Carboxymethyl Cellulose Market Report Scope & Overview:

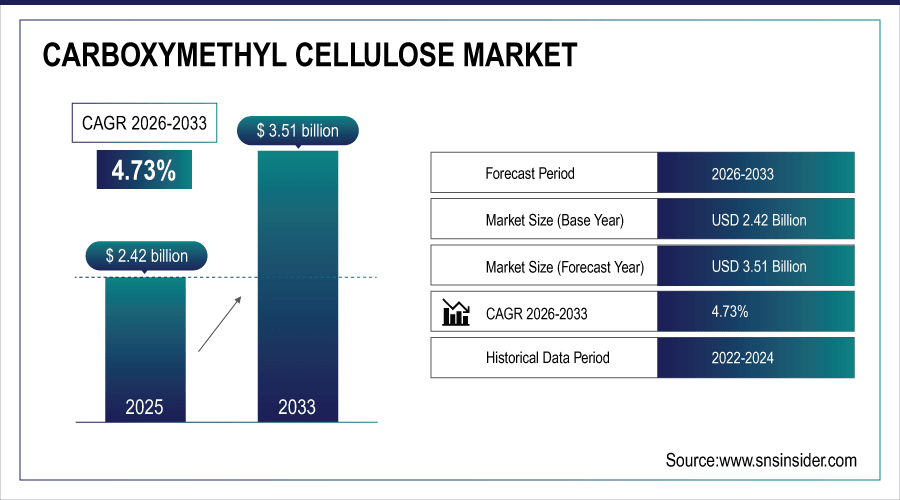

The Carboxymethyl Cellulose Market Size was valued at USD 2.42 billion in 2025E and is expected to reach USD 3.51 billion by 2033, growing at a CAGR of 4.73% over the forecast period of 2026-2033.

The Carboxymethyl Cellulose (CMC) Market is witnessing robust growth, driven by rising demand across food, pharmaceutical, and personal care industries. Its versatility as a thickener, stabilizer, and binding agent enhances product performance. Increasing applications in detergents, oil & gas, and industrial sectors further fuel market expansion globally.

To Get More Information On Carboxymethyl Cellulose Market - Request Free Sample Report

Market Size and Forecast:

-

Carboxymethyl Cellulose Market Size in 2025E: USD 2.42 Billion

-

Carboxymethyl Cellulose Market Size by 2033: USD 3.51 Billion

-

CAGR: 4.73% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Key Carboxymethyl Cellulose Market Trends

-

Growing demand in food & beverage applications as a stabilizer, thickener, and emulsifier.

-

Rising adoption in pharmaceuticals and personal care for controlled-release formulations and cosmetic products.

-

Increasing use in detergents and cleaners due to eco-friendly and biodegradable properties.

-

Expansion in oil & gas and industrial applications as a rheology modifier and drilling additive.

-

Advancements in high-purity and specialty CMC grades to meet performance requirements in sensitive applications.

-

Rising focus on sustainable production processes and green chemistry initiatives by manufacturers.

U.S. Carboxymethyl Cellulose Market Insights

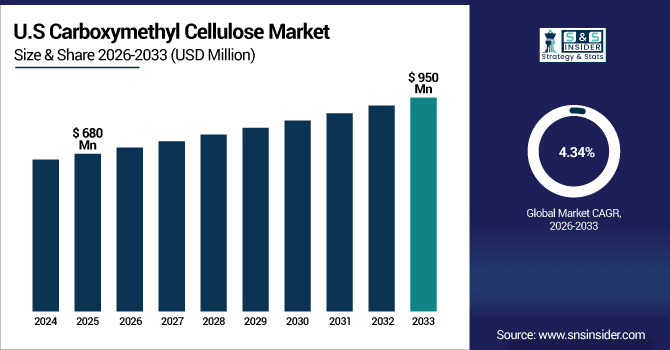

The U.S. Carboxymethyl Cellulose Market size was USD 680 Million in 2025 and is expected to reach USD 950 Million by 2033 growing at a CAGR of 4.34% over the forecast period of 2026-2033. The growth is driven by increasing demand for high-purity CMC in food & beverage, pharmaceuticals, and personal care products, which require superior viscosity and stability. Expanding industrial applications in oil & gas and detergents further fuel adoption, while rising consumer awareness of eco-friendly and biodegradable ingredients encourages manufacturers to invest in sustainable production processes, boosting overall market expansion.

Carboxymethyl Cellulose Market Growth Driver

-

Growing Demand for High-Purity and Eco-Friendly Carboxymethyl Cellulose in Food, Pharma, and Personal Care Industries Drives Market Expansion

The increasing consumer preference for natural, biodegradable, and non-toxic ingredients has driven the adoption of high-purity CMC in food, pharmaceuticals, and personal care applications. This trend has prompted manufacturers to invest in advanced production technologies that ensure consistent viscosity, solubility, and functional performance, allowing formulation of safer, more effective products. As regulatory authorities enforce stricter guidelines on additives and preservatives, companies are transitioning to eco-friendly CMC, boosting market penetration. The rising application of CMC in detergents, oil & gas, and pulp & paper industries further accelerates growth, creating higher demand for specialty grades. Technological innovations, such as enzyme-assisted and solvent-free production methods, enhance sustainability while meeting industrial requirements, reinforcing CMC’s critical role in multiple sectors and fostering overall market expansion.

For instance, in March 2024, CP Kelco launched a new high-purity CMC grade specifically for clean-label beverages, improving product stability and meeting stringent FDA guidelines, supporting increased adoption in the U.S. and European markets.

Carboxymethyl Cellulose Market Restraint

-

High Raw Material Costs and Supply Chain Volatility Pose Challenges, Limiting Carboxymethyl Cellulose Market Growth

The CMC market faces restraints from fluctuating cellulose raw material costs and chemical reagent shortages, which directly impact production margins. Supply chain disruptions, particularly in Asia-Pacific, create challenges for manufacturers in maintaining consistent quality and timely deliveries. Small- and medium-scale producers are disproportionately affected by these cost pressures, limiting their ability to invest in high-purity or specialty-grade products. Price-sensitive end-users may shift to alternative thickening or stabilizing agents, reducing overall demand. Furthermore, stringent regulatory compliance for CMC grades in food, pharma, and personal care sectors adds operational complexity, increasing time-to-market and limiting market expansion. Consequently, manufacturers are compelled to optimize procurement strategies and diversify sourcing to mitigate these challenges.

In January 2024, a supply shortage of cellulose in India caused by reduced raw material harvests led Amtex Chemicals to delay CMC shipments, affecting client production timelines and increasing procurement costs.

Carboxymethyl Cellulose Market Opportunity

-

Expansion of CMC Applications in Pharmaceutical and Specialty Food Products Presents Lucrative Market Opportunities

The growing demand for specialty functional CMC grades in pharmaceutical formulations, nutraceuticals, and clean-label food products offers significant growth potential. Advanced CMC derivatives improve drug solubility, controlled release, and stability, while in food applications, they enhance texture, shelf life, and viscosity. Manufacturers investing in R&D for tailored grades are capitalizing on this opportunity to meet evolving end-user requirements. Additionally, regulatory incentives and sustainability trends encourage adoption of eco-friendly CMC in processed foods and personal care products. Expansion in emerging markets with rising healthcare expenditure and food processing industries further supports long-term growth, creating high-value market prospects.

In June 2024, Ashland Global Holdings introduced a specialty CMC grade for pharmaceutical tablets and vegan-friendly bakery products, enabling improved product performance and addressing growing consumer demand for clean-label solutions.

Carboxymethyl Cellulose Market Segment Highlights:

-

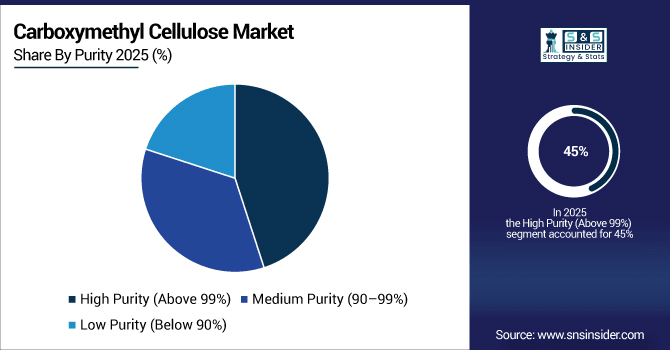

By Purity Outlook: High Purity (Above 99%) – 45% (largest), Medium Purity (90–99%) – 35%, Low Purity (Below 90%) – 20%

-

By End-Use Outlook: Food & Beverages – 30% (largest), Pharmaceuticals – 25%, Cosmetics & Personal Care – 15%, Oil & Gas – 10%, Pulp & Paper – 8%, Detergents & Cleaners – 7%, Other End Uses – 5%

Carboxymethyl Cellulose Market Segment Analysis

By Purity Outlook

High Purity (Above 99%) dominates the market with a 45% share, driven by its superior solubility, stability, and performance in pharmaceuticals, food, and personal care applications. Medium Purity (90–99%), at 35%, is widely adopted in industrial and detergent formulations due to cost-effectiveness and functional versatility. Low Purity (Below 90%), holding 20%, serves niche applications such as pulp & paper and oil & gas. Growing demand for high-performance, eco-friendly, and functional ingredients is boosting adoption of high and medium purity CMC grades globally.

By End-Use

Food & Beverages lead with a 30% share, driven by CMC’s ability to improve texture, stability, and shelf life in processed foods. Pharmaceuticals follow at 25%, leveraging CMC as a binder, stabilizer, and thickener in formulations. Cosmetics & Personal Care (15%) benefit from its emulsifying and water-binding properties. Oil & Gas (10%) and Pulp & Paper (8%) adopt CMC for viscosity control and process efficiency. Detergents & Cleaners (7%) and Other End Uses (5%) reflect specialized industrial applications. End-user demand, regulatory compliance, and functional versatility drive market adoption worldwide.

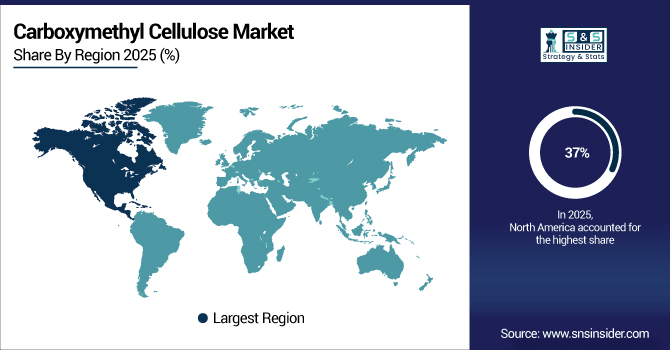

Carboxymethyl Cellulose Market Regional Analysis

North America Carboxymethyl Cellulose Market Insights

North America leads the Carboxymethyl Cellulose Market with a 37% share in 2025, driven by widespread industrial automation, high adoption of EV production lines, and investments in smart manufacturing technologies. The U.S. dominates regional growth through extensive deployment of high- and medium-purity CMC across food & beverages, pharmaceuticals, and industrial applications. Rising focus on energy efficiency, predictive maintenance, and regulatory incentives accelerates adoption, while collaborations between CMC manufacturers and industrial integrators enhance operational efficiency, reliability, and cost optimization, making North America a pivotal hub for CMC innovations.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Carboxymethyl Cellulose Market Insights

Europe holds 29% of the Carboxymethyl Cellulose Market in 2025, supported by stringent energy efficiency regulations, industrial automation adoption, and sustainability-focused manufacturing initiatives. Germany, France, and the U.K. are leading contributors, emphasizing smart factories, robotics, and modular automation systems. Government incentives, compliance with EU energy standards, and collaborations between industrial firms and CMC manufacturers promote the adoption of high-efficiency products, reinforcing Europe’s drive toward decarbonization, reduced energy consumption, and technologically advanced industrial operations.

Asia-Pacific Carboxymethyl Cellulose Market Insights

Asia-Pacific accounts for 24% of the market in 2025 and is the fastest-growing region due to rapid industrialization, expanding manufacturing hubs, and increasing EV production. China, India, Japan, and Australia are key contributors, leveraging IoT-enabled, connected CMC for predictive maintenance and industrial automation. Government-backed programs for energy efficiency, renewable integration, and smart manufacturing further support market expansion. Adoption of modular and customizable CMC across automotive, robotics, and material handling sectors is accelerating growth across the region.

Latin America and Middle East & Africa (MEA) Carboxymethyl Cellulose Market Insights

Latin America holds 4% and MEA 6% of the Carboxymethyl Cellulose Market in 2025, emerging as high-potential regions. Brazil, Mexico, UAE, and Saudi Arabia are investing in industrial automation, manufacturing modernization, and renewable energy-driven applications. Public-private partnerships, government initiatives promoting energy efficiency, and rising adoption of IoT-based monitoring solutions are driving steady market growth. Increasing industrial infrastructure development, energy-conscious manufacturing, and focus on operational efficiency support the regional expansion of CMC applications.

Competitive Landscape for Carboxymethyl Cellulose Market:

Ashland Global Holdings Inc.

Ashland Global Holdings Inc. is a U.S.-based specialty chemicals company providing Carboxymethyl Cellulose solutions for food, pharmaceutical, and industrial applications.

-

In November 2024, Ashland announced a $75 million investment to expand its CMC production capacity at its Kentucky facility, enhancing supply for high-purity CMC grades and meeting increasing demand from North American food and pharmaceutical industries.

Nouryon

Nouryon is a global specialty chemicals company offering Carboxymethyl Cellulose products with applications in food, personal care, and industrial sectors.

-

In May 2025, Nouryon launched a new sustainable CMC product line, featuring eco-friendly production methods and reduced environmental impact, aimed at meeting the growing global demand for sustainable industrial and food-grade additives.

Dow Chemical Company

Dow Chemical Company is a multinational corporation supplying Carboxymethyl Cellulose and other specialty chemicals for industrial, food, and pharmaceutical applications.

-

In March 2025, Dow commissioned a new high-capacity CMC production line in Germany, increasing output for the European market and enabling faster delivery for automotive, pharmaceutical, and food processing sectors.

Carboxymethyl Cellulose Market Key Players

Some of the CARBOXYMETHYL CELLULOSE Companies

-

Ashland Global Holdings Inc.

-

Nouryon

-

Dow Chemical Company

-

CP Kelco

-

Tate & Lyle

-

J.M. Huber Corporation

-

Lamberti S.p.A.

-

Nippon Paper Industries Co., Ltd.

-

DKS Co., Ltd.

-

Amtex Chemicals LLC

-

Zibo Hailan Chemical Co., Ltd.

-

Chongqing Lihong Fine Chemicals Co., Ltd.

-

Reliance Cellulose Products Ltd.

-

Sigachi Industries

-

JRS Pharma

-

DFE Pharma

-

Mikro-Technik GmbH & Co. KG

-

Changzhou Science & Technology Co., Ltd.

-

Amtex Corp SA de CV

-

Foodchem International Corporation.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.42 Billion |

| Market Size by 2033 | USD 3.51 Billion |

| CAGR | CAGR of4.73% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Purity Outlook: (High Purity (Above 99%), Medium Purity (90–99%), Low Purity (Below 90%)) • By End-Use Outlook: (Food & Beverages, Pharmaceuticals, Cosmetics & Personal Care, Oil & Gas, Pulp & Paper, Detergents & Cleaners, Other End Uses) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Ashland Global Holdings Inc., Nouryon, Dow Chemical Company, CP Kelco, Tate & Lyle, J.M. Huber Corporation, Lamberti S.p.A., Nippon Paper Industries Co., Ltd., DKS Co., Ltd., Amtex Chemicals LLC, Zibo Hailan Chemical Co., Ltd., Chongqing Lihong Fine Chemicals Co., Ltd., Reliance Cellulose Products Ltd., Sigachi Industries, JRS Pharma, DFE Pharma, Mikro-Technik GmbH & Co. KG, Changzhou Science & Technology Co., Ltd., Amtex Corp SA de CV, Foodchem International Corporation |