Regenerative Medicine Market Overview and Growth

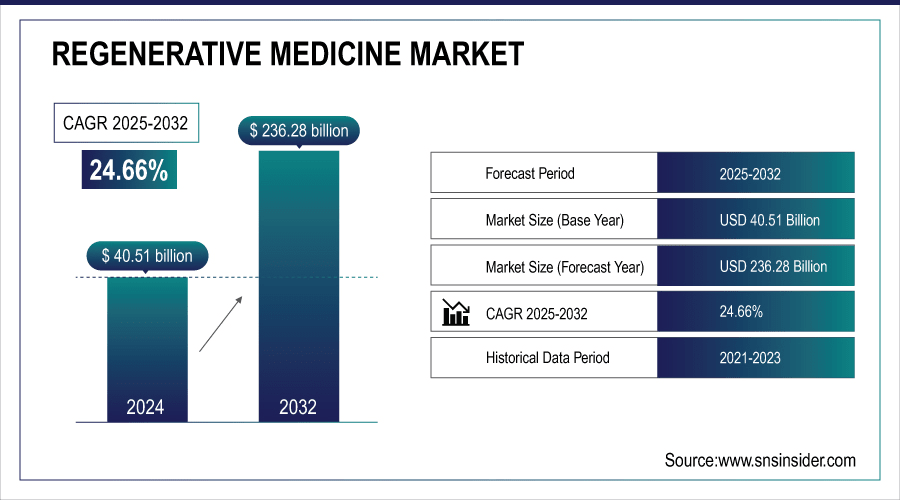

The Regenerative Medicine Market was valued at USD 40.51 billion in 2024 and is expected to reach USD 236.28 billion by 2032, growing at a CAGR of 24.66% from 2025-2032.

The Regenerative Medicine Market is revolutionizing healthcare by offering therapies that repair, regenerate, and replace damaged tissues and organs. Utilizing stem cell therapy, gene therapy, tissue engineering, and biomaterials, it addresses chronic and degenerative conditions such as cardiovascular diseases, neurodegenerative disorders, musculoskeletal injuries, and genetic abnormalities. Scientific breakthroughs like induced pluripotent stem cells (iPSCs) and CRISPR gene-editing have enabled patient-specific therapies and successful treatments for corneal blindness and inherited blood disorders. Growing chronic disease prevalence, regulatory support through RMAT designations, and robust R&D funding are accelerating market growth.

To Get More Information On Regenerative Medicine Market - Request Free Sample Report

Regenerative Medicine Market Size and Forecast:

-

Market Size in 2024: USD 40.51 Billion

-

Market Size by 2032: USD 236.28 Billion

-

CAGR: 24.66% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2022

Regenerative Medicine Market Trends

-

Growing prevalence of chronic diseases and injuries is driving demand for regenerative therapies.

-

Advancements in stem cell therapy, tissue engineering, and gene therapy are expanding treatment options.

-

Increasing focus on personalized and precision medicine is shaping therapeutic development.

-

Rising R&D investments and clinical trials are accelerating innovation and product pipelines.

-

Adoption of bioengineered tissues and biomaterials is improving patient outcomes and recovery rates.

-

Regulatory approvals and supportive policies are facilitating market growth.

-

Collaborations between biotech firms, research institutions, and healthcare providers are fostering advanced regenerative solutions.

Regenerative Medicine Market Growth Drivers

-

Rising Prevalence of Chronic and Degenerative Diseases

The increasing burden of chronic conditions like diabetes, cardiovascular diseases, and neurodegenerative disorders is a significant driver for the regenerative medicine market. Traditional treatments often address symptoms rather than underlying damage, creating a demand for innovative therapies. For instance, stem cell-based treatments for Type 1 diabetes are advancing, with clinical trials showing the potential to regenerate insulin-producing beta cells. Similarly, cartilage repair therapies for osteoarthritis are gaining traction as non-surgical alternatives for pain management and mobility restoration.

-

Technological Advancements in Regenerative Solutions

Innovations in 3D bioprinting, gene-editing tools like CRISPR, and biomaterials have revolutionized the field of regenerative medicine. These technologies allow for precise tissue engineering and personalized therapeutic solutions. For example, 3D bioprinted tissues are being developed to replace damaged organs, while hydrogels are improving cell delivery for wound healing applications. Such advancements significantly enhance treatment efficacy and broaden the scope of regenerative medicine.

-

Government Initiatives and Increased Funding

Supportive regulatory frameworks and substantial funding are accelerating market growth. Policies like Japan's Act on the Safety of Regenerative Medicine and the U.S. FDA’s RMAT designation streamline clinical trials and approvals, fostering innovation. Simultaneously, global R&D investments in regenerative medicine exceeded USD 14 billion in recent years, enabling breakthroughs such as lab-grown skin for burn victims and gene therapies for rare diseases. These efforts not only drive innovation but also improve accessibility to advanced treatments worldwide.

Regenerative Medicine Market Restraints:

-

High Costs and Complexities in Development and Commercialization

One of the primary restraints for the regenerative medicine market is the high cost and complexity associated with developing and commercializing advanced therapies. Processes like stem cell harvesting, tissue engineering, and gene editing require sophisticated technologies, skilled expertise, and extensive R&D investments, driving up production costs. For instance, CAR-T cell therapies, though highly effective for certain cancers, can cost upwards of USD 373,000 per patient. Additionally, navigating the stringent regulatory pathways for approval, which demand extensive clinical trials and long-term safety evaluations, can delay market entry and inflate expenses. The scalability of personalized therapies also presents challenges, as each treatment often requires customization to individual patient needs, further complicating manufacturing processes. These factors limit the accessibility of regenerative treatments, particularly in low- and middle-income countries, posing a significant barrier to the widespread adoption of these transformative medical solutions.

Regenerative Medicine Market Segmentation Analysis

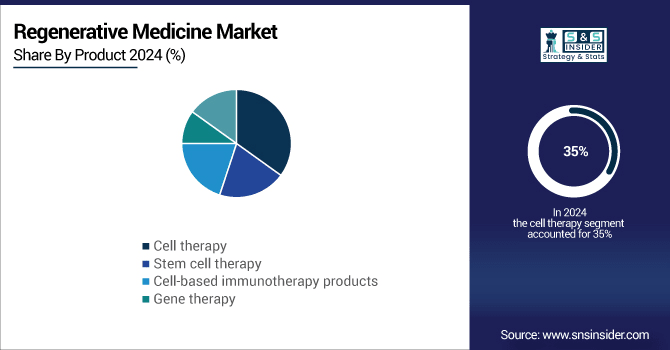

By Product Cell Therapy dominated while Stem Cell Therapy is expected to grow fastest

In 2024, cell therapy was the dominant product segment in the regenerative medicine market, accounting for 35% of the total market share. Cell therapy’s dominance is driven by its broad applicability across various therapeutic areas, including oncology, musculoskeletal disorders, and neurological diseases. One of the most notable innovations in this segment is CAR-T cell therapy (Chimeric Antigen Receptor T-cell therapy), which has revolutionized the treatment of certain cancers, particularly blood cancers such as leukemia and lymphoma. Additionally, stem cells used in regenerative treatments for bone, cartilage, and nerve regeneration further enhance the reach and effectiveness of cell therapy. Cell therapy has become a cornerstone of regenerative medicine with the growing prevalence of chronic diseases, degenerative conditions, and the need for personalized therapies.

Stem cell therapy emerged as the fastest-growing segment throughout the forecast period, within the broader cell therapy category. Stem cells have garnered attention due to their remarkable ability to regenerate and repair damaged tissues, making them a promising option for treating a wide range of conditions. Stem cell therapies are now being investigated and applied to diseases such as osteoarthritis, heart disease, neurodegenerative diseases, and even spinal cord injuries. These therapies are not only helping to regenerate tissue but also providing a potential alternative to organ transplants, a major challenge in modern healthcare.

By Therapeutic Area Oncology led while Cardiovascular Diseases are projected to grow fastest

Oncology was the leading therapeutic area for regenerative medicine in 2024, dominating the market with 40% of the total share. The field of oncology is one of the largest and most crucial for regenerative medicine due to the significant burden that cancer places on global healthcare systems. The growth of innovative cell therapies, particularly CAR-T cell therapy, has dramatically improved treatment outcomes for certain types of cancer, such as blood cancers including leukemia, lymphoma, and myeloma. The ability of CAR-T cells to be engineered to target specific cancer cells and induce long-term remission has garnered substantial attention and investment. Additionally, gene therapy approaches, including the modification of immune cells to enhance their cancer-fighting capabilities, are further accelerating the use of regenerative medicine in oncology. With the increasing number of cancer cases worldwide and the growing demand for more effective and targeted treatments, regenerative therapies in oncology are seen as a groundbreaking advancement.

Cardiovascular Diseases are anticipated to be the fastest-growing segment over the forecast period. This segment is rapidly advancing due to its potential to revolutionize the treatment of heart conditions, particularly those resulting from myocardial infarctions (heart attacks) and heart failure. Stem cell therapies are being developed to regenerate damaged heart tissues, improve heart function, and reduce scarring, offering a promising alternative to traditional treatments like heart transplants and surgeries.

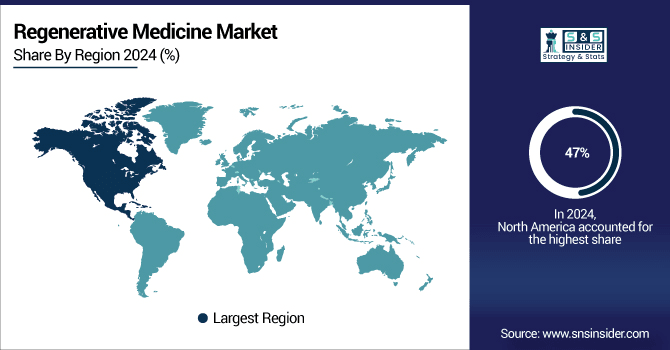

Regenerative Medicine Market Regional Insights

North America Regenerative Medicine Market

North America is the dominant region in 2024 with a 47% share, particularly the U.S., which held the largest market share due to its advanced healthcare infrastructure, significant investments in research and development, and a high number of clinical trials. Leading companies such as Astellas Pharma, Pfizer, and Merck are based in this region, further boosting the market. The U.S. Food and Drug Administration (FDA) has been instrumental in approving regenerative therapies, accelerating the market's growth. Additionally, the increasing prevalence of chronic conditions like cardiovascular diseases, neurological disorders, and musculoskeletal issues is driving the demand for regenerative medicine.

Get Customized Report as Per Your Business Requirement - Enquiry Now

Europe Regenerative Medicine Market

In Europe, countries like the UK, Germany, and France are making strides in stem cell-based therapies and tissue engineering technologies. The region benefits from growing collaborations between biotech firms and research institutions. The European Medicines Agency (EMA) has also facilitated the approval of various regenerative medicine products, supporting the sector’s growth.

Asia Pacific Regenerative Medicine Market

Meanwhile, the Asia-Pacific region is the fastest-growing, driven by expanding healthcare investments, an aging population, and a rise in clinical trial activity. Countries such as Japan, China, and South Korea are advancing in stem cell research and gene therapy, with government-backed funding programs further fostering innovation. As healthcare access improves in these regions, the regenerative medicine market in Asia-Pacific is expected to grow rapidly in the coming years.

Middle East & Africa and Latin America Insights

The Middle East & Africa and Latin America regenerative medicine markets are emerging rapidly, driven by increasing chronic disease prevalence, growing healthcare infrastructure, and rising government support. Investments in stem cell research, tissue engineering, and gene therapies are fueling growth, while limited organ donation and unmet medical needs create strong demand for innovative regenerative solutions across these regions.

Competitive Landscape of Regenerative Medicine Market

AstraZeneca

AstraZeneca is exploring regenerative medicine through stem cell-based therapies, currently in preclinical stages. The company focuses on developing patient-specific treatments aimed at repairing and regenerating damaged tissues. By leveraging advanced cellular technologies, AstraZeneca seeks to address chronic and degenerative conditions, including cardiovascular and musculoskeletal disorders. Strategic research and collaborations in regenerative therapeutics position the company to contribute to innovative healthcare solutions, supporting long-term growth in the expanding regenerative medicine market.

-

2025: AstraZeneca acquired EsoBiotec for up to $1 billion, integrating its ENaBL platform to enable IV-delivered cell therapies, reducing manufacturing time and improving patient access to regenerative treatments.

-

2024: AstraZeneca collaborated with global regulators to establish frameworks for living medicines, streamlining cell therapy manufacturing standards, safety monitoring, and approval pathways, accelerating the development of innovative regenerative therapies.

-

2024: AstraZeneca expanded its cell therapy pipeline by acquiring Gracell Biotechnologies, enhancing manufacturing speed and capacity for immuno-oncology and autoimmune disease regenerative therapies.

-

2023: AstraZeneca launched a lineage-tracing research initiative to study heart and liver cell regeneration, paving the way for targeted regenerative therapies for organ repair and fibrosis reduction.

Sarepta Therapeutics

Sarepta Therapeutics is a leading player in regenerative medicine, focusing on gene therapies for rare genetic disorders, particularly Duchenne muscular dystrophy. Its innovative pipeline includes therapies like SRP-9001, designed to restore functional dystrophin in patients’ muscles. By leveraging advanced gene-editing and viral vector technologies, Sarepta aims to provide long-term, disease-modifying treatments. The company’s research and clinical programs position it at the forefront of regenerative solutions for neuromuscular and genetic conditions.

-

2025: The U.S. FDA granted Platform Technology Designation to Sarepta’s rAAVrh74 viral vector used in SRP-9003 for limb-girdle muscular dystrophy, streamlining development and regulatory review across multiple gene therapy programs.

-

2024: Sarepta completed Phase 3 enrollment for the EMERGENE trial of SRP-9003 in LGMD2E/R4 patients, advancing toward potential accelerated BLA filing in 2025 pending supportive data.

-

2024: The U.S. FDA accepted Sarepta’s ELEVIDYS efficacy supplement under Priority Review, aiming to broaden Duchenne muscular dystrophy indications and convert approval from accelerated to traditional.

-

2023: Sarepta expanded its strategic manufacturing partnership with Catalent to support commercial-scale production of SRP-9001, its leading gene therapy candidate for Duchenne muscular dystrophy.

Novartis AG

Novartis AG is a major player in regenerative medicine, focusing on gene and cell therapies to treat rare and inherited disorders. Its portfolio includes Luxturna for inherited retinal disease and Zolgensma for spinal muscular atrophy, offering transformative, one-time treatments. By leveraging advanced viral vector technologies and gene-editing platforms, Novartis aims to restore function and improve quality of life. Strategic R&D investments position the company to expand regenerative therapy innovations globally.

-

2025: Novartis completed the acquisition of Regulus Therapeutics, acquiring the miR-17 targeting oligonucleotide, farabursen, for ADPKD; Phase 1b data demonstrated improved kidney volume markers and patient safety.

-

2025: Novartis committed $23 billion over five years in the U.S. to expand R&D and manufacturing infrastructure, including a biomedical research hub in San Diego and multiple biologics and radioligand therapy facilities.

-

2025: Novartis announced a tender offer for Regulus at $7 per share plus contingent milestone rights, integrating the ADPKD therapy into its regenerative medicine pipeline.

Key Players in the Regenerative Medicine Industry

-

F. Hoffmann-La Roche Ltd

-

Integra Lifesciences Corp

-

Cook Biotech, Inc

-

Pfizer, Inc.

-

Merck KGaA

-

Abbott

-

Vericel Corp.

-

Novartis AG

-

GlaxoSmithKline (GSK)

-

Biogen, Inc.

-

Sarepta Therapeutics, Inc.

-

Gilead Sciences, Inc.

-

Amgen Inc.

-

Smith+Nephew

-

MEDIPOST Co., Ltd.

-

JCR Pharmaceuticals Co., Ltd.

-

Takeda Pharmaceutical Company Limited

-

CORESTEM, Inc.

| Report Attributes | Details |

| Market Size in 2024 | USD 40.51 billion |

| Market Size by 2032 | USD 236.28 billion |

| CAGR | CAGR of 24.66% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product [Cell therapy, Stem cell therapy (Cell transplantations, Stem cell therapy products, {Autologous therapy, Allogenic therapy}, Cell-based immunotherapy products, Gene therapy, Tissue engineering] • By Therapeutic Area [Oncology, Musculoskeletal disorders, Dermatology & wound care, Cardiovascular diseases, Ophthalmology, Neurology, Other applications] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AstraZeneca plc, F. Hoffmann-La Roche Ltd., Integra Lifesciences Corp., Astellas Pharma, Inc., Cook Biotech, Inc., Bayer AG, Pfizer, Inc., Merck KGaA, Abbott, Vericel Corp., Novartis AG, GlaxoSmithKline (GSK), Biogen, Inc., Sarepta Therapeutics, Inc., Gilead Sciences, Inc., Amgen Inc., Smith+Nephew, MEDIPOST Co., Ltd., JCR Pharmaceuticals Co., Ltd., Takeda Pharmaceutical Company Limited, CORESTEM, Inc. |