Cell-based Assays Market Overview:

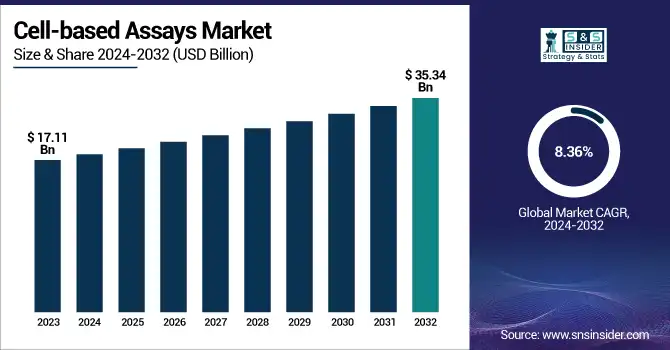

The Cell-based Assays Market was valued at USD 17.11 billion in 2023 and is expected to reach USD 35.34 billion by 2032, growing at a CAGR of 8.36% from 2024-2032.

To Get more information on Cell-based Assays Market - Request Free Sample Report

The report gives extensive insights into the Cell-based Assays Market based on trends of market adoption and utilization in 2023, emphasizing their growing contribution to drug discovery and toxicology studies. It explores regional demand differences, evaluating the effects of R&D spending and regulation policies on the adoption of assays. The report also delves into technology breakthroughs, such as AI-assisted automation and 3D cell culture models, determining the future of cell-based assays. In addition, it also analyzes R&D spending trends between 2023 and 2032 and the regulatory environment's influence on assay validation and commercialization, providing an exclusive vision of compliance issues and technology development in this market.

The U.S. Cell-based Assays Market size was USD 2.93 billion in 2023 and is expected to reach USD 6.01 billion by 2032, growing at a CAGR of 8.34% over the forecast period of 2024-2032.

The U.S. Cell-based Assays Market is experiencing growth due to the rising demand for advanced drug discovery and development solutions. Increased adoption of high-throughput screening (HTS) and 3D cell culture technologies is driving innovation in this space. The market is also benefiting from the growing focus on personalized medicine and biologics, which require more precise cellular analysis. Additionally, expanding applications in toxicity testing, cancer research, and immunology are further propelling market expansion.

Cell-based Assays Market Dynamics

Drivers

-

Increasing Adoption of Cell-based Assays in Drug Discovery and Development is accelerating the market growth.

Cell-based assays are now becoming the drug discovery and development tools of choice because they have the potential to deliver physiologically relevant data. Pharmaceutical companies can use the assays to test drug efficacy, toxicity, and mechanism of action in the lab before they reach the clinic. Industry reports suggest that close to 50% of preclinical drug testing involves cell-based assays, minimizing the use of classical animal models. Recent developments include the launch of the Gibco CTS Rotea Counterflow Centrifugation System by Thermo Fisher Scientific, aimed at streamlining cell therapy workflows. High-throughput screening tools and automation are also enhancing assay accuracy to accelerate drug development. As the use of cell-based assays in pharmaceutical R&D increases, driven by stringent regulatory needs for trustworthy safety testing, market growth is huge.

-

Advancements in High-Content Screening (HCS) and 3D Cell Culture Technologies are driving the market to grow.

The transition from conventional 2D cell cultures to 3D cell-based models is transforming the market by delivering more valid biological responses. High-content screening (HCS) with 3D cell culture provides researchers the capability of examining complex cellular behaviors, enhancing predictive validity in assays. Agilent Technologies has recently launched the xCELLigence RTCA HT Instrument, which facilitates real-time, label-free observation of cellular interactions, critical for oncology drug discovery. Additionally, corporations such as Corning Incorporated have established ultra-low attachment surfaces and spheroid microplates to aid 3D culture applications. Such innovations are driving the growth of cell-based assays in personalized medicine, toxicology research, and stem cell research, which is fueling market growth. The inclusion of artificial intelligence (AI) in image analysis is also augmenting the effectiveness of HCS systems, thus making cell-based assays more dependable and scalable.

Restraint

-

The technical sophistication and high expense of cell-based assays are a major hindrance to market expansion.

Cell-based assays are more expensive than conventional biochemical assays because they need specialized reagents, advanced imaging systems, and sophisticated automation, which increase the cost of operation. Equipment like high-content screening (HCS) platforms and flow cytometers can be as expensive as hundreds of thousands of dollars, which is out of reach for small research centers and biotech companies. In addition, the culture of live cells requires controlled environments, strict protocols, and qualified personnel, contributing to overall complexity. Regulatory hurdles also make assay validation more complicated, slowing product approvals and adding compliance expenses. Even with innovations such as 3D cell culture and artificial intelligence-driven data analysis, the requirement for heavy financial outlay and technical knowledge still constrains widespread use, particularly in cost-conscious markets and emerging countries.

Opportunities

-

The increasing focus on personalized medicine and precision drug development creates a huge opportunity for the cell-based assays market.

As stem cell research advances, organ-on-a-chip technologies, and 3D cell culture systems, pharmaceuticals are increasingly employing cell-based assays to create patient-specific therapies. The emergence of targeted therapies for cancer, neurological diseases, and rare genetic diseases has generated demand for highly predictive and physiologically relevant cell models. Moreover, regulatory bodies such as the FDA and EMA are promoting alternative methods to minimize animal testing, further promoting adoption. Merging AI and automation increases assay efficiency, enhancing throughput and reproducibility. With clinical research trending toward more individualized treatment strategies, demand for high-content screening (HCS) and live-cell imaging assays is likely to increase, providing lucrative market growth opportunities.

Challenges

-

Ensuring reproducibility and standardization across experiments is one of the greatest challenges for the cell-based assays market.

Owing to the intrinsic biological heterogeneity of living cells, the performance of an assay is variable depending on the source of the cells, passage number, culture conditions, and consistency of reagents. The variability hinders assay validation and cross-comparison of data among different labs, causing variations in drug screening and biomarker identification. Moreover, variations in assay protocols, data interpretation techniques, and instrumentation calibration also affect reproducibility. Regulatory bodies are encouraging strict Good Cell Culture Practice (GCCP) guidelines, but universal standardization is still a challenge. These issues need to be addressed through sophisticated automation, AI-based data analysis, and improved quality control measures, but full reproducibility across worldwide research environments is still a recurring challenge for market participants.

Segmentation Insights

By Products & Services

The Assay Kits segment dominated the cell-based assays market with a 38.55% market share in 2023, mainly because of their extensive use in drug discovery, toxicity testing, and high-throughput screening (HTS) applications. The kits offer pre-optimized, ready-to-use solutions that improve reproducibility, minimize variability, and optimize workflow efficiency in pharmaceutical and biotech research. The rising demand for target-directed drug screening, technological advances in fluorescence and luminescence-based assays, and growth in cancer and neurological disorders research have highly driven the usage of assay kits. In addition, key industry players are increasingly introducing novel multiplex assay kits allowing simultaneous analysis of several biomarkers, further cementing the segment's leadership. Regulatory focus on precise, high-sensitivity cell-based testing within preclinical studies has further led to widespread adoption of assay kits in both research and clinical labs.

The Reagents segment is experiencing the fastest growth in the cell-based assays market in the forecast years, fueled by the increasing demand for high-grade cell culture media, fluorescent probes, and selective buffers applied in complex biological research. The growing trend towards 3D cell culture, stem cell research, and organ-on-chip models has fueled the demand for high-end reagents that facilitate complex cellular interactions and increase assay sensitivity. The expanding use of customized and high-purity reagents in personalized medicine and biopharmaceutical production is also driving market growth. The ongoing advancement of CRISPR-based assays, next-generation sequencing (NGS)-integrated cell analysis, and high-content screening (HCS) platforms has also fueled reagent demand. Strategic partnerships among reagent makers and research institutions will keep pushing innovation, leading this segment to be the fastest-growing in the market.

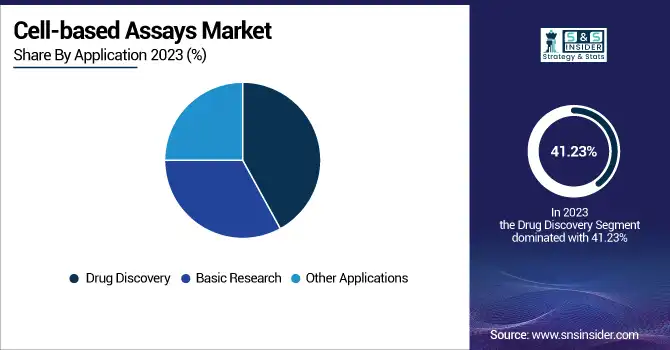

By Application

The Drug Discovery segment dominated the cell-based assays market with a 41.23% market share in 2023, mainly because pharmaceutical and biotechnology firms are increasingly depending on high-throughput screening (HTS), phenotypic assays, and target-based drug discovery methods. The increasing incidence of chronic diseases such as cancer, cardiovascular disease, and neurodegenerative disease has propelled the demand for improved drug development pipelines in which cell-based assays have a key function in assessing drug efficacy, toxicity, and mode of action in physiologically relevant conditions. Furthermore, improved 3D cell culture models, organ-on-chip systems, and CRISPR screening assays have contributed to enhanced drug discovery processes. Regulatory bodies, including the FDA and EMA, are continuously promoting cell-based assay use in preclinical validation, thereby cementing the dominance of this segment.

The Basic Research segment is expected to witness the fastest growth in the cell-based assays market in the forecast years, fueled by growing investment in academic and research facilities, in addition to augmented funding for cell biology, molecular diagnostics, and regenerative medicine research. Increased curiosity about learning about cellular pathways, gene expression, and disease processes has spurred growing use of cell-based assays in basic life sciences research. Also, emerging capabilities in single-cell analysis, high-content screening (HCS), and AI-driven cell imaging are speeding up findings in biomedical research. Governments and private agencies globally are heavily investing in genomic and proteomic research initiatives, increasing demand for cutting-edge cell-based assays even more. While precision medicine and synthetic biology expand in popularity, the Basic Research segment is slated to grow rapidly.

By End-Use

The Pharmaceutical & Biotechnology Companies segment dominated the cell-based assays market with 52.23% market share in 2023, largely because cell-based assays have become widely used across drug discovery, toxicity testing, and high-throughput screening (HTS). With growing pressure to develop biologics, targeted treatments, and personalized medication, pharma and biotech companies have heavily invested in cell-based technologies to improve drug development speed and minimize clinical trial failure rates. Additionally, the increasing pipeline of new cancer, autoimmune disease, and infectious disease therapeutics has resulted in increasing dependence on cell-based assays for preclinical studies and biomarker discovery. Regulatory agencies like the FDA and EMA are also encouraging cell-based models for drug assessment, increasing their use by industry participants even further.

The Academic & Research Institutes segment is expected to be the fastest-growing end-user segment with 8.99% CAGR throughout the forecast period in the cell-based assays market. This is attributed to increasing investment in life sciences research, a growing number of collaborations between industry and academia, and the growth of government-sponsored cell biology projects. Researchers at institutes and universities are actively utilizing cell-based assays to investigate disease pathways, stem cell therapies, and gene-editing technologies like CRISPR-Cas9. Growing interest in single-cell analysis, synthetic biology, and regenerative medicine is further fueling the need for these assays. Furthermore, improvements in high-content imaging, AI-based analytics, and laboratory automation are streamlining cell-based research, making it affordable and efficient, and inducing exponential growth in this market.

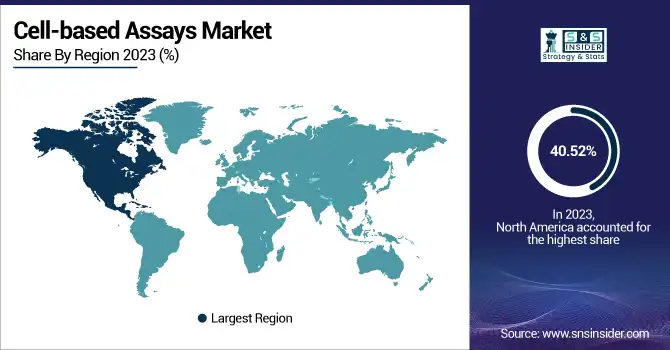

Regional Analysis

North America dominated the cell-based assays market with a 40.52% market share in 2023, driven by the well-established pharmaceutical and biotechnology sectors, sophisticated research infrastructure, and robust regulatory backup. The United States is a leader in this region, buoyed by increased investments in drug discovery, heavy adoption of newer screening technologies, and increasing attention to precision medicine. Moreover, the growing incidence of chronic diseases like cancer, diabetes, and neurodegenerative diseases has pushed the demand for novel assay technologies. Regulatory bodies like the FDA and NIH continually sponsor research activities, while interplay between academic and industry entities further fuels the market growth. The presence of advanced automation, AI-based analytics, and HTS platforms has further consolidated the region's hold on cell-based assay applications.

Asia Pacific is the fastest-growing region in the cell-based assays market with 9.03% CAGR throughout the forecast period, driven by accelerated growth in biopharmaceutical research, growing government grants, and escalating clinical trial activity. China, India, and Japan are heavily investing in stem cell research, biotechnology, and regenerative medicine, expanding the need for high-content screening (HCS) and three-dimensional (3D) cell culture assays. The area is experiencing a rise in contract research organizations (CROs) and biopharmaceutical outsourcing, providing low-cost drug discovery solutions. Further, an increasing patient base, growing incidence of chronic diseases, and favorable regulatory reforms support the use of innovative assay technologies. Growth in biotech incubators, collaborations among global pharmaceutical companies and local players, and AI-based research breakthroughs also propel the region's growth at an accelerated pace.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Cell-based Assays Market

-

Thermo Fisher Scientific Inc. (Gibco Cell-Based Assays, Invitrogen CellSensor Assay Kits)

-

Becton, Dickinson and Company (BD) (BD Cell Viability Assays, BD Cell-Based ELISA Kits)

-

Merck KGaA (MilliCell Cell Culture Inserts, Muse Cell Analysis Assays)

-

Danaher Corporation (Molecular Devices Cell-Based Assays, Beckman Coulter Flow Cytometry Assays)

-

PerkinElmer Inc. (AlphaLISA Cell-Based Assay Kits, Opera Phenix High-Content Screening System)

-

Bio-Rad Laboratories, Inc. (Bio-Plex Multiplex Immunoassays, S3e Cell Sorter)

-

Promega Corporation (CellTiter-Glo Luminescent Cell Viability Assay, NanoBRET Target Engagement Assays)

-

Agilent Technologies, Inc. (Seahorse XF Cell Metabolic Assays, xCELLigence Real-Time Cell Analysis)

-

Roche Holding AG (xCELLigence RTCA Systems, Cell Death Detection ELISA)

-

Lonza Group Ltd. (Cell Culture Media, Nucleofector Cell Transfection Kits)

-

Charles River Laboratories International, Inc. (Endosafe Endotoxin Testing, Celsis Rapid Detection Assays)

-

Cisbio Bioassays (HTRF Kinase Assays, Tag-lite Receptor Binding Assays)

-

DiscoverX Corporation (PathHunter Cell-Based Assays, KINOMEscan Profiling Services)

-

Cell Signaling Technology, Inc. (ELISA Kits, SimpleChIP Enzymatic Chromatin IP Kits)

-

BioTek Instruments, Inc. (Cytation Cell Imaging Multi-Mode Reader, Lionheart Automated Microscopes)

-

Abcam plc (Cell-Based ELISA Kits, FirePlex Multiplex Assays)

-

Enzo Life Sciences, Inc. (CELLestial Fluorescent Probe Assays, SCREEN-WELL Compound Libraries)

-

GenScript Biotech Corporation (cPass SARS-CoV-2 Neutralization Antibody Detection Kit, Custom Cell Line Development Services)

-

BioVision Inc. (EZCell Cell-Based Assay Kits, CytoGlow Fluorescence Imaging Kits)

-

R&D Systems (a Bio-Techne brand) (Fluorokine Cell-Based Assays, Proteome Profiler Antibody Arrays)

Suppliers (These suppliers provide essential materials such as cell culture media, reagents, assay kits, microplates, and lab consumables required for conducting cell-based assays) in the Cell-based Assays Market

-

Corning Incorporated

-

Eppendorf AG

-

Sartorius AG

-

GE Healthcare (now Cytiva)

-

Thermo Fisher Scientific Inc.

-

Merck KGaA (Sigma-Aldrich)

-

Lonza Group Ltd.

-

BD Biosciences

-

Bio-Rad Laboratories, Inc.

-

Agilent Technologies, Inc.

Recent Developments

-

June 2024 – BD (Becton, Dickinson and Company), a medical technology leader, launched commercially an enhanced single-cell research instrument. This new solution will help advance scientists' insight into cellular and molecular mechanisms and their function in governing changes that lead to disease, including cancer.

-

February 2024 – Charles River Laboratories International, Inc. formed a strategic partnership with Pluristyx Inc., a leading source of cell therapy development tools and technologies. In this partnership, Charles River accesses comprehensive access to well-characterized stem cell lines, such as high-quality embryonic stem (ES) cells and induced pluripotent stem cells (iPSCs), to drive research and further new therapeutic approaches.

Cell-based Assays Market Report Scope:

Report Attributes Details Market Size in 2023 US$ 17.11 Billion Market Size by 2032 US$ 35.34 Billion CAGR CAGR of 8.36% From 2024 to 2032 Base Year 2023 Forecast Period 2024-2032 Historical Data 2020-2022 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Products & Services (Reagents, Assay Kits, Microplates, Probes & Labels, Instruments & Software, Cell Lines)

• By Application (Basic Research, Drug Discovery, Other Applications)

• By End-Use (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations)

Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) Company Profiles Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), Merck KGaA, Danaher Corporation, PerkinElmer Inc., Bio-Rad Laboratories, Inc., Promega Corporation, Agilent Technologies, Inc., Roche Holding AG, Lonza Group Ltd., Charles River Laboratories International, Inc., Cisbio Bioassays, DiscoverX Corporation, Cell Signaling Technology, Inc., BioTek Instruments, Inc., Abcam plc, Enzo Life Sciences, Inc., GenScript Biotech Corporation, BioVision Inc., R&D Systems (a Bio-Techne brand), and other players.