

Asia Pacific Carbon Black Market Insights:

The Asia Pacific dominated the Carbon Black Market in 2025E, with over 54.20% revenue share, due to the high demand from automotive OEMs and tire manufacturing, and industrial rubber products. The market is mainly driven by rapid industrialization, escalating vehicle production, and increasing demand for replacement tires. Increasing consumption of specialty carbon black in electronics, batteries, and high-performance plastics are also contributing to the market growth in the region. Major players focus on investing in production facilities, technology as well as R&D activities to improve the supply of its product and innovation of new products. Strong industrial activity and varied applications further render the Asia-Pacific region the biggest and most dominant carbon black market in the world.

Get Customized Report as per Your Business Requirement - Enquiry Now

China and India Carbon Black Market Insights

China and India lead the Carbon Black Market due to rapid industrialization, high automotive and tire production, growing replacement demand, expanding non-tire applications, and increasing adoption of specialty carbon black in advanced industries.

Middle East and Africa Carbon Black Market Insights:

The Middle East and Africa region is expected to have the fastest-growing CAGR 7.00%, due to industrialisation, growing automotive production, and increasing demand for tires and rubber products. The increasing demand for carbon black for construction, packaging, and electronics is also expected to drive the business expansion in the region. Growing usage of specialty carbon black which are used in manufacturing parts like battery, conductive plastics and coatings are driving the market for carbon black. Growth is also propelled by investments in manufacturing plants, technical updates and infrastructural development. The MEA region offers lucrative opportunities as the urbanization pace is increasing and with various industrial diversifications taking place, carbon black manufacturers can now target some of the high rate of growth market segments in both the conventional or speciality applications.

Europe Carbon Black Market Insights

The Europe carbon black market is witnessing steady growth, driven by the region’s automotive and tire manufacturing sectors, which account for the largest share of carbon black consumption. High-performance and specialty tires are gaining momentum, and demand for plastic, coatings, and inks bolster non-tire applications, creating an impetus for market growth. Industry-driven demand characteristics and regulatory sustainability efforts can peer pressure into greener/less polluting manufacturing technology adoption, also affecting market dynamics, however. Moreover, rising demand for specialty carbon black in electronics, conductive plastics, and energy storage sectors presents new opportunities. Europe is a significant player in the global carbon black market owing to strong industrial infrastructure, technology, and R&D investments.

Germany and U.K. Carbon Black Market Insights

Germany and the U.K. lead the Carbon Black Market due to strong automotive and tire manufacturing, high demand for specialty carbon black, industrial applications, and focus on advanced materials and sustainable production.

Latin America (LATAM) Carbon Black Market Insights

The Latin America carbon black market is experiencing steady growth, driven by expanding automotive and tire manufacturing, rising replacement tire demand, and growth in industrial applications such as rubber goods, plastics, and coatings. Increasing adoption of specialty carbon black in electronics and high-performance materials further supports market expansion. Investments in production facilities, technological advancements, and infrastructure development enhance supply capabilities. Growing urbanization, industrialization, and regional demand for durable and high-performance materials make Latin America a significant market with promising growth opportunities in both conventional and specialty carbon black segments.

Carbon Black Market Competitive Landscape

Birla Carbon is a major global carbon black manufacturer, offering standard and specialty grades for tires, non-tire rubber, plastics, coatings, and inks. Focused on sustainability and innovation, the company drives market growth through eco-friendly products, R&D initiatives, and adoption of circular economy solutions, catering to increasing demand from automotive, electronics, and industrial applications worldwide.

-

In October 2024, Birla Carbon Introduced Continua™ Sustainable Carbonaceous Material (SCM), a circular carbon black product derived from post-consumer tires, aiming to enhance sustainability in the industry.

Tokai Carbon Co., Ltd. is a key player in the global carbon black market, producing furnace black, acetylene black, and specialty carbon black. The company supports industries such as automotive, energy storage, and electronics, leveraging technological advancements and eco-friendly initiatives. Expansion into emerging markets and collaboration on circular economy projects strengthen its position in high-growth carbon black segments worldwide.

-

In January 2025, Tokai Carbon Co., Ltd. Collaborated with Bridgestone to develop eco Carbon Black (eCB) from end-of-life tires, aiming to contribute to a circular economy and carbon neutrality.

Sid Richardson Carbon & Energy Co. is a leading producer of specialty and standard carbon black, focusing on high-performance applications in tires, rubber, plastics, and coatings. The company emphasizes innovation and quality, expanding its product portfolio to meet growing demand in automotive, electronics, and industrial sectors, while maintaining sustainability initiatives to reduce environmental impact and optimize production efficiency.

-

In May 2024, Sid Richardson Carbon & Energy Co. Launched a new line of specialty carbon black products designed for high-performance applications in the electronics and automotive industries.

Carbon Black Market Key Players:

Some of the Carbon Black Market Companies are:

-

Cabot Corporation

-

Birla Carbon

-

Orion Engineered Carbons S.A.

-

Tokai Carbon Co., Ltd.

-

Phillips Carbon Black Limited (PCBL)

-

Continental Carbon Company

-

Omsk Carbon Group

-

Jiangxi Black Cat Carbon Black Co., Ltd.

-

Mitsubishi Chemical Corporation

-

Sid Richardson Carbon & Energy Co.

-

Imerys S.A.

-

Asahi Carbon Co., Ltd.

-

Himadri Specialty Chemical Ltd.

-

Ralson Carbon

-

Longxing Chemical Stock Co., Ltd.

-

Atlas Organic Pvt. Ltd.

-

OCI Company Ltd.

-

Black Bear Carbon B.V.

-

Monolith Materials

-

International CSRC

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 26.17 Billion |

| Market Size by 2033 | USD 38.54 Billion |

| CAGR | CAGR of 4.97% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Furnace Black, Thermal Black, Acetylene Black, Others) • By Grade (Standard Grade, Specialty Grade) • By Application (Tire, Non-Tire Rubber, Inks & Toners, Plastics, Others) • By End-User (Automotive, Construction, Packaging, Electronics, Paints & Coatings, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Cabot Corporation, Birla Carbon, Orion Engineered Carbons S.A., Tokai Carbon Co., Ltd., Phillips Carbon Black Limited (PCBL), Continental Carbon Company, Omsk Carbon Group, Jiangxi Black Cat Carbon Black Co., Ltd., Mitsubishi Chemical Corporation, Sid Richardson Carbon & Energy Co., Imerys S.A., Asahi Carbon Co., Ltd., Himadri Specialty Chemical Ltd., Ralson Carbon, Longxing Chemical Stock Co., Ltd., Atlas Organic Pvt. Ltd., OCI Company Ltd., Black Bear Carbon B.V., Monolith Materials, International CSRC, and Others. |