Cell Dissociation Market Size Analysis:

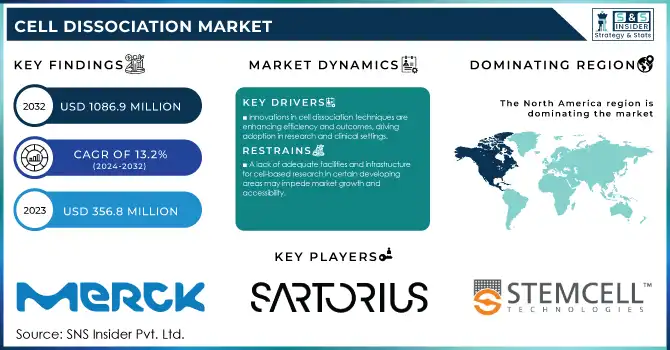

The Cell Dissociation Market size was valued at USD 356.8 Million in 2023 and is expected to reach USD 1086.9 Million by 2032 and grow at a CAGR of 13.2% over the forecast period 2024-2032.

Get more information on Cell Dissociation Market - Request Sample Report

The cell dissociation market is set to witness significant growth during the forecast period, owing to increased investments in cell-based research and the high demand for innovative therapeutics. The major factors supporting this impressive growth are the rise in biotechnology and biopharmaceutical R&D activities. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), European pharmaceutical companies spent EUR 47.01 billion (USD 49.43 billion) on R&D in 2022, which is expected to grow to EUR 50 billion (USD 54.11 billion) in 2023. Despite increasingly pro-cell-based nationalist governments coming into power abroad, the US maintains its status as the hinterland of cell-based research, with about a billion dollars in National Institutes of Health (NIH) funding going to stem cell research annually. Such funding is boosted by more partnerships between academia and industry, bridging the gap from lab to table. In addition, the increasing prevalence of chronic diseases, especially cancer, will also fuel the market. According to the Cancer Facts and Figures 2023 report from the American Cancer Society, roughly 1.9 million new cancer cases and 0.6 million cancer deaths are projected for the United States in 2023.

Additionally, the aging population in developed countries is expected to drive demand for novel biopharmaceuticals and cell-based therapies. The percentage of the U.S. population that is over 65 years old is expected to rise from 16% (2019) to 21.6% by 2040. The increase in the aging population along with the very high prevalence of chronic diseases creates huge scope for market growth. The cell dissociation market is also benefiting from technological advancements, with the integration of AI and the growing use of single-cell RNA sequencing (scRNA-seq) techniques emerging as key trends. By improving the efficiency and accuracy of cell dissociation processes, these innovations are boosting market growth in numerous applications, such as regenerative medicine, stem cell research, and cancer research. In addition, the advancement of the government is also a key driver in the field. The U.S. Food and Drug Administration (FDA), for example, has been fostering the development of cell and gene therapies, approving multiple pioneering therapies in the past few years. The FDA's Regenerative Medicine Advanced Therapy (RMAT) designation has been instrumental in expediting the development and review of regenerative medicine therapies, including those utilizing cell dissociation techniques. The European Medicines Agency (EMA), too, has been very active in advanced therapy medicinal products (ATMPs), with great importance attributed to cell dissociation technologies in their recent guidelines in Europe.

Market Dynamics

Drivers

-

Biopharmaceutical companies are allocating more funds to research and development, enhancing the demand for cell dissociation products essential in drug development and pathophysiology studies.

-

Innovations in cell dissociation techniques and products are improving efficiency and outcomes, attracting more adoption in various research and clinical settings.

-

The increasing incidence of chronic conditions necessitates advanced research and therapeutic approaches, boosting the need for cell dissociation in developing effective treatments.

The growth of the cell dissociation market is directly associated with the increasing research and development (R&D) investments in the biotechnology and pharmaceutical sectors. This trend highlights the increasing need for sophisticated cell dissociation technologies critical for drug development, regenerative medicine, and disease pathophysiology applications. New reports indicate that worldwide bio-pharma R&D spending has now exceeded $220 billion and the trend line continues to climb year-on-year. Significant investment goes into cell-based studies, emphasizing the importance of cell dissociation for effective cell isolation, culture, and analysis for therapeutic uses. Stem cell research a linchpin of regenerative medicine also directly depends on effective cell dissociation to keep harvested cells viable and functional. One such research project based in the U.S. in 2024, employed enzymatic dissociation to facilitate better use of CAR-T cell therapy, demonstrating effective response against blood cancers. Environmental-related diseases like prostate cancer and other neurodegenerative disorders, including Parkinson's disease and Alzheimer's disease, are under investigation with novel dissociation protocols developed in European academic institutions.

In addition, funding for single-cell analysis projects by government agencies such as the U.S. National Institutes of Health (NIH) is also- helping in the adoption of cell dissociation- technologies. Such investments are not only speeding the pace of scientific discoveries but also creating a strong demand for next-generation enzymatic and non-enzymatic dissociation products, stimulating innovations in this area.

Restraints:

-

Ethical issues related to the use of human and animal cells in research impose stringent regulations, potentially hindering the growth of cell dissociation studies.

-

The significant expenses associated with soft-tissue procedures and cell-based research can limit the adoption of cell dissociation technologies, especially in resource-constrained settings.

-

A lack of adequate facilities and infrastructure for cell-based research in certain developing areas may impede market growth and accessibility.

Ethical concerns pose significant challenges in the cell dissociation market, particularly in the context of research involving human and animal cells. The use of embryonic stem cells, animal tissues, or cells derived from humans raises moral and ethical questions. Such worries frequently result in regulatory regimes that researchers and organizations must work through before they are able to conduct studies or bring products to market. Some of these include ensuring donors give informed consent and that appropriate animal welfare standards are met during tissue extraction. Wherever this has not already been done, the stultifying laws of certain regions and the committees overseeing ethical behaviour may well slow down the cancer research timetable or constrain the range and size applicable for the research.

Moreover, public opinion and advocacy groups opposing certain types of cell-based research can influence funding and policy decisions, creating additional barriers. These ethical challenges can be managed by increased transparency, compliance with international guidelines, and regular interactions between researchers, regulators, and the general public to ensure that the development of this technology is balanced between innovation and ethical responsibility.

Cell Dissociation Market Segmentation analysis

By Products

In 2023, the enzymatic dissociation segment accounted for the largest revenue share of 46% and is expected to dominate primarily due to its ability to efficiently and selectively dissociate cells while maintaining cell viability and functionality. Enzymatic solutions such as trypsin, dispase, and collagenase are widely employed in research and industry due to their consistency in releasing cells from multicellular tissues. These products of enzymatic hydrolysis are extensively used in regenerative medicine-related projects funded by NIH in the U.S. but are seldom used in organ regeneration and cancer studies in the same country. The increasing number of clinical trials involving enzymatic cell dissociation, such as those registered under ClinicalTrials.gov, demonstrates the expanding utility of these products in healthcare innovation.

The growth of this segment is also driven by the development of formulation techniques that enhance enzyme activity and specificity alongside reducing the possibility of contamination as well as promoting the outcomes of cell-based experiments. In Asia Pacific regions, investment by governments including MHLW of Japan in research facilities with high advanced instruments of enzymatic dissociation will further aid in expanding the market.

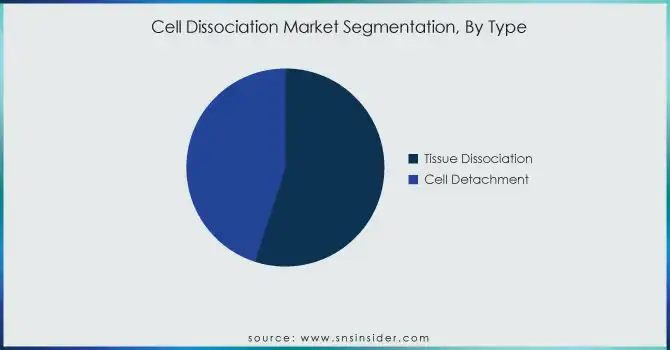

By Type

In 2023, the tissue dissociation segment dominated the market and accounted for a 55% revenue share. Tissue dissociation’s widespread adoption is attributed to its critical role in isolating cells for downstream applications such as cell therapy, drug screening, and personalized medicine. In 2023, more than 70% of stem cell-related studies employed tissue dissociation techniques according to the Stem Cell Research Fund of the NIH. Also, tissue dissociation could provide single-cell suspensions of high quality, which are necessary for NG sequencing and other flow cytometry applications.

Government-funded advanced lab settings in Europe, such as the UK’s Research and Innovation catalyst program, are accelerating tissue dissociation protocol adoption. We are working on such programs to improve cellular assays and reproducibility of results from experiments. Furthermore, countries such as India have started to adopt the advances in tissue dissociation technology owing to increased spending on biotechnology by the government, with funding increasing by 12% in 2023 as per reports by the Department of Biotechnology (DBT), Government of India.

By End User

Pharmaceutical & biotechnology companies remained the largest end-user segment, accounting for over 70% of market share in 2023. The dominance is due to the high usage of cell dissociation products in drug discovery, preclinical studies, and biopharmaceutical product manufacturing. According to recent government statistics, nearly 65% of the total world R&D spending in 2023 was from pharmaceutical companies, which directed a large share of that spending toward cellular therapies and biologics.

The U.S. Food and Drug Administration (FDA) reported that over 55 cell-based therapy IND applications were approved in 2023, underlining the pivotal role of pharmaceutical companies in advancing cell dissociation techniques. Likewise, the European Medicines Agency (EMA) observed that more than 30% of approved 2023 'ATMPs' employed cell dissociation during manufacture. These stats highlight the dependency of pharma/biotech companies on these advanced dissociation products to optimize their workflows and comply with regulatory-mandated guidelines.

Regional Insights

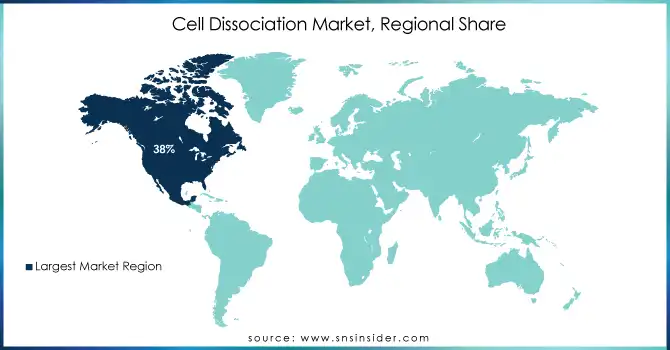

In 2023, North America held the largest revenue share of 38% in the cell dissociation market. Strong government funding, an established healthcare infrastructure, and major biopharma companies across the region give a competitive edge to this area. The NIH’s increased budget for cell-based research and Canada’s CIHR funding initiatives have collectively bolstered North America’s market position.

On the other hand, the Asia-Pacific region is expected to experience the highest growth in the forecast period, due to increasing biotechnology investments and growing acceptance of advanced research technologies. The year 2023 also marks a 15% increase in funding for stem cell research among China’s Ministry of Science and Technology, further demonstrating the region’s commitment to advancing the cell dissociation market. In addition, the establishment of various biotech hubs to aid advanced research announced by India's DBT is further driving the market growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Key Service Providers/Manufacturers

-

Thermo Fisher Scientific, Inc. (TrypLE Express Enzyme, Liberase™)

-

Merck KGaA, (Accutase, Collagenase NB 6)

-

Miltenyi Biotec (MACS Tissue Dissociation Kits, Tumor Dissociation Kit)

-

STEMCELL Technologies, Inc. (Gentle Cell Dissociation Reagent, Neural Dissociation Kit)

-

BD Biosciences (Accumax, Accutase)

-

Worthington Biochemical Corporation (Collagenase, Trypsin)

-

Corning Incorporated (Cellstripper, Dispase II)

-

HiMedia Laboratories Pvt. Ltd. (Trypsin-EDTA Solution, Collagenase)

-

Promega Corporation (TrypLE Select, Dispase)

-

Takara Bio, Inc. (Liberase TM, TrypLE Express)

Key Users:

-

Pfizer Inc.

-

Novartis International AG

-

Roche Holding AG

-

Sanofi S.A.

-

Johnson & Johnson

-

GlaxoSmithKline plc

-

AstraZeneca plc

-

Eli Lilly and Company

-

Bristol-Myers Squibb Company

-

Regeneron Pharmaceuticals, Inc.

Recent Developments

-

In June 2023, The NIH launched a collaborative project to explore advanced enzymatic dissociation techniques for organoid research, aiming to improve the scalability of regenerative therapies.

-

In September of 2024, Singleron launched its sCelLiVE® Tissue Dissociation Kit (Skin) for mouse and human skin tissues. The processing time is heavily reduced by this product while still permitting approximately 90% cell viability so that the product can be combined with downstream processes such as single-cell sequencing, etc. with minimal effect.

-

Agilent Technologies Inc. acquired e-MSion a developer of ExD cell for electron capture dissociation in March 2023. Designed as a compact solution for mass spectrometry, Boosts functionality to improve the efficiency of analyses supported by technological improvements that advance biotherapeutics development, affects the cell dissociation market.

Cell Dissociation Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 356.8 Million |

| Market Size by 2032 | US$ 1086.9 Million |

| CAGR | CAGR of 13.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments |

• By Product (Enzymatic Dissociation, Non-enzymatic dissociation, Instruments & Accessories) • By Type (Tissue Dissociation, Cell Detachment) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles |

Thermo Fisher Scientific, Inc., Merck KGaA, Miltenyi Biotec, Stemcell Technologies, Inc., BD Biosciences, Worthington Biochemical Corporation, Corning Incorporated, HiMedia Laboratories Pvt. Ltd., Promega Corporation, Takara Bio, Inc. |

| Key Drivers |

• Biopharmaceutical companies are allocating more funds to research and development, enhancing the demand for cell dissociation products essential in drug development and pathophysiology studies. • Innovations in cell dissociation techniques and products are improving efficiency and outcomes, attracting more adoption in various research and clinical settings. |

| Market Challenges |

• Ethical issues related to the use of human and animal cells in research impose stringent regulations, potentially hindering the growth of cell dissociation studies. • The significant expenses associated with soft-tissue procedures and cell-based research can limit the adoption of cell dissociation technologies, especially in resource-constrained settings. |