Pepper Spray Market Report Scope & Overview:

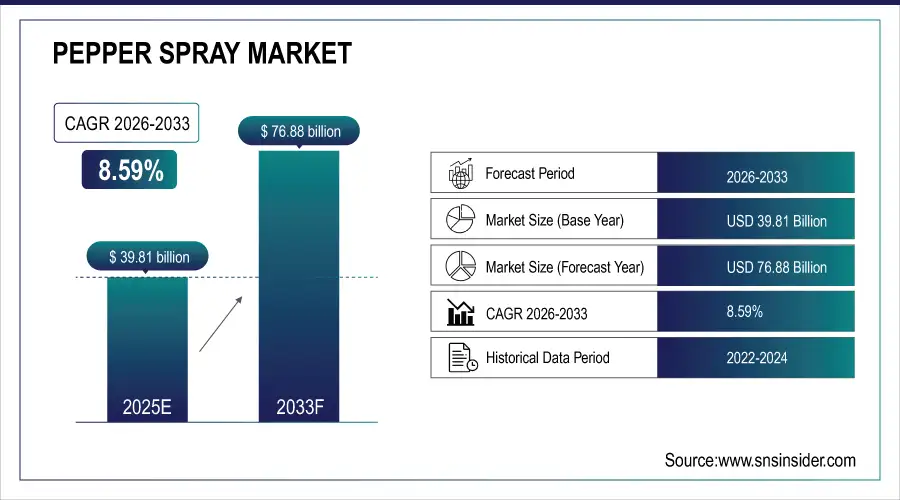

The Pepper Spray Market size is valued at USD 39.81 Billion in 2025E and is projected to reach USD 76.88 Billion by 2033, growing at a CAGR of 8.59% during 2026-2033.

The Pepper Spray Market analysis highlights the growing demand for personal safety products, driven by rising concerns over individual security, increasing crime rates, and greater acceptance of non-lethal self-defense tools.

In 2025, 68% of adults in the U.S. and EU reported feeling less safe in public than five years ago, driving a 30% increase in personal defense product sales

Market Size and Forecast:

-

Market Size in 2025E: USD 39.81 Billion

-

Market Size by 2033: USD 76.88 Billion

-

CAGR: 8.59% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Pepper Spray Market - Request Free Sample Report

Pepper Spray Market Trends

-

Increasing crime rates and greater personal safety awareness are driving higher consumer adoption of pepper sprays for everyday self-defense use.

-

Consumers prefer compact, pocket-sized pepper spray devices offering convenience, discreet carry options, and improved ergonomics for daily protection and reliability.

-

Expansion of online marketplaces increases accessibility, price competition, product variety, and discreet purchasing—boosting pepper spray sales globally across demographics rapidly.

-

Innovations in formulations extend spray range, target accuracy, and non-flammable, eco-friendly propellants, enhancing performance and user safety while reducing risks.

-

Law enforcement and private security increasingly adopt advanced pepper spray models for non-lethal crowd control, officer safety, and tactical flexibility.

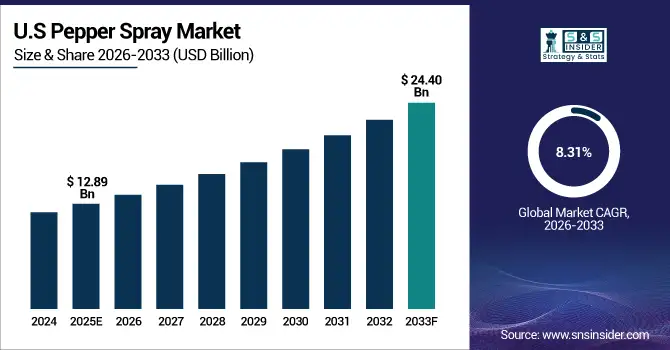

The U.S. Pepper Spray Market size is valued at USD 12.89 Billion in 2025E and is projected to reach USD 24.40 Billion by 2033, growing at a CAGR of 8.31% during 2026-2033. Pepper Spray Market growth is driven by rising personal safety concerns and self-defense awareness. Increasing instances of assaults and burglaries have boosted demand among civilians and security personnel alike.

Pepper Spray Market Growth Drivers:

-

Rising Personal Safety Awareness and Self-Defense Adoption Among Civilians

Growing concerns over personal safety, increasing crime rates, and heightened awareness of self-defense are driving global demand for pepper sprays. The availability of compact, easy-to-use products and their affordability have made them a preferred choice for civilians, especially women and elderly populations. Additionally, government permissions for non-lethal defense tools in many countries are further boosting product adoption.

In 2025, 71% of women in the U.S., UK, and India reported feeling unsafe in public spaces, with 58% owning or planning to buy pepper spray

Pepper Spray Market Restraints:

-

Regulatory Restrictions and Misuse Concerns in Certain Countries

Stringent regulations surrounding the possession, use, and transportation of pepper spray in several regions hinder market growth. Many countries classify it as a restricted weapon, limiting civilian access and distribution. Concerns regarding accidental discharge, misuse, and potential health effects from improper use also challenge market expansion. Such factors compel manufacturers to ensure compliance and enhance safety labeling to avoid liability and meet legal standards.

Pepper Spray Market Opportunities:

-

Technological Advancements and Expansion of Online Distribution Channels

Innovation in spray mechanisms, safety locks, and eco-friendly propellants is creating new opportunities for manufacturers. The increasing influence of e-commerce platforms offers greater accessibility and visibility for pepper spray products globally. Enhanced marketing through digital platforms and social media is enabling brands to target diverse customer bases more effectively, fostering long-term market growth.

Child-resistant and flip-top safety locks are now standard on 75% of consumer pepper sprays, reducing accidental discharges by 40%

Pepper Spray Market Segment Analysis

-

By product type, Stream Spray led the pepper spray market in 2025 with a 38.50% share, while Gel Spray was the fastest-growing segment with a CAGR of 8.50%.

-

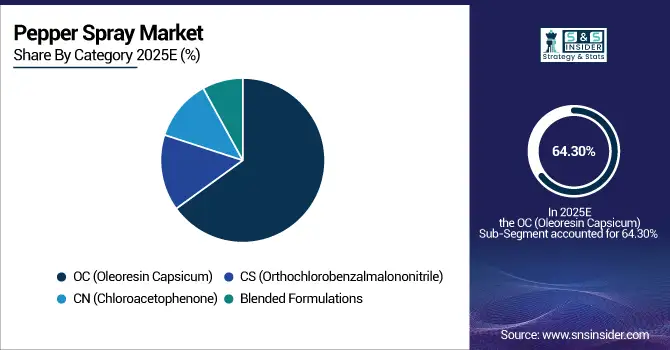

By category, OC (Oleoresin Capsicum) dominated the market with a 64.30% share in 2025, while Blended Formulations grew fastest at a CAGR of 7.60%.

-

By end-use, Personal Defense led with a 52.80% share in 2025, while Law Enforcement recorded the fastest growth at a CAGR of 8.45%.

-

By distribution channel, Online Retail held the largest 41.20% share in 2025, while Specialty Stores grew fastest at a CAGR of 9.10%.

By Category, OC (Oleoresin Capsicum) Dominate While Blended Formulations Shows Rapid Growth

OC (Oleoresin Capsicum) remains the leading category in the pepper spray market, favored for its natural chili-based composition, strong irritant effect, and safety for non-lethal defense applications. It is the most recognized and trusted active ingredient among consumers and enforcement agencies. However, blended formulations combining OC with CN or CS agents are rapidly gaining traction, offering extended incapacitation effects and quicker response times. These advanced blends cater to growing demand for higher potency and specialized tactical applications.

By Product, Stream Spray Leads Market While Gel Spray Registers Fastest Growth

Stream spray dominates the pepper spray market in 2025 due to its accuracy, longer range, and minimal risk of blowback during use. It is widely preferred for personal defense and law enforcement because it allows better target control in outdoor conditions. However, gel spray is emerging as the fastest-growing segment owing to its advanced formulation, stickiness, and reduced airborne contamination, making it safer for indoor use. Its precision and improved adherence to targets drive rapid adoption among urban users.

By End-Use, Personal Defense Lead While Law Enforcement Registers Fastest Growth

Personal defense applications account for the largest share of the pepper spray market, driven by increasing safety awareness among civilians, especially women and elderly individuals. Easy availability through online and retail channels has further boosted consumer access. Meanwhile, law enforcement agencies are witnessing the fastest growth in adoption, utilizing pepper sprays as a non-lethal crowd control and self-defense solution. The growing emphasis on minimal-force policing and officer safety is fueling demand for high-performance professional-grade products.

By Distribution Channel, Online Retail Lead While Specialty Stores Grow Fastest

Online retail dominates the distribution landscape for pepper sprays due to convenience, product variety, and discreet purchasing options. Consumers prefer e-commerce platforms for better accessibility and competitive pricing. While, specialty stores are the fastest-growing distribution channel, offering expert guidance, demonstrations, and brand-specific product portfolios. The rise of safety equipment stores and defense-focused retail chains is supporting growth in this segment, particularly among law enforcement and professional users seeking personalized product recommendations and hands-on experience.

Pepper Spray Market Regional Analysis:

North America Pepper Spray Market Insights

In 2025 North America dominated the Pepper Spray Market and accounted for 44.58% of revenue share, this leadership is due to the widespread civilian acceptance and strong law enforcement adoption. Growing safety awareness, robust online distribution, and the presence of leading manufacturers drive regional leadership. The market benefits from favorable self-defense laws across several states. Innovation in formulations and packaging continues to strengthen consumer trust and usage.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Pepper Spray Market Insights

The U.S. represents the largest share of the North American pepper spray market, driven by high personal security concerns. Increased incidents of assaults, coupled with active promotion by safety organizations, fuel product demand.

Asia-pacific Pepper Spray Market Insights

Asia-pacific is expected to witness the fastest growth in the Pepper Spray Market over 2026-2033, with a projected CAGR of 9.29% due to increasing personal safety awareness and rising crime rates. Expanding urban populations and women’s self-defense initiatives are boosting product demand. Governments are gradually easing restrictions on non-lethal weapons, enhancing market penetration. Rising e-commerce accessibility further supports regional sales growth.

China Pepper Spray Market Insights

China’s pepper spray market is witnessing steady expansion due to increased urban safety concerns and growing interest in self-defense tools. The government’s strict regulatory framework limits civilian access, yet online awareness and discreet purchasing channels are expanding.

Europe Pepper Spray Market Insights

In 2025, Europe emerged as a promising region in the Pepper Spray Market, due to varying national regulations and legal restrictions. Countries with permissive self-defense laws show stronger adoption rates. Rising concerns over public safety, especially among women, support product demand. Increased law enforcement usage and awareness campaigns contribute to steady growth. E-commerce expansion further enhances regional sales potential.

Germany Pepper Spray Market Insights

Germany is one of Europe’s most promising pepper spray markets due to a balance of strict regulation and high safety awareness. Civilian use for personal protection is legally permitted under controlled conditions, supporting steady demand.

Latin America (LATAM) and Middle East & Africa (MEA) Pepper Spray Market Insights

The Pepper Spray Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the expanding demand for pepper sprays, fueled by increasing crime rates and low-cost accessibility. In Latin America, urban safety concerns drive adoption among civilians and private security forces. Meanwhile, MEA countries are slowly opening markets through regulated imports. Limited awareness and affordability challenges persist, yet growing online availability supports gradual expansion.

Pepper Spray Market Competitive Landscape:

Byrna dominates the pepper spray market with its innovative range of non-lethal personal defense products combining OC and kinetic technologies. The company’s pepper spray launchers offer extended range, accuracy, and safety, appealing to both civilian and law enforcement users. Byrna’s emphasis on rechargeable, reusable systems and training programs strengthens brand loyalty and market positioning globally.

-

In January 2025, Byrna partnered with United States Concealed Carry Association (USCCA) to promote its less-lethal launchers, gaining access to nearly one million members through training and liability insurance offerings.

Mace Brand is an iconic name in the personal defense industry, offering a diverse range of pepper sprays and security products. The company emphasizes user safety, ergonomic design, and continuous innovation in formulations. With a strong retail and online presence, Mace Brand caters to both individual consumers and professional users seeking non-lethal protection solutions.

-

In April 2024, Mace launched the “S2 Salt + Mace Brand Pepper Launcher”, a .68-caliber non-lethal launching system developed with Salt Supply LLC, offering high stopping power and compatibility with Mace pepper projectiles across all 50 US states without permit requirements.

SABRE is a global market leader in personal safety products, offering a wide range of pepper sprays, gels, and smart safety devices. Its products are trusted by law enforcement and civilians for their effectiveness and long shelf life. SABRE’s strong brand recognition, safety training programs, and innovation in design enhance its dominance in the global market.

-

In January 2024, Sabre introduced a smart pepper spray at CES 2024 featuring live GPS tracking, app integration, and 24/7 monitoring capability alongside its traditional OC formulas.

Pepper Spray Market Key Players:

-

Byrna

-

Counter Assault

-

Fox Labs

-

J & L Self Defense Products

-

Mace Brand

-

Plegium Inc.

-

Police Magnum

-

SABRE - Security Equipment Corp

-

UDAP Industries Inc.

-

Zarc International Inc.

-

Super-Sparkly Safety Stuff, LLC

-

Suresafety

-

Nidec, S.L.U.

-

Blingsting

-

Radex Poland

-

Defensive Protection Systems, LLC

-

Carl Hoernecke Chem. Fabrik GmbH & Co. KG

-

Tornado Pepper Spray

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 39.81 Billion |

| Market Size by 2033 | USD 76.88 Billion |

| CAGR | CAGR of 8.59% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Stream Spray, Fogger Spray, Gel Spray, Foam Spray, and Others) • By Category (OC (Oleoresin Capsicum), CS (Orthochlorobenzalmalononitrile), CN (Chloroacetophenone), and Blended Formulations) • By End User (Personal Defense, Law Enforcement, and Military Applications) • By Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, and Security Equipment Stores) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Byrna, Counter Assault, Defense Technology, Fox Labs, J & L Self Defense Products, Mace Brand, Plegium Inc., Police Magnum, SABRE - Security Equipment Corp, UDAP Industries Inc., Zarc International Inc., Super-Sparkly Safety Stuff, LLC, Suresafety, Nidec, S.L.U., Adventure Ready Brands, Blingsting, Radex Poland, Defensive Protection Systems, LLC, Carl Hoernecke Chem. Fabrik GmbH & Co. KG |