CBD Oil Market Report Scope & Overview:

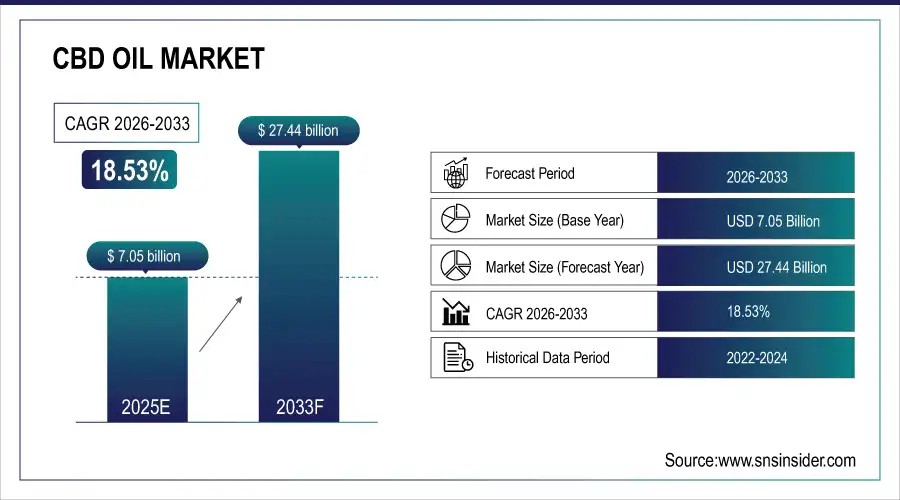

The CBD Oil Market Size was valued at USD 7.05 Billion in 2025E and is projected to reach USD 27.44 Billion by 2033, growing at a CAGR of 18.53% during the forecast period 2026–2033.

The CBD Oil Market analysis offers an overview of market dynamics. Increasing awareness of health benefits, rising adoption of CBD-infused products, and growing consumer demand are driving market growth, supported by innovations in formulations, distribution channels, and expanding acceptance.

The CBD Oil Market reached 12 million users in 2025, driven by CBD adoption for pain, anxiety, sleep, and skincare across hospitals, wellness centers, and retail channels.

Market Size and Forecast:

-

Market Size in 2025: USD 7.05 Billion

-

Market Size by 2033: USD 27.44 Billion

-

CAGR: 18.53% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On CBD Oil Market - Request Free Sample Report

CBD Oil Market Trends:

-

Growing awareness of natural wellness and holistic therapies is driving CBD adoption for pain management, anxiety relief, sleep support, and skincare applications.

-

Extract, formulation and bioavailability technologies have been refined in product manufacturing that is increasing the effectiveness or confidence consumers have in CBD oils, tinctures and topicals.

-

Regulatory clarity and its legalization throughout several areas are driving health care service providers, wellness centers, and retailers to incorporate CBD products.

-

Growing medical literature about the benefits of CBD, and clinical evidence and published studies, are building trust with physicians and consumers.

-

Stay updated with latest market trends, grow your business and explore new market opportunities with the Homeopathy industry reports.

U.S. CBD Oil Market Insights:

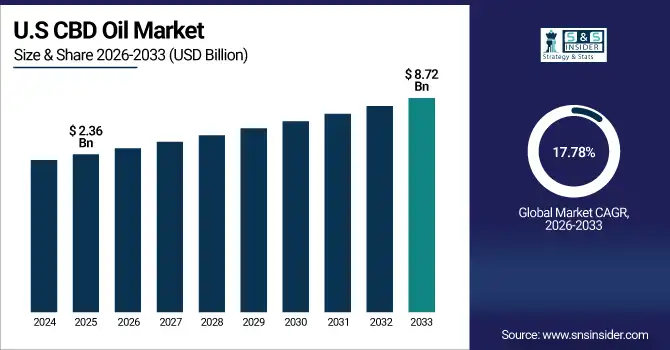

The U.S. CBD Oil Market is projected to grow from USD 2.36 Billion in 2025E to USD 8.72 Billion by 2033 at a CAGR of 17.78%. Growth is being pushed by pain management, anxiety, sleep support and skincare uses and growing consumer awareness and increasing online and wellness distribution.

CBD Oil Market Growth Drivers:

-

Rising consumer preference for natural, plant-based remedies is boosting demand for CBD-based wellness and therapeutic products.

Increasing adoption of CBD-based wellness and therapeutic products is driving the CBD Oil market growth. In 2025, there were more than 12 million differently-estimated consumers globally (mainly for pain, anxiety, sleep and skin) and to express a certain appetite of priority. Primary markets driving this demand are also US, Canada and Germany where clinical research, wellness programmes and commercial sales are increasing. These Initiatives: Augment product awareness, consumer awareness and reactions within CBD form & application categories.

CBD Oil adoption reached over 12 million users in 2025, driven by pain management, anxiety, sleep disorders, and skincare applications.

CBD Oil Market Restraints:

-

Inconsistent regulations and quality standards across regions are hindering large-scale adoption and consumer trust in CBD products.

Inconsistent regulations and quality standards are key factors influencing the growth of the CBD Oil Market. By 2025, one-third of would-be consumers in Europe and North America may be blocked from consuming CBD products due to regulations or ambiguity over labelling. Verified quality products are also hard to find for at small health centers and clinics compared to big retailers. A patchwork of legal frameworks, inconsistency in quality testing and a lack of professional guidelines haunts the broader acceptance even as consumers show an increase interest in natural therapies.

CBD Oil Market Opportunities:

-

Expansion of e-commerce platforms and telehealth consultations creates opportunities to increase CBD product accessibility and consumer adoption.

E-commerce platforms and telehealth consultations are expanding the CBD Oil Market. More than 5 million had purchased CBD online or sought professional advice remotely in 2025, and that figure is projected to top 18 million by 2033. Health and wellness retailers, pharmacy chains and online companies are increasingly employing digital tools to educate consumers, verify products and create more convenient experience. These are the developments that are making CBD treatments more accessible, popular and routine than.

E-commerce sales and telehealth consultations accounted for 25% of new CBD product adoption in 2025, driven by wellness centers, pharmacies, and online retail platforms.

CBD Oil Market Segmentation Analysis:

-

By Product Type, Oils & Tinctures held the largest market share of 38.25% in 2025, while Beverages are expected to grow at the fastest CAGR of 21.35%.

-

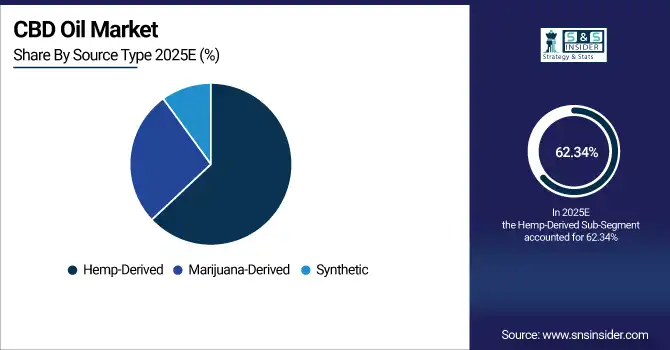

By Source Type, Hemp-Derived dominated with a 62.34% share in 2025, while Synthetic is projected to expand at the fastest CAGR of 21.05%.

-

By Application, Pain Management accounted for the highest market share of 32.56% in 2025, and Skincare & Cosmetics are projected to record the fastest CAGR of 22.08%.

-

By End User, Hospitals & Clinics held the largest share of 28.35% in 2025, while Online Retail is expected to grow at the fastest CAGR of 21.65%.

By Product Type, Oils & Tinctures Dominates While Beverages Expands Rapidly:

Oils & Tinctures segment dominated the market with 4.5 million users owing to their convenient consumption, multi-usage and improved pain relieving, anti-anxiety and better sleep-inducing properties compared to other forms. In health centers and hospitals, it’s already high on paying list so if the growth sustains, more the consumer trust will be. Beverages segment is the fastest growing in the market with 1.2 million users in 2025, is led by functional drinks and lifestyle trends; More product innovation and wider retail availability drive rapid uptake across.

By Source Type, Hemp-Derived Dominates While Synthetic Expands Rapidly:

Hemp-Derived segment dominated the market due to its legal status, wide availability, consumer acceptance, and strong support from research and healthcare provider recommendations, with 7.5 million users in 2025. Synthetic segment is the fastest growing in the market with 0.9 million users in 2025, owing to exact formulations and consistent quality along with foray into pharmaceuticals & wellness companies, appealing more to the standardized and controlled therapeutic effects pursuers.

By Application, Pain Management Dominates While Skincare & Cosmetics Expands Rapidly:

Pain Management segment dominated the market due to widespread adoption in chronic pain, arthritis, and musculoskeletal treatments across hospitals, wellness centers, and homecare settings, with 3.8 million users in 2025. Its clinical performance history and positive patient results are still driving market preference. The Skincare & Cosmetics segment is the fastest growing in the market with 1.1 million users by 2025 on account of growing natural beauty trends, anti-inflammatory properties, and rising penetration in creams, serums, and topical solutions across personal care & wellness channels.

By End User, Hospitals & Clinics Dominates While Online Retail Expands Rapidly:

Hospitals & Clinics segment dominated the market due to supervised treatment interventions, patient care programs, and clinical trials, with well-controlled usage enhancing reliability, with 3.2 million users in 2025. Online Retail segment is fastest growing in the market with 1.4 million users in 2025, driven by increasing e commerce, telehealth consultations and accessibility. Growing E-commerce marketplaces and certified product ensures that online consumers are more confident and globally adoptive.

CBD Oil Market Regional Analysis:

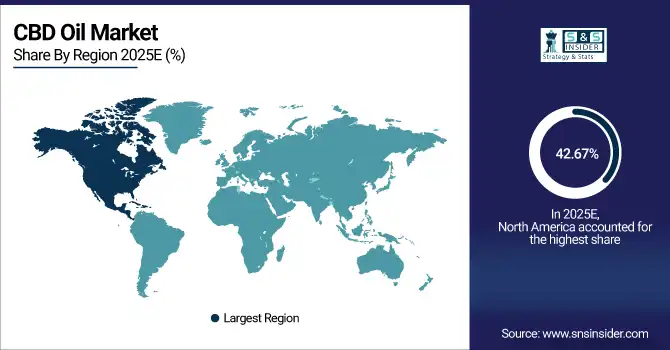

North America CBD Oil Market Insights:

North America dominated the CBD Oil market due to favorable regulatory systems, high consumer awareness, and well-developed distribution networks, with 5.1 million users in 2025 for applications including pain management, anxiety, sleep disorders, and skincare, capturing a 42.67% market share. Rising use in hospitals, wellness centres and retail stores, combined with expanding studies on potential therapeutic effects, is set to make North America the largest market for CBD and encourage product innovation.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. CBD Oil Market Insights:

The U.S. CBD market growth is driven by rising health awareness, e-commerce expansion, robust clinical research, and telemedicine, as hospitals, wellness centers, and stores expand CBD offerings, serving over 3.2 million users in 2025, including 1.5 million for pain management and 0.9 million for anxiety relief.

Asia-Pacific CBD Oil Market Insights:

The Asia Pacific region is the fastest growing at CAGR of 20.06% in CBD Oil Market due to increasing use of wellness and pain management health supplements, anxiety & depression treatment along with skin care products. By 2025, over 1.2 million users came from Japan and close to 0.9 million users came from Australia. Growth is driven by regulatory changes, growing consumer awareness, e-commerce growth and the opening of wellness centres and clinics throughout the region.

Japan CBD Oil Market Insights:

Japan’s CBD market growth is aided by regulatory reforms, rising wellness awareness, expanding e-commerce channels, development of dedicated wellness centers, and increasing CBD-based therapeutic and personal care products, serving over 1.2 million users in 2025, including 0.6 million for pain management and 0.4 million for anxiety relief.

Europe CBD Oil Market Insights:

Europe served over 4.3 million CBD users in 2025, with Germany leading at 1.5 million users, followed by France with 1.1 million and Italy with 0.9 million. Painkilling and anxiety-destroying were the most common uses, with applications for sleep and skin care also being ample. Growth is backed by regulatory transparency, a rising awareness of wellness, e-commerce on the rise and better presence through wellness centers in major regional markets.

Germany CBD Oil Market Insights:

Germany’s CBD market growth is driven by regulatory clarification, increasing health consciousness, expansion of health and wellness stores, rising e-commerce adoption, and growing clinical research and therapeutic use of CBD products, addressing over 1.5 million consumers in 2025, including 0.8 million for pain alleviation and 0.4 million for anxiety relief, with Oils & Tinctures leading the market.

Latin America CBD Oil Market Insights:

Latin America’s CBD market growth is driven by regulatory reforms, rising wellness awareness, expanding e-commerce, and new health and wellness centers, serving over 0.8 million users in 2025, with Brazil at 52%, Argentina at 30%, and Colombia at 18%. Pain and anxiety reduction led usage, while sleep support and skincare applications grew rapidly.

Middle East and Africa CBD Oil Market Insights:

Middle East & Africa’s CBD market growth is driven by regulatory changes, rising wellness awareness, e-commerce integration, and increasing wellness outlets, catering to 0.45 million users in 2025, including 0.18 million in the UAE and 0.12 million in South Africa. Oils & Tinctures led the market, with anxiety relief and pain management closely following.

CBD Oil Market Competitive Landscape:

Charlotte’s web dominated the market due to their fully integrated model that includes cultivation, manufacturing and retail. By 2025, it was being used by more than 2.8 million people mainly to help relieve pain, anxiety and to aid sleep. Its full-spectrum oils, gummies, capsules and topical’s combined with science-based formulations and strategic partnership distribution channels including health practitioners, wellness centers, retirement homes and big box retailers and online prove its strong position in the competitive CBD industry.

-

In September 2025, Charlotte’s Web introduced Quiet Sleep Mushroom Gummies, combining functional mushrooms and botanicals to support sleep and relaxation. These gummies utilize the company's TiME INFUSION technology, enhancing bioavailability and efficacy.

Joy Organics is one of my favorite CBD brands from USDA organic certified tinctures, to gummies and topicals. Now, in 2025, the company has grown to supply high quality CBD products for wellbeing and relaxation to over 1.9 million people. It's that trust factor combined with the transparency and education efforts, strong e-commerce offset it. Innovative collaborations with wellness and retail groups have helped to accelerate the acceptance of Joy Organics as a powerful force in the CBD Oil market.

-

In June 2025, Joy Organics launched Organic 25mg CBD Capsules, offering a vegan, water-soluble formula for improved absorption. These capsules are USDA-certified organic and free from THC, catering to consumers seeking clean and effective CBD options.

CBDistillery is a major player in the CBD Oil industry, selling everything from oils and capsules to gummies and topicals. By 2025, Balance had more than 2.2 million customers, including new and experienced CBD users interested in high quality products. Its focus on product quality, accessibility and innovation provides for broad adoption. Paired with a heavy focus on online and retail partnerships, CBDistillery has a dominant place in the marketplace and still impacts trends today in the CBD space.

-

In 2025, CBDistillery released Enhanced Relief Gummies, each containing 75mg of CBD and 5mg of THC. These gummies are designed to provide full-body relaxation and support recovery. The product exemplifies CBDistillery's focus on delivering potent and effective CBD solutions to meet consumer demand.

CBD Oil Market Key Players:

Some of the CBD Oil Market Companies are:

-

Charlotte’s Web

-

Joy Organics

-

CBDistillery

-

Medterra

-

Lazarus Naturals

-

NuLeaf Naturals

-

Green Roads

-

Papa & Barkley

-

Wyld CBD

-

CBDfx

-

Isodiol International Inc.

-

Gaia Botanicals

-

PharmaHemp

-

Cresco Labs

-

Tilray Brands, Inc.

-

Green Thumb Industries

-

Lord Jones

-

Vena CBD

-

Sisters of the Valley

-

Healthcare International Research

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 7.05 Billion |

| Market Size by 2033 | USD 27.44 Billion |

| CAGR | CAGR of 18.53% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Oils & Tinctures, Capsules & Softgels, Topicals, Edibles, Beverages, Others) • By Source Type (Hemp-Derived, Marijuana-Derived, Synthetic) • By Application (Pain Management, Anxiety & Depression, Sleep Disorders, Skincare & Cosmetics, Others) • By End User (Hospitals & Clinics, Wellness Centers, Pharmacies & Drug Stores, Online Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Charlotte’s Web, Joy Organics, CBDistillery, Medterra, Lazarus Naturals, NuLeaf Naturals, Green Roads, Papa & Barkley, Wyld CBD, CBDfx, Isodiol International Inc., Gaia Botanicals, PharmaHemp, Cresco Labs, Tilray Brands, Inc., Green Thumb Industries, Lord Jones, Vena CBD, Sisters of the Valley, Healthcare International Research |