Flow Cytometry Market Size & Growth Overview:

To Get More Information on Flow Cytometry Market - Request Sample Report

The Flow Cytometry Market was valued at USD 5.34 billion in 2023 and is expected to reach USD 11.41 billion by 2032, growing at a CAGR of 8.82% over the forecast period 2024-2032.

The Flow Cytometry Market is experiencing significant growth, driven by technological advancements, rising demand for personalized medicine, and the increasing prevalence of chronic diseases such as cancer and autoimmune disorders. For instance, in oncology, flow cytometry has become essential for monitoring immune responses in cancer immunotherapies, such as CAR-T cell treatments. A study published by the National Institutes of Health (NIH) highlights how flow cytometry is used to assess the presence of tumor-specific T cells in patients undergoing immunotherapy. This capability is critical in tracking tumor progression and evaluating the effectiveness of treatments, directly improving patient outcomes.

The demand for highly accurate diagnostic tools is another significant factor propelling market growth. Flow cytometry’s ability to conduct multi-parameter analysis is especially valuable in diagnosing hematological cancers. The National Cancer Institute (NCI) has emphasized flow cytometry as a gold standard for diagnosing leukemia and lymphoma. The technique allows for detecting specific cell surface markers, enabling precise classification of cancer types and monitoring of disease progression. For example, in a study supported by the NIH, flow cytometry was used to identify subtypes of B-cell lymphoma, improving diagnostic accuracy and treatment strategies.

Technological innovations have further expanded the capabilities of flow cytometry. High-throughput flow cytometers, such as the BD FACSymphony and Beckman Coulter CytoFLEX systems, allow for the analysis of tens of thousands of cells per second, improving the data collection speed and accuracy. These systems also support complex assays, such as 15-parameter flow cytometry, which enables researchers to explore cellular heterogeneity in greater detail. This technology is increasingly used in clinical trials to monitor immune cells in cancer therapies and other experimental treatments, providing critical data to evaluate treatment efficacy.

Flow Cytometry Market Dynamics

Drivers

-

Technological Advancements and Rising Demand for Personalized Medicine Driving Growth in the Flow Cytometry Market

The ongoing innovation in flow cytometry technology, which enhances precision and throughput in cell analysis. The development of multi-parameter flow cytometers and advanced detection systems enables more detailed characterization of complex cell populations, improving research capabilities and clinical diagnostics. These improvements are particularly beneficial in immuno-oncology, where accurate immune profiling is essential for personalizing cancer treatments. Another key driver is the increasing emphasis on personalized medicine and targeted therapies. As healthcare shifts towards individualized treatments, precise cell and biomarker analysis becomes more critical in developing tailored therapies. Flow cytometry is crucial in assessing treatment efficacy, such as monitoring immune responses or detecting specific tumor markers, making it an indispensable tool in drug development and patient management.

Moreover, the growing use of flow cytometry in clinical diagnostics contributes to its market expansion. The technique’s ability to analyze various diseases, including hematological cancers and autoimmune disorders, supports its integration into routine diagnostic practices. Additionally, increased funding for research and public health initiatives further accelerates the adoption of flow cytometry in both research and clinical environments, driving continued growth in the market.

Restraints

-

High Costs and Training Barriers Limiting the Adoption of Flow Cytometry

The adoption of flow cytometry is significantly impacted by its high equipment and maintenance costs. Advanced technologies and sophisticated systems integral to flow cytometry require substantial investment, creating a financial barrier, particularly for smaller laboratories and institutions. This limits accessibility and widespread usage, especially in regions with constrained healthcare budgets or limited research funding.

Additionally, the complexity of operations and the need for specialized training pose further challenges. Flow cytometry instruments demand skilled professionals for operation and accurate data interpretation. The intricate nature of these systems requires extensive training, making it difficult for facilities with limited resources to integrate the technology seamlessly. The shortage of adequately trained personnel can slow down the adoption rate, particularly in clinical and research settings where streamlined workflows are critical.

Flow Cytometry Market Segmentation Analysis

By Technology

Cell-based flow cytometry was the dominant segment in 2023, accounting for the largest share of the market. This technology is extensively used for analyzing cellular characteristics such as size, complexity, and protein expression, making it vital for research in immunology, oncology, and stem cell biology. Its wide application in personalized medicine, cancer immunotherapy, and cellular research contributed to its market dominance, representing around 65% of the market share. The increasing demand for precise and high-throughput analysis continues to drive the popularity of this technology.

Bead-based flow cytometry is the fastest-growing segment, gaining traction due to its ability to conduct multiplex assays with high sensitivity. This technology allows for the simultaneous analysis of multiple targets, making it ideal for research applications such as biomarker discovery, infectious disease diagnostics, and immune profiling. Its ability to process smaller sample sizes with increased precision has accelerated its adoption in both research and diagnostic fields, driving its rapid growth in the market.

By Product and Service

Reagents and consumables held the largest market share in 2023, accounting for 45% of the flow cytometry market. These products, including antibodies, buffers, and staining reagents, are fundamental for daily laboratory operations, ensuring their continued demand. The widespread use of reagents in clinical diagnostics and research applications, such as biomarker analysis and immunophenotyping, has driven this segment’s dominance. Additionally, advancements in reagent technology, offering enhanced specificity and efficiency, have further contributed to their significant share of the market.

Software solutions for flow cytometry are proliferating due to increasing demands for advanced data analysis and automation. The complexity of flow cytometry data requires sophisticated software tools to ensure accurate interpretation and efficient management. Enhanced data processing capabilities, integration of machine learning for pattern recognition, and real-time data analysis are factors contributing to the rapid growth of this segment. Software that supports high-throughput analysis and improves accuracy in diagnostic applications is further fueling its expansion in the market.

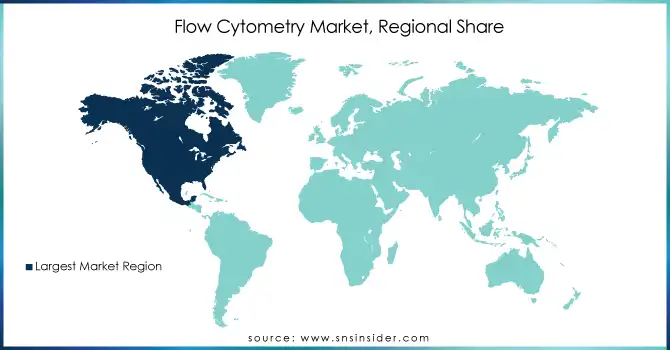

Regional Insights

North America dominated the Flow Cytometry Market in 2023, accounting for a significant share of the global market. This is primarily due to the high adoption of advanced technologies, a strong presence of major players in the region, and substantial investments in research and development. The United States, in particular, plays a crucial role due to its leading research institutions, hospitals, and biotechnology companies, which drive the demand for flow cytometry in research and clinical diagnostics. Additionally, increasing government funding for healthcare and medical research further supports the market growth in North America.

Europe also held a significant share of the market, driven by robust healthcare infrastructure and rising investments in biomedical research. The increasing prevalence of chronic diseases, such as cancer and autoimmune disorders, has fueled the adoption of flow cytometry in clinical diagnostics. Countries like Germany, the UK, and France are prominent contributors to the market's expansion due to advancements in research and healthcare technology.

The Asia-Pacific region is the fastest-growing market, owing to the rapid advancement of healthcare infrastructure, growing healthcare expenditure, and increasing research activities in emerging economies such as China and India. The rising demand for personalized medicine and diagnostics in these regions is driving the adoption of flow cytometry. Furthermore, the expanding number of contract research organizations (CROs) and pharmaceutical companies in the region is expected to boost market growth in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Beckman Coulter Flow Cytometers (e.g., CytoFLEX, Gallios, and Navios series)

-

Flow Cytometry Reagents (e.g., monoclonal antibodies and kits for cell analysis)

2. Becton, Dickinson and Company (BD)

-

BD FACSCanto System (flow cytometer)

-

BD FACSymphony System (advanced flow cytometry platform)

-

BD Horizon Reagents (fluorescent antibodies for cell analysis)

-

BD Cytometer Setup & Tracking Beads (for system validation)

3. Sysmex Corporation

-

CyFlow Flow Cytometers (e.g., CyFlow Cube 6, CyFlow Cube 8)

-

Flow Cytometry Reagents (antibodies, beads, and assays)

-

Agilent NovoCyte Flow Cytometers (e.g., NovoCyte 3000 and 4000)

-

Flow Cytometry Software (NovoExpress analysis software)

5. Apogee Flow Systems Ltd.

-

Apogee A50 Micro Flow Cytometer

-

Flow Cytometry Reagents (cell-based assays)

6. Bio-Rad Laboratories, Inc.

-

S3e Cell Sorter

-

Flow Cytometry Reagents (e.g., antibodies, dyes, and kits)

-

Flow Cytometry Software (e.g., FlowJo analysis software)

7. Thermo Fisher Scientific, Inc.

-

Thermo Scientific Attune NxT Flow Cytometer

-

Flow Cytometry Reagents (e.g., Invitrogen antibodies, kits)

-

Flow Cytometry Software (e.g., FlowJo)

8. Miltenyi Biotec

-

MACSQuant Analyzers (flow cytometers)

-

MACS Reagents (antibodies, beads, and buffers for cell analysis)

9. Cytek Biosciences

-

Cytek Aurora Flow Cytometer

-

Flow Cytometry Reagents (e.g., antibodies, dyes, kits)

10. Sony Biotechnology Inc.

-

Sony SH800 Cell Sorter and Analyzer

-

Flow Cytometry Reagents (e.g., fluorescent antibodies and kits)

11. bioMérieux

-

VITEK MS (Mass Spectrometry)

-

Flow Cytometry Reagents (for microbiology applications)

12. Cytonome/ST, LLC

-

Cytonome Cell Sorters (high-speed sorting systems)

-

Flow Cytometry Reagents (for sorting applications)

13. Sartorius AG

-

CytoSMART Instruments (cell imaging and flow cytometry products)

-

Flow Cytometry Reagents (antibodies, beads, buffers)

Recent Development

-

In Oct 2024, BioAffinity's CyPath Lung Cancer Test received backing from newly published flow cytometry guidelines, further validating its potential in lung cancer detection. These updated guidelines support the test's use, enhancing its credibility in the clinical setting.

-

In March 2024, Beckman Coulter Life Sciences received FDA clearance for its DxFLEX Flow Cytometer, featuring innovative APD detector technology. This advancement allows for larger antibody panels and simplifies the compensation process, enhancing flow cytometry capabilities.

-

In May 2023, Sysmex Corporation launched its Clinical Flow Cytometry System in Japan, following its introduction in North America, Europe, and Asia Pacific. The new system, including the Flow Cytometer XF-1600, Sample Preparation System PS-10, and monoclonal antibody reagents, automates the entire flow cytometry testing process, improving efficiency and standardization in the diagnosis and analysis of hematological diseases like leukemia and malignant lymphoma.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.34 billion |

| Market Size by 2032 | USD 11.41 Billion |

| CAGR | CAGR of 8.82% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology [Cell-based Flow Cytometry, Bead-based Flow Cytometry] • By Product and Service [Reagents and Consumables (Antibodies, Assays & Kits, Other Reagents & Consumables), Instruments (Cell Analyzers {High-range, Mid-range, Low-range}, Cell Sorters {High-range, Mid-range, Low-range}), Services, Software, Accessories] • By Application [Research Applications (Pharmaceuticals and Biotechnology {Drug Discovery, Stem Cell Research, In Vitro Toxicity Testing}, Immunology, Cell Sorting, Apoptosis, Cell Cycle Analysis, Cell Viability, Cell Counting, Other Research Applications), Clinical Applications {Cancer Diagnostics, Hematology, Autoimmune Diseases, Organ Transplantation, Other Clinical Applications}), Industrial Applications] • By End User [Academic & Research Institutes, Hospitals & Clinical Testing Laboratories, Pharmaceutical & Biotechnology Companies] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Danaher Corporation, Becton, Dickinson and Company (BD), Sysmex Corporation, Agilent Technologies, Inc., Apogee Flow Systems Ltd., Bio-Rad Laboratories, Inc., Thermo Fisher Scientific, Inc., Miltenyi Biotec, Cytek Biosciences, Sony Biotechnology Inc., bioMérieux, Cytonome/ST, LLC, and Sartorius AG |

| Key Drivers | • Technological Advancements and Rising Demand for Personalized Medicine Driving Growth in the Flow Cytometry Market |

| Restraints | • High Costs and Training Barriers Limiting the Adoption of Flow Cytometry |