Cryogenic Insulation Market Report Scope & Overview:

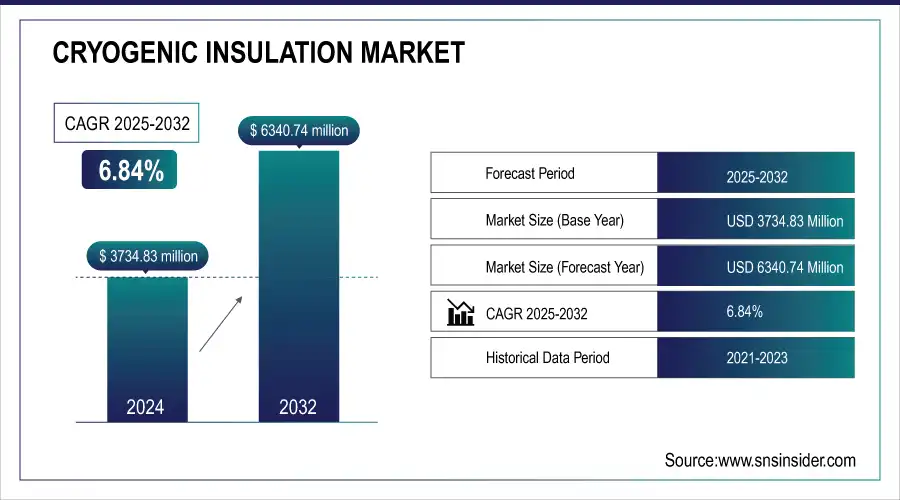

The Cryogenic Insulation Market is estimated at USD 3982.82 million in 2025 and is expected to reach USD 6661.19 million by 2033, growing at a CAGR of 6.84% from 2026-2033.

The cryogenic insulation market is steadily growing, driven by rising LNG demand, aerospace expansion, and healthcare applications for medical gas storage. Advanced materials like aerogels, multilayer insulation (MLI), and LCI systems provide superior thermal resistance, especially under high vacuum conditions. Sustainability concerns are promoting eco-friendly, recyclable solutions. Growth is further supported by space exploration, cryogenic fuels, industrial gas processing, and petrochemical applications, positioning the market for sustained innovation in high-performance, energy-efficient insulation technologies.

Cryogenic Insulation Market Size and Forecast

-

Cryogenic Insulation Market Size in 2025: USD 3982.82 Million

-

Cryogenic Insulation Market Size by 2033: USD 6661.19 Million

-

CAGR: 6.84% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Cryogenic Insulation Market - Request Sample Report

Cryogenic Insulation Market Trends

-

Rising demand for LNG, LPG, and industrial gas storage is driving the cryogenic insulation market.

-

Expansion of energy infrastructure, including pipelines, storage tanks, and transport vessels, is boosting adoption.

-

Increasing use in aerospace, healthcare, and cryogenic research applications is fueling market growth.

-

Advancements in vacuum-insulated panels, aerogels, and multilayer insulation technologies are improving thermal performance and efficiency.

-

Growing focus on energy conservation, safety, and reduction of boil-off losses is shaping industry trends.

-

Government initiatives and investments in cryogenic storage and cold-chain logistics are supporting market expansion.

-

Collaborations between insulation manufacturers, equipment suppliers, and industrial gas companies are accelerating innovation and deployment.

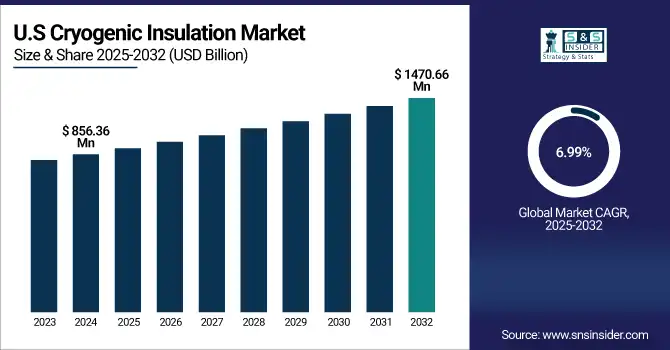

U.S. Cryogenic Insulation Market was valued at USD 856.36 million in 2024 and is expected to reach USD 1470.66 million by 2032, growing at a CAGR of 6.99% from 2025-2032.

The U.S. cryogenic insulation market is growing due to rising LNG exports, expansion of storage and transportation infrastructure, development of advanced and energy-efficient insulation materials, and investments in large-scale LNG terminals. Leading domestic companies drive innovation, while sustainability initiatives and upgrades in energy distribution further boost demand for cryogenic systems.

-

According to the U.S. Energy Information Administration (EIA), the U.S. became the world's largest exporter of LNG in 2023, with volumes exceeding 10 Bcf/d, further increasing demand for cryogenic systems.

-

Leading companies such as Owens Corning, Johns Manville, and Aspen Aerogels are based in the U.S. and have contributed to market innovation through the development of advanced cryogenic insulation materials.

Cryogenic Insulation Market Growth Drivers:

-

Rising LNG adoption, healthcare needs, aerospace applications, and advanced aerogel technology drive global cryogenic insulation market growth.

The cryogenic insulation market is expanding due to increasing liquefied natural gas (LNG) use, which demands high-performance insulation for safe storage and transportation at extremely low temperatures. Growth is further supported by healthcare, where reliable cryogenic systems preserve medical gases, vaccines, and biopharmaceuticals, and by aerospace, which relies on insulation for rocket propulsion and fuel storage. Advanced materials, particularly aerogel blankets, are gaining prominence, offering minimal thermal conductivity, durability, and hydrophobic protection. U.S. manufacturers dominate global aerogel production, supplying over 80% of the market. Overall, energy, healthcare, aerospace, and innovative materials collectively drive market expansion.

|

Key Metric / News |

Value / Details |

|

Global LNG trade |

387 million tons (2020) |

|

New LNG importers |

China and India |

|

Capacity of largest LNG export terminals |

6–8 process trains per terminal |

|

Planned LNG export terminals |

18 terminals in the next 5–10 years |

|

Additional LNG export terminals under consideration |

17 terminals |

|

Aerogel production |

U.S. manufacturers control ~80% of global output |

|

Asia-Pacific vaccine production |

Increasing, driving demand for cryogenic storage |

|

Hydrogen storage cryogenic insulation |

Adoption growing since 2021 |

-

Rising industrial gas production for oxygen, nitrogen, and argon fuels cryogenic insulation demand across healthcare, chemical, and manufacturing sectors.

The growth of industrial gas production, particularly oxygen, nitrogen, and argon, is a key driver for the cryogenic insulation market. These gases are vital across healthcare, chemical, manufacturing, and electronics industries and are stored in liquid form at extremely low temperatures. Cryogenic insulation ensures safe and efficient storage and transport, preventing thermal loss and hazards. In healthcare, liquid oxygen supports respiratory treatments, while nitrogen aids pharmaceutical processes and cryopreservation. Chemical and manufacturing sectors rely on these gases for cooling, inerting, and metalworking applications. Increasing demand for industrial gases directly boosts the need for advanced cryogenic insulation solutions, presenting substantial market opportunities.

Key Stats & News:

-

EU industrial production growth: Up 0.5% in 2024, with manufacturing capacity utilization at 79.5%.

-

Asia-Pacific: High utilization in energy and manufacturing industries; growing adoption of cryogenic insulation in LNG and hydrogen sectors.

-

Cryogenic insulation in chemical & petrochemical industries (Asia-Pacific): Widespread use for gas storage and production.

Cryogenic Insulation Market Restraints:

-

High initial investment and raw material price volatility challenge cryogenic insulation adoption despite demand from LNG, healthcare, and aerospace.

While demand for cryogenic insulation grows across LNG, healthcare, and aerospace sectors, high initial costs and fluctuating raw material prices pose significant challenges. Advanced materials like aerogel blankets offer exceptional thermal conductivity, durability, and flexibility at extreme cryogenic temperatures, but require substantial capital for materials and installation, limiting adoption by smaller enterprises. Additionally, raw material price volatility affecting silica, glass fibers, and specialty composites raises production costs and impacts market competitiveness. Standards such as ASTM C1728-13 help maintain quality and performance, but the overall high cost and supply uncertainty continue to constrain widespread deployment of cryogenic insulation systems globally.

Key Stats & News:

-

Fiberglass insulation costs in the U.S. (2023): USD 0.30–USD 1.50 per sq. ft.; total estimated cost for installation USD 2,285–USD 3,608.

-

Raw material price volatility: Silica for aerogel and specialty composites fluctuate due to supply chain and geopolitical factors.

-

Standards: ASTM C1728-13, ASTM C552-12b, ISO 9001 help maintain insulation quality.

Cryogenic Insulation Market Opportunities:

-

Material Innovation and Sustainable High-Performance Cryogenic Insulation Driving Cryogenic Insulation Market Differentiation and R&D Opportunities

The cryogenic insulation Cryogenic Insulation Market presents significant opportunities through advanced material innovation and sustainability. Novel insulation materials, including aerogels, vacuum-insulated panels, and hybrid composites, are enabling higher thermal efficiency and reduced energy losses. Emphasis on eco-friendly options such as low-GWP foams and recyclable materials aligns with global sustainability trends, appealing to environmentally conscious industries. This landscape encourages R&D-led firms to develop cutting-edge solutions while fostering strategic partnerships between material innovators and cryogenic system integrators. Companies that prioritize performance and sustainability can capture Cryogenic Insulation Market share and offer differentiated value in industrial gas, LNG, and hydrogen storage applications.

|

Innovation Focus / Key Topics |

Key Insights / Statistics |

|

Development of novel cryogenic devices and insulation materials for advanced energy systems |

Innovations in insulation materials to reduce heat losses in cryogenic energy storage systems; increased insulation efficiency by up to 30%. |

|

Study on materials for cryogenic insulation and behavior under extreme conditions |

Exploring composite insulation solutions to improve thermal efficiency; potential 20%-30% improvement in heat retention. |

|

Development of cryogenic solutions for gas evaporation and mixing in industrial applications |

Focus on improving gas-phase insulation through better evaporation and mixing processes; efficiency improvements up to 15%-25%. |

|

Application of cryogenics in food preservation and beverage production |

Cryogenic freezing leads to better nutrient retention and longer shelf-life; Cryogenic Insulation Market growth driven by 7%-9% CAGR in the sector. |

|

Analysis of corporate R&D and innovation in cryogenics and energy storage technologies |

China increasing investments in cryogenic energy storage by 15% annually; competitive advantage through local production. |

|

R&D trends in cryogenics related to healthcare and industrial gas applications |

R&D investments in cryogenics for cold storage technologies expected to grow 10%-12% annually globally; significant focus on biotech cryogenics. |

|

Innovations in heat transfer mechanisms in cryogenic systems |

Research focused on super-insulation materials; up to 40% better heat retention in cryogenic systems. |

|

Research on cryogenic reciprocating pumps for liquefied gases transportation and storage |

Increased pumping efficiency in cryogenic transport systems by 20%-25%; enhanced insulation performance to reduce energy losses. |

|

R&D on cryogenic carbon capture technologies to reduce emissions |

Development of cryogenic CO2 capture technologies could reduce industrial emissions by up to 30%. |

|

Innovations in cryogenic carbon capture technologies |

Cryogenic CO2 capture systems projected to capture 500+ million metric tons of CO2 annually by 2030. |

|

Development of cryogenic gas relief valves to manage pressure in tanks |

Gas relief valves in cryogenic systems expected to improve safety and efficiency by up to 25% in industrial gas systems. |

|

Research into thermal insulation properties of materials used in cryogenic environments |

Thermal conductivity reduction through advanced insulation techniques expected to improve efficiency by 15%-20%. |

|

Strategic R&D initiatives for cryogenic technologies in hydrogen storage and transport |

Investments in cryogenic hydrogen storage technologies could increase 12%-15% annually over the next five years. |

|

Development of advanced cryogenic solutions and insulation technologies for energy storage and transportation |

Innovations in cryogenic heat exchangers and insulation systems for LNG storage expected to improve energy efficiency by 18%-22%. |

Cryogenic Insulation Market Segment Analysis

By Type, PU/PIR Dominates the Market and Fiberglass is the Fastest Growing Segment

PU/PIR leads the cryogenic insulation market with a 43.58% share in 2024. Its dominance is driven by excellent thermal performance, long-term durability, cost-efficiency, and compliance with global energy efficiency regulations, making it the preferred choice for LNG, chemical, and industrial cryogenic applications.

Fiberglass is the fastest-growing segment, projected to reach USD 1,383.04 million by 2032 from USD 795.02 million in 2024 at a CAGR of 7.17%. Growth is fueled by its low cost, recyclability, effective thermal insulation, and increasing adoption in LNG storage, petrochemical, and industrial cryogenic applications worldwide.

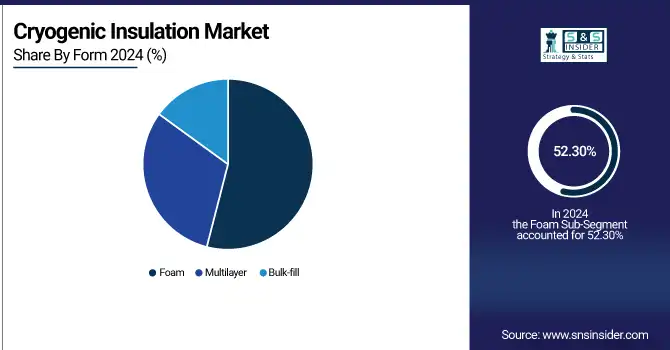

By Form, Foam Dominates the Market and Multilayer Insulation is the Fastest-Growing Segment

Foam dominates the global cryogenic insulation market with a 52.30% share in 2024, driven by superior thermal performance, cost-effectiveness, ease of handling, and compliance with energy efficiency regulations. Its widespread adoption in LNG storage, pipelines, and industrial applications ensures continued market leadership.

Multilayer insulation (MLI) is the fastest-growing segment, projected to grow at a CAGR of 7.47% from USD 1406.27 million in 2024 to USD 2,501.97 million by 2032. Its lightweight, durable, and highly efficient thermal resistance makes it ideal for cryogenic, aerospace, and LNG applications, supported by increasing energy conservation and sustainability initiatives globally.

By End-User, Energy and Power Dominates End-User Segment While Transportation Is Fastest-Growing in Cryogenic Insulation Market

Energy & Power dominates the cryogenic insulation end-user market with a 49% share in 2024, driven by LNG and LPG storage requirements, renewable energy growth, government investments in infrastructure, and regulatory incentives for energy efficiency in ultra-low temperature applications.

Transportation is the fastest-growing segment, expected to grow at a CAGR of 7.61% from USD 319.20 million in 2024 to USD 573.80 million by 2032, fueled by LNG and hydrogen adoption, regulatory emission targets, investments in cryogenic transport infrastructure, and advancements in high-performance insulation for marine, road, and industrial gas transportation.

-

In 2023, over 1,000 LNG-fueled ships were operational globally, while the U.S. DOE allocated USD 7 billion for regional hydrogen hubs.

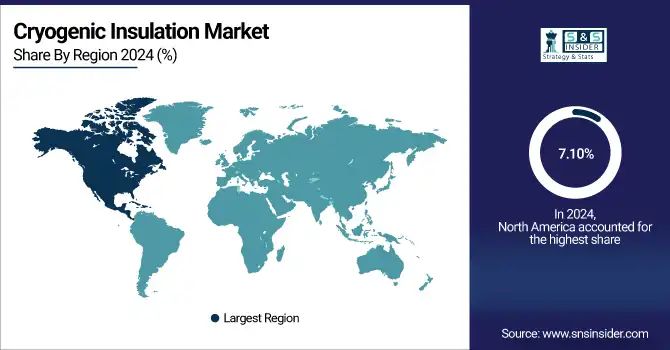

Cryogenic Insulation Market Regional Analysis

North America Cryogenic Insulation Market Insights

North America, valued at USD 1114.57 million in 2024, is the fastest-growing region in the cryogenic insulation market, expected to grow at a CAGR of 7.10% during the forecast period. Growth is driven by increasing LNG production and exports, adoption of advanced insulation materials such as multi-layer insulation (MLI) and vacuum-insulated panels (VIPs), energy efficiency initiatives, aerospace applications involving liquid hydrogen, and ongoing development of cryogenic infrastructure including storage tanks, pipelines, and LNG terminals.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

Canada leads North America’s fastest-growing cryogenic insulation market, with a 7.61% CAGR during 2024-2032, driven by LNG reserves, cold climate, clean energy initiatives, and advanced solutions from Rockwool and Kingspan meeting energy-efficient, sustainable, and safe insulation demands.

Asia Pacific Cryogenic Insulation Market Insights

Asia Pacific dominates the cryogenic insulation market, valued at USD 1482.68 million in 2024 and growing at a CAGR of 6.94% during 2024-2032. Rapid industrialization in China, India, and Japan, rising LNG demand, cleaner energy adoption, and government-backed energy-efficient policies drive growth. The region leads in both consumption and export of cryogenic insulation materials, supporting key sectors like oil & gas, energy, and chemical processing, while contributing significantly to global LNG trade.

-

China leads the Asia Pacific cryogenic insulation market with USD 575.02 million in 2024, growing at a 6.68% CAGR, driven by expanding LNG infrastructure, rising imports, advanced insulation technologies, government investments, and innovations in high-performance, eco-friendly cryogenic materials.

Europe Cryogenic Insulation Market Insights

Europe’s cryogenic insulation market is expanding, driven by strong demand in oil & gas, energy, and industrial gas sectors. Western Europe dominates with USD 840.33 million in 2024, fueled by LNG storage, government investments, and EU initiatives like the Green Deal. Strict environmental regulations, R&D in advanced materials by BASF and Linde, and the push for sustainable energy, including hydrogen production, further boost adoption of efficient cryogenic insulation solutions.

-

Germany dominates Western Europe’s cryogenic insulation market with USD 198.92 million in 2024, driven by a strong industrial sector, government energy efficiency policies, R&D investments, LNG infrastructure expansion, and continuous innovations in high-performance, sustainable insulation solutions.

Middle East & Africa and Latin America Cryogenic Insulation Market Insights

In the Middle East & Africa, the cryogenic insulation market is driven by expanding oil and gas infrastructure, LNG terminal development, and government initiatives in energy efficiency, growing at a 5.50% CAGR. Latin America’s market, growing at 6.01% CAGR, benefits from abundant natural gas reserves, LNG export expansion, industrial infrastructure projects, and government incentives for cleaner energy, alongside adoption of advanced and eco-friendly cryogenic insulation technologies to enhance storage and transportation efficiency.

Cryogenic Insulation Companies are:

-

Alkegen

-

Aspen Aerogels, Inc.

-

Cabot Corporation

-

Armacell International Holding GMBH

-

BASF SE

-

Rochling Group

-

Rockwool International A/S

-

Saint-Gobain

-

Sekisui Chemical Co Ltd

-

Zotefoams Plc

-

Nichias Corporation

-

Johns Manville Inc.

-

Hertel Holding B.V.

-

Lydall Inc.

-

Trelleborg AB

-

Aerogel Technologies

-

Owens Corning

-

Kingspan Group

-

UBE Industries Ltd.

-

Kaefer Insulation

-

Huntsman Corporation

Cryogenic Insulation Market Competitive Landscape:

INOXCVA

INOXCVA, part of the INOX Group, specializes in cryogenic storage and gas solutions, offering a wide range of industrial and energy sector applications. The company focuses on LNG, liquid air, and industrial gas storage technologies, emphasizing innovation, reliability, and global expansion. INOXCVA aims to support energy infrastructure growth while enabling sustainable and efficient cryogenic solutions for industrial and clean energy markets.

-

November 2024: INOX India won a contract to supply cryogenic tanks for the UK’s first Liquid Air Energy Storage (LAES) facility, supporting renewable energy goals.

-

November 2024: INOX India secured an order to construct a mini LNG terminal in the Bahamas, enhancing international LNG presence.

-

March 2023: INOXCVA announced a ₹200 crore cryogenic tank manufacturing facility in Vadodara to meet rising industrial demand.

-

February 2023: Collaborated with Adani Total Gas to expand LNG storage and transportation infrastructure across India.

Alkegen

Alkegen is a specialty materials company focusing on high-performance thermal, acoustic, and protective solutions for industrial and automotive applications. The firm emphasizes innovation in materials engineering, supporting electric vehicle safety, battery protection, and sustainable industrial solutions. Alkegen strategically invests in technology and partnerships to drive growth in advanced material development and strengthen its market position in the EV and industrial sectors.

-

September 2024: Announced a capital infusion to accelerate innovation and expansion in advanced industrial materials.

-

April 2024: Collaborated with Jaguar Land Rover (JLR) to develop advanced thermal protection systems for EV batteries, enhancing safety and performance.

-

February 2023: Sold its Thermal and Acoustic Solutions business to Regent LP to focus on high-performance specialty materials.

Sekisui Chemical Co., Ltd.

Sekisui Chemical is a global leader in innovative chemical, polymer, and material solutions, emphasizing sustainability, carbon recycling, and industrial efficiency. The company focuses on environmentally responsible technologies, including enzyme development, biomanufacturing, and AI-driven energy optimization. Sekisui leverages strategic partnerships and advanced research to develop high-performance, sustainable chemicals and materials, supporting industrial transformation and environmental goals.

-

September 2024: Entered a master license agreement with LanzaTech to develop carbon recycling technologies, converting industrial emissions into valuable chemicals.

-

June 2024: Hitachi introduced AI-powered systems to improve industrial energy efficiency, optimizing power use and reducing carbon emissions.

-

January 2024: Partnered with RevolKa for enzyme development to advance sustainable chemical production and biomanufacturing technologies.

Rockwool International A/S

Rockwool International is a leading manufacturer of stone wool insulation solutions for industrial, commercial, and residential applications. The company emphasizes energy efficiency, sustainability, and product innovation, providing advanced insulation materials with superior water and corrosion resistance. Rockwool continues to expand globally, investing in state-of-the-art production lines and strategic acquisitions to strengthen its market position and meet growing insulation demand worldwide.

-

December 2024: Approved a $100 million investment for a new production line at its Marshall, Mississippi plant, producing wallboard with WR-Tech water repellence and CR-Tech corrosion resistance, operational by 2027.

-

December 2023: Signed an agreement to acquire Boerner Insulation Sp. z o.o. in Poland, aiming to expand product offerings and market presence.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3734.83 Million |

| Market Size by 2032 | USD 6340.74 Million |

| CAGR | CAGR of 6.84% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Fiberglass, Cellular Glass, Perlite Insulation, PU/PIR, and Others) • By Form (Foam, Multilayer, and Bulk-fill) • By Application (Storage Tanks, Fuel Tanks, Pipe Systems, Terminals, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Rochling Group, Armacell International Holding GmbH, Aspen Aerogels Inc., BASF SE, Cabot Corporation, Johns Manville Inc., Hertel Holding B.V., Lydall Inc., DUNMORE, Saint-Gobain, Rockwool International, Sekisui Chemical Co., Ltd., Trelleborg AB, Zotefoams Plc, Aerogel Technologies, Owens Corning, Kingspan Group, UBE Industries Ltd., Kaefer Insulation, Huntsman Corporation. |